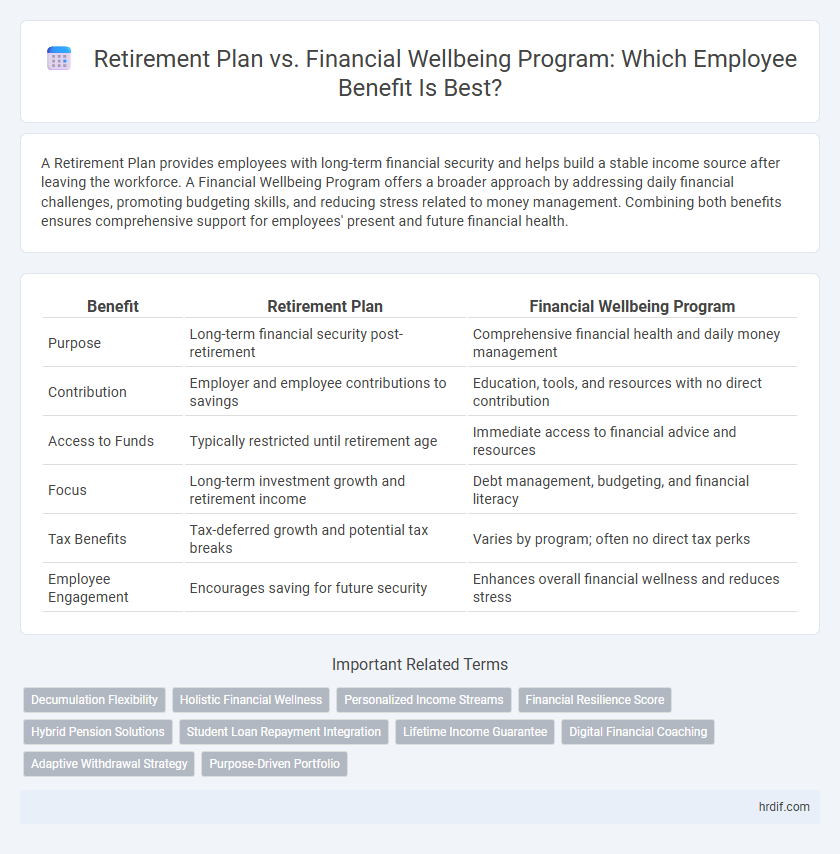

A Retirement Plan provides employees with long-term financial security and helps build a stable income source after leaving the workforce. A Financial Wellbeing Program offers a broader approach by addressing daily financial challenges, promoting budgeting skills, and reducing stress related to money management. Combining both benefits ensures comprehensive support for employees' present and future financial health.

Table of Comparison

| Benefit | Retirement Plan | Financial Wellbeing Program |

|---|---|---|

| Purpose | Long-term financial security post-retirement | Comprehensive financial health and daily money management |

| Contribution | Employer and employee contributions to savings | Education, tools, and resources with no direct contribution |

| Access to Funds | Typically restricted until retirement age | Immediate access to financial advice and resources |

| Focus | Long-term investment growth and retirement income | Debt management, budgeting, and financial literacy |

| Tax Benefits | Tax-deferred growth and potential tax breaks | Varies by program; often no direct tax perks |

| Employee Engagement | Encourages saving for future security | Enhances overall financial wellness and reduces stress |

Overview: Retirement Plans vs Financial Wellbeing Programs

Retirement plans primarily focus on long-term savings and investment strategies to ensure financial security after leaving the workforce, often including options such as 401(k)s or pension plans. Financial wellbeing programs provide a broader approach, addressing immediate financial literacy, budgeting, debt management, and overall financial health to improve employees' day-to-day and future financial stability. Employers offering both solutions create a comprehensive benefits package that supports employees' financial goals at every stage of their career.

Key Differences Between Retirement Plans and Financial Wellbeing Benefits

Retirement plans primarily focus on long-term financial security through structured savings and investment options like 401(k)s or pensions, while financial wellbeing programs offer a broader spectrum of resources including budgeting tools, debt management, and financial education. Retirement plans typically provide tax advantages and employer contributions to enhance retirement savings, whereas financial wellbeing benefits aim to improve overall financial literacy and immediate financial health. Employers often integrate both to address employees' future security and day-to-day financial challenges effectively.

Long-term Security: Assessing Retirement Plan Benefits

Retirement plans provide structured, long-term financial security through consistent contributions, employer matches, and tax advantages, ensuring stable income after career completion. Financial wellbeing programs offer broader support, including debt management, budgeting tools, and financial education, but may lack the guaranteed retirement income that dedicated plans deliver. Prioritizing retirement plans maximizes future income reliability and addresses critical savings needs for lasting economic stability.

Holistic Support: The Advantages of Financial Wellbeing Programs

Financial wellbeing programs deliver holistic support by addressing employees' diverse financial challenges beyond retirement savings, including debt management, budgeting, and emergency planning. These programs foster long-term financial resilience and reduce stress, enhancing overall productivity and job satisfaction. Unlike traditional retirement plans, financial wellbeing initiatives provide personalized, ongoing education and resources tailored to individual financial goals.

Impact on Employee Engagement and Retention

Retirement plans directly enhance employee engagement by providing long-term financial security, fostering loyalty and reducing turnover rates. Financial wellbeing programs improve retention by addressing immediate financial stress, boosting productivity and job satisfaction. Both benefits contribute significantly to a positive workplace culture, but retirement plans tend to have a more substantial impact on long-term employee commitment.

