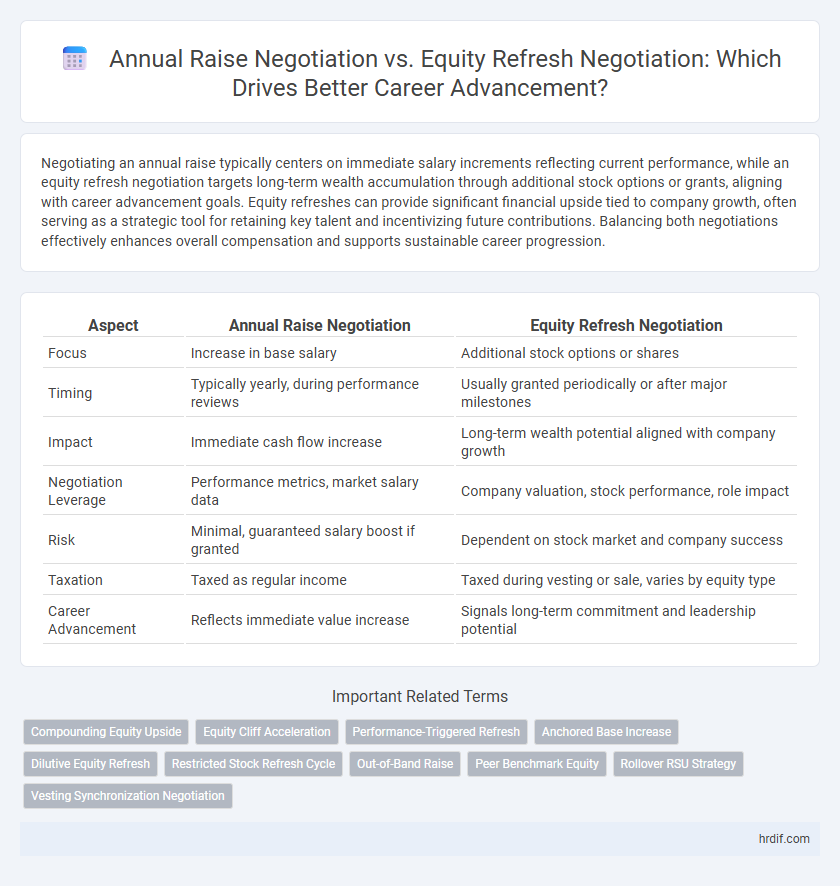

Negotiating an annual raise typically centers on immediate salary increments reflecting current performance, while an equity refresh negotiation targets long-term wealth accumulation through additional stock options or grants, aligning with career advancement goals. Equity refreshes can provide significant financial upside tied to company growth, often serving as a strategic tool for retaining key talent and incentivizing future contributions. Balancing both negotiations effectively enhances overall compensation and supports sustainable career progression.

Table of Comparison

| Aspect | Annual Raise Negotiation | Equity Refresh Negotiation |

|---|---|---|

| Focus | Increase in base salary | Additional stock options or shares |

| Timing | Typically yearly, during performance reviews | Usually granted periodically or after major milestones |

| Impact | Immediate cash flow increase | Long-term wealth potential aligned with company growth |

| Negotiation Leverage | Performance metrics, market salary data | Company valuation, stock performance, role impact |

| Risk | Minimal, guaranteed salary boost if granted | Dependent on stock market and company success |

| Taxation | Taxed as regular income | Taxed during vesting or sale, varies by equity type |

| Career Advancement | Reflects immediate value increase | Signals long-term commitment and leadership potential |

Introduction: Annual Raises vs Equity Refresh – What’s the Difference?

Annual raises provide a predictable salary increase based on performance or inflation adjustments, directly impacting immediate take-home pay and short-term financial stability. Equity refreshes involve granting additional stock options or shares, aligning long-term incentives with company performance and potential wealth accumulation. Understanding the difference helps employees strategically negotiate compensation packages that balance current income needs with future growth opportunities.

Understanding the Role of Compensation in Career Growth

Annual raise negotiations primarily address immediate salary adjustments reflecting current performance and market value, directly impacting short-term financial stability. Equity refresh negotiations focus on long-term wealth creation and alignment with company growth, often serving as a strategic incentive for sustained career advancement. Understanding the distinct roles of salary increases and equity refreshes enables professionals to optimize compensation packages for both immediate rewards and future financial gains.

Timing and Frequency: When to Negotiate Raises vs Equity

Annual raise negotiations typically align with performance review cycles, occurring once per year to reflect yearly accomplishments and market adjustments. Equity refresh negotiations often take place less frequently, generally every two to three years or during significant company milestones such as funding rounds or promotions. Timing equity discussions strategically during these key events can maximize long-term career growth and compensation impact.

Evaluating Financial Impact: Salary Increases vs Equity Grants

Evaluating financial impact during annual raise negotiation versus equity refresh negotiation requires comparing immediate salary increases with potential long-term gains from equity grants. Salary raises provide predictable income growth affecting cash flow and tax liabilities, while equity refreshes offer ownership stakes that may appreciate but carry market risk. Understanding vesting schedules, dilution effects, and company valuation trends is critical for optimizing total compensation in career advancement discussions.

Aligning Negotiation Strategies with Career Goals

Annual raise negotiation centers on immediate salary increases reflecting current performance, while equity refresh negotiation targets long-term ownership and wealth accumulation aligned with career growth. Aligning negotiation strategies with career goals requires assessing the balance between short-term financial needs and long-term investment in the company's success. Prioritizing equity refresh may benefit professionals seeking leadership roles and sustained influence, whereas annual raises suit those focusing on immediate compensation and market value recognition.

