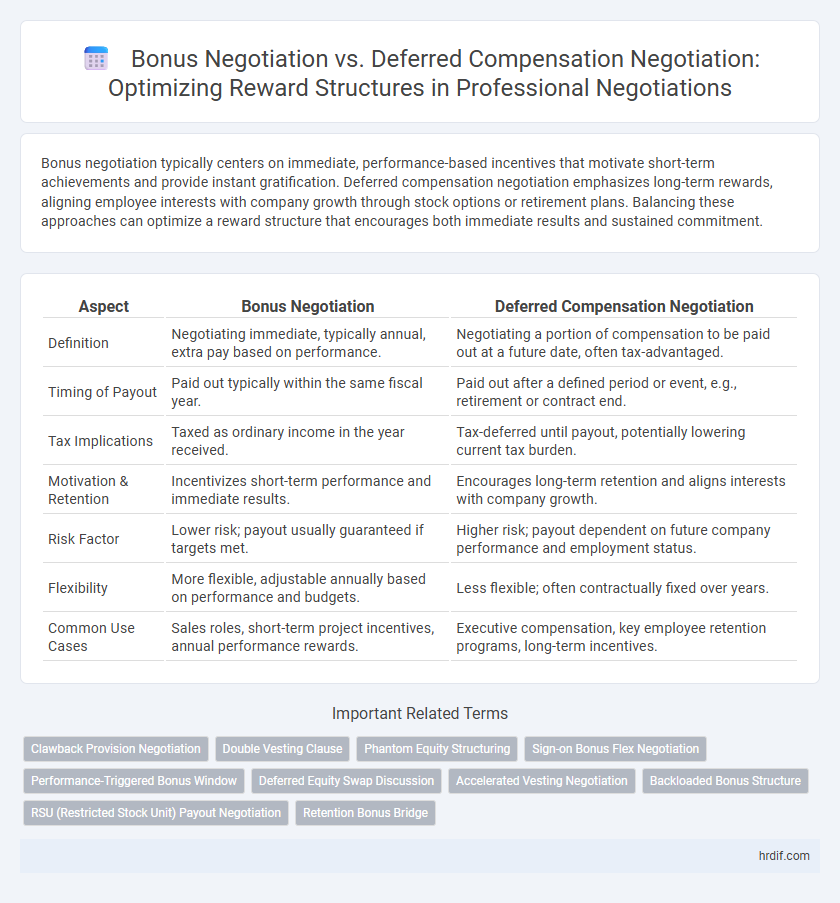

Bonus negotiation typically centers on immediate, performance-based incentives that motivate short-term achievements and provide instant gratification. Deferred compensation negotiation emphasizes long-term rewards, aligning employee interests with company growth through stock options or retirement plans. Balancing these approaches can optimize a reward structure that encourages both immediate results and sustained commitment.

Table of Comparison

| Aspect | Bonus Negotiation | Deferred Compensation Negotiation |

|---|---|---|

| Definition | Negotiating immediate, typically annual, extra pay based on performance. | Negotiating a portion of compensation to be paid out at a future date, often tax-advantaged. |

| Timing of Payout | Paid out typically within the same fiscal year. | Paid out after a defined period or event, e.g., retirement or contract end. |

| Tax Implications | Taxed as ordinary income in the year received. | Tax-deferred until payout, potentially lowering current tax burden. |

| Motivation & Retention | Incentivizes short-term performance and immediate results. | Encourages long-term retention and aligns interests with company growth. |

| Risk Factor | Lower risk; payout usually guaranteed if targets met. | Higher risk; payout dependent on future company performance and employment status. |

| Flexibility | More flexible, adjustable annually based on performance and budgets. | Less flexible; often contractually fixed over years. |

| Common Use Cases | Sales roles, short-term project incentives, annual performance rewards. | Executive compensation, key employee retention programs, long-term incentives. |

Understanding Bonus and Deferred Compensation: Key Differences

Bonus negotiation focuses on securing immediate, performance-based rewards typically paid out within a fiscal year, enhancing short-term motivation and employee retention. Deferred compensation negotiation involves structuring rewards to be received in the future, often linked to long-term company performance or retirement plans, optimizing tax advantages and long-term financial security. Understanding these key differences enables negotiators to balance immediate incentives with sustained employee commitment and financial planning strategies.

