Salaried workers receive a fixed regular income, providing financial stability and predictable budgeting. Equity-compensated workers earn part of their compensation through stock options or shares, offering potential for significant long-term gains tied to company performance. This form of compensation aligns employee incentives with company success but carries inherent market risks and variability in actual earnings.

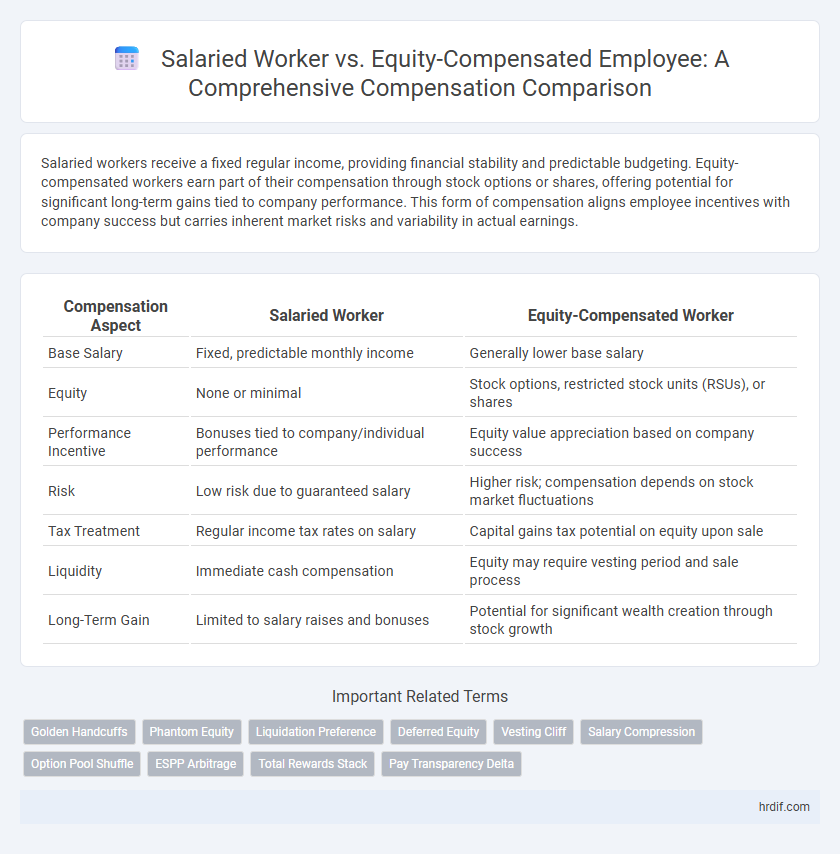

Table of Comparison

| Compensation Aspect | Salaried Worker | Equity-Compensated Worker |

|---|---|---|

| Base Salary | Fixed, predictable monthly income | Generally lower base salary |

| Equity | None or minimal | Stock options, restricted stock units (RSUs), or shares |

| Performance Incentive | Bonuses tied to company/individual performance | Equity value appreciation based on company success |

| Risk | Low risk due to guaranteed salary | Higher risk; compensation depends on stock market fluctuations |

| Tax Treatment | Regular income tax rates on salary | Capital gains tax potential on equity upon sale |

| Liquidity | Immediate cash compensation | Equity may require vesting period and sale process |

| Long-Term Gain | Limited to salary raises and bonuses | Potential for significant wealth creation through stock growth |

Overview: Salaried Employees vs Equity-Compensated Employees

Salaried employees receive a fixed regular income that provides predictable financial stability, typically paid monthly or bi-weekly, regardless of company performance. Equity-compensated employees earn part of their total compensation through stock options or shares, aligning their financial incentives with the company's growth and long-term success. This compensation structure can offer significant wealth-building opportunities but carries higher risk compared to a guaranteed salary.

Defining Salary-Based Compensation

Salary-based compensation refers to a fixed regular payment, typically expressed as an annual amount, provided to employees regardless of the company's performance. This type of compensation offers financial stability and predictable income, which can be crucial for budgeting and long-term planning. Unlike equity compensation, salaried workers receive guaranteed monetary remuneration without direct participation in the company's ownership or stock value fluctuations.

Understanding Equity Compensation

Equity-compensated workers receive shares or stock options, aligning their financial incentives with company performance and long-term growth. Salaried workers earn fixed wages, providing consistent income but limited participation in the company's upside potential. Understanding equity compensation is crucial for employees evaluating total remuneration and potential future wealth accumulation.

Cash Flow: Regular Paycheck vs Potential Payout

Salaried workers receive a consistent cash flow through regular paychecks, ensuring predictable income for budgeting and financial stability. Equity-compensated workers may experience fluctuating cash flow, as their potential payout depends on company performance and stock valuation, which can lead to significant gains or losses over time. This difference affects financial planning, with salaried employees prioritizing steady cash inflows while equity holders balance immediate liquidity against long-term wealth accumulation.

Risk and Reward Profiles

Salaried workers receive fixed, predictable income with minimal financial risk but limited upside potential, ensuring stable cash flow regardless of company performance. Equity-compensated workers face higher financial risk as their earnings depend on company stock value fluctuations, yet they have significant reward potential if the company grows and stock prices increase. This risk-reward tradeoff influences employee motivation, retention, and alignment with long-term corporate goals.

