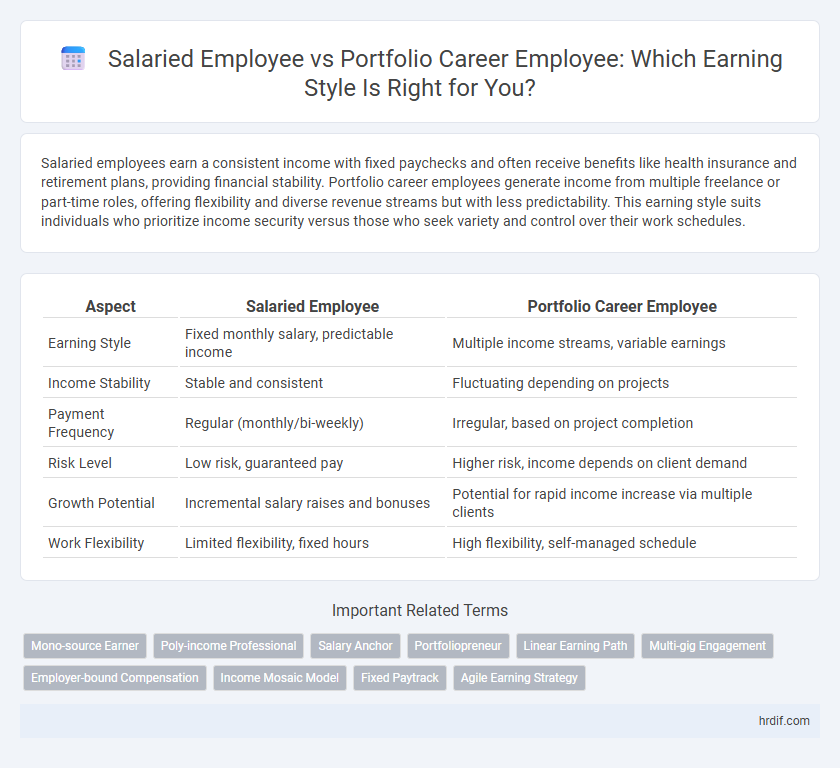

Salaried employees earn a consistent income with fixed paychecks and often receive benefits like health insurance and retirement plans, providing financial stability. Portfolio career employees generate income from multiple freelance or part-time roles, offering flexibility and diverse revenue streams but with less predictability. This earning style suits individuals who prioritize income security versus those who seek variety and control over their work schedules.

Table of Comparison

| Aspect | Salaried Employee | Portfolio Career Employee |

|---|---|---|

| Earning Style | Fixed monthly salary, predictable income | Multiple income streams, variable earnings |

| Income Stability | Stable and consistent | Fluctuating depending on projects |

| Payment Frequency | Regular (monthly/bi-weekly) | Irregular, based on project completion |

| Risk Level | Low risk, guaranteed pay | Higher risk, income depends on client demand |

| Growth Potential | Incremental salary raises and bonuses | Potential for rapid income increase via multiple clients |

| Work Flexibility | Limited flexibility, fixed hours | High flexibility, self-managed schedule |

Understanding Salaried Employment

Salaried employees receive fixed, predictable income with defined benefits, providing financial stability and clear career progression within a single organization. Portfolio career employees monetize diverse skills through multiple part-time roles or freelance projects, prioritizing flexibility and varied income streams. Understanding salaried employment highlights consistent earning patterns and employer-driven job security, contrasting with the variable and self-managed earnings of portfolio careers.

What is a Portfolio Career?

A portfolio career involves multiple part-time jobs, freelance projects, or entrepreneurial ventures instead of a single salaried position, offering diverse income streams and flexibility. Salaried employees typically earn a fixed, predictable income with structured benefits, whereas portfolio career employees generate earnings based on varied gigs or contracts, leading to potential income fluctuations but greater control. Portfolio career professionals prioritize skill development and diverse opportunities, contrasting with the stability and routine focus of salaried workers.

Earning Stability: Salaried vs Portfolio Employee

Salaried employees benefit from consistent monthly income and financial stability due to fixed pay structures and employer benefits. Portfolio career employees experience varied income streams from multiple gigs or freelance projects, which can lead to fluctuating earnings and less predictable financial security. The choice between salaried and portfolio careers often depends on an individual's preference for steady cash flow versus diversified income opportunities.

Income Flexibility and Growth Potential

Salaried employees benefit from stable, predictable income with structured growth through promotions and raises, providing financial security but limited income flexibility. Portfolio career employees experience diverse income streams from multiple simultaneous roles, offering greater income flexibility and potential for accelerated growth based on skills and market demand. The trade-off involves balancing guaranteed stability against variable earnings that can scale with entrepreneurial effort and market opportunities.

Job Security in Both Career Paths

Salaried employees typically enjoy stable, predictable income with benefits such as health insurance and retirement plans, enhancing their job security through long-term contracts or tenure. Portfolio career employees, who juggle multiple part-time roles or freelance projects, face fluctuating earnings but gain diverse income streams that can mitigate risk if one source diminishes. Job security in salaried roles depends heavily on employer stability, while portfolio careers rely on continuous client acquisition and skill adaptability to maintain financial stability.

