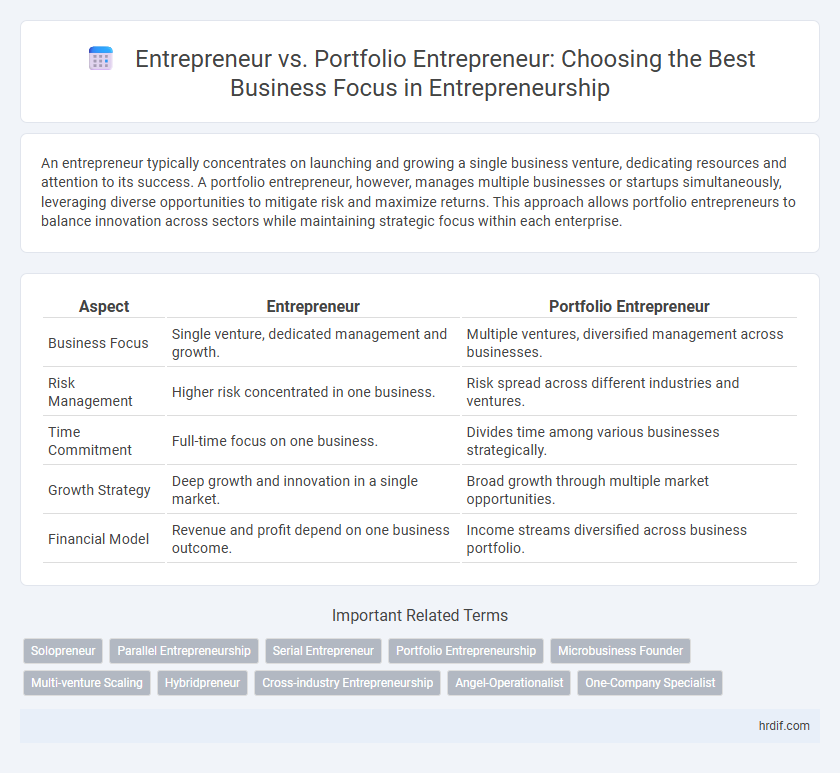

An entrepreneur typically concentrates on launching and growing a single business venture, dedicating resources and attention to its success. A portfolio entrepreneur, however, manages multiple businesses or startups simultaneously, leveraging diverse opportunities to mitigate risk and maximize returns. This approach allows portfolio entrepreneurs to balance innovation across sectors while maintaining strategic focus within each enterprise.

Table of Comparison

| Aspect | Entrepreneur | Portfolio Entrepreneur |

|---|---|---|

| Business Focus | Single venture, dedicated management and growth. | Multiple ventures, diversified management across businesses. |

| Risk Management | Higher risk concentrated in one business. | Risk spread across different industries and ventures. |

| Time Commitment | Full-time focus on one business. | Divides time among various businesses strategically. |

| Growth Strategy | Deep growth and innovation in a single market. | Broad growth through multiple market opportunities. |

| Financial Model | Revenue and profit depend on one business outcome. | Income streams diversified across business portfolio. |

Defining Entrepreneur and Portfolio Entrepreneur

An entrepreneur is an individual who starts and manages a single business venture, taking on financial risks to pursue a specific market opportunity and drive innovation. In contrast, a portfolio entrepreneur simultaneously manages multiple businesses across different industries, leveraging diverse investments to mitigate risk and capitalize on various growth opportunities. This strategic approach allows portfolio entrepreneurs to balance their focus between multiple enterprises, optimizing overall business performance and resource allocation.

Key Differences Between Entrepreneur and Portfolio Entrepreneur

An entrepreneur typically concentrates on launching and scaling a single business venture, allocating all resources and attention to its growth and market success. In contrast, a portfolio entrepreneur manages multiple businesses or startups simultaneously, diversifying risk and leveraging cross-industry opportunities for broader financial and strategic gains. The key differences lie in business focus scope, resource allocation, and risk management strategies between single-venture entrepreneurs and those with diversified investment portfolios.

Advantages of a Traditional Entrepreneur

A traditional entrepreneur typically immerses fully in a single business, allowing for deep industry expertise and focused resource allocation that drives sustained growth. This dedicated approach often results in stronger brand identity and operational efficiency, as attention is concentrated on refining products and customer experience. By prioritizing one venture, traditional entrepreneurs can build robust networks and secure specialized funding tailored to their specific market.

Benefits of Being a Portfolio Entrepreneur

Portfolio entrepreneurs diversify risk by managing multiple businesses simultaneously, which enhances financial stability and growth potential. Their varied experience across industries fosters innovative problem-solving and strategic agility, increasing overall business resilience. Access to multiple revenue streams improves capital allocation efficiency and accelerates wealth accumulation.

Risk Management: Solo Venture vs Multiple Ventures

A solo entrepreneur typically concentrates all resources and risk management efforts on a single venture, leading to higher exposure but deeper operational control. Portfolio entrepreneurs diversify their risk by managing multiple ventures simultaneously, spreading financial and market uncertainties across various industries or projects. This strategic distribution enables portfolio entrepreneurs to mitigate the impact of any single business failure while pursuing broader innovation opportunities.

Resource Allocation and Time Management

Entrepreneurs allocate resources predominantly to a single venture, allowing deep focus and streamlined decision-making that drives specialized growth. Portfolio entrepreneurs distribute resources and time across multiple startups, enhancing diversification but requiring superior multitasking skills and strategic prioritization to maintain progress in each business. Efficient time management becomes critical for portfolio entrepreneurs to balance commitments while entrepreneurs benefit from concentrated effort to optimize resource utilization.