Immediate Rewards: The Dynamics of Bonus Negotiation

Bonus negotiation centers on securing immediate financial incentives that directly reflect individual or team performance, providing instant motivation and tangible recognition. Unlike deferred compensation negotiation, which emphasizes long-term benefits and future value, bonus discussions prioritize clarity in performance metrics and timing to maximize present reward impact. Understanding the dynamics of bonus negotiation helps align short-term productivity goals with immediate reward expectations, ensuring greater employee engagement and satisfaction.

Long-Term Incentives: Navigating Deferred Compensation Negotiation

Negotiating deferred compensation as a long-term incentive involves aligning reward structures with future organizational performance, enhancing employee retention and motivation over extended periods. Unlike bonus negotiations that focus on immediate financial rewards tied to short-term achievements, deferred compensation requires a strategic approach to balance risk, timing, and potential tax benefits for both parties. Effectively navigating this negotiation ensures sustainable value creation and reinforces commitment to long-term business goals.

Assessing Value: Comparing Bonuses to Deferred Compensation

Bonus negotiation offers immediate monetary rewards that provide instant financial gratification and liquidity, which can enhance employee motivation in the short term. Deferred compensation negotiation focuses on long-term financial planning by securing benefits like retirement savings or stock options, often yielding tax advantages and encouraging retention. Comparing these reward structures requires assessing the present value of bonuses against the projected growth and future benefits of deferred compensation.

Timing Matters: When to Prioritize Bonuses Over Deferred Compensation

Bonus negotiation is optimal when immediate employee motivation and short-term performance are critical, providing an instant financial reward that enhances engagement and retention. Deferred compensation negotiation suits long-term talent retention and aligns employee interests with company growth, typically benefiting senior executives or high-impact roles. Timing matters: prioritize bonuses during peak performance cycles or project completions, while deferred compensation should be emphasized during long-term strategic planning and talent development phases.

Tax Implications in Reward Structure Negotiations

Bonus negotiation offers immediate financial gain, subject to higher current income tax rates, impacting the employee's take-home pay significantly. Deferred compensation negotiation allows tax deferral, enabling income to be recognized in a potentially lower tax bracket during retirement or future periods. Understanding tax implications is crucial in reward structure negotiations to optimize net benefits and align with long-term financial planning.

Strategic Approaches to Bonus Negotiation

Strategic approaches to bonus negotiation emphasize aligning performance metrics with company goals to maximize immediate rewards, fostering motivation and retention through clear, quantifiable targets. Unlike deferred compensation negotiation, which centers on long-term incentives and future financial security, bonus negotiation requires real-time assessment of individual and team contributions to ensure timely recognition and reinforcement. Effective strategies include leveraging market benchmarks, transparent communication, and flexible structures that accommodate changing business priorities while enhancing employee engagement.

Effective Techniques for Deferred Compensation Negotiation

Effective techniques for deferred compensation negotiation include clearly articulating the long-term value and tax advantages to align interests between employer and employee. Emphasizing flexibility in payment schedules and vesting conditions can address concerns about liquidity and commitment. Utilizing benchmarking data to compare industry standards enhances credibility and supports a fair, competitive reward structure.

Aligning Reward Structure With Career Goals

Bonus negotiation offers immediate financial incentives linked to short-term performance, making it ideal for professionals seeking quick rewards aligned with current achievements. Deferred compensation negotiation emphasizes long-term financial security and growth, aligning reward structures with career trajectories focused on sustained success and retirement planning. Choosing between bonus and deferred compensation negotiations depends on aligning the reward system with personal career goals, risk tolerance, and financial priorities.

