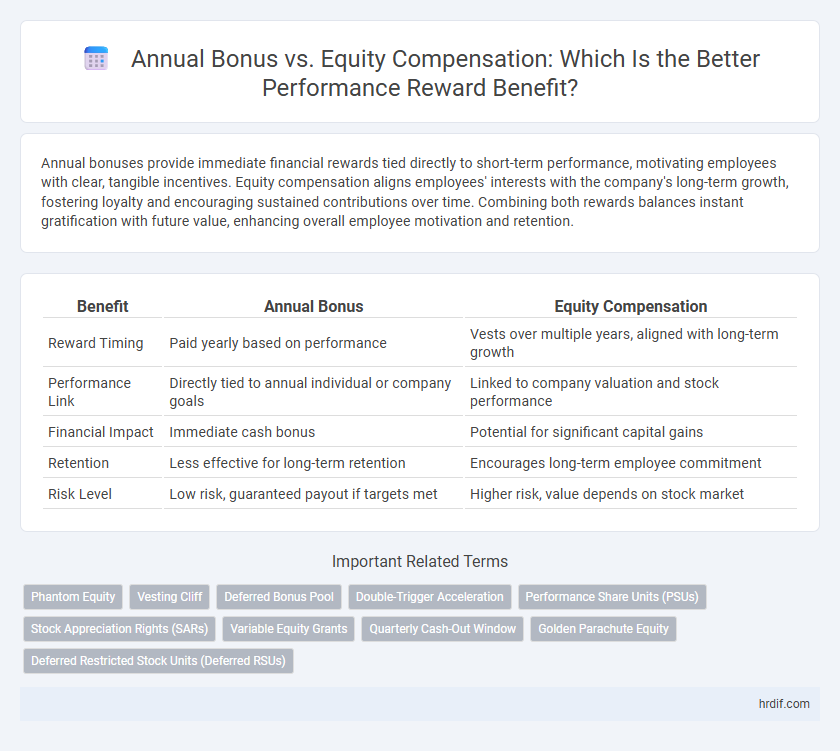

Annual bonuses provide immediate financial rewards tied directly to short-term performance, motivating employees with clear, tangible incentives. Equity compensation aligns employees' interests with the company's long-term growth, fostering loyalty and encouraging sustained contributions over time. Combining both rewards balances instant gratification with future value, enhancing overall employee motivation and retention.

Table of Comparison

| Benefit | Annual Bonus | Equity Compensation |

|---|---|---|

| Reward Timing | Paid yearly based on performance | Vests over multiple years, aligned with long-term growth |

| Performance Link | Directly tied to annual individual or company goals | Linked to company valuation and stock performance |

| Financial Impact | Immediate cash bonus | Potential for significant capital gains |

| Retention | Less effective for long-term retention | Encourages long-term employee commitment |

| Risk Level | Low risk, guaranteed payout if targets met | Higher risk, value depends on stock market |

Definition of Annual Bonus and Equity Compensation

Annual bonus is a cash reward given to employees based on their performance or company profitability, typically paid annually to incentivize short-term achievement. Equity compensation involves granting employees stock options, shares, or other ownership interests, aligning their rewards with the long-term success and growth of the company. Both forms of rewards serve to motivate employees but differ in liquidity, risk, and impact on employee retention.

Key Differences Between Annual Bonus and Equity Compensation

Annual bonuses provide immediate cash rewards based on short-term performance metrics, enhancing employee motivation for yearly targets. Equity compensation, such as stock options or restricted shares, aligns employees with long-term company growth by offering ownership stakes that appreciate over time. While bonuses deliver quick financial gratification, equity fosters sustained commitment and potential wealth accumulation through stock value increases.

Impact on Short-Term vs Long-Term Motivation

Annual bonuses provide immediate financial rewards that boost short-term motivation by directly linking performance to tangible gains within the same fiscal year. Equity compensation, such as stock options or restricted stock units, aligns employee interests with company growth, driving sustained long-term motivation as the value of equity typically appreciates over several years. Combining both reward types balances immediate performance incentives with incentives for enduring commitment and company success.

Tax Implications for Employees

Annual bonuses are typically taxed as ordinary income in the year they are received, resulting in immediate tax liability for employees. Equity compensation, such as stock options or restricted stock units (RSUs), often offers tax deferral advantages, with taxation occurring upon vesting or sale, which can help employees manage their tax burden more strategically. Understanding the timing and nature of tax obligations for each reward type is critical for employees to optimize their after-tax compensation and financial planning.

Potential for Wealth Accumulation

Annual bonuses provide immediate cash rewards based on short-term performance, offering liquidity but limited growth potential. Equity compensation, such as stock options or restricted stock units, aligns employee incentives with company success and can significantly increase long-term wealth through stock price appreciation. The potential for wealth accumulation is higher with equity compensation due to market-driven gains and compounding value over time.

Risk Factors of Equity Compensation

Equity compensation carries significant risk factors including market volatility, company performance fluctuations, and potential dilution of shares, which may result in unpredictable reward values. Unlike annual bonuses that provide fixed or guaranteed payouts, equity rewards depend heavily on stock price appreciation and the company's long-term success. Employees must consider the possibility of losing value if the stock underperforms or if restrictive vesting schedules limit liquidity.