Market Trends: How Companies Approach Raises and Equity Refreshes

Market trends reveal companies increasingly favor equity refresh negotiations over annual raises to align employee incentives with long-term performance and shareholder value. Annual raises primarily address cost-of-living adjustments and short-term retention, whereas equity refreshes offer significant upside potential, especially in growth sectors like technology and biotech. This shift reflects a strategic move by employers to balance immediate compensation with future growth opportunities, influencing career advancement decisions.

Risk and Reward: Stability of Raises vs Potential of Equity

Annual raise negotiations offer predictable financial growth and stability, providing a reliable boost to income each year with minimal risk. Equity refresh negotiations carry higher risk due to market volatility and company performance, but they present the potential for significant long-term rewards through stock value appreciation. Balancing the certainty of salary increases against the speculative nature of equity is crucial for strategic career advancement and financial planning.

Preparing for Negotiation: Key Metrics and Talking Points

Focusing on annual raise negotiations, key metrics include individual performance benchmarks, market salary data, and company financial health to justify salary increases. For equity refresh negotiations, emphasize company valuation trends, stock performance, and previous equity grants' impact on employee retention. Preparing tailored talking points around these data points strengthens your position in both salary and equity discussions.

Pitfalls to Avoid in Raise and Equity Refresh Negotiations

Neglecting market benchmarking during annual raise negotiations often leads to undervaluation, while ignoring company equity policies may result in missed opportunities for equity refresh grants. Failing to clearly differentiate between guaranteed compensation and potential equity growth causes confusion and undermines negotiation leverage. Overemphasizing short-term salary increases without considering long-term equity potential limits career advancement and wealth accumulation.

Making the Right Choice for Your Career Advancement

Negotiating an annual raise directly increases your immediate salary, providing tangible financial benefits that reflect your current market value and performance. Equity refresh negotiations, by contrast, focus on long-term wealth accumulation through additional stock options or shares, aligning your incentives with the company's future success and potential appreciation. Prioritizing between these options depends on your career goals, risk tolerance, and belief in the company's growth trajectory to make the right choice for sustainable career advancement.

Related Important Terms

Compounding Equity Upside

Negotiating an equity refresh focuses on enhancing long-term compounding equity upside, offering exponential career advancement value compared to an annual raise that provides immediate but linear salary growth. Prioritizing equity refresh negotiations leverages ownership stakes to maximize wealth accumulation over time, aligning personal incentives with company success more effectively than incremental pay increases.

Equity Cliff Acceleration

Equity refresh negotiation often provides long-term financial upside through stock option cliff acceleration, which can significantly enhance total compensation beyond the immediate benefits of an annual raise. Prioritizing equity cliff acceleration aligns career advancement with company performance, incentivizing sustained contributions and ownership in the business's growth trajectory.

Performance-Triggered Refresh

Performance-triggered equity refresh negotiations often yield greater long-term value compared to annual raise discussions by aligning compensation with measurable contributions and company growth. Prioritizing equity refreshes incentivizes sustained performance and enhances career advancement opportunities through ownership stakes rather than solely immediate salary increases.

Anchored Base Increase

Annual raise negotiation centers on securing an anchored base increase tied to salary benchmarks and performance metrics, ensuring consistent income growth aligned with market standards. Equity refresh negotiation offers potential long-term wealth through stock options or RSUs, but may carry higher risk and variable valuation, making anchored base salary increases more reliable for career advancement stability.

Dilutive Equity Refresh

Annual raise negotiation typically impacts immediate cash compensation, while equity refresh negotiation, especially involving dilutive equity refresh, influences long-term wealth through additional stock options that may dilute existing shareholders. Prioritizing dilutive equity refresh can align employee incentives with company growth, but necessitates careful evaluation of potential dilution effects on ownership percentage and overall equity value.

Restricted Stock Refresh Cycle

Negotiating an annual raise primarily impacts immediate cash compensation, whereas equity refresh negotiations focus on long-term wealth accumulation through the Restricted Stock Refresh Cycle, typically aligned with performance reviews or vesting milestones. Understanding the timing and value of equity refresh grants can significantly enhance career advancement by maximizing stock-based incentives over consecutive cycles.

Out-of-Band Raise

Annual raise negotiations primarily address immediate compensation adjustments tied to performance cycles, while equity refresh negotiations focus on long-term career advancement and wealth accumulation through stock options or RSUs. Emphasizing an Out-of-Band Raise can bypass standard review timelines, providing a strategic opportunity to secure a significant salary increase aligned with exceptional contributions or market shifts.

Peer Benchmark Equity

Annual raise negotiations primarily address immediate salary adjustments based on peer benchmark equity within the current compensation framework, reflecting market standards and individual performance. Equity refresh negotiations focus on long-term career advancement by securing additional ownership stakes tied to company valuation and peer comparisons, aligning employees' interests with sustained organizational growth.

Rollover RSU Strategy

Annual raise negotiations primarily impact immediate cash compensation, while equity refresh negotiations influence long-term wealth accumulation through additional RSUs; leveraging a rollover RSU strategy allows employees to defer taxes and maximize the compound growth of their equity holdings. Integrating rollover RSUs during equity refresh discussions can enhance career advancement by aligning compensation with company performance and personal financial goals.

Vesting Synchronization Negotiation

Negotiating an annual raise typically involves immediate salary increases, while equity refresh negotiations emphasize aligning additional stock grants with existing vesting schedules to maximize long-term value. Prioritizing vesting synchronization ensures that new equity awards vest in tandem with prior grants, fostering continuous employee retention and career advancement incentives.

Annual raise negotiation vs Equity refresh negotiation for career advancement Infographic

hrdif.com

hrdif.com