Health insurance provides comprehensive coverage for physical health needs, offering financial protection against medical expenses and ensuring access to necessary treatments. Mental health support specifically addresses emotional and psychological well-being, promoting resilience and effective coping strategies that improve overall quality of life. Combining both benefits creates a holistic approach to health, enhancing physical recovery and mental wellness simultaneously.

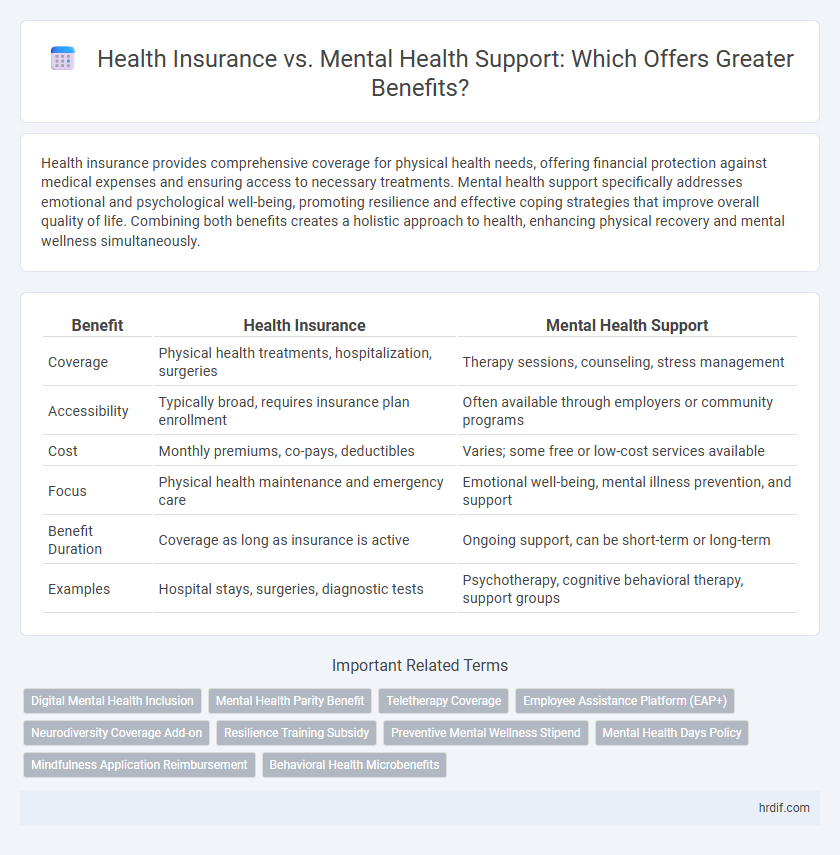

Table of Comparison

| Benefit | Health Insurance | Mental Health Support |

|---|---|---|

| Coverage | Physical health treatments, hospitalization, surgeries | Therapy sessions, counseling, stress management |

| Accessibility | Typically broad, requires insurance plan enrollment | Often available through employers or community programs |

| Cost | Monthly premiums, co-pays, deductibles | Varies; some free or low-cost services available |

| Focus | Physical health maintenance and emergency care | Emotional well-being, mental illness prevention, and support |

| Benefit Duration | Coverage as long as insurance is active | Ongoing support, can be short-term or long-term |

| Examples | Hospital stays, surgeries, diagnostic tests | Psychotherapy, cognitive behavioral therapy, support groups |

Understanding Employee Benefits: Health Insurance vs Mental Health Support

Health insurance provides comprehensive medical coverage, including physical health treatments and emergency care, ensuring employees have access to essential healthcare services. Mental health support benefits focus on counseling, therapy, and mental wellness programs that address stress, anxiety, and emotional well-being. Employers offering both health insurance and mental health support create a holistic benefits package that improves overall employee health and productivity.

Comparing Coverage: Health Insurance and Mental Health Support

Health insurance plans typically cover a broad range of medical services including hospitalization, surgeries, and preventive care, while mental health support often requires specialized coverage that is sometimes limited or excluded. Mental health benefits focus on therapy sessions, psychiatric medication, and counseling, which may have different copay structures and visit limits compared to general health services. Comparing coverage reveals that comprehensive plans integrating both physical and mental health services provide the most effective benefit for overall wellness and cost management.

The Financial Impact of Health Insurance and Mental Health Benefits

Health insurance reduces out-of-pocket medical expenses by covering hospital stays, surgeries, and prescription drugs, alleviating financial strain during health crises. Mental health benefits lower costs associated with therapy, counseling, and psychiatric medications, contributing to improved productivity and reduced absenteeism in the workplace. Integrating comprehensive mental health coverage within health insurance plans maximizes economic advantages by promoting early intervention and preventing expensive emergency care.

Employee Wellbeing: Physical Health vs Mental Health Programs

Employee wellbeing programs that integrate both health insurance and mental health support produce comprehensive benefits by addressing physical and psychological needs simultaneously. Health insurance coverage ensures access to medical care and preventive services, reducing absenteeism and enhancing productivity, while mental health support programs contribute to emotional resilience, stress reduction, and improved workplace morale. Prioritizing a balanced approach that includes mental health initiatives alongside traditional health insurance optimizes overall employee health outcomes and fosters a supportive work environment.

How Health Insurance and Mental Health Support Improve Retention

Health insurance coverage and mental health support both significantly enhance employee retention by reducing stress and financial burdens associated with medical expenses. Comprehensive plans that include mental health services foster a supportive work environment, leading to higher job satisfaction and loyalty. Organizations investing in these benefits experience decreased turnover rates and improved overall productivity.

