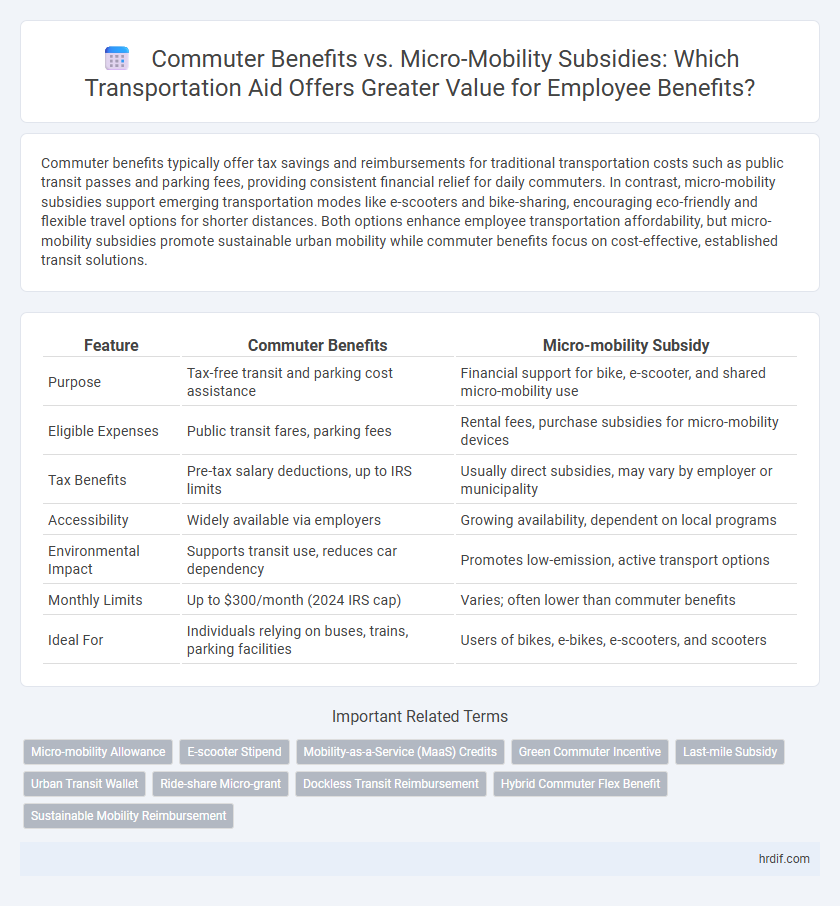

Commuter benefits typically offer tax savings and reimbursements for traditional transportation costs such as public transit passes and parking fees, providing consistent financial relief for daily commuters. In contrast, micro-mobility subsidies support emerging transportation modes like e-scooters and bike-sharing, encouraging eco-friendly and flexible travel options for shorter distances. Both options enhance employee transportation affordability, but micro-mobility subsidies promote sustainable urban mobility while commuter benefits focus on cost-effective, established transit solutions.

Table of Comparison

| Feature | Commuter Benefits | Micro-mobility Subsidy |

|---|---|---|

| Purpose | Tax-free transit and parking cost assistance | Financial support for bike, e-scooter, and shared micro-mobility use |

| Eligible Expenses | Public transit fares, parking fees | Rental fees, purchase subsidies for micro-mobility devices |

| Tax Benefits | Pre-tax salary deductions, up to IRS limits | Usually direct subsidies, may vary by employer or municipality |

| Accessibility | Widely available via employers | Growing availability, dependent on local programs |

| Environmental Impact | Supports transit use, reduces car dependency | Promotes low-emission, active transport options |

| Monthly Limits | Up to $300/month (2024 IRS cap) | Varies; often lower than commuter benefits |

| Ideal For | Individuals relying on buses, trains, parking facilities | Users of bikes, e-bikes, e-scooters, and scooters |

Understanding Commuter Benefits and Micro-mobility Subsidies

Commuter benefits offer employees tax-free allowances for traditional transportation expenses like public transit and parking, reducing overall commuting costs and promoting sustainable travel. Micro-mobility subsidies cover emerging transport modes such as e-scooters and bike-sharing programs, encouraging eco-friendly, short-distance trips and complementing public transit options. Understanding these options enables employers and employees to maximize transportation aid while supporting environmental goals and urban mobility innovation.