Crafting a Winning Negotiation Strategy for Maximum Rewards

Bonus negotiation often targets immediate financial incentives tied to performance metrics, while deferred compensation negotiation emphasizes long-term wealth accumulation through stock options or retirement plans. Crafting a winning negotiation strategy requires a deep understanding of personal financial goals and the organization's reward structure, leveraging data on bonus benchmarks and industry-standard deferred compensation plans. Aligning negotiation tactics with company performance cycles and individual contribution metrics maximizes total rewards and ensures sustainable financial growth.

Related Important Terms

Clawback Provision Negotiation

Negotiating a bonus typically involves immediate financial rewards with potential clawback provisions that reclaim incentives if performance targets are not met, whereas deferred compensation negotiation focuses on long-term incentives where clawback clauses protect the company by retrieving earned benefits if the employee departs prematurely or violates contract terms. Emphasizing clear clawback provisions in both structures ensures alignment of incentives, mitigates risk, and secures accountability in executive compensation agreements.

Double Vesting Clause

Bonus negotiation emphasizes immediate reward based on performance metrics, often providing upfront financial incentives, while deferred compensation negotiation centers on long-term value, typically linked to company growth and future payouts. The inclusion of a Double Vesting Clause in deferred compensation agreements ensures accelerated ownership rights, balancing risk and reward by granting equity benefits more rapidly upon specific milestones or termination events.

Phantom Equity Structuring

Bonus negotiation typically emphasizes immediate, performance-based cash rewards, while deferred compensation negotiation, particularly in Phantom Equity structuring, aligns long-term incentives with company valuation and executive retention. Phantom Equity offers virtual stock units that mimic ownership benefits without actual equity dilution, creating a strategic tool to incentivize leadership through future-value realization rather than upfront payouts.

Sign-on Bonus Flex Negotiation

Negotiating a sign-on bonus offers immediate, tangible financial benefits that can enhance initial compensation without affecting long-term salary growth or equity plans. Deferred compensation negotiation impacts future income and tax planning but may lack the instant liquidity and flexibility provided by a well-structured sign-on bonus agreement.

Performance-Triggered Bonus Window

Performance-triggered bonus windows offer immediate financial incentives tied to specific achievements, enhancing motivation through short-term reward certainty. Deferred compensation negotiation, by contrast, aligns long-term interests with company success, incentivizing sustained performance but delaying tangible financial benefits.

Deferred Equity Swap Discussion

Bonus negotiation typically involves immediate cash rewards tied to short-term performance, while deferred compensation focuses on long-term incentives such as stock options or equity grants, aligning employee interests with company growth. Deferred equity swap discussions emphasize exchanging current equity awards for different equity instruments, optimizing tax implications and enhancing retention through customizable vesting schedules.

Accelerated Vesting Negotiation

Bonus negotiation typically secures immediate financial rewards, enhancing short-term motivation, whereas deferred compensation negotiation, particularly focused on accelerated vesting, aligns long-term incentives by enabling earlier access to stock options or equity. Prioritizing accelerated vesting negotiation can maximize retention and reward performance by reducing risk and increasing liquidity for employees before the standard vesting schedule concludes.

Backloaded Bonus Structure

Backloaded bonus structures provide incentives by deferring a significant portion of the reward until future performance milestones are achieved, which contrasts with traditional bonus negotiations that focus on immediate payouts. Deferred compensation negotiation emphasizes long-term financial planning and risk management, aligning employee rewards with company growth and retention objectives.

RSU (Restricted Stock Unit) Payout Negotiation

Bonus negotiation typically targets immediate cash rewards linked to performance metrics, while deferred compensation negotiation, especially regarding RSU payout, centers on long-term equity value tied to company growth and stock price appreciation. Prioritizing RSU negotiations can align employee incentives with shareholder interests, leveraging vesting schedules and market conditions to maximize total compensation over time.

Retention Bonus Bridge

Bonus negotiation typically emphasizes immediate, tangible financial rewards to incentivize performance, whereas deferred compensation negotiation aligns long-term rewards with company growth and retention goals. Retention Bonus Bridge structures effectively combine both approaches by providing upfront bonuses linked to continued employment, enhancing employee loyalty and reducing turnover risk.

Bonus negotiation vs Deferred compensation negotiation for reward structure Infographic

hrdif.com

hrdif.com