When negotiating a promotion, raise negotiations typically focus on increasing base salary to reflect immediate value and performance, while equity refresh negotiations aim to enhance long-term compensation through additional stock options or grants. Prioritizing raise negotiations can provide more predictable monthly income, whereas equity refresh negotiations offer potential future upside linked to company growth. Understanding the balance between these two enables employees to tailor their compensation package according to financial needs and career goals.

Table of Comparison

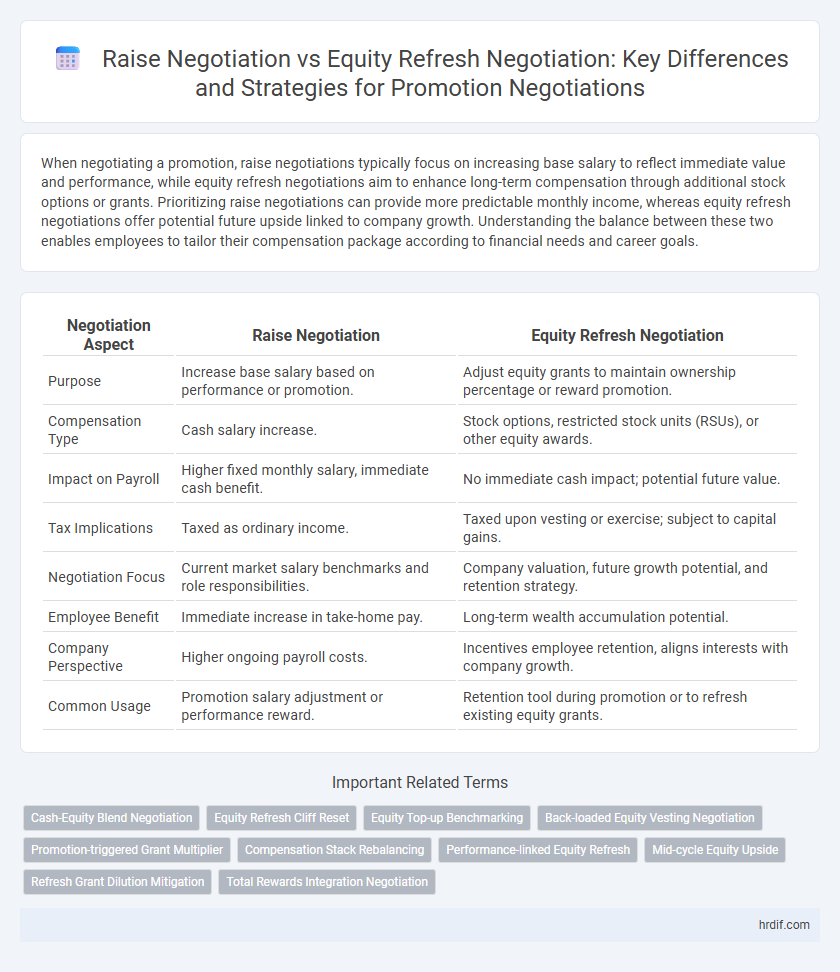

| Negotiation Aspect | Raise Negotiation | Equity Refresh Negotiation |

|---|---|---|

| Purpose | Increase base salary based on performance or promotion. | Adjust equity grants to maintain ownership percentage or reward promotion. |

| Compensation Type | Cash salary increase. | Stock options, restricted stock units (RSUs), or other equity awards. |

| Impact on Payroll | Higher fixed monthly salary, immediate cash benefit. | No immediate cash impact; potential future value. |

| Tax Implications | Taxed as ordinary income. | Taxed upon vesting or exercise; subject to capital gains. |

| Negotiation Focus | Current market salary benchmarks and role responsibilities. | Company valuation, future growth potential, and retention strategy. |

| Employee Benefit | Immediate increase in take-home pay. | Long-term wealth accumulation potential. |

| Company Perspective | Higher ongoing payroll costs. | Incentives employee retention, aligns interests with company growth. |

| Common Usage | Promotion salary adjustment or performance reward. | Retention tool during promotion or to refresh existing equity grants. |

Understanding Raise Negotiation and Equity Refresh Negotiation

Raise negotiation primarily focuses on securing an immediate increase in base salary to reflect new responsibilities or performance improvements, impacting direct cash compensation. Equity refresh negotiation involves discussing additional stock options or restricted stock units (RSUs) granted during promotion to maintain or increase ownership stake and long-term wealth. Both require understanding company compensation philosophy, market benchmarks, and potential tax implications for optimal negotiation outcomes.

