Salaried employees benefit from a stable and predictable income, receiving regular paychecks and often additional benefits such as health insurance and retirement plans. Portfolio careerists generate income from multiple sources, including freelancing, consulting, and part-time roles, which can offer greater financial flexibility but may lack consistency. The choice between a salaried position and a portfolio career depends on the individual's preference for security versus diverse revenue streams.

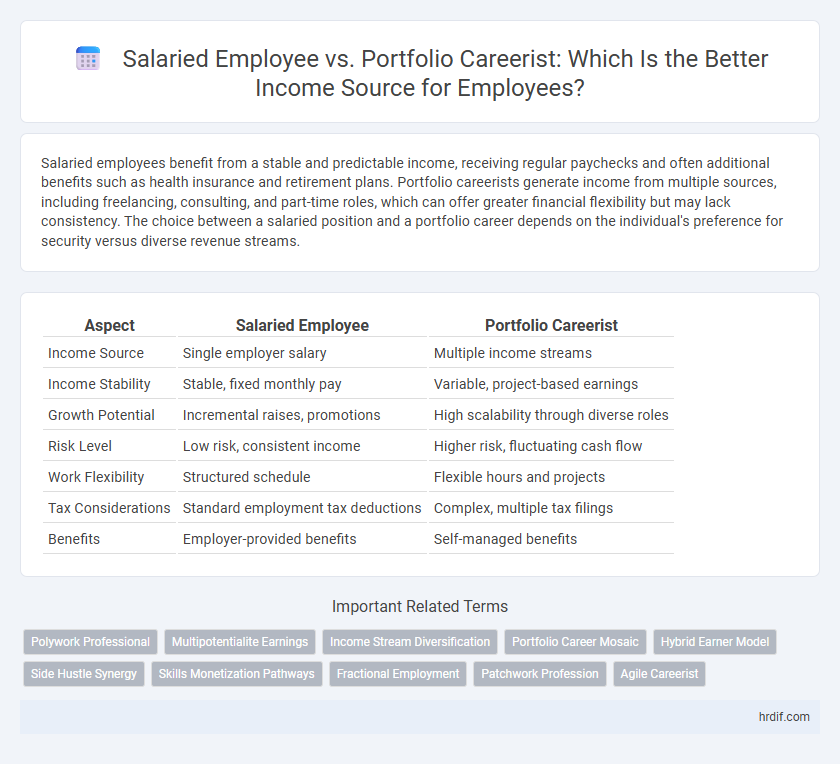

Table of Comparison

| Aspect | Salaried Employee | Portfolio Careerist |

|---|---|---|

| Income Source | Single employer salary | Multiple income streams |

| Income Stability | Stable, fixed monthly pay | Variable, project-based earnings |

| Growth Potential | Incremental raises, promotions | High scalability through diverse roles |

| Risk Level | Low risk, consistent income | Higher risk, fluctuating cash flow |

| Work Flexibility | Structured schedule | Flexible hours and projects |

| Tax Considerations | Standard employment tax deductions | Complex, multiple tax filings |

| Benefits | Employer-provided benefits | Self-managed benefits |

Defining Salaried Employees and Portfolio Careerists

Salaried employees earn a fixed income through a consistent employer, relying on a single source for financial stability and benefits such as health insurance and retirement plans. Portfolio careerists generate income from multiple freelance, consulting, or entrepreneurial activities, diversifying their earnings across various projects and clients. This approach offers flexibility and varied income streams but requires proactive management of time and resources to maintain financial security.

Income Stability: Predictable vs. Variable Earnings

Salaried employees benefit from predictable monthly income due to fixed pay structures and employer-provided benefits, ensuring financial stability and easier budgeting. Portfolio careerists experience variable earnings that fluctuate based on project availability, client demand, and market conditions, which can result in higher income potential but less consistency. Understanding these differences is crucial for financial planning and risk management in workforce decisions.

Opportunities for Income Growth

Salaried employees benefit from structured income growth through regular promotions, performance bonuses, and annual raises tied to company benchmarks. Portfolio careerists generate diverse income streams by leveraging multiple freelance projects, consulting roles, and passive investments, offering flexibility and potentially higher earnings. The portfolio career model often allows faster income scaling by capitalizing on varied skill sets and market demand.

Diversification of Income Streams

Salaried employees typically rely on a single steady paycheck from one employer, providing financial stability but limited income diversification. Portfolio careerists generate income from multiple freelance projects, part-time roles, or entrepreneurial ventures, enhancing financial resilience through diversified revenue streams. This approach reduces dependence on any single source and mitigates risks associated with job loss or market fluctuations.

Flexibility and Work-Life Balance

Salaried employees benefit from stable income and structured work hours but often face limited flexibility, impacting their work-life balance. Portfolio careerists leverage multiple income sources, enabling greater autonomy to tailor schedules and prioritize personal commitments. This flexibility supports improved work-life balance despite potentially variable earnings.

Job Security and Risk Factors

Salaried employees benefit from consistent income and greater job security due to stable employer contracts and access to benefits such as health insurance and retirement plans. Portfolio careerists, managing multiple income streams through freelance projects or part-time roles, face higher income volatility and limited job security but gain flexibility and diversified risk exposure. Choosing between these options depends on individual risk tolerance and preference for stability versus entrepreneurial income opportunities.

