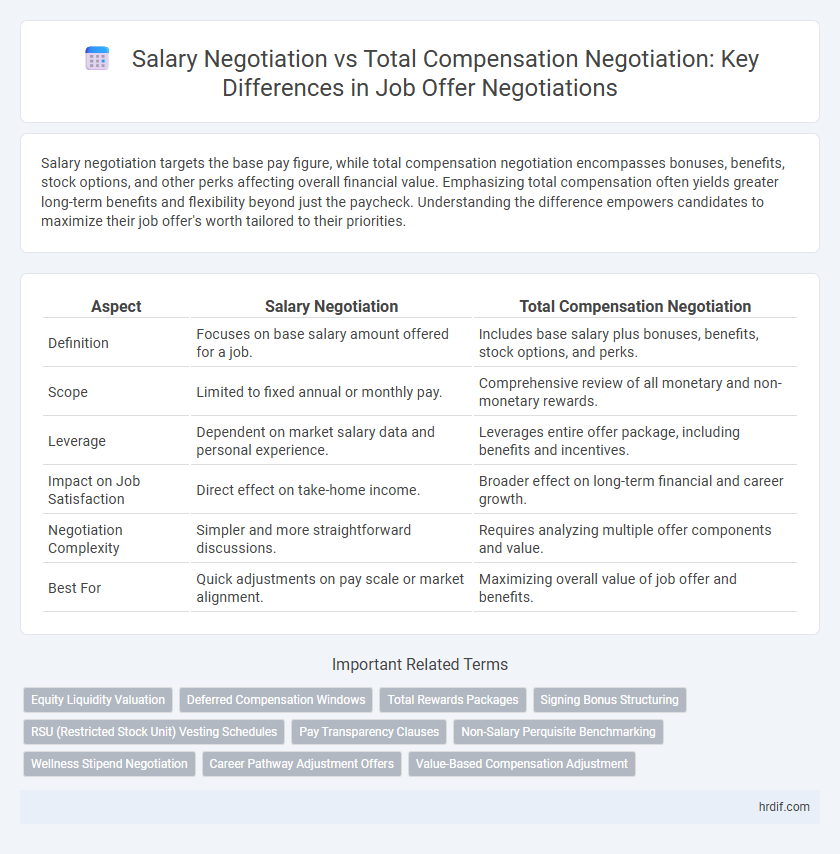

Salary negotiation targets the base pay figure, while total compensation negotiation encompasses bonuses, benefits, stock options, and other perks affecting overall financial value. Emphasizing total compensation often yields greater long-term benefits and flexibility beyond just the paycheck. Understanding the difference empowers candidates to maximize their job offer's worth tailored to their priorities.

Table of Comparison

| Aspect | Salary Negotiation | Total Compensation Negotiation |

|---|---|---|

| Definition | Focuses on base salary amount offered for a job. | Includes base salary plus bonuses, benefits, stock options, and perks. |

| Scope | Limited to fixed annual or monthly pay. | Comprehensive review of all monetary and non-monetary rewards. |

| Leverage | Dependent on market salary data and personal experience. | Leverages entire offer package, including benefits and incentives. |

| Impact on Job Satisfaction | Direct effect on take-home income. | Broader effect on long-term financial and career growth. |

| Negotiation Complexity | Simpler and more straightforward discussions. | Requires analyzing multiple offer components and value. |

| Best For | Quick adjustments on pay scale or market alignment. | Maximizing overall value of job offer and benefits. |

Introduction: Framing Salary vs Total Compensation Negotiation

Salary negotiation traditionally centers on the base pay figure, often neglecting other crucial elements such as bonuses, stock options, benefits, and work flexibility. Total compensation negotiation expands the conversation to include all monetary and non-monetary perks, providing a comprehensive view of the job offer's true value. This holistic approach enables candidates to leverage various components, ultimately optimizing their overall employment package.

Understanding Salary Negotiation

Salary negotiation primarily focuses on the base pay offered by an employer, which directly affects immediate financial income and taxation. Understanding salary negotiation enables candidates to leverage market research, highlight unique skills, and articulate their value to achieve a competitive wage. Emphasizing base salary sets a critical foundation before discussing total compensation elements like bonuses, benefits, and stock options.

What Constitutes Total Compensation?

Total compensation encompasses more than just base salary, including bonuses, stock options, health benefits, retirement plans, and other perks that significantly impact the overall value of a job offer. Understanding the full scope of total compensation allows candidates to better evaluate the true worth of an offer and negotiate more effectively. Factoring in variables like performance incentives and work-life benefits provides a comprehensive view crucial for making informed employment decisions.

Key Differences Between Salary and Total Compensation Negotiations

Salary negotiation focuses primarily on the base pay offered by an employer, emphasizing the fixed annual or hourly wage. Total compensation negotiation encompasses the entire package, including bonuses, stock options, benefits, retirement plans, and other perks beyond the base salary. Understanding these key differences enables candidates to maximize their overall financial and non-financial value from a job offer.

Benefits of Focusing on Salary Alone

Focusing solely on salary during job offer negotiations highlights immediate financial gain, providing clear and straightforward leverage for employees. This approach simplifies comparison across offers based on take-home pay, making it easier to evaluate short-term earning potential. Concentrating on salary alone also streamlines discussions, avoiding potential confusion over complex benefits packages.

