Negotiating base salary focuses solely on the fixed annual pay, which provides immediate financial clarity but may overlook other valuable compensation elements. Total rewards negotiation encompasses salary, bonuses, benefits, stock options, and work-life balance, offering a comprehensive approach to maximize overall job value. Prioritizing total rewards can lead to a more satisfying employment package tailored to long-term career and personal goals.

Table of Comparison

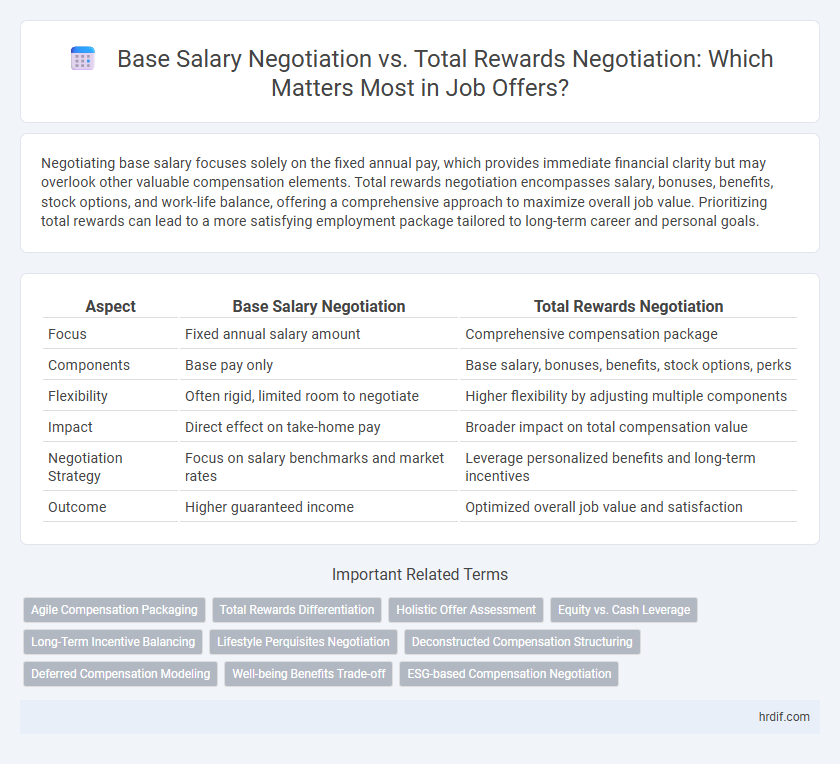

| Aspect | Base Salary Negotiation | Total Rewards Negotiation |

|---|---|---|

| Focus | Fixed annual salary amount | Comprehensive compensation package |

| Components | Base pay only | Base salary, bonuses, benefits, stock options, perks |

| Flexibility | Often rigid, limited room to negotiate | Higher flexibility by adjusting multiple components |

| Impact | Direct effect on take-home pay | Broader impact on total compensation value |

| Negotiation Strategy | Focus on salary benchmarks and market rates | Leverage personalized benefits and long-term incentives |

| Outcome | Higher guaranteed income | Optimized overall job value and satisfaction |

Understanding Base Salary Negotiation

Understanding base salary negotiation involves focusing on the initial fixed annual compensation offered by an employer, which serves as the foundation for total rewards discussions. Negotiating the base salary directly impacts long-term earnings, benefits like bonuses, and retirement contributions tied to this fixed amount. Mastering this aspect ensures candidates secure a competitive, fair wage before exploring variable elements of total rewards packages.

Defining Total Rewards in Compensation Packages

Total rewards in compensation packages encompass more than just base salary, including bonuses, benefits, stock options, retirement plans, and work-life balance perks. Negotiating total rewards requires evaluating the full spectrum of financial and non-financial incentives that contribute to overall job satisfaction and long-term value. Understanding total rewards allows candidates to maximize their compensation beyond the base salary, aligning with personal priorities and career goals.

Key Differences: Base Salary vs. Total Rewards Negotiation

Base salary negotiation focuses solely on the fixed annual cash compensation offered by the employer, which directly impacts immediate income but excludes benefits and bonuses. Total rewards negotiation encompasses a broader scope, including base salary, bonuses, health benefits, retirement plans, stock options, and work-life balance perks, providing a holistic view of overall compensation. Understanding the distinction allows candidates to prioritize elements that align with their financial needs and long-term career goals during job acceptance discussions.

Pros and Cons of Focusing on Base Salary

Focusing on base salary negotiation ensures immediate financial gain and provides a clear, quantifiable metric for job value comparison. However, it may overlook total rewards components such as bonuses, benefits, stock options, and work-life balance, which significantly impact overall compensation and job satisfaction. Prioritizing base salary alone can limit flexibility and long-term financial growth opportunities embedded in comprehensive total rewards packages.

Advantages of Negotiating Total Rewards

Negotiating total rewards offers a broader scope beyond base salary, including benefits like bonuses, stock options, retirement plans, and flexible work arrangements that can substantially increase overall compensation and job satisfaction. This approach allows candidates to tailor their employment package to better fit personal needs and long-term financial goals, enhancing retention and motivation. Emphasizing total rewards negotiation demonstrates a comprehensive understanding of value, positioning candidates as strategic professionals focused on holistic career growth.

When to Prioritize Base Salary in Negotiations

Prioritize base salary negotiation when immediate financial stability and fixed income are crucial for your living expenses and financial commitments. Focus on base salary if market data indicates that the offer falls below industry standards or your skill level, as this ensures long-term earning potential. Base salary holds more weight during early career stages or roles with limited variable compensation and bonuses.

