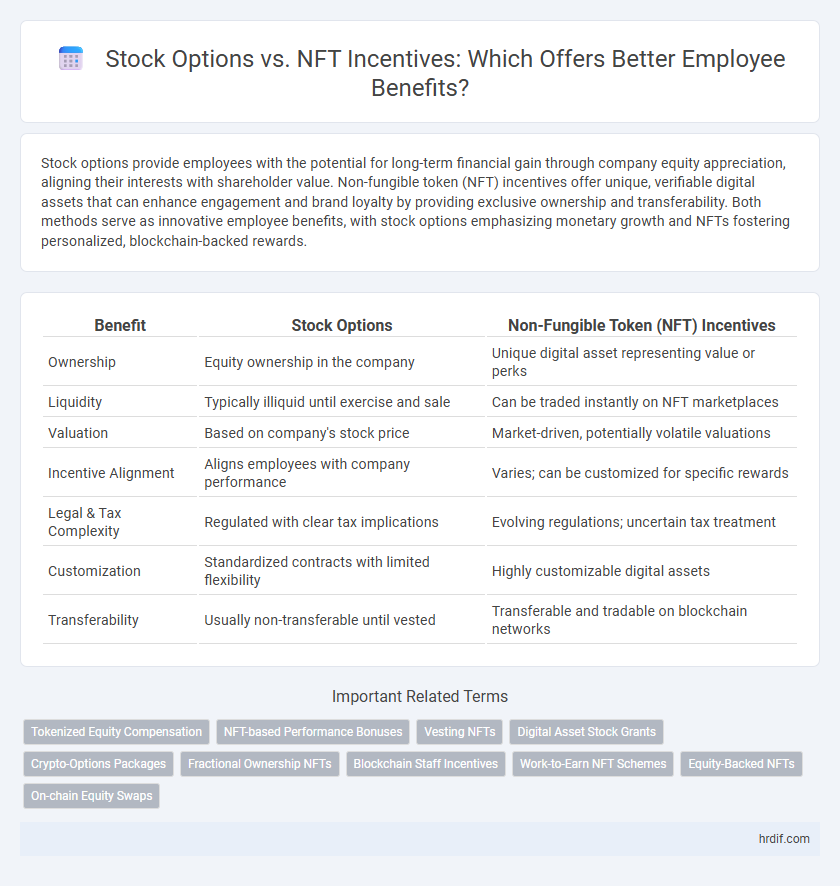

Stock options provide employees with the potential for long-term financial gain through company equity appreciation, aligning their interests with shareholder value. Non-fungible token (NFT) incentives offer unique, verifiable digital assets that can enhance engagement and brand loyalty by providing exclusive ownership and transferability. Both methods serve as innovative employee benefits, with stock options emphasizing monetary growth and NFTs fostering personalized, blockchain-backed rewards.

Table of Comparison

| Benefit | Stock Options | Non-Fungible Token (NFT) Incentives |

|---|---|---|

| Ownership | Equity ownership in the company | Unique digital asset representing value or perks |

| Liquidity | Typically illiquid until exercise and sale | Can be traded instantly on NFT marketplaces |

| Valuation | Based on company's stock price | Market-driven, potentially volatile valuations |

| Incentive Alignment | Aligns employees with company performance | Varies; can be customized for specific rewards |

| Legal & Tax Complexity | Regulated with clear tax implications | Evolving regulations; uncertain tax treatment |

| Customization | Standardized contracts with limited flexibility | Highly customizable digital assets |

| Transferability | Usually non-transferable until vested | Transferable and tradable on blockchain networks |

Understanding Stock Options as Employee Benefits

Stock options serve as a powerful employee benefit by granting the right to purchase company shares at a predetermined price, aligning employee interests with corporate growth and fostering long-term value creation. Unlike non-fungible token (NFT) incentives, stock options offer established liquidity and regulatory clarity, making them a reliable form of compensation with potential financial upside. Their widespread use in employee benefit programs underscores their effectiveness in attracting, motivating, and retaining talent while driving shareholder value.

