Commuter benefits offer structured support for employees using public transit or carpooling, reducing monthly travel costs through pre-tax deductions or employer subsidies. Remote work allowances provide flexible transportation support by compensating for occasional travel needs, such as trips to the office or client meetings, adapting to hybrid work models. Choosing between these benefits depends on commuting frequency and the company's remote work policy to optimize employee satisfaction and cost efficiency.

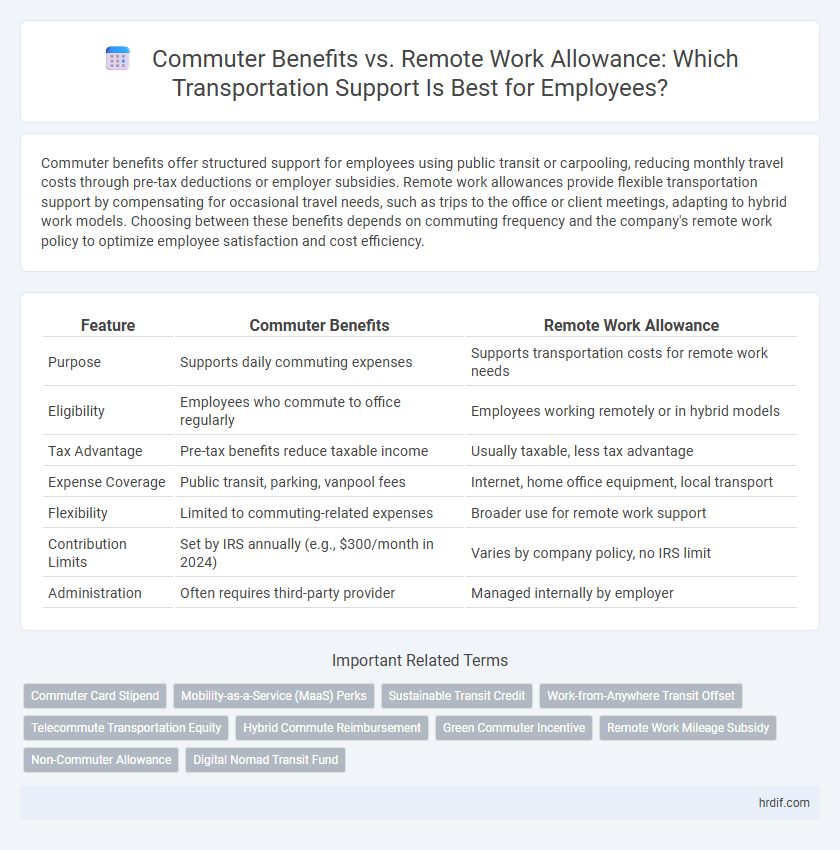

Table of Comparison

| Feature | Commuter Benefits | Remote Work Allowance |

|---|---|---|

| Purpose | Supports daily commuting expenses | Supports transportation costs for remote work needs |

| Eligibility | Employees who commute to office regularly | Employees working remotely or in hybrid models |

| Tax Advantage | Pre-tax benefits reduce taxable income | Usually taxable, less tax advantage |

| Expense Coverage | Public transit, parking, vanpool fees | Internet, home office equipment, local transport |

| Flexibility | Limited to commuting-related expenses | Broader use for remote work support |

| Contribution Limits | Set by IRS annually (e.g., $300/month in 2024) | Varies by company policy, no IRS limit |

| Administration | Often requires third-party provider | Managed internally by employer |

Understanding Commuter Benefits and Remote Work Allowances

Commuter benefits offer tax-advantaged programs that help employees save on transportation costs such as transit passes, vanpooling, and parking expenses, enhancing affordability for daily commutes. Remote work allowances provide financial support specifically for home office expenses and occasional transportation needs, promoting flexibility for employees working outside traditional office settings. Understanding the distinctions between these benefits helps organizations optimize support based on workforce commuting patterns and remote work arrangements.

