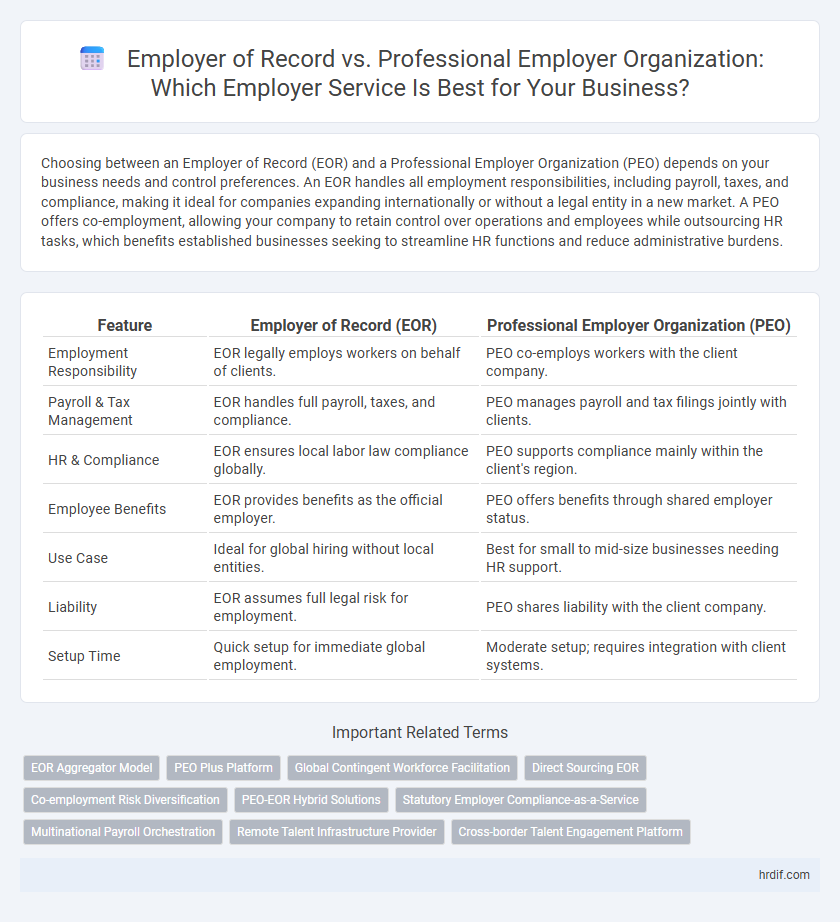

Choosing between an Employer of Record (EOR) and a Professional Employer Organization (PEO) depends on your business needs and control preferences. An EOR handles all employment responsibilities, including payroll, taxes, and compliance, making it ideal for companies expanding internationally or without a legal entity in a new market. A PEO offers co-employment, allowing your company to retain control over operations and employees while outsourcing HR tasks, which benefits established businesses seeking to streamline HR functions and reduce administrative burdens.

Table of Comparison

| Feature | Employer of Record (EOR) | Professional Employer Organization (PEO) |

|---|---|---|

| Employment Responsibility | EOR legally employs workers on behalf of clients. | PEO co-employs workers with the client company. |

| Payroll & Tax Management | EOR handles full payroll, taxes, and compliance. | PEO manages payroll and tax filings jointly with clients. |

| HR & Compliance | EOR ensures local labor law compliance globally. | PEO supports compliance mainly within the client's region. |

| Employee Benefits | EOR provides benefits as the official employer. | PEO offers benefits through shared employer status. |

| Use Case | Ideal for global hiring without local entities. | Best for small to mid-size businesses needing HR support. |

| Liability | EOR assumes full legal risk for employment. | PEO shares liability with the client company. |

| Setup Time | Quick setup for immediate global employment. | Moderate setup; requires integration with client systems. |

Understanding Employer of Record (EOR) and Professional Employer Organization (PEO)

An Employer of Record (EOR) assumes full legal responsibility for employee management, handling payroll, taxes, benefits, and compliance on behalf of the client company, often used for international or remote workforce management. A Professional Employer Organization (PEO) provides co-employment services, sharing employer responsibilities with the client while offering HR support, risk management, and employee benefits administration primarily for domestic businesses. Choosing between EOR and PEO depends on the company's need for legal employment control, geographic scope, and desired level of HR support.