Benefits and Perks Comparison

Salaried employees often enjoy stable income with fixed benefits such as health insurance, retirement plans, and paid leave, providing financial security and consistent perks. Portfolio careerists benefit from diversified income streams, offering flexibility and potential for higher earnings but typically face limited access to traditional employee benefits. Understanding these distinctions helps individuals weigh financial stability against autonomy when choosing their career path.

Skill Development and Career Progression

Salaried employees benefit from structured skill development programs and clear career progression paths within organizations, leading to steady income growth. Portfolio careerists enhance diverse skill sets through varied projects and roles, fostering adaptability and entrepreneurial opportunities that can result in multiple income streams. Both approaches offer unique advantages in cultivating marketable skills and advancing professional growth tailored to individual career goals.

Job Satisfaction and Personal Fulfillment

Salaried employees often value job stability and consistent income, which can enhance job satisfaction through financial security and structured career progression. Portfolio careerists derive personal fulfillment from diverse projects and flexible work arrangements, enabling creativity and continuous skill development. Balancing income sources, portfolio careerists may experience variable earnings but often report higher intrinsic motivation and overall work-life balance.

Long-Term Financial Planning and Retirement

Salaried employees benefit from predictable income streams and often have access to employer-sponsored retirement plans such as 401(k)s or pensions, which simplify long-term financial planning. Portfolio careerists rely on multiple income sources, including freelance projects, investments, and consulting, requiring diversified saving strategies and proactive retirement fund management to ensure stability. Both approaches demand tailored financial planning, but portfolio careerists must prioritize building robust emergency funds and diversified retirement accounts due to variable cash flow.

Related Important Terms

Polywork Professional

Salaried employees benefit from stable, predictable income and employer-provided benefits, while portfolio careerists, particularly Polywork professionals, diversify their income sources through multiple freelance projects, side gigs, and entrepreneurial ventures, enhancing financial flexibility and skill development. Polywork's platform enables these professionals to showcase varied expertise and connect with diverse opportunities, optimizing both income potential and career growth beyond traditional employment.

Multipotentialite Earnings

Salaried employees benefit from a stable income with fixed benefits, while portfolio careerists, especially multipotentialites, diversify earnings across multiple income streams such as freelancing, consulting, and passive investments. This diversified approach allows portfolio careerists to leverage a broad skill set, increasing financial resilience and growth potential compared to the single-source salary model.

Income Stream Diversification

Salaried employees rely primarily on a fixed monthly income from a single employer, providing financial stability but limited income stream diversification. Portfolio careerists generate revenue from multiple simultaneous roles or projects, enhancing income stream diversification and reducing dependency on any one source.

Portfolio Career Mosaic

Salaried employees typically rely on a fixed monthly income from a single employer, while portfolio careerists generate diverse revenue streams through multiple projects and roles, embodying the Portfolio Career Mosaic model. This approach enhances financial resilience and professional flexibility by combining freelance work, consulting, part-time roles, and entrepreneurial ventures.

Hybrid Earner Model

Salaried employees benefit from consistent income and employment stability, while portfolio careerists diversify earnings through multiple freelance projects, investments, or side businesses, embodying the hybrid earner model that combines steady wages with variable revenue streams. This hybrid approach enhances financial resilience by balancing the predictability of a salary with the growth potential of entrepreneurial ventures.

Side Hustle Synergy

Salaried employees benefit from stable income but often face limits on financial growth, whereas portfolio careerists leverage multiple revenue streams, including side hustles, to maximize earnings and diversify risk. Side hustle synergy enhances portfolio careerists' income potential by integrating skills across various projects, creating a dynamic and resilient financial foundation.

Skills Monetization Pathways

Salaried employees typically generate income through stable, role-specific expertise within a single organization, leveraging consistent skill application and corporate benefits to maximize earnings. Portfolio careerists diversify income by monetizing multiple skills across freelance projects, consulting, and entrepreneurial ventures, enhancing financial resilience through varied revenue streams.

Fractional Employment

Fractional employment offers a flexible income source by allowing portfolio careerists to engage in multiple part-time roles simultaneously, contrasting with salaried employees who rely on a fixed monthly salary from a single employer. This model increases income diversification and reduces dependency on one employer, catering to professionals seeking varied job experiences and skill development.

Patchwork Profession

Salaried employees receive a consistent income through fixed monthly wages, offering financial stability and predictable benefits, while portfolio careerists in patchwork professions generate income from multiple freelance projects, consulting roles, and part-time engagements, creating diversified revenue streams but with variable cash flow. The patchwork professional's adaptability and skill breadth enhance earning potential, though they often face challenges in income consistency and benefits security compared to traditional salaried roles.

Agile Careerist

Salaried employees benefit from steady paychecks and structured benefits, providing financial stability while portfolio careerists, especially Agile Careerists, diversify income streams through multiple freelance projects and entrepreneurial ventures, enhancing adaptability in dynamic job markets. Agile Careerists leverage varied skill sets to optimize earning potential, mitigate risk through multiple income sources, and maintain career resilience amid economic fluctuations.

Salaried employee vs Portfolio careerist for income source. Infographic

hrdif.com

hrdif.com