Key Differences Between Commuter Benefits and Remote Work Stipends

Commuter benefits provide employees with tax-advantaged funds specifically for public transportation and parking expenses incurred during their daily commute, whereas remote work stipends offer a broader, often taxable allowance intended to cover various home office and transportation costs for employees working remotely. Commuter benefits are regulated under IRS Section 132(f) with monthly pre-tax contribution limits, while remote work stipends lack standardized tax treatment and typically come as flexible reimbursements. Employers may choose commuter benefits to incentivize sustainable transportation, while remote work stipends are designed to support diverse expenses associated with hybrid or fully remote work arrangements.

Cost Savings for Employers: Which Transportation Support Wins?

Commuter benefits often provide significant tax advantages for employers, reducing payroll taxes and lowering overall transportation costs. Remote work allowances offer direct financial support without tax benefits, but they may lead to greater savings by decreasing office-related expenses and parking costs. Analyzing both options, commuter benefits typically result in more immediate cost savings, while remote work allowances can yield long-term reductions in operational expenses.

Employee Preferences: Flexibility vs. Traditional Commutes

Employee preferences highlight a growing demand for flexibility, with many prioritizing remote work allowances over traditional commuter benefits to support transportation costs. While commuter benefits typically cover expenses such as transit passes and parking, remote work allowances offer broader usage, enabling employees to tailor support based on diverse transportation needs or home office setups. Data indicates that companies providing flexible remote work allowances often experience higher employee satisfaction and retention compared to those limited to conventional commuter benefits.

Tax Implications of Commuter and Remote Work Benefits

Commuter benefits typically offer pre-tax deductions for public transit and parking expenses, reducing taxable income and providing immediate tax savings for employees. Remote work allowances, often treated as taxable income, may not provide the same upfront tax advantages but can be partially offset by business expense deductions if properly documented. Employers must navigate IRS guidelines carefully to optimize tax outcomes while ensuring compliance for both types of transportation support benefits.

Environmental Impact: Reducing Carbon Footprint with Each Option

Commuter benefits, such as subsidized public transit passes and carpool incentives, significantly reduce individual carbon footprints by encouraging the use of eco-friendly transportation modes. Remote work allowances minimize daily commutes altogether, leading to a substantial decrease in vehicle emissions and energy consumption associated with office travel. Both options contribute to corporate sustainability goals by lowering greenhouse gas emissions and promoting greener commuting habits.

Accessibility and Inclusivity in Transportation Support Programs

Commuter benefits enhance accessibility by offering pre-tax transit passes and subsidies, making public transportation more affordable for a diverse workforce. Remote work allowances provide flexible financial support that employees can allocate toward various transportation needs, including rideshares or parking, promoting inclusivity for those with unique commuting challenges. Both programs contribute to reducing transportation barriers, fostering an equitable work environment through tailored support options.

Administrative Considerations for Implementing Each Benefit

Commuter benefits require employers to navigate complex tax regulations and ensure compliance with IRS limits on pre-tax contributions, demanding meticulous payroll adjustments and reporting. Remote work allowances offer greater administrative flexibility, allowing for straightforward lump-sum payments without stringent tax restrictions but necessitate clear policies to define eligible transportation expenses. Both options require robust documentation and communication strategies to manage employee eligibility and prevent misuse.

Productivity Outcomes: Commuting vs. Working Remotely

Commuter benefits reduce employee stress and improve punctuality by subsidizing transit costs, directly enhancing workplace productivity during office hours. Remote work allowances support transportation flexibility, enabling employees to allocate saved commuting time toward focused tasks and work-life balance. Employees with optimized transportation support report higher engagement and output, driven by reduced daily travel fatigue and increased autonomy.

Future Trends in Employee Transportation Support Benefits

Future trends in employee transportation support benefits show a shift from traditional commuter benefits to more flexible remote work allowances, reflecting the growing prevalence of hybrid work models. Employers increasingly offer stipends or reimbursements tailored to individual commuting needs, including public transit, ride-sharing, and home office expenses, to enhance employee satisfaction and retention. Enhanced digital platforms and data analytics are being integrated to optimize transportation benefit programs and support sustainability goals.