Key Differences Between Traditional Commuter Benefits and Micro-mobility Options

Traditional commuter benefits typically include pre-tax transit passes and parking subsidies that support public transportation and car commuting, while micro-mobility subsidies focus on promoting alternatives like e-scooters, bike-sharing, and other small electric vehicles. These micro-mobility options offer more flexible, last-mile transportation solutions that enhance urban mobility and reduce reliance on cars. Key differences lie in the modes of transit supported, the environmental impact, and the convenience offered for short-distance trips.

Employee Preferences: Flexibility vs. Consistency in Transportation Aid

Employee preferences in transportation aid often balance between flexibility and consistency, with commuter benefits providing reliable, predictable support for daily travel expenses, while micro-mobility subsidies offer adaptable options for spontaneous, short-distance trips. Commuter benefits typically appeal to workers with fixed routes and schedules, ensuring stable financial assistance for transit passes or parking fees. In contrast, micro-mobility subsidies cater to employees seeking on-demand convenience and eco-friendly alternatives like e-scooters or bike shares, reflecting a growing trend toward personalized, flexible commuting solutions.

Cost-effectiveness of Commuter Benefits vs. Micro-mobility Subsidies

Commuter benefits such as transit passes and pre-tax deductions typically offer higher cost-effectiveness by directly reducing employee commuting expenses while lowering employer payroll taxes. Micro-mobility subsidies, including e-scooter and bike-share programs, often involve higher administrative costs and variable usage rates, which can reduce overall economic efficiency. Employers seeking the greatest return on investment generally find commuter benefits more predictable and scalable compared to micro-mobility subsidies.

Environmental Impact: Sustainable Transportation Incentives

Commuter benefits and micro-mobility subsidies both promote sustainable transportation by reducing carbon emissions and traffic congestion. Commuter benefits often support public transit usage, which lowers individual car trips, while micro-mobility subsidies encourage eco-friendly options like e-scooters and bike-sharing programs. These incentives collectively foster greener urban mobility and contribute to improved air quality.

Accessibility and Equity in Workplace Transportation Programs

Commuter benefits and micro-mobility subsidies both enhance workplace transportation accessibility, but micro-mobility subsidies often provide more equitable options for employees without traditional vehicle access. Subsidizing micro-mobility services like e-scooters and bike shares addresses last-mile connectivity, reducing barriers for low-income workers in urban areas. Prioritizing these subsidies alongside commuter benefits creates a more inclusive transportation program that supports diverse commuting needs.

Tax Implications for Employers and Employees

Commuter benefits offer tax-exempt subsidies up to $300 monthly for transit and vanpool costs, reducing taxable income for employees and lowering payroll taxes for employers. Micro-mobility subsidies, such as e-bike or scooter reimbursements, often lack comprehensive federal tax exclusions, potentially resulting in taxable income for employees and added payroll tax liabilities for employers. Employers must navigate IRS regulations carefully to maximize tax advantages while ensuring compliance in offering transportation aid programs.

Integrating Micro-mobility Subsidies into Existing Benefit Packages

Integrating micro-mobility subsidies into existing commuter benefit packages enhances transportation aid by expanding user options beyond traditional transit methods, supporting environmentally friendly and cost-effective travel choices. Employers can boost participation rates by offering combined benefits that cover e-bikes, scooters, and public transit, aligning with sustainability goals and addressing diverse commuting needs. This hybrid approach maximizes employee satisfaction and reduces carbon footprints while maintaining tax advantages under current commuter benefit regulations.

Measuring Employee Productivity and Well-being

Commuter benefits directly reduce employee stress associated with travel costs and time, increasing punctuality and overall productivity by easing financial burdens and promoting consistent attendance. Micro-mobility subsidies encourage active commuting options such as biking or e-scooters, which enhance employee well-being through physical activity and reduced carbon footprint. Measuring productivity improvements linked to these benefits involves tracking attendance patterns, reported stress levels, and health-related absenteeism to assess their impact on workforce efficiency and morale.

