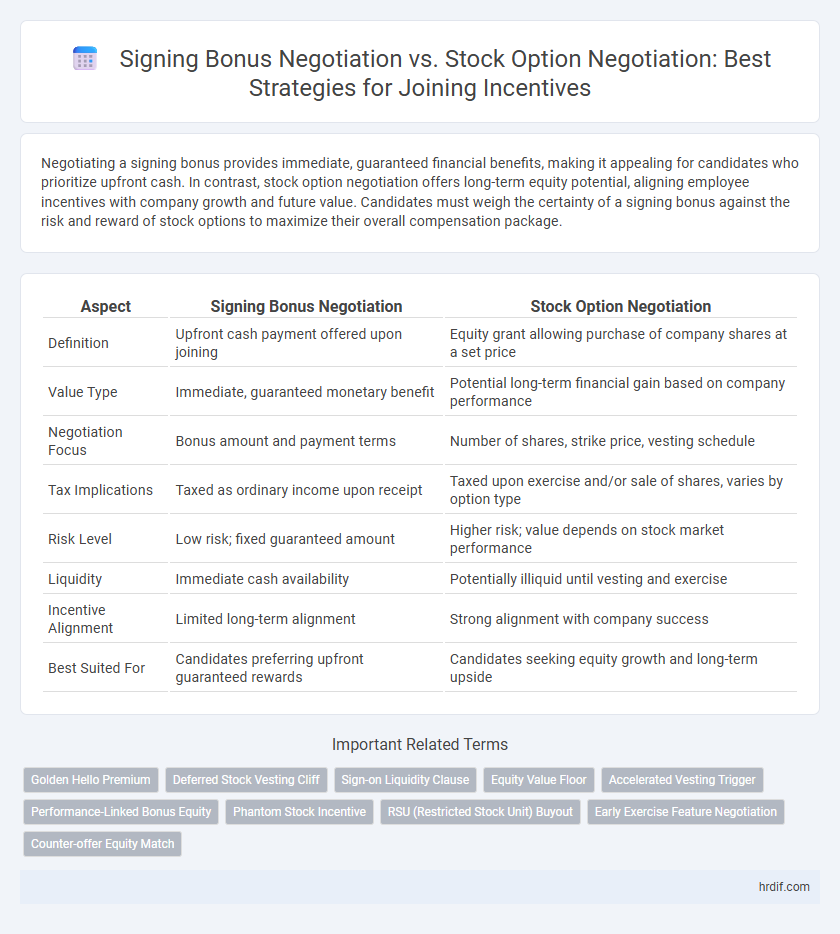

Negotiating a signing bonus provides immediate, guaranteed financial benefits, making it appealing for candidates who prioritize upfront cash. In contrast, stock option negotiation offers long-term equity potential, aligning employee incentives with company growth and future value. Candidates must weigh the certainty of a signing bonus against the risk and reward of stock options to maximize their overall compensation package.

Table of Comparison

| Aspect | Signing Bonus Negotiation | Stock Option Negotiation |

|---|---|---|

| Definition | Upfront cash payment offered upon joining | Equity grant allowing purchase of company shares at a set price |

| Value Type | Immediate, guaranteed monetary benefit | Potential long-term financial gain based on company performance |

| Negotiation Focus | Bonus amount and payment terms | Number of shares, strike price, vesting schedule |

| Tax Implications | Taxed as ordinary income upon receipt | Taxed upon exercise and/or sale of shares, varies by option type |

| Risk Level | Low risk; fixed guaranteed amount | Higher risk; value depends on stock market performance |

| Liquidity | Immediate cash availability | Potentially illiquid until vesting and exercise |

| Incentive Alignment | Limited long-term alignment | Strong alignment with company success |

| Best Suited For | Candidates preferring upfront guaranteed rewards | Candidates seeking equity growth and long-term upside |

Introduction: Understanding Joining Incentives

Negotiating joining incentives plays a crucial role in attracting top talent, where signing bonuses provide immediate financial rewards, while stock options offer long-term equity potential. Understanding the differences between these incentives helps candidates align their priorities with the company's compensation strategy and negotiate effectively. Companies often balance signing bonuses to secure early commitment and stock options to foster long-term retention and performance.