Work-Life Balance Comparisons

Salaried employees typically earn a stable, fixed income with predictable paychecks, which supports a more structured work-life balance due to consistent hours and benefits such as paid leave. Portfolio career employees, who generate income from multiple short-term jobs or freelance projects, often experience fluctuating earnings and flexible schedules, allowing for greater personal freedom but also potential instability and challenges in maintaining work-life balance. Balancing diverse income streams requires portfolio workers to manage both time effectively and financial uncertainty, contrasting the consistent routine of salaried employees.

Skill Development Opportunities

Salaried employees typically experience structured skill development through company-sponsored training programs and clear career progression paths. Portfolio career employees gain diverse skill sets by engaging in multiple projects or roles across different industries, enhancing adaptability and breadth of expertise. This varied exposure often accelerates skill acquisition compared to the more specialized development seen in salaried positions.

Career Progression and Advancement

Salaried employees typically benefit from a stable income with predictable raises and structured career progression within a single organization, allowing focused advancement through hierarchical promotions. Portfolio career employees earn income from multiple part-time or freelance roles, prioritizing diverse skill development and flexible work but facing less predictable earnings and less traditional promotion pathways. Career progression for salaried employees aligns with organizational goals, while portfolio career workers advance by expanding their professional network and skill portfolio.

Financial Planning Considerations

Salaried employees benefit from steady, predictable income streams, allowing for more structured financial planning with consistent contributions to retirement funds and emergency savings. Portfolio career employees experience variable income from multiple sources, requiring flexible budgeting strategies and robust cash flow management to accommodate fluctuating earnings. Both types must prioritize tax planning and diversified investment portfolios to optimize long-term financial stability.

Choosing the Right Path for Your Goals

Salaried employees benefit from consistent income and job security, which suits those prioritizing financial stability and long-term benefits like retirement plans and healthcare. Portfolio career employees earn through multiple streams, offering flexibility and diverse skill development, ideal for individuals seeking creative control and varied opportunities. Choosing the right path depends on your financial goals, risk tolerance, and desire for workplace structure versus independence.

Related Important Terms

Mono-source Earner

Salaried employees typically rely on a stable, fixed income from a single employer, embodying a mono-source earning style focused on job security and consistent paychecks. Portfolio career employees diversify their income streams by engaging in multiple part-time roles or freelance projects, reducing dependency on a single source but lacking the predictability of a traditional salaried position.

Poly-income Professional

Salaried employees receive stable, fixed incomes with predictable pay cycles, while portfolio career employees diversify earnings through multiple freelance projects, investments, and side businesses, embodying the poly-income professional model. This approach enhances financial resilience and flexibility by leveraging various income streams beyond a single employer salary.

Salary Anchor

Salaried employees typically rely on a stable, fixed-income salary anchor that prioritizes financial security and predictable earnings, whereas portfolio career employees diversify their income streams by combining multiple roles or projects, emphasizing flexibility and varied skill application over a singular salary focus. The salary anchor for salaried employees encourages long-term career loyalty and incremental raises, while portfolio careerists focus on maximizing overall revenue through diverse, often project-based compensation.

Portfoliopreneur

Salaried employees receive fixed, predictable income tied to consistent job roles, whereas portfoliopreneurs generate diverse revenue streams from multiple projects, enhancing financial flexibility and entrepreneurial growth. Portfolio career employees leverage varied skills across industries, optimizing earning potential by balancing stability with innovation in dynamic market environments.

Linear Earning Path

Salaried employees follow a linear earning path with predictable, fixed income based on set working hours and roles, ensuring financial stability and clear career progression. Portfolio career employees experience variable income streams from multiple projects or gigs, which can lead to fluctuating earnings but offers diversified income sources and flexibility.

Multi-gig Engagement

Salaried employees receive consistent monthly income with a focus on stability, while portfolio career employees maximize earnings through multi-gig engagements across diverse projects, enhancing financial flexibility and skill diversification. Portfolio career workers leverage multiple income streams by balancing freelance, part-time, and contract roles, contrasting the single-source revenue model of salaried workers.

Employer-bound Compensation

Salaried employees receive a fixed employer-bound compensation typically with benefits such as health insurance and retirement plans, providing steady and predictable income. Portfolio career employees, by contrast, earn through diversified income streams often lacking traditional employer-bound benefits, focusing on flexible engagement rather than a consistent salary.

Income Mosaic Model

Salaried employees typically rely on a stable, predictable income derived from a single employer, aligning with the Income Mosaic Model's emphasis on consistent revenue streams. In contrast, portfolio career employees diversify their earnings across multiple roles and projects, creating a complex income mosaic that enhances financial resilience through varied sources.

Fixed Paytrack

Salaried employees earn a consistent fixed paytrack, providing financial stability and predictable monthly income, whereas portfolio career employees often rely on variable earnings from multiple projects, resulting in fluctuating income streams. The fixed paytrack of salaried employees supports long-term financial planning and benefits eligibility, contrasting with the diverse but less predictable compensation patterns of portfolio career workers.

Agile Earning Strategy

Salaried employees benefit from consistent, predictable income streams with an emphasis on steady career growth and job security, aligning with traditional earning models. Portfolio career employees leverage multiple income sources across freelance, consulting, and part-time roles, optimizing flexibility and resilience through an Agile Earning Strategy that adapts to market trends and personal skill development.

Salaried Employee vs Portfolio Career Employee for earning style Infographic

hrdif.com

hrdif.com