Which Offers Greater Value: Health Insurance or Mental Health Support?

Health insurance provides comprehensive coverage for physical illnesses and emergencies, often including some mental health benefits, but mental health support services offer targeted care that directly improves psychological well-being, stress management, and emotional resilience. Studies show that access to mental health support reduces absenteeism and enhances productivity, potentially offering greater long-term value for overall health outcomes. Prioritizing integrated mental health support within health insurance plans maximizes benefits by addressing both physical and psychological needs efficiently.

Employer Strategies: Integrating Health and Mental Health Benefits

Employers who integrate health insurance with mental health support enhance overall employee well-being, reducing absenteeism and increasing productivity. Comprehensive benefits packages that combine physical and mental health coverage foster a supportive workplace culture and improve employee retention. Strategic investments in holistic health benefits demonstrate an employer's commitment to addressing diverse health needs and improving long-term workforce resilience.

Accessibility of Services: Health Insurance vs Mental Health Support

Health insurance often provides broad coverage for physical health conditions but may have limited accessibility to specialized mental health services due to provider shortages or high out-of-pocket costs. Mental health support programs prioritize accessible care through teletherapy options, sliding scale fees, and community initiatives designed to reduce barriers for underserved populations. Accessibility of services is crucial in ensuring timely intervention and continuous care, making tailored mental health support a critical benefit alongside traditional health insurance.

Evolving Workplace Needs: Prioritizing Health and Mental Wellness

Health insurance provides essential coverage for medical treatments and preventive care, addressing physical health needs in the evolving workplace. Mental health support offers targeted resources like counseling and stress management, crucial for maintaining employee well-being and productivity. Prioritizing both health insurance and mental health initiatives aligns with modern workplace demands, fostering a holistic approach to employee wellness.

Future Trends: The Shift Towards Comprehensive Health Benefits

Future trends in employee benefits reveal a decisive shift towards integrating mental health support within traditional health insurance plans, recognizing mental wellness as essential to overall health. Comprehensive health benefits now emphasize personalized care, teletherapy access, and preventive mental health services to improve long-term outcomes. Employers increasingly invest in holistic benefits packages that combine physical and mental health coverage driven by data on productivity gains and reduced healthcare costs.

Related Important Terms

Digital Mental Health Inclusion

Digital mental health inclusion enhances health insurance benefits by providing accessible, real-time support through apps and teletherapy, improving overall treatment adherence and outcomes. Integrating these services reduces healthcare costs and promotes equitable access to mental health care, essential for comprehensive insurance coverage.

Mental Health Parity Benefit

Mental Health Parity Benefit ensures equal coverage for mental health services alongside physical health treatments, reducing financial barriers and promoting comprehensive well-being. Health insurance plans that include this benefit provide essential support for mental health conditions, leading to improved access and outcomes.

Teletherapy Coverage

Health insurance plans increasingly include teletherapy coverage, offering convenient access to mental health support that reduces barriers like travel and stigma. Teletherapy enhances benefit value by providing timely, flexible counseling services that improve overall patient well-being and reduce long-term healthcare costs.

Employee Assistance Platform (EAP+)

Health Insurance covers medical expenses broadly, while Mental Health Support through an Employee Assistance Platform (EAP+) provides specialized access to counseling, stress management, and crisis intervention services. EAP+ enhances employee well-being and productivity by offering confidential mental health resources tailored to workplace challenges, complementing traditional health insurance benefits.

Neurodiversity Coverage Add-on

Health insurance plans with Neurodiversity Coverage Add-ons offer tailored benefits that specifically support individuals with autism, ADHD, and other neurodiverse conditions, ensuring access to specialized therapies and treatments often excluded from standard mental health support. This targeted coverage enhances overall well-being by addressing unique cognitive and behavioral needs, promoting comprehensive care beyond generic mental health services.

Resilience Training Subsidy

Health insurance typically covers a wide range of medical expenses but often lacks comprehensive support for mental health resilience programs, whereas a Resilience Training Subsidy directly funds specialized mental health support aimed at enhancing emotional coping skills and stress management. Investing in a Resilience Training Subsidy complements traditional health insurance by improving overall well-being and reducing long-term healthcare costs through preventative mental health care.

Preventive Mental Wellness Stipend

A Preventive Mental Wellness Stipend enhances traditional health insurance by funding proactive mental health activities, reducing long-term healthcare costs and improving overall employee well-being. Investing in mental wellness stipends supports early intervention and resilience, leading to decreased absenteeism and higher productivity.

Mental Health Days Policy

Mental Health Days Policy offers targeted support by providing employees with dedicated paid time off to address mental well-being, complementing traditional health insurance coverage. This approach enhances workplace productivity and reduces burnout by acknowledging the importance of mental health alongside physical health benefits.

Mindfulness Application Reimbursement

Health insurance plans increasingly offer mindfulness application reimbursement as a cost-effective benefit to enhance mental health support and reduce stress-related illnesses. This integration not only promotes regular mental wellness practices but also lowers overall healthcare expenses by preventing more severe mental health conditions.

Behavioral Health Microbenefits

Behavioral health microbenefits provide targeted mental health support that complements traditional health insurance by addressing specific conditions such as anxiety, depression, and substance use disorders through short-term, accessible interventions. These microbenefits enhance overall well-being by offering cost-effective, scalable solutions that improve treatment adherence, reduce absenteeism, and lower long-term healthcare expenses.

Health Insurance vs Mental Health Support for benefit. Infographic

hrdif.com

hrdif.com