Signing Bonus Negotiation: Key Considerations

Signing bonus negotiation centers on securing immediate financial incentives that enhance initial job offer appeal and provide upfront liquidity for new employees. Key considerations include understanding the company's budget constraints, evaluating the bonus's tax implications, and aligning the signing bonus with long-term career goals to ensure it complements overall compensation. Emphasizing clear communication about performance conditions tied to the bonus helps mitigate risks and fosters a transparent negotiation process.

Stock Option Negotiation: Essential Factors

Stock option negotiation requires evaluating the vesting schedule, strike price, and potential dilution to maximize long-term financial benefits. Understanding the company's valuation and growth trajectory is critical for assessing the true value of stock options compared to immediate signing bonuses. Negotiators must also consider tax implications and exit opportunities to optimize the overall compensation package.

Immediate vs Long-Term Rewards: A Comparative Analysis

Signing bonus negotiation offers immediate financial rewards, providing new hires with upfront cash incentives that can address short-term expenses or highlight the company's commitment. In contrast, stock option negotiation emphasizes long-term value, aligning employee interests with company growth by offering potential equity appreciation over time. Balancing these options requires evaluating the candidate's preference for instant liquidity against the desire for future wealth accumulation tied to the company's performance.

Evaluating Company Growth Potential in Stock Option Offers

Evaluating company growth potential is crucial when negotiating stock option offers as it directly impacts the future value of equity compensation. Unlike signing bonuses, which provide immediate cash benefits, stock options offer long-term incentives tied to company performance and market expansion. Understanding the company's revenue trajectory, market position, and innovation pipeline helps candidates assess the real worth of stock options compared to upfront signing bonuses.

Tax Implications: Bonuses vs Stock Options

Signing bonuses are typically taxed as ordinary income in the year they are received, resulting in immediate tax liability for the employee. Stock options, particularly incentive stock options (ISOs), often provide tax advantages by deferring taxation until the shares are sold, potentially qualifying for favorable capital gains rates if holding period requirements are met. Careful evaluation of the differing tax implications for bonuses versus stock options is crucial for maximizing the net value of joining incentives during negotiation.

Risk Assessment: Cash Now or Equity Later?

Signing bonus negotiation provides immediate cash incentives, reducing financial uncertainty and offering guaranteed income upon joining, whereas stock option negotiations involve future equity with potential for higher returns but increased risk due to market volatility and company performance. Evaluating personal risk tolerance and financial needs is crucial when deciding between upfront cash versus delayed equity benefits in compensation packages. Candidates prioritizing liquidity often prefer signing bonuses, while those confident in long-term company growth may favor stock options for greater wealth accumulation.

Negotiation Strategies for Signing Bonuses

Negotiation strategies for signing bonuses emphasize clear articulation of immediate financial needs, highlighting market research to justify a higher upfront payment compared to stock options' delayed value. Candidates often leverage competing offers and personal financial goals to strengthen their position for a substantial signing bonus, ensuring liquidity upon employment start. Employers may counterbalance bonus requests by emphasizing long-term equity growth, requiring negotiators to present compelling rationale for prioritizing guaranteed cash over potential stock gains.

Negotiation Tactics for Stock Options

Effective negotiation tactics for stock options include thoroughly understanding the company's valuation and growth potential to accurately assess the option's worth. Emphasizing the long-term alignment of interests with the company's success can strengthen your position when requesting favorable vesting schedules or accelerated exercisability. Leveraging market data on comparable startup equity packages ensures you negotiate competitive terms that maximize your total compensation value.

