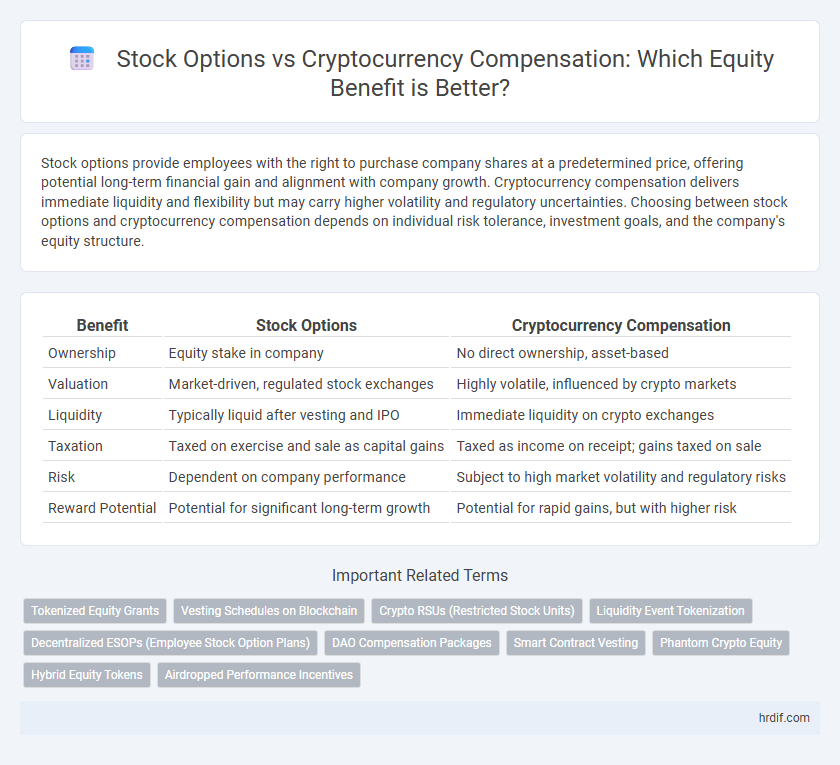

Stock options provide employees with the right to purchase company shares at a predetermined price, offering potential long-term financial gain and alignment with company growth. Cryptocurrency compensation delivers immediate liquidity and flexibility but may carry higher volatility and regulatory uncertainties. Choosing between stock options and cryptocurrency compensation depends on individual risk tolerance, investment goals, and the company's equity structure.

Table of Comparison

| Benefit | Stock Options | Cryptocurrency Compensation |

|---|---|---|

| Ownership | Equity stake in company | No direct ownership, asset-based |

| Valuation | Market-driven, regulated stock exchanges | Highly volatile, influenced by crypto markets |

| Liquidity | Typically liquid after vesting and IPO | Immediate liquidity on crypto exchanges |

| Taxation | Taxed on exercise and sale as capital gains | Taxed as income on receipt; gains taxed on sale |

| Risk | Dependent on company performance | Subject to high market volatility and regulatory risks |

| Reward Potential | Potential for significant long-term growth | Potential for rapid gains, but with higher risk |

Understanding Stock Options as Employee Equity

Stock options provide employees with the right to purchase company shares at a set price, offering potential financial gain if the company's valuation increases. Unlike cryptocurrency compensation, stock options align employees' interests with long-term company growth and stability through established equity frameworks. Understanding stock options as employee equity emphasizes their role in fostering ownership, incentivizing performance, and delivering tax advantages under specific regulatory provisions.

What is Cryptocurrency Compensation in the Workplace?

Cryptocurrency compensation in the workplace involves paying employees in digital currencies like Bitcoin or Ethereum, offering an alternative to traditional stock options. This method provides benefits such as faster transactions, global accessibility, and potential for significant asset appreciation. Companies adopting cryptocurrency compensation can enhance employee incentives by aligning rewards with emerging financial technologies and market trends.

Key Differences Between Stock Options and Cryptocurrency Equity

Stock options provide employees with the right to purchase company shares at a predetermined price, offering potential capital gains tied to company growth, whereas cryptocurrency compensation offers immediate or vested tokens that can fluctuate widely in value. Unlike stock options, which are regulated and often come with tax advantages under specific conditions, cryptocurrency equity operates in a more volatile and less regulated market, impacting risk and liquidity. Understanding these key differences is critical for evaluating compensation packages, as stock options align employee interests with long-term company success while cryptocurrency compensation provides more immediate but unpredictable financial benefits.

Volatility and Risk: Stock Options vs Cryptocurrency Compensation

Stock options offer employees equity participation with historically lower volatility compared to cryptocurrency compensation, which experiences significant price fluctuations often exceeding 10% daily. The predictable market behavior of stocks provides a relatively stable valuation, reducing financial risk for recipients, whereas cryptocurrency's extreme volatility can lead to unpredictable gains or losses. Employers and employees must weigh the stability of traditional stock options against the high-risk, high-reward nature of cryptocurrency compensation when considering equity benefits.

Tax Implications: Navigating Equity Compensation Choices

Stock options generally offer tax advantages such as deferral until exercise and favorable capital gains treatment, whereas cryptocurrency compensation can trigger immediate taxable income upon receipt and complex reporting requirements. Understanding the tax implications of each equity compensation type is crucial for optimizing financial outcomes and minimizing tax liabilities. Careful planning with a tax advisor ensures compliance and strategic timing for exercising stock options or selling cryptocurrencies.