Advantages of Negotiating Total Compensation

Negotiating total compensation allows candidates to maximize the overall value of their job offer by considering salary, bonuses, stock options, benefits, and perks beyond base pay. This holistic approach can lead to improved financial security, better work-life balance, and enhanced job satisfaction. Focusing on total compensation also provides flexibility to tailor agreements that align with long-term career goals and personal needs.

When to Prioritize Salary Over Total Compensation

Prioritize salary negotiation over total compensation when immediate financial needs or cash flow requirements are critical, such as covering living expenses or debts. A higher base salary guarantees consistent income regardless of bonuses or stock performance, providing financial stability. Focus on salary if jobs offer unpredictable variable pay or if you plan a short tenure where long-term benefits won't be fully realized.

Strategies for Effective Total Compensation Negotiation

Effective total compensation negotiation involves evaluating all elements of a job offer, including base salary, bonuses, stock options, benefits, and work-life balance perks. Prioritizing these components according to personal and financial goals ensures a well-rounded agreement that maximizes overall value beyond just salary. Leveraging market data and clearly communicating your worth and needs strengthens your position in negotiating a comprehensive compensation package.

Common Mistakes in Salary and Total Compensation Negotiations

Many candidates focus solely on base salary during negotiations, overlooking the full scope of total compensation that includes benefits, bonuses, stock options, and other perks. Misunderstanding or undervaluing elements like health insurance, retirement contributions, and professional development funds can lead to less favorable overall offers. Failing to research industry standards and the company's compensation structure often results in missed opportunities to negotiate a more comprehensive and competitive package.

Choosing the Right Approach: Salary, Total Compensation, or Both?

Choosing between salary negotiation and total compensation negotiation hinges on evaluating immediate financial needs against long-term benefits like bonuses, stock options, and retirement plans. Emphasizing total compensation provides a comprehensive view, often revealing hidden value beyond base salary. Combining both approaches ensures a well-rounded agreement, maximizing overall job offer value and aligning with career and financial goals.

Related Important Terms

Equity Liquidity Valuation

Negotiating total compensation rather than just salary includes evaluating equity liquidity and valuation, crucial for understanding the real financial benefit of stock options or shares. Equity liquidity impacts when and how you can convert shares to cash, while valuation determines the current and potential worth, helping you assess the true value of the offer beyond base salary.

Deferred Compensation Windows

Negotiating total compensation, including deferred compensation windows, offers greater long-term financial benefits compared to focusing solely on salary, as deferred options like stock grants or retirement plans can substantially increase overall value. Understanding the timing and vesting schedules of deferred compensation is crucial to maximize wealth accumulation and align incentives with company performance.

Total Rewards Packages

Focusing on total compensation negotiation rather than just salary ensures a comprehensive evaluation of a job offer's total rewards package, including bonuses, stock options, health benefits, retirement plans, and paid time off. Emphasizing total rewards allows candidates to maximize overall value and better align the offer with personal and financial priorities.

Signing Bonus Structuring

Negotiating a signing bonus as part of total compensation often yields better overall value than focusing solely on base salary, allowing candidates to leverage upfront financial incentives to offset longer-term salary constraints. Structuring signing bonuses with clear terms on payment timing, tax implications, and clawback provisions ensures both employer and employee manage expectations and financial planning effectively.

RSU (Restricted Stock Unit) Vesting Schedules

Negotiating total compensation rather than just salary allows candidates to optimize the value of RSU vesting schedules, which typically span four years with a one-year cliff, thereby maximizing long-term financial benefits. Understanding and negotiating the timing of vesting events can significantly impact overall earnings and align incentives with company performance and retention goals.

Pay Transparency Clauses

Salary negotiation often centers on the base pay, while total compensation negotiation includes bonuses, stock options, and benefits, making pay transparency clauses critical for understanding the full value of a job offer. Pay transparency clauses help candidates access detailed breakdowns of compensation components, promoting fairness and enabling informed negotiations beyond just salary figures.

Non-Salary Perquisite Benchmarking

Non-salary perquisite benchmarking in total compensation negotiation enables candidates to evaluate benefits such as health insurance, retirement plans, and stock options against industry standards, ensuring a comprehensive understanding of the job offer's value beyond base salary. This approach highlights the strategic importance of perquisites in maximizing overall remuneration, often leading to more favorable and tailored compensation packages.

Wellness Stipend Negotiation

Negotiating a wellness stipend as part of total compensation can significantly enhance overall job benefits, offering financial support for health-related expenses beyond base salary adjustments. Emphasizing wellness stipend negotiation demonstrates a strategic approach to maximize employer-provided perks, contributing to improved work-life balance and long-term employee satisfaction.

Career Pathway Adjustment Offers

Negotiating total compensation instead of just salary offers a comprehensive evaluation of benefits such as bonuses, stock options, and professional development funds, aligning with long-term career pathway adjustments. Emphasizing total compensation can lead to more strategic career growth and financial stability in evolving roles within an organization.

Value-Based Compensation Adjustment

Focusing on total compensation negotiation rather than just salary allows candidates to leverage value-based compensation adjustments, encompassing benefits, bonuses, stock options, and professional development opportunities that collectively enhance the overall job offer worth. Prioritizing these elements can lead to a more strategically optimized employment package that aligns with long-term financial goals and personal career growth.

Salary negotiation vs Total compensation negotiation for job offers Infographic

hrdif.com

hrdif.com