Liquidity and Accessibility of Rewards

Annual bonuses provide immediate liquidity and are accessible as cash, allowing employees to use rewards instantly without waiting periods. Equity compensation, such as stock options or restricted stock units, often entails vesting schedules and market dependencies, limiting immediate access to their value. The choice between these rewards depends on employees' preference for liquid cash versus potential long-term wealth growth through equity.

Alignment with Company Performance

Equity compensation aligns employee rewards directly with company performance by linking financial gain to stock value growth, fostering long-term commitment and shared success. Annual bonuses provide immediate incentives based on short-term performance metrics but may not fully reflect sustained company value creation. Equity stakes encourage employees to prioritize strategic goals that enhance shareholder wealth, creating stronger alignment between individual efforts and corporate performance.

Employee Retention and Loyalty Effects

Annual bonuses provide immediate financial gratification, which can boost short-term motivation but may not significantly influence long-term employee retention and loyalty. Equity compensation, such as stock options or restricted stock units, aligns employees' interests with company performance, fostering a deeper sense of ownership and encouraging retention over multiple years. Companies leveraging equity compensation often experience higher employee loyalty and reduced turnover rates due to the vested interest employees have in the organization's sustained success.

Ideal Scenarios for Each Compensation Type

Annual bonuses are ideal for roles with clear short-term performance targets, such as sales or project-based positions, where immediate financial rewards drive motivation and productivity. Equity compensation suits employees in startups or growth-focused companies who prioritize long-term value creation and retention, aligning personal success with company growth. Combining both can optimize incentives, balancing immediate recognition with future wealth accumulation in dynamic business environments.

Related Important Terms

Phantom Equity

Phantom equity offers employees the financial upside of equity ownership without diluting company shares, serving as a long-term performance incentive compared to the immediate payout of annual bonuses. This form of compensation aligns employee interests with company growth by granting cash or stock value tied to company performance, enhancing retention and motivation.

Vesting Cliff

Annual bonus payments provide immediate financial rewards tied to yearly performance but lack long-term retention benefits, whereas equity compensation with a vesting cliff incentivizes employee loyalty by requiring a minimum tenure before any shares fully vest, aligning interests with company growth. The vesting cliff typically ranges from one to four years, ensuring employees remain engaged and contribute to sustained performance before accessing significant equity value.

Deferred Bonus Pool

Deferred Bonus Pool allows companies to allocate a portion of annual bonuses to be paid out over time, aligning employee incentives with long-term performance and enhancing retention. Equity compensation complements this by granting stock options or shares that appreciate with company value, fostering ownership but involving market risk and delayed liquidity.

Double-Trigger Acceleration

Double-trigger acceleration in equity compensation ensures employees receive accelerated vesting upon both a company acquisition and subsequent termination without cause, providing stronger long-term incentives compared to an annual bonus that offers immediate but one-time performance rewards. This mechanism aligns employee interests with shareholder value by protecting equity stakes while encouraging retention through corporate transitions.

Performance Share Units (PSUs)

Performance Share Units (PSUs) align employee rewards with company performance by granting shares based on meeting specific targets, creating long-term incentives beyond immediate cash bonuses. Unlike annual bonuses, PSUs promote sustained growth and employee retention by linking compensation to stock value appreciation and strategic goals achievement.

Stock Appreciation Rights (SARs)

Stock Appreciation Rights (SARs) provide employees with benefits linked directly to company stock performance, offering potential upside without requiring actual stock purchase, making them a flexible alternative to traditional annual bonuses. Unlike fixed cash bonuses, SARs align employee incentives with long-term shareholder value by granting rights to the increase in stock price over a specified period.

Variable Equity Grants

Variable equity grants provide employees with ownership stakes that can appreciate over time, aligning their performance directly with company growth and shareholder value. Unlike annual bonuses, these grants offer long-term incentives that promote retention and sustained motivation by converting performance achievements into tangible equity rewards.

Quarterly Cash-Out Window

Quarterly cash-out windows provide employees with timely liquidity for annual bonuses, enhancing immediate financial motivation compared to equity compensation, which typically vests over longer periods. This structure supports improved cash flow management and aligns short-term performance rewards with employee satisfaction and retention.

Golden Parachute Equity

Golden Parachute Equity provides executives with substantial financial security during mergers or acquisitions, often surpassing the immediate benefits of Annual Bonuses by offering long-term wealth accumulation and alignment with shareholder interests. This equity-based compensation ensures sustained motivation and retention, potentially yielding higher returns than one-time Annual Bonuses tied solely to short-term performance metrics.

Deferred Restricted Stock Units (Deferred RSUs)

Deferred Restricted Stock Units (Deferred RSUs) offer long-term value appreciation aligned with company performance, providing employees with vested shares that typically mature over several years, promoting retention and sustained motivation. Unlike annual bonuses, Deferred RSUs defer immediate cash rewards, allowing employees to benefit from stock price growth and potential dividends, enhancing total compensation through equity ownership.

Annual Bonus vs Equity Compensation for performance rewards. Infographic

hrdif.com

hrdif.com