Venture capitalists typically provide larger sums of funding and seek equity stakes with significant control over the startup's direction, making them ideal for businesses aiming for rapid scaling. Angel syndicate leaders pool resources from multiple individual investors, offering more flexible terms and personalized mentorship but usually smaller capital amounts. Entrepreneurs should weigh the trade-offs between the structured oversight of venture capital and the collaborative, network-driven support of angel syndicates when seeking funding.

Table of Comparison

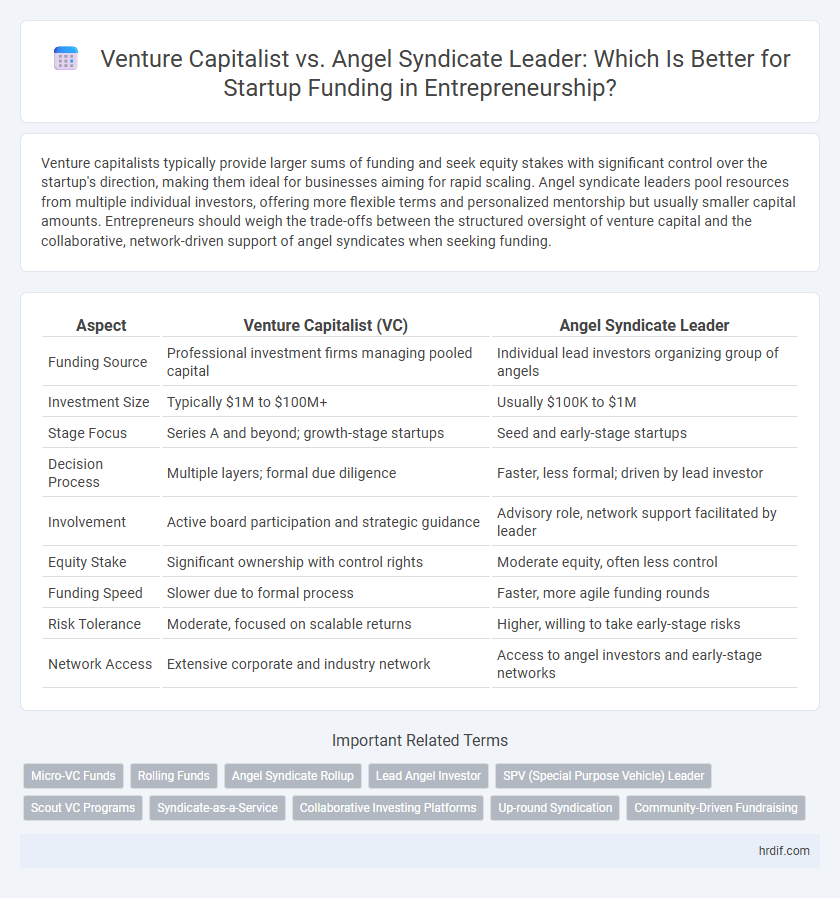

| Aspect | Venture Capitalist (VC) | Angel Syndicate Leader |

|---|---|---|

| Funding Source | Professional investment firms managing pooled capital | Individual lead investors organizing group of angels |

| Investment Size | Typically $1M to $100M+ | Usually $100K to $1M |

| Stage Focus | Series A and beyond; growth-stage startups | Seed and early-stage startups |

| Decision Process | Multiple layers; formal due diligence | Faster, less formal; driven by lead investor |

| Involvement | Active board participation and strategic guidance | Advisory role, network support facilitated by leader |

| Equity Stake | Significant ownership with control rights | Moderate equity, often less control |

| Funding Speed | Slower due to formal process | Faster, more agile funding rounds |

| Risk Tolerance | Moderate, focused on scalable returns | Higher, willing to take early-stage risks |

| Network Access | Extensive corporate and industry network | Access to angel investors and early-stage networks |

Understanding Venture Capitalists and Angel Syndicate Leaders

Venture capitalists (VCs) are professional investors managing pooled funds to invest in high-growth startups, often demanding equity and significant control in exchange for funding. Angel syndicate leaders organize groups of individual investors to co-invest in early-stage companies, offering not only capital but also mentorship and industry connections. Understanding the differing risk profiles, investment expectations, and involvement levels of VCs versus angel syndicate leaders is crucial for entrepreneurs seeking tailored funding strategies.