Key Differences Between EOR and PEO Solutions

Employer of Record (EOR) assumes full legal responsibility for employees, managing payroll, benefits, tax compliance, and employment contracts, while Professional Employer Organizations (PEOs) enter a co-employment relationship, sharing employer responsibilities with the client company. EOR services are preferred for rapid market entry and managing compliance in multiple jurisdictions without establishing a local entity, whereas PEOs offer integrated HR solutions and employee management primarily within a single country. Cost structures differ as EORs charge fees per employee without long-term contracts, while PEOs often have fixed fees tied to payroll percentages and require longer commitments.

Legal Responsibilities: EOR vs. PEO for Employers

Employers using an Employer of Record (EOR) retain primary responsibility for business operations while the EOR assumes full legal liability for payroll, taxes, and compliance with employment laws. In contrast, a Professional Employer Organization (PEO) shares these legal responsibilities with the employer through a co-employment model, jointly managing HR functions and regulatory compliance. Understanding the distinction in legal obligations is crucial for businesses when selecting between EOR and PEO services to mitigate risks and ensure adherence to employment regulations.

Compliance and Risk Management: EOR and PEO Compared

Employer of Record (EOR) solutions provide businesses with direct management of compliance by assuming full responsibility for payroll, taxes, and labor law adherence in multiple jurisdictions, significantly reducing legal risks. Professional Employer Organizations (PEOs) share employer responsibilities through co-employment, offering risk management support but requiring the client to maintain some legal accountability. EORs offer greater compliance security and minimize liability exposure compared to PEOs, making them ideal for companies expanding internationally or navigating complex regulatory environments.

Payroll and Benefits Administration with EOR and PEO

Employer of Record (EOR) services manage payroll by legally employing workers on behalf of a company, ensuring compliance with local tax laws and labor regulations. Professional Employer Organizations (PEOs) provide co-employment arrangements, handling payroll processing and benefits administration while sharing employer responsibilities with the client company. Both EORs and PEOs streamline payroll management and offer access to comprehensive benefits packages, but EORs assume full legal employment liability, whereas PEOs function through a shared employment model.

International Expansion: EOR vs. PEO for Global Employers

Employers expanding internationally often choose between an Employer of Record (EOR) and a Professional Employer Organization (PEO) to manage compliance with local labor laws and payroll. EORs provide full legal employment services, allowing companies to hire employees in foreign countries without establishing a local entity, while PEOs typically require a co-employment structure limited to countries where they operate. For global employers prioritizing rapid market entry and regulatory compliance, an EOR offers greater flexibility and reduced administrative burden in multiple jurisdictions.

Cost Considerations: EOR vs. PEO Service Fees

Employer of Record (EOR) services usually involve higher upfront fees as they fully assume legal responsibility for employees, leading to increased compliance and administrative costs. Professional Employer Organizations (PEOs) typically charge a fixed percentage of payroll or a per-employee monthly fee, which can be more cost-effective for businesses seeking shared employer responsibilities. Evaluating service fees requires businesses to consider the scope of services, regulatory obligations, and overall financial impact of EOR vs. PEO models.

Choosing the Right Employment Model for Your Business

Choosing the right employment model between an Employer of Record (EOR) and a Professional Employer Organization (PEO) depends on your business needs, compliance requirements, and control preferences. An EOR handles full legal responsibility for employees, including payroll, taxes, and regulatory compliance, making it ideal for businesses expanding into new regions or countries. In contrast, a PEO offers co-employment services where the business retains control over operations while outsourcing HR functions, benefits management, and risk mitigation.

Pros and Cons of EOR and PEO for Employers

An Employer of Record (EOR) simplifies global hiring by handling payroll, taxes, and compliance, providing employers with reduced legal risk and streamlined operations but often at a higher cost per employee. A Professional Employer Organization (PEO) offers shared employment responsibilities, including HR, benefits, and risk management, which can reduce administrative burdens and provide access to better benefits but may limit employer control over certain HR functions. Employers must weigh the EOR's strength in compliance and international reach against the PEO's advantage in integrated HR services and cost savings.