Long-Term Wealth Potential

Salaried workers receive a fixed income with predictable financial stability, but they often miss opportunities for wealth accumulation beyond their regular paychecks. Equity-compensated workers gain potential for significant long-term wealth through stock options, restricted stock units (RSUs), or employee stock purchase plans (ESPPs) that can appreciate as the company's value grows. The ability to convert equity into substantial financial rewards aligns employee interests with company performance, creating an incentive for sustained contribution and wealth building over time.

Job Stability and Compensation Predictability

Salaried workers benefit from job stability and consistent compensation, providing predictable monthly income and financial security. Equity-compensated workers may experience variable earnings tied to company performance and stock value, leading to less predictable compensation but potential for higher long-term rewards. The trade-off between stable salary and fluctuating equity compensation influences financial planning and risk tolerance for employees.

Impact on Motivation and Performance

Salaried workers often experience stable income that can promote consistent performance but may lack strong incentives for exceeding expectations. Equity-compensated workers, receiving stock options or shares, typically demonstrate higher motivation aligned with company success due to the potential for financial gain tied directly to performance. This alignment of interests can drive innovation, commitment, and long-term productivity, impacting overall organizational growth positively.

Tax Implications: Salary vs Equity

Salaried workers face straightforward tax implications with regular income taxed as ordinary wages and subject to withholding taxes, Social Security, and Medicare contributions. Equity-compensated workers encounter more complex tax treatment, with stock options and restricted stock units triggering taxable events upon vesting or exercise, potentially resulting in capital gains tax advantages if shares are held long-term. Understanding these differences is crucial for optimizing tax liability and aligning total compensation with personal financial goals.

Choosing the Right Compensation Structure

Choosing the right compensation structure between salaried and equity-compensated workers depends on company goals and employee motivation. Salaried workers receive fixed income ensuring financial stability, while equity compensation aligns employee interests with company growth by offering stock options or shares. Balancing immediate cash flow requirements with long-term incentive potential is essential for attracting and retaining talent effectively.

Related Important Terms

Golden Handcuffs

Salaried workers receive fixed, predictable income, while equity-compensated workers gain stock options or shares designed to incentivize long-term commitment through golden handcuffs, which restrict selling or exercising options prematurely. These golden handcuffs align employees' interests with company performance but may limit mobility due to deferred financial rewards tied to vesting schedules.

Phantom Equity

Phantom equity offers salaried workers the financial benefits of equity compensation without actual stock ownership, providing a cash payout tied to company valuation increases. This structure aligns employee incentives with company performance while avoiding dilution and complex stock issuance processes.

Liquidation Preference

Salaried workers receive fixed regular payments, providing predictable income without exposure to company equity risks, while equity-compensated workers gain ownership stakes that may yield significant returns influenced by the company's liquidation preference, which prioritizes payouts to preferred shareholders before common stockholders. Understanding how liquidation preferences affect equity value is crucial for evaluating the true compensation potential for equity holders compared to guaranteed salary earnings.

Deferred Equity

Salaried workers receive fixed regular payments, ensuring predictable income but limited ownership stakes, while equity-compensated workers gain deferred equity such as stock options or restricted stock units that align long-term incentives with company performance and potential capital gains. Deferred equity serves as a powerful retention tool by vesting over time, encouraging employee commitment and contributing to wealth accumulation beyond base salary.

Vesting Cliff

Salaried workers receive fixed regular payments without vesting cliffs, ensuring immediate full compensation, whereas equity-compensated workers face vesting cliffs that delay ownership of stock options, typically requiring a one-year period before any equity is vested. This vesting cliff incentivizes employee retention by locking equity ownership until specific tenure milestones are met, impacting the timing and realization of total compensation value.

Salary Compression

Salary compression occurs when salaried workers receive similar or lower pay than newer employees or equity-compensated workers with less experience, undermining wage differentiation and morale. Equity compensation often includes stock options or restricted shares, which can widen total compensation gaps but may exacerbate perceived salary compression for traditional salaried employees.

Option Pool Shuffle

Salaried workers receive fixed, predictable income through regular paychecks, while equity-compensated workers gain ownership stakes that may dilute as the option pool is reshuffled during funding rounds or employee hiring. The option pool shuffle impacts equity value by reallocating shares, potentially reducing the percentage held by founders and early employees as new stock options are granted from the pool.

ESPP Arbitrage

Salaried workers receive fixed, predictable income while equity-compensated workers benefit from stock options or ESPP arbitrage, allowing potential gains through discounted stock purchases and strategic sales. ESPP arbitrage leverages the price difference between discounted purchase prices and market value, optimizing total compensation beyond base salary.

Total Rewards Stack

Salaried workers receive fixed base pay and predictable bonuses as core components of their total rewards stack, whereas equity-compensated workers gain value largely from stock options, restricted stock units (RSUs), and performance shares, aligning compensation with company growth and long-term shareholder value. The total rewards stack for equity-compensated employees often includes lower base salaries offset by significant upside potential and wealth accumulation through equity appreciation and dividend payouts.

Pay Transparency Delta

Salaried workers receive fixed, predictable income, making pay transparency straightforward and consistent across roles and experience levels. Equity-compensated workers face fluctuating compensation tied to company performance, creating greater pay transparency delta due to variable stock valuations and vesting schedules.

Salaried worker vs Equity-compensated worker for compensation. Infographic

hrdif.com

hrdif.com