Key Differences in Investment Strategies

Venture capitalists typically invest larger sums in later-stage startups with proven traction, emphasizing scalable business models and significant market potential. Angel syndicate leaders often fund early-stage companies, leveraging smaller, more diversified investments and closer relationships to the founding teams. The strategic focus of venture capitalists leans toward high-growth exit opportunities, while angel syndicate leaders prioritize mentorship and portfolio diversification to mitigate risk.

Funding Amounts: VC vs Angel Syndicates

Venture capitalists typically provide larger funding amounts, ranging from $1 million to over $10 million per round, targeting startups with high growth potential and scalable business models. Angel syndicate leaders coordinate smaller investments, often between $100,000 and $1 million, pooling resources from multiple individual angels to support early-stage ventures. The funding scale disparity reflects differing risk appetites and investment stages prioritized by venture capital firms versus angel syndicates.

Decision-Making Processes Compared

Venture Capitalists rely on structured due diligence, emphasizing market traction, scalable business models, and financial projections, often involving investment committees for decision approval. Angel Syndicate Leaders prioritize relationships and founder potential, using more agile, intuition-driven assessments with quicker decisions. Both approaches balance risk and opportunity but differ in formality, speed, and investment scale.

Value-Added Support: Mentorship and Networks

Venture capitalists provide startups with extensive value-added support through seasoned mentorship and access to expansive professional networks, facilitating strategic growth and scalability. Angel syndicate leaders offer personalized guidance and leverage closely-knit investor communities to accelerate early-stage development and market entry. Both funding sources enhance entrepreneurial success by connecting founders to critical resources beyond capital.

Risk Appetite and Expectations

Venture capitalists typically exhibit a higher risk appetite, investing larger amounts with expectations of substantial returns and active involvement in scaling startups. Angel syndicate leaders often prefer moderate risk, pooling resources from multiple investors to diversify and focus on early-stage ventures with a more hands-on mentorship approach. Both roles seek high-growth potential but differ in investment size, involvement level, and exit timeline expectations.

Ideal Startups for Venture Capitalist Funding

Ideal startups for venture capitalist funding typically exhibit scalable business models, significant market potential, and a clear path to profitability within a few years. These ventures often operate in technology-driven industries such as software, biotechnology, or fintech, where rapid growth and substantial capital infusion are critical. Venture capitalists prioritize startups with proven traction, strong management teams, and the ability to disrupt existing markets or create new ones.

When to Choose an Angel Syndicate Leader

Choosing an Angel Syndicate Leader is ideal during early-stage funding when startups require not only capital but also strategic mentorship and industry connections. Angel Syndicate Leaders often bring valuable hands-on experience, personalized guidance, and access to a network of like-minded investors passionate about nurturing innovation. This option suits entrepreneurs seeking flexible investment terms and collaborative support to accelerate growth before pursuing larger venture capital rounds.

Long-Term Partnership Dynamics

Venture capitalists typically seek structured investments with defined exit strategies, emphasizing scalable growth and formal governance in their long-term partnerships. Angel syndicate leaders often prioritize more flexible, relationship-driven collaborations, offering personalized mentorship and leveraging diverse networks to support startup development. Understanding these distinct dynamics helps entrepreneurs align funding choices with their growth vision and partnership expectations.

How to Pitch: Tailoring Your Approach for Each Type

When pitching to a venture capitalist, emphasize scalable business models, detailed financial projections, and a clear exit strategy to demonstrate potential for significant returns. For an angel syndicate leader, focus on the team's expertise, early traction, and a compelling personal story to build trust and convey passion. Tailoring your pitch to address each investor's priorities increases the likelihood of securing funding.