Related Important Terms

Commuter Card Stipend

Commuter Card Stipends provide employees with a flexible, tax-free method to cover public transit, parking, and ride-share expenses, optimizing transportation support compared to Remote Work Allowance which primarily reimburses home office costs. This targeted benefit enhances commuter convenience and reduces taxable income, making it a more efficient solution for organizations prioritizing sustainable and cost-effective employee transportation solutions.

Mobility-as-a-Service (MaaS) Perks

Commuter Benefits often include Mobility-as-a-Service (MaaS) perks such as subsidized transit passes, rideshare credits, and bike-share memberships that streamline and reduce the cost of daily travel. Remote Work Allowance for transportation support typically offers flexible spending for occasional travel needs, but MaaS perks in commuter benefits provide a more integrated, technology-driven solution enhancing sustainable and efficient mobility options.

Sustainable Transit Credit

Sustainable Transit Credit offers employees a tax-advantaged benefit to cover public transportation costs, encouraging eco-friendly commuting options and reducing carbon emissions. Unlike Remote Work Allowance, which typically reimburses general home office expenses, this credit directly supports sustainable transit expenses, promoting long-term environmental and financial savings for both employers and employees.

Work-from-Anywhere Transit Offset

Work-from-Anywhere Transit Offset provides employees with flexible transportation support regardless of their location, ensuring equitable access to transit benefits compared to traditional Commuter Benefits that focus primarily on fixed-route commuting. This approach enhances employee satisfaction by covering expenses such as ride-share credits, bike-sharing memberships, and public transit, supporting diverse commuting patterns and promoting sustainable mobility.

Telecommute Transportation Equity

Commuter benefits typically provide structured subsidies for public transit or vanpool expenses, promoting equitable transportation access for employees using traditional commuting methods. Remote work allowances for transportation support focus on offsetting costs related to telecommuting, such as occasional travel or home office setup, ensuring fairness in compensation irrespective of daily commute presence.

Hybrid Commute Reimbursement

Hybrid commute reimbursement offers a flexible solution by combining commuter benefits with remote work allowances, enabling employees to receive tax-advantaged subsidies for transportation expenses on office days while supporting remote work costs. This approach maximizes cost-efficiency and employee satisfaction by tailoring benefits to varied commute patterns, enhancing overall workforce productivity and reducing environmental impact.

Green Commuter Incentive

Green Commuter Incentives offer tax-advantaged benefits that encourage employees to use eco-friendly transportation, making commuter benefits more cost-effective compared to remote work allowances focused solely on transportation reimbursement. These programs reduce carbon footprints by supporting public transit, biking, and carpooling, aligning with corporate sustainability goals while providing substantial financial savings for both employers and employees.

Remote Work Mileage Subsidy

Remote Work Mileage Subsidy offers a targeted transportation support benefit by reimbursing employees for miles driven when commuting from home to temporary work locations, enhancing cost efficiency for remote workers. This subsidy complements commuter benefits by addressing unique travel patterns in remote work setups, promoting equitable expense management.

Non-Commuter Allowance

Non-commuter allowances provide financial support for transportation costs unrelated to daily commuting, catering to remote employees who may require occasional travel or delivery services. These benefits enhance flexibility and acknowledge diverse work arrangements beyond traditional commuter subsidies.

Digital Nomad Transit Fund

The Digital Nomad Transit Fund offers a flexible transportation support option compared to traditional commuter benefits by providing remote workers with stipends to cover diverse transit costs beyond fixed routes. This allowance enhances mobility for employees working from various locations, promoting productivity and reducing reliance on conventional commuting subsidies.

Commuter Benefits vs Remote Work Allowance for transportation support. Infographic

hrdif.com

hrdif.com