Liquidity and Access: Selling Your Stock or Crypto Equity

Stock options typically require a vesting period and potential waiting periods before selling, limiting immediate liquidity compared to cryptocurrency compensation, which can often be sold or traded on various exchanges instantly. Cryptocurrency equity provides more flexible access to funds due to 24/7 market availability, enhancing the ability to quickly convert assets into cash. However, stock options may offer more stable valuation and regulatory protections, influencing the timing and strategy of selling for optimal financial benefit.

Company Stage: Which Equity Model Fits Best?

Early-stage companies often prefer stock options as a compensation model because they align employee incentives with long-term company growth and offer potential tax advantages. In contrast, established companies with stable valuation might consider cryptocurrency compensation to attract tech-savvy talent and provide liquidity without diluting equity. Evaluating the company's growth trajectory, cash flow, and regulatory environment helps determine whether stock options or cryptocurrency best supports equity incentives.

Employee Perspective: Preferences and Retention Impact

Stock options offer employees long-term financial security and a sense of ownership, aligning their interests with company growth and boosting retention rates. Cryptocurrency compensation appeals to employees seeking immediate liquidity and potential high returns, but its volatility may impact perceived stability and thus retention. Employers balancing these options must consider workforce preferences and market trends to optimize engagement and loyalty.

Employer Considerations: Costs, Regulations, and Incentives

Employers weigh stock options against cryptocurrency compensation by analyzing costs such as issuance and administration fees, alongside fluctuating market values impacting long-term expense management. Regulatory frameworks differ significantly, with stock options governed by established securities laws and tax codes, whereas cryptocurrency compensation faces evolving compliance challenges globally. Incentive structures vary as stock options align employee interests with company equity growth, while cryptocurrency rewards offer liquidity and appeal to tech-savvy talent, influencing retention and recruitment strategies.

Future Trends: The Evolution of Equity Compensation

Future trends in equity compensation highlight a growing shift from traditional stock options to cryptocurrency-based rewards, driven by blockchain technology's transparency and liquidity advantages. Companies integrating tokenized equity aim to enhance employee engagement through instant trading capabilities and reduced vesting complexities. This evolution reflects a broader move toward decentralized finance solutions, aligning compensation structures with the digital economy's dynamic landscape.

Related Important Terms

Tokenized Equity Grants

Tokenized equity grants enhance traditional stock options by providing faster liquidity and programmable automation on blockchain platforms, enabling employees to trade or manage their equity more efficiently. This innovative compensation method reduces administrative costs and increases transparency compared to conventional stock options, positioning tokenized equity as a superior alternative within employee incentive plans.

Vesting Schedules on Blockchain

Stock options with blockchain-based vesting schedules offer transparent, tamper-proof records that enhance trust and facilitate automated release of equity over predetermined periods. Cryptocurrency compensation leverages blockchain to enable instant, verifiable transactions but may lack the structured, gradual ownership transfer inherent in traditional stock option vesting models.

Crypto RSUs (Restricted Stock Units)

Crypto RSUs offer employees a unique blend of liquidity and potential appreciation without immediate tax liabilities, enhancing compensation flexibility compared to traditional stock options. These units leverage blockchain technology to provide transparent, secure, and programmable equity rewards, aligning long-term incentives with company performance in dynamic markets.

Liquidity Event Tokenization

Stock options provide structured equity compensation with clear tax implications and potential for liquidity at IPO or acquisition, while cryptocurrency compensation leverages liquidity event tokenization to enable faster, fractionalized asset trading on blockchain platforms. Tokenized equity enhances transparency and accessibility, offering employees more flexible liquidity options compared to traditional stock options.

Decentralized ESOPs (Employee Stock Option Plans)

Decentralized ESOPs leverage blockchain technology to offer transparent, secure, and easily tradable stock options, enhancing employee ownership and liquidity compared to traditional equity plans. Cryptocurrency compensation in decentralized ESOPs enables real-time valuation, reduces administrative overhead, and provides global access, attracting tech-savvy talent and fostering innovative company cultures.

DAO Compensation Packages

DAO compensation packages often favor stock options for providing equity holders with clear governance voting rights and long-term value appreciation, whereas cryptocurrency compensation offers immediate liquidity and decentralized payment flexibility. Balancing equity in DAOs requires assessing stock options' alignment with organizational control against cryptocurrency's volatility and tax implications.

Smart Contract Vesting

Stock options offer predictable equity growth with smart contract vesting that automates option release based on time or performance milestones, ensuring transparent and enforceable vesting schedules. Cryptocurrency compensation leverages blockchain-based smart contracts for immediate, tamper-proof vesting and potential liquidity, but introduces market volatility risks impacting overall equity value.

Phantom Crypto Equity

Phantom Crypto Equity offers employees the financial upside of stock options without actual share issuance, providing a flexible alternative to traditional equity compensation. This form of compensation grants value tied to the company's cryptocurrency performance, aligning employee incentives with market-driven digital asset appreciation.

Hybrid Equity Tokens

Hybrid Equity Tokens combine the liquidity and flexibility of cryptocurrency with traditional stock option benefits, offering employees faster access to value and potential for global trading. This hybrid model enhances compensation strategies by providing both equity ownership and cryptocurrency market exposure.

Airdropped Performance Incentives

Airdropped performance incentives in cryptocurrency compensation provide immediate liquidity and enhanced flexibility compared to traditional stock options, which often involve prolonged vesting periods and regulatory constraints. These crypto-based rewards enable employees to participate directly in the value growth of decentralized assets, aligning incentives with real-time market performance.

Stock Options vs Cryptocurrency Compensation for equity. Infographic

hrdif.com

hrdif.com