Key Differences Between Salary Raises and Equity Refresh

Salary raises provide immediate cash compensation increases reflecting current performance and market benchmarks, while equity refresh grants additional stock options or shares to align employees with long-term company growth and retention goals. Raises are subject to standard payroll taxes and directly impact take-home pay, whereas equity refreshes often include vesting schedules and potential capital gains tax benefits. The negotiation strategy differs as raises emphasize demonstrated value and market rate alignment, while equity discussions focus on future company potential and employee commitment.

When to Negotiate a Raise vs. Equity Refresh During Promotion

Negotiating a raise is most effective when demonstrating clear, quantifiable contributions and increased responsibilities that justify immediate salary adjustment. An equity refresh negotiation is ideal during promotion discussions that emphasize long-term commitment and aligning personal goals with company growth through stock options or shares. Prioritize raise negotiations for short-term financial recognition and equity refreshes when seeking sustained investment in the company's future value.

Benefits and Drawbacks of Salary Raises

Salary raises provide immediate financial benefits by directly increasing an employee's take-home pay, enhancing motivation and job satisfaction. However, raises can lead to higher fixed costs for employers and may not align with long-term company equity growth strategies. Unlike equity refresh negotiations, raises lack potential for compounded value, limiting wealth accumulation despite offering predictable short-term income increases.

Advantages and Disadvantages of Equity Refreshes

Equity refreshes offer employees continued ownership stakes, aligning long-term incentives with company growth and potentially yielding substantial financial gains if the company performs well. However, equity refreshes carry inherent risks, such as market volatility and dilution of shares, which may decrease their immediate monetary value compared to a guaranteed raise. Unlike raises, equity refreshes do not increase base salary or improve cash flow, potentially limiting their attractiveness for employees seeking immediate financial stability after a promotion.

How Promotions Impact Raise and Equity Opportunities

Promotions typically lead to both a salary raise and an equity refresh, but the negotiation strategies differ significantly. Raise negotiations center on immediate compensation increases reflecting enhanced responsibilities, whereas equity refresh negotiations focus on long-term wealth accumulation through additional stock grants or options aligned with the employee's elevated role. Understanding that promotions expand both cash and equity potential enables stronger leverage in negotiating a comprehensive compensation package.

Factors Influencing Successful Negotiation Outcomes

Successful negotiation outcomes in raise versus equity refresh discussions hinge on understanding company valuation trends, individual performance metrics, and market salary benchmarks. Effective preparation includes analyzing recent equity fluctuations, projected company growth, and alignment of compensation with comparable roles in the industry. Clear communication of value contributions and long-term commitment significantly enhances leverage in both raise and equity refresh negotiations.

Common Pitfalls in Raise and Equity Negotiations

Common pitfalls in raise and equity refresh negotiations include failing to research market compensation data and overestimating personal leverage, resulting in unrealistic demands. Candidates often neglect to clarify the total compensation package, mixing base salary raises with equity components without understanding their differing tax implications and vesting schedules. Lack of preparation on company valuation and future growth potential can lead to undervaluation of equity refresh offers, reducing long-term financial gains.

Strategic Tips for Combining Raise and Equity Negotiation

Combining raise negotiation and equity refresh negotiation requires a strategic approach that balances immediate financial gain with long-term wealth potential. Prioritize understanding your company's valuation trends and equity vesting schedules to leverage both salary increase and stock options effectively. Tailoring your negotiation pitch to demonstrate your enhanced role impact and aligning it with the company's growth objectives maximizes your total compensation package during promotion discussions.