Strategizing Total Rewards Negotiations for Maximum Value

Strategizing total rewards negotiations maximizes overall compensation by evaluating salary alongside benefits such as bonuses, stock options, retirement plans, and health coverage. Prioritizing elements like flexible work arrangements, professional development stipends, and wellness programs can enhance long-term job satisfaction and financial security. Leveraging comprehensive compensation data enables candidates to create personalized packages that align with career goals and lifestyle needs.

Common Mistakes in Salary and Benefits Negotiation

Common mistakes in base salary negotiation include fixating solely on the salary figure without considering total compensation such as bonuses, stock options, and benefits. Overlooking the full scope of total rewards negotiation can lead to undervaluation of health insurance, retirement plans, and paid time off, which significantly impact overall job satisfaction. Failing to research market benchmarks and not articulating the value of comprehensive benefits often result in missed opportunities for a better overall package.

How to Prepare for a Comprehensive Compensation Discussion

Thorough preparation for a comprehensive compensation discussion involves researching industry salary benchmarks and understanding the full spectrum of total rewards, including bonuses, stock options, benefits, and work-life balance perks. Gather data on comparable roles' base salaries and additional incentives to articulate your value effectively and negotiate beyond just the base pay. Practice framing your requests clearly, highlighting how your skills and experience justify the total compensation package you seek.

Making the Final Decision: Salary vs. Total Rewards

When making the final decision in job negotiations, evaluating base salary against total rewards is crucial for long-term satisfaction. Total rewards encompass benefits like bonuses, health insurance, retirement plans, and work-life balance, which often add significant value beyond the base salary. Prioritizing total rewards can lead to a more comprehensive compensation package that supports financial stability and personal well-being.

Related Important Terms

Agile Compensation Packaging

Base salary negotiation centers on securing a fixed annual income, while total rewards negotiation encompasses a broader spectrum including bonuses, equity, benefits, and professional development opportunities aligned with Agile Compensation Packaging principles. Agile Compensation Packaging enables flexible, personalized reward structures that adapt to individual needs and market trends, ensuring a comprehensive and motivating job offer beyond just the base salary.

Total Rewards Differentiation

Total rewards negotiation encompasses salary, bonuses, benefits, stock options, and work-life balance, providing a comprehensive package that can significantly enhance employee satisfaction beyond base salary adjustments. Emphasizing total rewards differentiation allows candidates to leverage unique offerings like healthcare, retirement plans, and professional development opportunities, creating a more attractive and personalized employment value proposition.

Holistic Offer Assessment

Evaluating a job offer requires assessing both base salary and total rewards to gain a comprehensive understanding of overall compensation, including benefits, bonuses, and work-life balance perks. Prioritizing total rewards negotiation ensures alignment with long-term career satisfaction and financial well-being beyond immediate salary figures.

Equity vs. Cash Leverage

Negotiating total rewards rather than just base salary provides greater leverage by incorporating equity components like stock options or restricted stock units, which can significantly enhance long-term compensation beyond immediate cash benefits. Equity-based negotiation aligns employee incentives with company performance, offering potential upside that cash salary alone cannot match, especially in growth-oriented industries.

Long-Term Incentive Balancing

Long-term incentive balancing in total rewards negotiation integrates stock options, performance bonuses, and retirement plans to enhance overall compensation beyond base salary, aligning employee motivation with company growth objectives. Prioritizing these incentives over immediate salary increases can yield greater financial benefits and job satisfaction over time, fostering sustained commitment and performance.

Lifestyle Perquisites Negotiation

Negotiating lifestyle perquisites such as flexible work hours, remote work options, and wellness programs can significantly enhance job satisfaction beyond base salary discussions. Emphasizing total rewards negotiation allows candidates to tailor benefits that support work-life balance, productivity, and long-term well-being.

Deconstructed Compensation Structuring

Deconstructed compensation structuring enables candidates to negotiate beyond base salary, incorporating bonuses, stock options, benefits, and work flexibility to optimize total rewards. Focusing solely on base salary often overlooks valuable components like performance incentives and non-monetary perks that enhance overall job satisfaction and long-term financial gain.

Deferred Compensation Modeling

Deferred compensation modeling plays a crucial role in total rewards negotiation by allowing candidates to evaluate the long-term financial benefits beyond base salary, such as stock options, retirement contributions, and performance bonuses. Incorporating deferred compensation elements helps job seekers maximize overall package value, aligning compensation with future financial goals rather than immediate cash flow.

Well-being Benefits Trade-off

Negotiating total rewards instead of just base salary allows candidates to prioritize well-being benefits such as health insurance, paid time off, and flexible work arrangements that enhance long-term job satisfaction. This trade-off can lead to a more balanced compensation package, addressing financial needs alongside physical and mental wellness priorities.

ESG-based Compensation Negotiation

Negotiating base salary focuses on fixed monetary compensation, while total rewards negotiation encompasses salary, benefits, bonuses, and ESG-based incentives like sustainability bonuses and ethical performance rewards that align with corporate social responsibility goals. Prioritizing ESG-based compensation ensures alignment with environmental, social, and governance criteria, enhancing job satisfaction and supporting long-term value creation for both employees and employers.

Base Salary Negotiation vs Total Rewards Negotiation for job acceptance. Infographic

hrdif.com

hrdif.com