Introduction to NFTs as Workplace Incentives

Non-fungible tokens (NFTs) offer a unique approach to workplace incentives by providing digital assets that are verifiably scarce and customizable, contrasting traditional stock options tied to company equity. NFTs enable employees to receive exclusive rewards such as branded digital collectibles, access tokens, or rights to future projects, enhancing engagement through personalized ownership experiences. This innovative method aligns employee motivation with brand loyalty while leveraging blockchain technology for transparent, secure tracking of incentive distribution.

Comparing Value Growth: Stocks vs. NFTs

Stock options offer value growth through company equity appreciation, often tied to stock market performance and potential dividends, providing long-term financial benefits. Non-fungible tokens (NFTs) gain value based on digital scarcity, market demand, and cultural significance, leading to volatile but potentially rapid price increases. While stock options present more stable and regulated growth, NFTs offer higher risk with the chance for exponential value spikes in niche markets.

Liquidity and Accessibility of Stock Options vs. NFTs

Stock options offer higher liquidity compared to non-fungible tokens (NFTs), as they can be traded on established financial markets with clear valuation metrics. NFTs provide unique digital ownership and accessibility benefits through decentralized platforms but often face challenges in liquidity and price transparency. Therefore, stock options are more accessible for immediate financial benefits, while NFTs offer long-term value potential with less market fluidity.

Risk Assessment: Traditional Equity vs. Digital Assets

Stock options present inherent risks tied to market volatility and company performance, often subject to regulatory scrutiny and liquidity constraints. Non-fungible token (NFT) incentives introduce unique risk profiles, including technological vulnerabilities, market illiquidity, and the nascent regulatory environment surrounding digital assets. Thorough risk assessment must weigh traditional equity's established frameworks against the innovative but uncertain landscape of NFT-based compensation.

Employee Ownership and Engagement: Which Motivates More?

Stock options provide employees with direct financial stakes tied to company performance, fostering a sense of ownership and long-term commitment that can enhance motivation and retention. Non-fungible token (NFT) incentives offer unique, tradable digital assets that can increase engagement through personalization and exclusivity but may lack the tangible financial benefit of traditional equity. Empirical studies indicate stock options tend to drive deeper employee ownership mindset, while NFTs serve better as supplementary rewards enhancing engagement without replacing core equity incentives.

Tax Implications: Stock Options versus NFT Benefits

Stock options offer potential tax advantages such as deferral of taxable events until exercise, with favorable capital gains treatment if holding requirements are met, whereas NFT incentives often trigger immediate taxable income upon receipt or sale, classified as ordinary income. The distinction in tax treatment affects net benefit realization, with stock options typically providing planned tax timing strategies. Understanding IRS guidelines and recent regulations on digital assets is crucial for optimizing tax outcomes in both stock options and NFT-based employee benefits.

Legal and Regulatory Considerations

Stock options and non-fungible token (NFT) incentives differ significantly in legal and regulatory frameworks, with stock options governed by securities laws such as the Securities Act of 1933 and the Securities Exchange Act of 1934, ensuring strict compliance and disclosure requirements. NFTs, classified as digital assets, face evolving regulations related to intellectual property, taxation, and anti-money laundering (AML) laws, varying widely across jurisdictions. Companies offering NFT incentives must carefully assess jurisdiction-specific regulations to mitigate legal risks and ensure compliance with emerging digital asset governance standards.

Long-term Wealth Potential for Employees

Stock options provide employees with the potential for significant long-term wealth through appreciation in company stock value, aligning their interests with corporate growth and success. Non-fungible token (NFT) incentives offer unique digital assets that can appreciate based on rarity and demand, but their market volatility and liquidity challenges may impact sustained wealth accumulation. Evaluating these benefits requires considering the stability of stock markets versus the emerging, speculative nature of NFT markets in shaping employees' financial futures.