Related Important Terms

Micro-VC Funds

Micro-VC funds offer specialized, early-stage investment capital that bridges the gap between angel syndicate leaders and traditional venture capitalists, providing startups with tailored financial support and strategic guidance. Unlike angel syndicate leaders who rely on pooling individual investors, micro-VCs operate as formal investment entities with structured due diligence processes, enabling faster decision-making and scalable funding rounds.

Rolling Funds

Venture Capitalists typically manage larger Rolling Funds with structured investment cycles, providing scalable capital and extensive industry networks, while Angel Syndicate Leaders often leverage smaller, more flexible Rolling Funds to attract niche investors and offer personalized deal flow. Rolling Funds enable both to continuously deploy capital over time, but VCs emphasize institutional scale whereas Angel Syndicate Leaders prioritize agility and community-driven investments.

Angel Syndicate Rollup

Angel syndicate rollup enables entrepreneurs to access larger pools of capital by consolidating multiple individual angel investors under a single syndicate leader, streamlining deal flow and negotiation processes. Unlike traditional venture capitalists who deploy institutional funds, syndicate leaders leverage personal networks to aggregate investments, offering startups more flexible terms and quicker funding rounds.

Lead Angel Investor

Lead Angel Investors typically drive early-stage funding by leveraging personal capital and extensive industry networks, providing startups with both crucial financial resources and strategic mentorship. Unlike venture capitalists who manage pooled funds from limited partners, lead angels often play a more hands-on role, fostering deeper founder relationships and facilitating connections within their angel syndicates to accelerate business growth.

SPV (Special Purpose Vehicle) Leader

A Special Purpose Vehicle (SPV) leader in an angel syndicate pools capital from multiple investors to streamline investment in startups, offering focused management and reduced complexity compared to traditional venture capital firms. SPV leaders enable entrepreneurs to access diversified funding sources while providing transparency and centralized ownership structures that appeal to both founders and syndicate investors.

Scout VC Programs

Scout VC programs empower angel syndicate leaders to source early-stage startups with high growth potential, leveraging their industry expertise and networks for strategic investments. Venture capitalists often rely on these scouts to identify innovative opportunities, accelerating deal flow and enhancing portfolio diversification in competitive markets.

Syndicate-as-a-Service

Angel Syndicate Leaders leverage Syndicate-as-a-Service platforms to efficiently pool capital from multiple investors, offering startups faster access to diverse funding and strategic mentorship. Venture Capitalists traditionally provide larger, more structured investments but may involve lengthier due diligence and less personalized engagement compared to the flexible, scalable approach of syndicate-led fundraising.

Collaborative Investing Platforms

Venture capitalists typically lead larger funding rounds with structured investment terms, while angel syndicate leaders coordinate smaller, more flexible investments through collaborative platforms that pool resources and expertise from multiple individual investors. Collaborative investing platforms enhance deal flow efficiency and due diligence, enabling syndicate leaders to unlock diversified capital sources and foster stronger investor networks in early-stage entrepreneurship.

Up-round Syndication

Venture Capitalists typically lead up-round syndications by leveraging extensive networks and higher capital capacity, enabling larger funding rounds and more structured deal terms. Angel syndicate leaders often facilitate early-stage up-rounds by aggregating individual investors, providing flexibility and quicker decision-making processes in funding startups.

Community-Driven Fundraising

Venture capitalists typically provide larger funding rounds with structured investment terms, while angel syndicate leaders focus on community-driven fundraising by pooling smaller contributions from individual investors who share a vested interest in the startup's success. This collaborative approach leverages a network of experienced entrepreneurs and mentors, enhancing both financial support and strategic guidance.

Venture Capitalist vs Angel Syndicate Leader for funding. Infographic

hrdif.com

hrdif.com