Venture capitalists bring significant financial resources and strategic connections but often demand equity and a strong influence on company decisions. Operator angels, typically experienced entrepreneurs or industry experts, provide hands-on mentorship and operational guidance alongside funding. Choosing between the two depends on a startup's need for capital intensity versus hands-on support to scale effectively.

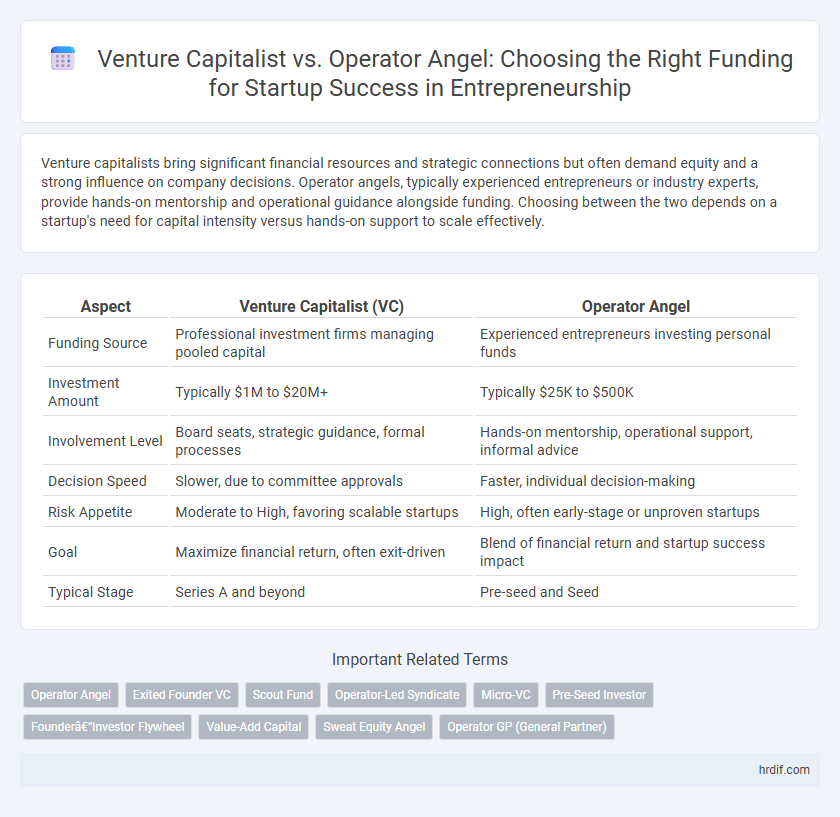

Table of Comparison

| Aspect | Venture Capitalist (VC) | Operator Angel |

|---|---|---|

| Funding Source | Professional investment firms managing pooled capital | Experienced entrepreneurs investing personal funds |

| Investment Amount | Typically $1M to $20M+ | Typically $25K to $500K |

| Involvement Level | Board seats, strategic guidance, formal processes | Hands-on mentorship, operational support, informal advice |

| Decision Speed | Slower, due to committee approvals | Faster, individual decision-making |

| Risk Appetite | Moderate to High, favoring scalable startups | High, often early-stage or unproven startups |

| Goal | Maximize financial return, often exit-driven | Blend of financial return and startup success impact |

| Typical Stage | Series A and beyond | Pre-seed and Seed |

Venture Capitalists vs Operator Angels: Defining the Roles

Venture capitalists primarily provide financial capital and strategic guidance to scale startups with high-growth potential, leveraging extensive networks to accelerate market expansion. Operator angels, often experienced entrepreneurs themselves, offer hands-on mentorship, operational expertise, and industry-specific insights, helping startups refine product development and navigate early-stage challenges. The core distinction lies in venture capitalists driving growth through investment and market connections, while operator angels focus on direct involvement in building operational capabilities and business execution.

Key Differences in Investment Approach

Venture capitalists focus on scalable startups with high growth potential and typically invest larger sums with structured funding rounds. Operator angels bring industry expertise and hands-on mentorship, often investing smaller amounts and engaging deeply in business operations. The key difference lies in VCs prioritizing financial metrics and exit strategies, while operator angels emphasize strategic guidance and operational support.

Funding Criteria: What Each Looks for in Startups

Venture capitalists prioritize scalability, market size, and strong financial projections, focusing on startups with high growth potential and clear exit strategies. Operator angels emphasize the founding team's expertise, product-market fit, and operational execution, seeking startups where their industry experience can add strategic value. Both assess traction and competitive advantage but differ in risk tolerance and post-investment involvement.

Value-Added Support: Network vs Hands-On Guidance

Venture capitalists provide startups with extensive networks and access to industry connections, accelerating market entry and fundraising opportunities. Operator angels offer hands-on guidance through direct operational experience, helping founders navigate product development and scaling challenges. Both funding sources deliver critical value, but the choice depends on whether a startup prioritizes network leverage or practical, day-to-day mentorship.

Speed and Flexibility in Decision-Making

Venture capitalists often follow structured decision-making processes that can prolong funding timelines, while operator angels typically offer faster funding due to their hands-on experience and flexible evaluation criteria. Operator angels leverage industry expertise and streamlined procedures to provide rapid capital injections, enabling startups to seize market opportunities more quickly. Speed and flexibility in decision-making make operator angels particularly valuable for early-stage startups facing urgent capital needs.