Cost Considerations for Employers

Retirement plans often require significant upfront contributions and ongoing administrative expenses, making them a substantial cost consideration for employers. Financial wellbeing programs, while potentially less costly to implement, may involve expenses related to technology platforms, coaching services, and continuous employee engagement efforts. Employers must balance the long-term liabilities of retirement plan commitments against the more flexible, often lower-cost investment in comprehensive financial wellbeing initiatives.

Flexibility and Personalization of Benefits

Retirement plans offer structured savings options with fixed contribution schedules, while financial wellbeing programs provide flexible, personalized benefits tailored to individual employee needs. Financial wellbeing programs adapt to diverse life stages and financial goals, incorporating counseling, debt management, and emergency savings support. Personalization in these programs enhances employee engagement by addressing unique financial situations beyond traditional retirement planning.

Supporting Diverse Workforce Needs

Retirement plans provide long-term financial security, essential for employees planning their future, while financial wellbeing programs offer immediate support through budgeting education, debt management, and personalized financial advice. Combining these benefits addresses diverse workforce needs by catering to varying life stages and economic situations. Employers can enhance retention and engagement by integrating both solutions to support holistic employee financial health.

Measuring ROI: Retirement Plans vs Financial Wellbeing Programs

Measuring ROI for Retirement Plans primarily involves assessing long-term employee financial security and reduced turnover rates, whereas Financial Wellbeing Programs demonstrate short-term impacts through increased productivity and decreased absenteeism. Retirement Plans show quantifiable benefits like tax advantages and retirement readiness, while Financial Wellbeing Programs offer broader improvements in mental health and employee engagement. Companies often find combining both strategies maximizes overall ROI by addressing immediate financial stress and ensuring future financial stability.

Choosing the Right Benefit for Your Organization

Selecting the right benefit for your organization hinges on aligning employee needs with strategic goals; a Retirement Plan secures long-term financial stability, while a Financial Wellbeing Program addresses immediate financial health and education. Data from the Employee Benefit Research Institute shows 59% of employees prioritize retirement savings, yet 64% also value financial wellness support to manage daily expenses. Balancing these options improves retention, productivity, and overall workforce satisfaction by offering comprehensive financial security solutions.

Related Important Terms

Decumulation Flexibility

A retirement plan typically offers structured decumulation options, ensuring predictable income streams during retirement, while financial wellbeing programs provide greater decumulation flexibility by allowing employees to tailor withdrawal strategies based on personal financial goals and changing needs. Enhanced flexibility in decumulation through financial wellbeing programs supports customized cash flow management and can improve overall retirement security.

Holistic Financial Wellness

Retirement plans provide structured savings and investment options to secure long-term financial stability, while financial wellbeing programs offer comprehensive support including budgeting, debt management, and personalized financial education to enhance overall financial health. Combining both strategies promotes holistic financial wellness by addressing immediate financial behaviors and future retirement security.

Personalized Income Streams

Retirement plans offer structured, long-term savings with predictable income streams tailored to retirement age, whereas financial wellbeing programs provide personalized income strategies that adapt to individuals' changing financial goals throughout their career. Personalized income streams enhance financial security by combining investment flexibility, risk management, and targeted cash flow planning.

Financial Resilience Score

Retirement plans contribute to long-term financial security by ensuring steady income post-retirement, directly improving employees' Financial Resilience Scores through consistent savings and investment growth. Financial Wellbeing Programs enhance short-term financial health by providing education and resources to manage debt, budgeting, and emergency funds, leading to higher Financial Resilience Scores through immediate financial stability and reduced stress.

Hybrid Pension Solutions

Hybrid pension solutions combine the long-term security of traditional retirement plans with the flexibility and personalized support offered by financial wellbeing programs, enhancing employee engagement and financial literacy. This integrated approach supports diversified retirement income streams while promoting proactive financial decision-making and stress reduction among participants.

Student Loan Repayment Integration

Retirement plans with student loan repayment integration provide dual benefits by enabling employees to simultaneously reduce student debt while building retirement savings, improving long-term financial security. Financial wellbeing programs that incorporate student loan repayment offer personalized strategies and educational resources, enhancing overall employee financial health and reducing debt-related stress.

Lifetime Income Guarantee

A Retirement Plan with Lifetime Income Guarantee ensures steady, predictable income throughout retirement, reducing the risk of outliving savings compared to Financial Wellbeing Programs that focus on short-term budgeting and investment education. This guarantee provides employees a secure financial foundation, enhancing long-term retirement readiness and peace of mind.

Digital Financial Coaching

Digital Financial Coaching in Retirement Plans enhances employee retirement readiness by providing personalized, data-driven guidance that adapts to individual financial goals and risk tolerance. Financial Wellbeing Programs offer broader support including budgeting and debt management, but integration of digital coaching specifically targets long-term retirement success and improves overall financial health metrics.

Adaptive Withdrawal Strategy

An Adaptive Withdrawal Strategy enhances Retirement Plans by dynamically adjusting income streams based on market performance and personal spending needs, ensuring long-term financial sustainability. Financial Wellbeing Programs complement this by offering personalized education and tools to optimize adaptive withdrawals, promoting comprehensive retirement security.

Purpose-Driven Portfolio

Retirement plans primarily focus on securing future financial stability through long-term investment strategies and employer contributions, whereas financial wellbeing programs emphasize holistic employee support, including financial education, debt management, and stress reduction. Purpose-driven portfolios within these benefits integrate sustainable investing principles, aligning employee investments with environmental, social, and governance (ESG) goals to foster both financial growth and ethical impact.

Retirement Plan vs Financial Wellbeing Program for benefit. Infographic

hrdif.com

hrdif.com