Financial Implications: Single vs Diverse Income Streams

Entrepreneurs with a single business focus often face higher financial risks due to reliance on one income stream, making cash flow management critical for sustainability. Portfolio entrepreneurs diversify their financial exposure by managing multiple ventures, which can stabilize income and create multiple revenue channels. This diversification typically results in varied capital allocation strategies and risk management practices tailored to different industry dynamics and growth potentials.

Impact on Business Growth and Innovation

Portfolio entrepreneurs typically drive business growth by leveraging multiple ventures simultaneously, fostering cross-industry innovation and risk diversification. Entrepreneurs concentrating on a single business often achieve deeper market penetration and product refinement, directly influencing sustainable growth and focused innovation. The portfolio approach accelerates ecosystem development, while singular entrepreneurship emphasizes specialized expertise and scalable impact within a niche.

Skills Required for Each Entrepreneurial Path

An entrepreneur typically requires strong skills in product development, market research, and operational management to successfully launch and grow a single business. A portfolio entrepreneur needs advanced multitasking abilities, strategic diversification expertise, and financial acumen to manage multiple ventures simultaneously. Both paths demand resilience and adaptability, but portfolio entrepreneurs must excel in time management and risk assessment to balance varied business interests effectively.

Choosing the Right Path: Entrepreneur or Portfolio Entrepreneur

Entrepreneurs typically concentrate their efforts on a single business venture, allowing for deep industry expertise and focused resource allocation to accelerate growth and innovation. Portfolio entrepreneurs manage multiple startup ventures simultaneously, leveraging diverse market opportunities to mitigate risk and maximize potential returns across different sectors. Selecting the right path depends on individual risk tolerance, management skills, and the desire for specialization versus diversification in business focus.

Related Important Terms

Solopreneur

A solopreneur typically concentrates on a single business venture, dedicating all resources and attention to its growth and success, whereas a portfolio entrepreneur manages multiple startups or businesses simultaneously, diversifying risk but spreading focus. For solopreneurs, deep expertise and specialization in one niche often drive more sustainable business outcomes compared to the multitasking approach of portfolio entrepreneurship.

Parallel Entrepreneurship

Portfolio entrepreneurs strategically manage multiple businesses simultaneously, leveraging diverse ventures to mitigate risks and maximize growth opportunities. Unlike traditional entrepreneurs who concentrate on a single enterprise, parallel entrepreneurship requires advanced multitasking skills and resource allocation to sustain success across various industries.

Serial Entrepreneur

Serial entrepreneurs actively launch and manage multiple businesses, leveraging experience and networks to accelerate growth and innovation, whereas portfolio entrepreneurs primarily invest in diverse companies without direct operational involvement. Serial entrepreneurs prioritize hands-on leadership and strategic agility to drive consistent value creation across ventures, distinguishing themselves through ongoing business creation and adaptability.

Portfolio Entrepreneurship

Portfolio entrepreneurs strategically manage multiple businesses simultaneously, leveraging diverse industry experiences to mitigate risk and maximize growth potential. This approach contrasts with traditional entrepreneurs who typically concentrate on a single venture, limiting scalability and innovation opportunities.

Microbusiness Founder

A microbusiness founder typically concentrates on a single venture, dedicating resources and strategy to develop and sustain that one enterprise efficiently. In contrast, a portfolio entrepreneur manages multiple businesses simultaneously, leveraging diverse revenue streams and spreading risk across various industries to optimize overall growth and stability.

Multi-venture Scaling

Entrepreneurs typically concentrate on building a single venture to scalability and market dominance, whereas portfolio entrepreneurs manage multiple startups simultaneously, leveraging cross-venture synergies for multi-venture scaling. Portfolio entrepreneurs optimize resource allocation and risk diversification across their business portfolio to accelerate growth and innovation more effectively than traditional single-venture entrepreneurs.

Hybridpreneur

A Hybridpreneur combines the strategic vision of a traditional entrepreneur with the diversified approach of a portfolio entrepreneur, balancing focused business growth and multiple ventures simultaneously. This business model leverages concentrated market expertise while mitigating risk through a diversified portfolio, optimizing innovation and resource allocation across varied industries.

Cross-industry Entrepreneurship

Portfolio entrepreneurs manage multiple ventures across diverse industries simultaneously, leveraging cross-industry insights to drive innovation and mitigate risks, while traditional entrepreneurs typically concentrate on a single business, honing industry-specific expertise and operational depth. This cross-industry approach enhances adaptability and fosters creative problem-solving by integrating varied market dynamics and technologies.

Angel-Operationalist

Angel-operationalists in entrepreneurship leverage hands-on experience and strategic investments to maximize value across multiple ventures, distinguishing portfolio entrepreneurs who actively manage diverse businesses from traditional entrepreneurs focused on a single enterprise. This approach accelerates growth and mitigates risk by combining capital injection with operational expertise, fostering scalable innovation and sustainable success in dynamic markets.

One-Company Specialist

A One-Company Specialist entrepreneur dedicates full attention and resources to scaling a single business, optimizing growth and operational efficiency within that focused venture. In contrast, a Portfolio Entrepreneur manages multiple startups simultaneously, diversifying risk but often spreading strategic focus thinner across various enterprises.

Entrepreneur vs Portfolio Entrepreneur for business focus. Infographic

hrdif.com

hrdif.com