Future Trends in Workplace Transportation Aid

Future trends in workplace transportation aid indicate a shift towards integrating commuter benefits with micro-mobility subsidies to enhance employee flexibility and reduce carbon footprints. Employers increasingly prioritize sustainable options like e-scooters and bike-sharing programs alongside traditional transit passes, driving higher adoption rates and improved urban mobility. Data shows that combining these benefits can lead to increased employee satisfaction and significant reductions in commuting costs and environmental impact.

Related Important Terms

Micro-mobility Allowance

Micro-mobility allowances provide employees with flexible transportation options such as e-scooters, bikes, and shared mobility services, reducing reliance on traditional public transit and decreasing carbon emissions. Offering targeted subsidies for micro-mobility enables companies to support sustainable commuting while promoting healthier, cost-effective travel alternatives compared to conventional commuter benefits like transit passes or parking reimbursements.

E-scooter Stipend

E-scooter stipends as part of micro-mobility subsidies provide employees with flexible, eco-friendly commuting options while reducing reliance on traditional commuter benefits like transit passes or parking reimbursements. Offering targeted e-scooter subsidies can enhance workforce satisfaction, lower carbon footprints, and support urban congestion relief more effectively than standard commuter benefit programs.

Mobility-as-a-Service (MaaS) Credits

Mobility-as-a-Service (MaaS) credits offer a flexible alternative to traditional commuter benefits by integrating various transportation options, including micro-mobility services, into a single digital platform, enhancing user convenience and cost-efficiency. Unlike standard commuter subsidies limited to public transit or parking, MaaS credits provide seamless access to scooters, bikes, ride-sharing, and public transit, promoting sustainable and multimodal commuting choices.

Green Commuter Incentive

Green Commuter Incentive programs significantly reduce carbon emissions by encouraging employees to use eco-friendly transportation options such as biking, electric scooters, and public transit. These initiatives often provide tax-free commuter benefits and micro-mobility subsidies, making sustainable travel more affordable while promoting environmental responsibility.

Last-mile Subsidy

Last-mile subsidies enhance commuter benefits by specifically targeting the final leg of an employee's journey, reducing reliance on personal vehicles and promoting eco-friendly options like e-scooters and bike shares. These targeted micro-mobility subsidies improve access, lower overall transportation costs, and support sustainable urban mobility initiatives.

Urban Transit Wallet

Urban Transit Wallet integrates both Commuter Benefits and Micro-mobility Subsidies, offering seamless access to multiple transportation modes such as buses, subways, e-scooters, and bike-sharing programs, optimizing cost savings and convenience for urban commuters. Leveraging digital wallets enhances subsidy management and usage tracking, increasing commuter participation in sustainable transit options and reducing urban traffic congestion.

Ride-share Micro-grant

Ride-share micro-grants provide targeted financial support for individuals using micro-mobility options like e-scooters and bike shares, enhancing affordable transportation access. Unlike traditional commuter benefits, these subsidies directly address short-distance travel, reducing reliance on personal vehicles and easing urban congestion.

Dockless Transit Reimbursement

Dockless transit reimbursement offers flexible, cost-effective transportation aid by covering fares for e-scooters, bikes, and other dockless vehicles, enhancing daily commutes without relying on traditional parking or fixed routes. Commuter benefits typically emphasize subsidies for public transit passes and parking, whereas dockless transit reimbursement directly supports environmentally friendly, last-mile solutions that reduce congestion and improve urban mobility.

Hybrid Commuter Flex Benefit

Hybrid Commuter Flex Benefit combines traditional commuter benefits like transit passes and parking subsidies with micro-mobility options such as e-scooters or bike share credits, offering employees versatile transportation aid tailored to urban mobility trends. This integrated approach enhances cost savings on commuting expenses while promoting sustainable, flexible, and multimodal transit solutions.

Sustainable Mobility Reimbursement

Commuter benefits often provide tax-free reimbursements for public transit and vanpool expenses, promoting cost-effective and sustainable commuting options. Micro-mobility subsidies specifically encourage the use of eco-friendly transportation modes like e-bikes and scooters, enhancing urban sustainability through reduced emissions.

Commuter Benefits vs Micro-mobility Subsidy for Transportation Aid. Infographic

hrdif.com

hrdif.com