Employees benefit from earned wage access by gaining immediate access to their earned income, which improves financial flexibility compared to traditional salary payment schedules. This system reduces reliance on high-interest loans and helps manage cash flow during unexpected expenses. Offering earned wage access enhances employee satisfaction and productivity by alleviating financial stress.

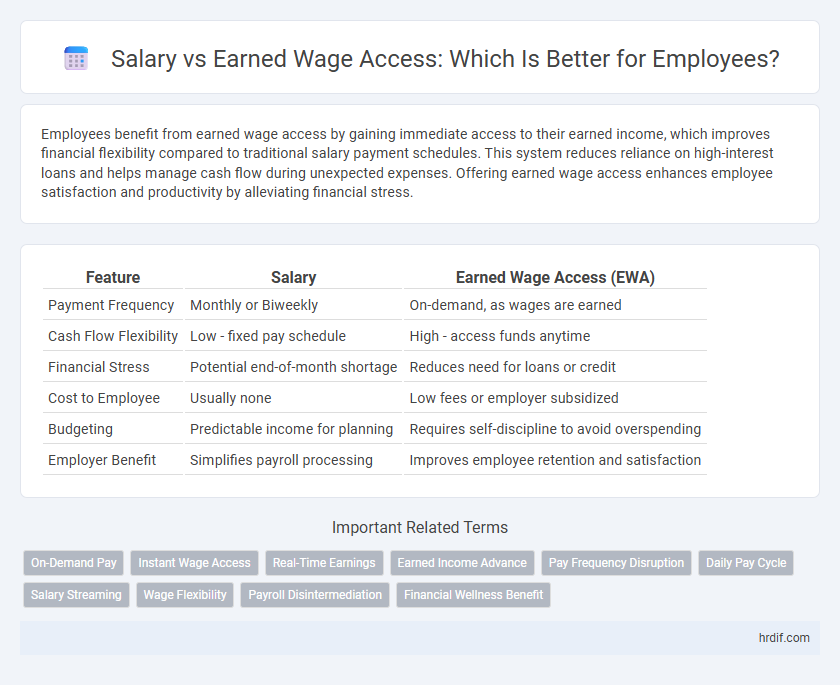

Table of Comparison

| Feature | Salary | Earned Wage Access (EWA) |

|---|---|---|

| Payment Frequency | Monthly or Biweekly | On-demand, as wages are earned |

| Cash Flow Flexibility | Low - fixed pay schedule | High - access funds anytime |

| Financial Stress | Potential end-of-month shortage | Reduces need for loans or credit |

| Cost to Employee | Usually none | Low fees or employer subsidized |

| Budgeting | Predictable income for planning | Requires self-discipline to avoid overspending |

| Employer Benefit | Simplifies payroll processing | Improves employee retention and satisfaction |

Understanding Traditional Salary Structures

Traditional salary structures provide employees with a fixed, predetermined amount paid on a regular schedule, often monthly or biweekly, regardless of daily work fluctuations. This predictable income stream contrasts sharply with Earned Wage Access (EWA), which allows employees to access a portion of their earned wages before the official payday, enhancing financial flexibility. Understanding these fundamental differences helps employees evaluate how salary and EWA impact cash flow management and financial well-being.

What is Earned Wage Access (EWA)?

Earned Wage Access (EWA) is a financial service that allows employees to access a portion of their earned wages before the traditional payday, improving cash flow and reducing reliance on costly loans or advances. Unlike a fixed salary disbursed on a set schedule, EWA provides flexible, on-demand access to earned income based on hours worked to date. This innovative approach enhances employee financial well-being by offering timely access to earned funds without interest or penalties.

Key Differences Between Salary and EWA

Salary provides employees with a fixed, predictable income paid at regular intervals, while Earned Wage Access (EWA) allows workers to access a portion of their earned wages before the official payday. Salary ensures financial stability and budgeting ease, whereas EWA offers flexibility by reducing the need for high-interest loans or overdraft fees. Salary typically benefits full-time employees with consistent hours, while EWA serves hourly or gig workers who require immediate access to earned funds.

Financial Flexibility for Employees

Earned Wage Access (EWA) provides employees with greater financial flexibility by allowing access to wages before the traditional payday, reducing reliance on high-interest loans and avoiding overdraft fees. Unlike fixed salary payments, EWA empowers employees to manage unexpected expenses and improve cash flow stability, enhancing overall financial well-being. This flexible approach supports better budgeting and reduces financial stress, leading to improved employee satisfaction and productivity.

Impact on Employee Financial Well-being

Salary provides employees with predictable, fixed income that supports long-term financial planning and stability. Earned Wage Access (EWA) offers immediate access to earned wages before payday, reducing financial stress and reliance on high-interest loans. Combining salary with EWA enhances employee financial well-being by improving cash flow management and reducing the risk of paycheck-to-paycheck living.