How to Transition Between EOR and PEO Services

Transitioning between Employer of Record (EOR) and Professional Employer Organization (PEO) services requires careful alignment of payroll, tax compliance, and employee benefits management to avoid disruptions. Begin by auditing existing employment contracts and ensure data transfer accuracy to maintain regulatory compliance and worker classification integrity. Effective communication with employees about changes in HR administration and service providers is crucial to maintain trust and streamline the transition process.

Related Important Terms

EOR Aggregator Model

The Employer of Record (EOR) Aggregator Model streamlines workforce management by consolidating multiple EOR services under one platform, enhancing compliance and operational efficiency for employers. This model contrasts with traditional Professional Employer Organization (PEO) services by offering greater scalability and localized expertise without co-employment risks.

PEO Plus Platform

The PEO Plus Platform combines the comprehensive payroll, benefits, and compliance management of a Professional Employer Organization (PEO) with enhanced Employer of Record (EOR) services, streamlining employment administration while ensuring legal hiring practices across multiple states. This integrated solution reduces employer liability, simplifies workforce management, and offers scalable support for businesses expanding their remote or international workforce.

Global Contingent Workforce Facilitation

An Employer of Record (EOR) assumes full legal employment responsibilities, enabling companies to hire global contingent workers quickly without establishing local entities, while a Professional Employer Organization (PEO) co-employs staff to manage HR, payroll, and compliance primarily within established legal frameworks. For global contingent workforce facilitation, EORs offer superior agility and compliance management across multiple countries, reducing risks and administrative burdens in complex international labor markets.

Direct Sourcing EOR

Direct Sourcing Employer of Record (EOR) services streamline global workforce management by legally employing talent on behalf of clients while ensuring compliance with local labor laws, payroll, and benefits administration. Unlike Professional Employer Organizations (PEOs) that co-employ staff, Direct Sourcing EOR provides full employer control and risk mitigation, enhancing operational efficiency in talent acquisition and management.

Co-employment Risk Diversification

Employer of Record (EOR) services assume full legal responsibility for employee compliance and payroll, effectively minimizing co-employment risk for client companies. In contrast, Professional Employer Organizations (PEOs) share employer responsibilities with businesses, distributing co-employment liabilities but potentially resulting in more complex risk management scenarios.

PEO-EOR Hybrid Solutions

PEO-EOR hybrid solutions combine the comprehensive workforce management and compliance benefits of Professional Employer Organizations (PEOs) with the legal employment and payroll processing expertise of Employers of Record (EORs), providing employers streamlined global hiring and risk mitigation. This integrated approach enables companies to scale internationally while maintaining full control over operational functions, reducing administrative burden, and ensuring adherence to local labor laws.

Statutory Employer Compliance-as-a-Service

Employer of Record (EOR) services provide comprehensive statutory employer compliance-as-a-service by assuming full legal responsibility for payroll taxes, workers' compensation, and labor law adherence, ensuring seamless compliance in multi-jurisdictional employment. Professional Employer Organizations (PEOs) offer co-employment arrangements, sharing compliance responsibilities with businesses while managing regulatory reporting and benefits administration to mitigate legal risks.

Multinational Payroll Orchestration

Employer of Record (EOR) provides a comprehensive solution for multinational payroll orchestration by directly employing workers in various countries, ensuring full compliance with local labor laws and tax regulations. Professional Employer Organizations (PEOs) offer co-employment services that simplify payroll and HR functions but may have limited capabilities in handling complex cross-border payroll intricacies and regulatory adherence.

Remote Talent Infrastructure Provider

Employer of Record (EOR) services manage global compliance, payroll, and legal responsibilities for remote talent, enabling companies to hire internationally without establishing local entities. Professional Employer Organizations (PEOs) offer co-employment solutions primarily for domestic workers, sharing HR duties but requiring the client to maintain legal employer status, which limits their effectiveness in global remote workforce management.

Cross-border Talent Engagement Platform

An Employer of Record (EOR) facilitates seamless cross-border talent engagement by legally hiring and managing employees on behalf of companies, ensuring compliance with local labor laws and payroll requirements in foreign jurisdictions. In contrast, a Professional Employer Organization (PEO) provides co-employment services primarily within a single country, handling HR functions but without the ability to directly employ staff internationally, limiting its effectiveness for global talent acquisition.

Employer of Record vs Professional Employer Organization for employer services. Infographic

hrdif.com

hrdif.com