Evaluating Total Compensation: Making the Right Choice

Evaluating total compensation requires analyzing both raise negotiation and equity refresh negotiation within the context of a promotion, focusing on immediate salary increases versus long-term equity growth potential. Understanding the current market value of salary increments compared to projected equity appreciation helps determine which option aligns best with financial goals and risk tolerance. Prioritizing a balanced approach that weighs guaranteed income against potential equity gains can lead to a more strategic compensation decision.

Related Important Terms

Cash-Equity Blend Negotiation

Cash-equity blend negotiation in promotion discussions balances immediate financial rewards with long-term investment value, maximizing overall compensation appeal. Strategically leveraging a raise alongside equity refresh can align employee incentives with company growth while providing liquidity and future wealth potential.

Equity Refresh Cliff Reset

Equity refresh negotiation during a promotion often centers on the equity refresh cliff reset, which reestablishes the vesting schedule to incentivize long-term retention. In contrast, raise negotiation focuses primarily on immediate salary increases without altering equity vesting timelines.

Equity Top-up Benchmarking

Equity top-up benchmarking during promotion negotiations prioritizes aligning share grants with market standards to enhance long-term value and retention, contrasting with raise negotiations that focus primarily on immediate cash compensation. Companies leverage equity refresh benchmarking data to ensure competitive equity packages, reflecting role maturity and individual performance without solely relying on salary increments.

Back-loaded Equity Vesting Negotiation

Back-loaded equity vesting negotiation prioritizes securing a larger portion of equity compensation deferred to later periods, aligning with long-term company growth and employee retention, which can offer more substantial value than immediate raise negotiations focused solely on salary increases. Balancing raise negotiation with equity refresh discussions is critical during promotion talks, as a back-loaded equity structure can enhance total compensation and incentivize sustained performance over short-term cash rewards.

Promotion-triggered Grant Multiplier

Promotion-triggered grant multipliers significantly enhance equity refresh negotiations by increasing the number of shares or options awarded relative to standard refresh grants, directly aligning employee incentives with company growth and retention goals. In contrast, raise negotiations typically focus on immediate salary increments without leveraging long-term equity upside, often resulting in less impactful compensation adjustments during promotion discussions.

Compensation Stack Rebalancing

Raise negotiation typically targets an immediate increase in base salary reflecting an employee's current market value and performance, while equity refresh negotiation focuses on granting additional stock options or shares to maintain long-term ownership and incentive alignment. Both strategies are integral to compensation stack rebalancing during promotion, ensuring a balanced mix of fixed salary and equity that drives retention and motivation.

Performance-linked Equity Refresh

Performance-linked equity refresh negotiation emphasizes aligning stock awards with individual and company achievements, offering long-term value tied to sustained performance rather than immediate cash increases. This approach often outweighs raise negotiation during promotion discussions by incentivizing continued growth and commitment through potential equity appreciation.

Mid-cycle Equity Upside

Mid-cycle equity refresh negotiation provides employees with additional stock grants that capitalize on company growth, often delivering greater long-term value than a one-time raise negotiation tied solely to salary increments. Emphasizing equity upside during promotion discussions aligns employee incentives with shareholder value, enhancing retention and motivation beyond immediate cash compensation.

Refresh Grant Dilution Mitigation

Raise negotiation typically focuses on immediate salary increases, while equity refresh negotiation centers on granting additional stock options or shares to offset dilution from existing grants. Refresh grant dilution mitigation ensures employees maintain ownership percentage and long-term incentive value, crucial during promotion discussions where equity stakes may be diluted by new grants.

Total Rewards Integration Negotiation

Raise negotiation focuses on increasing direct cash compensation based on performance and market benchmarks, while equity refresh negotiation targets long-term incentives through additional stock grants to align employee interests with company growth. Total rewards integration negotiation strategically balances salary raises and equity refreshes to optimize overall compensation packages, ensuring motivation, retention, and alignment with organizational goals during promotion discussions.

Raise Negotiation vs Equity Refresh Negotiation for promotion. Infographic

hrdif.com

hrdif.com