Payroll Administration: Salary vs EWA

Payroll administration for employees involves managing fixed salary disbursements versus earned wage access (EWA) systems that allow workers to access a portion of their earned income before the standard payday. Salary processing requires precise calculation of gross pay, deductions, and statutory compliance, while EWA demands real-time tracking of hours worked and integration with payroll systems to ensure accurate, timely payments. Effective payroll solutions balance these methods, improving employee financial wellness without compromising administrative efficiency or compliance.

Effects on Employee Retention and Satisfaction

Salary provides employees with consistent, predictable income, fostering financial stability that positively impacts retention and job satisfaction. Earned Wage Access (EWA) offers flexible access to wages before payday, reducing financial stress and enhancing employee well-being. Companies implementing EWA report higher employee engagement and lower turnover rates due to improved financial wellness support.

Compliance and Legal Considerations

Salary payment structures must comply with federal and state labor laws to ensure fair wage distribution and prevent violations such as wage theft or misclassification. Earned Wage Access (EWA) programs require adherence to regulations concerning payday lending, fair labor standards, and data privacy to avoid legal pitfalls. Employers implementing EWA services must secure transparent agreements and maintain compliance with the Department of Labor and Consumer Financial Protection Bureau guidelines.

Employer Perspectives on EWA Implementation

Employers increasingly view Earned Wage Access (EWA) as a strategic tool to improve employee financial wellness and reduce turnover rates by providing workers with real-time access to earned wages. Implementing EWA requires balancing administrative costs and ensuring compliance with labor laws while assessing the impact on payroll systems and financial planning. Data from firms using EWA indicate enhanced employee satisfaction and productivity, which can offset initial setup expenses and foster a more engaged workforce.

Future Trends: Salary Models vs Earned Wage Access

Future trends indicate a shift from traditional fixed salary models toward flexible earned wage access systems, empowering employees with real-time access to their earned income. Companies adopting earned wage access report increased employee satisfaction and reduced turnover, reflecting a growing demand for financial wellness solutions. Innovation in payroll technology continues to accelerate this transition, making on-demand pay a standard benefit in competitive employment packages.

Related Important Terms

On-Demand Pay

On-demand pay allows employees to access a portion of their earned wages before the traditional payday, improving financial flexibility and reducing reliance on high-interest loans. This earned wage access empowers employees to manage cash flow effectively, enhancing job satisfaction and reducing financial stress.

Instant Wage Access

Instant Wage Access provides employees with immediate access to earnings before the scheduled payday, improving financial flexibility compared to traditional salary payments. This service reduces reliance on high-interest loans and enhances employee satisfaction by offering real-time wage availability.

Real-Time Earnings

Real-time earnings empower employees by providing immediate access to accrued wages, enhancing financial flexibility and reducing reliance on traditional payday cycles. Integrating earned wage access solutions supports improved cash flow management and employee satisfaction by delivering transparent, up-to-date salary information.

Earned Income Advance

Earned Income Advance allows employees to access a portion of their earned wages before the regular payday, providing financial flexibility without waiting for the biweekly or monthly salary processing cycle. This service enhances cash flow management by reducing dependence on high-interest loans and offering instant access to earned income based on hours worked or sales closed.

Pay Frequency Disruption

Salary employees experience fewer pay frequency disruptions due to fixed monthly payments, ensuring consistent cash flow for budgeting. Earned Wage Access offers hourly or gig workers flexible access to earned income before payday, reducing financial stress from irregular pay cycles and unexpected expenses.

Daily Pay Cycle

Employees benefit from Earned Wage Access by accessing a portion of their earned wages before the traditional monthly salary payout, enabling improved financial flexibility and reduced reliance on high-interest loans. The daily pay cycle facilitated by Earned Wage Access empowers workers to manage cash flow effectively, enhance financial wellness, and alleviate stress associated with delayed salary payments.

Salary Streaming

Salary streaming enables employees to access a portion of their earned wages before the official payday, providing greater financial flexibility compared to traditional salary payments. This service helps reduce reliance on high-interest loans by allowing real-time access to earned income, improving overall financial wellness and cash flow management for employees.

Wage Flexibility

Salary provides employees with a fixed income at regular intervals, offering financial predictability but limited access to funds between paychecks. Earned Wage Access enhances wage flexibility by allowing employees to access a portion of their earned wages before payday, improving cash flow management and reducing reliance on high-interest loans or credit.

Payroll Disintermediation

Salary typically involves fixed periodic payments processed through traditional payroll systems, while Earned Wage Access (EWA) allows employees to access a portion of their earned wages before the scheduled payday. Payroll disintermediation enabled by EWA reduces reliance on payroll cycles, enhances cash flow flexibility, and empowers employees with real-time earnings access without waiting for end-of-period payroll processing.

Financial Wellness Benefit

Salary provides employees with a fixed, predictable income, while Earned Wage Access (EWA) offers flexible, on-demand access to wages as they are earned, enhancing financial wellness by reducing reliance on high-interest loans and improving cash flow management. Integrating EWA into employee benefits fosters financial stability, reduces stress, and boosts overall productivity.

Salary vs Earned Wage Access for Employee. Infographic

hrdif.com

hrdif.com