Typical Check Size and Ownership Expectations

Venture capitalists typically write larger checks ranging from $500,000 to several million dollars, expecting ownership stakes between 10% and 30% to justify their risk and provide significant returns. Operator angels usually invest smaller amounts, often between $25,000 and $250,000, seeking ownership percentages from 5% to 15% while leveraging their industry expertise to help startups grow. Both funding sources play crucial roles, with venture capitalists offering substantial capital for scaling and operator angels providing strategic guidance alongside moderate investments.

Industry Focus and Stage Preferences

Venture capitalists typically target later-stage startups with scalable business models and prefer industries demonstrating rapid growth potential, such as technology, healthcare, and fintech. Operator angels are often former entrepreneurs or industry experts who invest in early-stage startups within sectors they have deep domain expertise, providing not only capital but strategic guidance. The industry focus and stage preferences of each investor type significantly influence startup funding dynamics and operational support.

Due Diligence Process: Depth and Style

Venture capitalists conduct a rigorous due diligence process, emphasizing comprehensive financial analysis, market validation, and scalability potential, leveraging industry experts to minimize investment risks. Operators angel investors focus on hands-on expertise, assessing the founder's capabilities, product-market fit, and operational effectiveness through qualitative evaluations and direct engagement. The depth of venture capitalist due diligence tends to be more structured and data-driven, whereas operator angels apply a more personalized and experience-based approach.

Long-Term Partnership: Relationship Dynamics

Venture capitalists typically provide startups with significant financial resources and strategic guidance, prioritizing scalable growth and eventual exit returns, which can shape a more formal and milestone-driven partnership. Operator angels, often experienced entrepreneurs themselves, engage deeply in day-to-day operations, offering hands-on mentorship and domain expertise to foster sustainable development. The relationship dynamics differ as venture capitalists emphasize structured oversight and growth metrics, while operator angels cultivate collaborative, long-term involvement focused on operational excellence and adaptive problem-solving.

Choosing the Right Investor for Your Startup

Choosing the right investor for your startup significantly impacts growth trajectory and operational control. Venture capitalists typically bring substantial capital, structured funding rounds, and extensive networks ideal for rapid scaling, while operator angels offer hands-on expertise, industry insights, and personalized guidance crucial during early development stages. Evaluating the startup's current needs, long-term vision, and desired level of involvement helps determine whether a venture capitalist or an operator angel aligns best with the company's strategic goals.

Related Important Terms

Operator Angel

Operator Angels invest not only capital but also extensive industry experience and operational expertise, actively mentoring startups to accelerate growth and navigate challenges. Their hands-on approach improves strategic decision-making and increases the likelihood of scaling success compared to purely financial investors like Venture Capitalists.

Exited Founder VC

Exited founder VCs bring hands-on operational experience and strategic insight to startups, leveraging their successful exits to provide not only capital but also mentorship and industry connections. Unlike operator angels who primarily contribute expertise and early-stage guidance, exited founder VCs combine deep market understanding with scalable funding resources to drive rapid growth and maximize return on investment.

Scout Fund

Scout funds often serve as a bridge between venture capitalists and operator angels, leveraging experienced entrepreneurs to identify and invest in promising startups early. These funds enhance deal sourcing and portfolio support by combining operator insight with venture capital resources, optimizing startup funding outcomes.

Operator-Led Syndicate

Operator-led syndicates leverage the operational expertise and industry experience of founders to provide startups with hands-on guidance and strategic support beyond capital. These syndicates often deliver higher value by aligning investor involvement with the startup's growth trajectory, contrasting with traditional venture capitalists who primarily focus on financial returns and deal structuring.

Micro-VC

Micro-VCs typically provide early-stage startups with smaller, strategic investments and focused mentorship, leveraging deep industry expertise to accelerate growth. Operator angels combine hands-on operational experience and networks, often offering tailored guidance and active involvement, making them valuable partners in scaling ventures effectively.

Pre-Seed Investor

Venture capitalists typically provide structured funding with a focus on scalability and high returns, often favoring startups with clear growth potential, while operator angels bring hands-on industry experience and strategic guidance alongside capital, enhancing operational value during the pre-seed stage. Pre-seed investors play a critical role in validating early business models, where operators add mentorship and network access, and VCs contribute financial discipline and market insights.

Founder–Investor Flywheel

Venture capitalists bring extensive financial resources and market connections, accelerating startup growth, while operator angels offer hands-on expertise and operational mentorship, creating a dynamic Founder-Investor flywheel that drives sustained value creation. This synergistic relationship enhances founder capabilities and investor returns by continuously reinforcing trust, strategic guidance, and network expansion.

Value-Add Capital

Venture capitalists provide value-add capital by offering extensive networks, strategic guidance, and follow-on funding opportunities that accelerate startup growth and scale. Operator angels contribute hands-on operational expertise and industry-specific insights, enabling startups to refine product-market fit and enhance execution efficiency.

Sweat Equity Angel

Sweat equity angels contribute hands-on expertise and operational guidance in exchange for ownership stakes, enhancing startup value beyond mere capital infusion. Unlike traditional venture capitalists who provide financial resources and strategic oversight, sweat equity angels actively engage in daily business operations to accelerate growth and mitigate early-stage risks.

Operator GP (General Partner)

Operator General Partners bring deep industry expertise and hands-on operational experience to startup funding, enabling them to provide strategic guidance beyond capital. Their active involvement accelerates portfolio company growth by leveraging networks, optimizing business models, and driving scalable execution.

Venture Capitalist vs Operator Angel for funding startups. Infographic

hrdif.com

hrdif.com