Making the Final Decision: Choosing the Right Incentive

Evaluating signing bonuses versus stock options requires analyzing immediate financial needs against long-term wealth potential and company growth prospects. Signing bonuses offer guaranteed, upfront cash that can address short-term expenses, while stock options provide equity-based incentives aligned with future company performance. The final decision hinges on personal risk tolerance, financial goals, and confidence in the employer's market trajectory.

Related Important Terms

Golden Hello Premium

A signing bonus negotiation often delivers immediate, guaranteed cash incentives, appealing to candidates seeking upfront financial security, while stock option negotiation offers potential long-term equity growth, aligning employee interests with company performance. The Golden Hello premium enhances signing bonuses by providing an exclusive, higher-value upfront payment designed to attract top-tier talent swiftly.

Deferred Stock Vesting Cliff

Negotiating a signing bonus provides immediate financial incentive, while stock option negotiation focuses on long-term equity growth tied to company performance, often subject to a deferred stock vesting cliff that requires employees to remain with the company for a defined period before options fully vest. Understanding the implications of the vesting cliff is crucial since it affects liquidity and the timing of ownership rights, influencing the overall value of stock-based compensation compared to upfront signing bonuses.

Sign-on Liquidity Clause

Signing bonus negotiations offer immediate liquidity, providing new hires with upfront cash incentives that reduce financial uncertainty upon joining. In contrast, stock option negotiations typically involve vesting periods and market risk, making the inclusion of a sign-on liquidity clause critical to ensure employees can access funds without waiting for long-term appreciation.

Equity Value Floor

Negotiating a signing bonus provides immediate guaranteed compensation, whereas stock option negotiation hinges on future equity value potential with an emphasis on establishing an equity value floor to secure minimum worth. An equity value floor protects employees by setting a baseline for stock options, ensuring minimum compensation despite company valuation fluctuations.

Accelerated Vesting Trigger

Signing bonus negotiations provide immediate, guaranteed income upon joining, while stock option negotiations offer long-term equity with potential growth, often enhanced by accelerated vesting triggers that enable employees to realize stock benefits faster in events like acquisition or termination. Accelerated vesting triggers incentivize candidates by reducing the waiting period for equity maturity, making stock options more attractive compared to upfront signing bonuses.

Performance-Linked Bonus Equity

Performance-linked bonus equity aligns employee incentives with company success by offering stock options tied to specific performance targets, enhancing long-term motivation and retention more effectively than one-time signing bonuses. Negotiating for performance-linked equity provides potential for greater financial upside based on company growth, contrasting with the immediate but fixed value of signing bonuses.

Phantom Stock Incentive

Phantom Stock Incentive offers a risk-free alternative to traditional stock options by providing employees with cash bonuses tied to the company's stock value without actual equity dilution, making it a strategic tool in signing bonus negotiation. Compared to stock option negotiation, phantom stock aligns employee interests with company performance while ensuring predictable financial outcomes, enhancing the attractiveness of joining incentives without complicating ownership structures.

RSU (Restricted Stock Unit) Buyout

RSU buyout negotiations often provide long-term financial incentives through equity appreciation, whereas signing bonus negotiations offer immediate cash rewards that enhance upfront compensation. Prioritizing RSU buyouts can align employee interests with company performance, making them a strategic choice in talent retention during negotiation discussions.

Early Exercise Feature Negotiation

Negotiating the early exercise feature in stock options allows employees to purchase shares before the typical vesting schedule, providing immediate equity ownership and potential tax advantages compared to a lump-sum signing bonus. Prioritizing early exercise terms can enhance long-term financial gains and align employee incentives with company growth better than fixed signing bonuses.

Counter-offer Equity Match

Counter-offer equity match in signing bonus negotiation often provides immediate financial security, appealing to candidates seeking upfront compensation, while stock option negotiation emphasizes long-term equity growth and alignment with company performance. Evaluating the value and vesting schedules of stock options versus the guaranteed cash benefit of signing bonuses is critical for optimizing total compensation packages during talent acquisition.

Signing bonus negotiation vs Stock option negotiation for joining incentives. Infographic

hrdif.com

hrdif.com