Choosing the Right Incentive: Company Culture and Goals

Stock options align employee rewards with company growth, fostering long-term commitment and ownership mentality crucial in stable, mission-driven cultures. Non-fungible token (NFT) incentives offer unique, tradable digital assets that can enhance engagement and appeal to tech-savvy teams focused on innovation and brand differentiation. Selecting the right incentive depends on whether the company prioritizes sustainable equity value or cutting-edge, personalized rewards that reflect its evolving culture and strategic objectives.

Related Important Terms

Tokenized Equity Compensation

Tokenized equity compensation through non-fungible token (NFT) incentives offers enhanced liquidity, transparency, and programmability compared to traditional stock options, enabling real-time transferability and fractional ownership. This innovation reduces administrative overhead and aligns employee incentives with company performance by leveraging blockchain's immutable and secure nature.

NFT-based Performance Bonuses

NFT-based performance bonuses provide unique, verifiable digital assets that grant employees exclusive ownership and potential resale value, enhancing motivation through transparency and scarcity. Unlike traditional stock options, NFTs enable customizable rewards tied directly to individual achievements, fostering personalized engagement and long-term brand loyalty.

Vesting NFTs

Vesting NFTs provide employees with transparent, programmable ownership and transferability compared to traditional stock options, enhancing liquidity and reducing administrative complexity. Their immutable smart contract framework ensures automated, trustless vesting schedules, delivering enhanced security and real-time tracking of employee incentives in decentralized finance ecosystems.

Digital Asset Stock Grants

Digital asset stock grants provide employees with ownership in company equity through blockchain-verified stock options, enhancing transparency and liquidity compared to traditional stock incentives. Non-fungible token (NFT) incentives offer unique, verifiable digital rewards but lack the direct equity value and financial benefit inherent in stock options.

Crypto-Options Packages

Crypto-options packages offer enhanced liquidity and transparency compared to traditional stock options, enabling beneficiaries to trade tokenized equity rights on decentralized platforms. Unlike non-fungible token (NFT) incentives, these crypto-options provide programmable financial contracts with clear valuation models, reducing ambiguity in compensation and unlocking new avenues for employee wealth generation.

Fractional Ownership NFTs

Fractional Ownership NFTs offer a more liquid and transparent alternative to traditional stock options by enabling employees to own and trade partial digital shares with verifiable provenance on the blockchain. Unlike stock options, these NFTs provide real-time market valuation and reduced regulatory complexities, enhancing the overall benefit and flexibility of incentive programs.

Blockchain Staff Incentives

Stock options provide long-term equity incentives with potential market liquidity, while non-fungible token (NFT) incentives offer verifiable ownership and exclusive rights on blockchain, enhancing transparency and immediate asset transferability. NFT-based staff incentives leverage blockchain's security features to create unique, tradable tokens that align employee rewards with company growth and innovation in decentralized finance ecosystems.

Work-to-Earn NFT Schemes

Work-to-Earn NFT schemes offer distinct advantages over traditional stock options by providing immediate liquidity, enhanced transparency, and unique digital asset ownership that can appreciate independently of company performance. These incentives also foster stronger employee engagement through gamified reward systems and real-time proof of contribution, creating more personalized and flexible benefit structures.

Equity-Backed NFTs

Equity-backed NFTs offer a novel approach to employee incentives by combining the transparency and liquidity of blockchain technology with traditional stock option benefits, providing real-time ownership and transferability. Unlike conventional stock options, these non-fungible tokens enable fractionalized equity claims and instant market access, enhancing employee engagement and financial flexibility.

On-chain Equity Swaps

Stock options provide traditional equity stake with vesting schedules and tax benefits, while non-fungible token (NFT) incentives offer programmable, tradable digital assets representing ownership through on-chain equity swaps, enhancing liquidity and transparency. On-chain equity swaps enable automated, trustless transfers of ownership rights using smart contracts, streamlining benefit allocation and unlocking real-time market valuation.

Stock options vs Non-fungible token incentives for benefit. Infographic

hrdif.com

hrdif.com