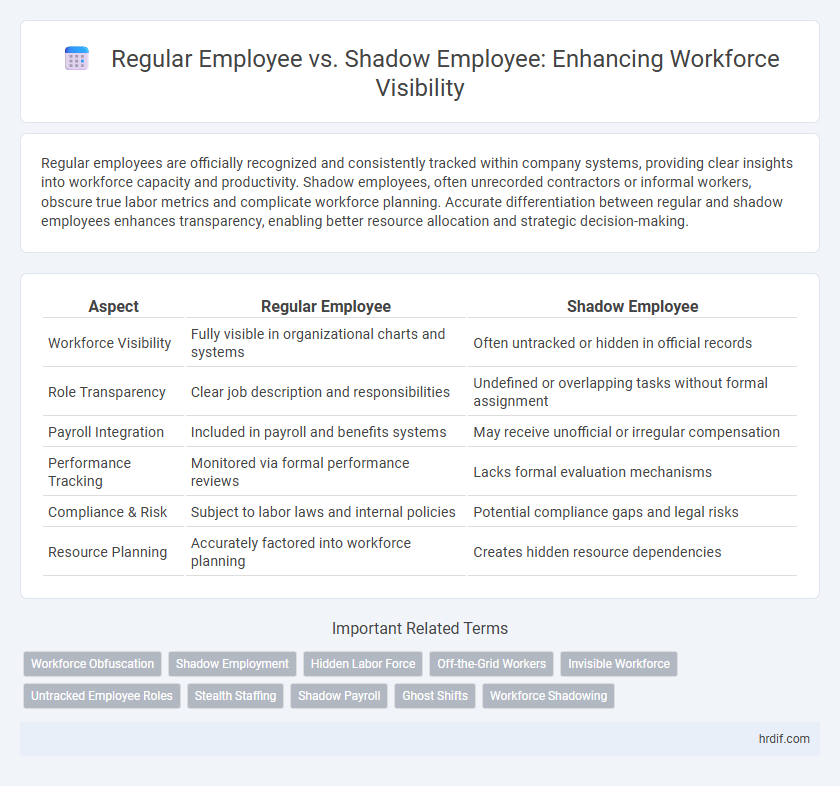

Regular employees are officially recognized and consistently tracked within company systems, providing clear insights into workforce capacity and productivity. Shadow employees, often unrecorded contractors or informal workers, obscure true labor metrics and complicate workforce planning. Accurate differentiation between regular and shadow employees enhances transparency, enabling better resource allocation and strategic decision-making.

Table of Comparison

| Aspect | Regular Employee | Shadow Employee |

|---|---|---|

| Workforce Visibility | Fully visible in organizational charts and systems | Often untracked or hidden in official records |

| Role Transparency | Clear job description and responsibilities | Undefined or overlapping tasks without formal assignment |

| Payroll Integration | Included in payroll and benefits systems | May receive unofficial or irregular compensation |

| Performance Tracking | Monitored via formal performance reviews | Lacks formal evaluation mechanisms |

| Compliance & Risk | Subject to labor laws and internal policies | Potential compliance gaps and legal risks |

| Resource Planning | Accurately factored into workforce planning | Creates hidden resource dependencies |

Understanding the Roles: Regular Employee vs Shadow Employee

Regular employees have defined roles, official job descriptions, and are formally recognized within organizational charts, providing clear workforce visibility. Shadow employees perform similar tasks but operate unofficially or without formal acknowledgment, creating challenges in tracking productivity and resource allocation. Differentiating these roles is crucial for accurate workforce management, compliance, and performance evaluation.

Defining Workforce Visibility in Modern Organizations

Regular employees are officially recognized members of an organization with defined roles and access, contributing to accurate workforce visibility through transparent attendance and performance tracking. Shadow employees operate without formal acknowledgment, often performing critical tasks off the official radar, which obscures comprehensive workforce data and complicates talent management. Achieving complete workforce visibility necessitates integrating both regular and shadow employee information to optimize resource allocation and strategic planning.

Key Differences Between Regular and Shadow Employees

Regular employees are officially registered with clear job roles, payroll, and benefits, ensuring full workforce visibility and accurate headcount. Shadow employees exist on paper without actual work assignments or presence, often used to inflate productivity metrics or obscure true staffing levels. Understanding these key differences aids organizations in improving transparency, compliance, and overall workforce management.

Impact of Shadow Employees on Organizational Transparency

Shadow employees obscure true workforce metrics by existing unofficially, which compromises organizational transparency and hinders accurate resource allocation. Their presence inflates perceived headcount and payroll expenses, complicating financial reporting and compliance efforts. Effective detection and integration of shadow employees into official records enhance workforce visibility and support strategic decision-making.

Challenges in Tracking Shadow Employees

Shadow employees pose significant challenges in workforce visibility due to their unrecorded or unofficial status, causing discrepancies in headcount and payroll data. Regular employees are tracked through formal systems ensuring accurate performance metrics and labor cost analysis, whereas shadow employees often operate outside these systems, leading to compliance risks and distorted workforce analytics. This lack of transparency hinders effective resource allocation, operational planning, and regulatory adherence within organizations.

Benefits of Workforce Visibility for Business Success

Regular employees contribute directly to core business operations with transparent roles and measurable performance, enhancing workforce visibility. Shadow employees, although less visible, can obscure true labor costs and productivity metrics, complicating workforce analysis. Clear differentiation improves resource allocation, compliance, and strategic decision-making, driving overall business success.

Risks Associated with Invisible or Shadow Employees

Invisible or shadow employees pose significant risks to workforce visibility by creating gaps in compliance, payroll accuracy, and security protocols. These untracked individuals can lead to increased chances of fraud, data breaches, and financial discrepancies due to lack of proper oversight. Ensuring all workforce members are accounted for in official records helps mitigate operational risks and supports accurate labor cost management.

Strategies for Improving Workforce Visibility

Regular employees are officially recorded in payroll and HR systems, enabling accurate tracking of their performance, attendance, and productivity data. Shadow employees, often unofficial or unrecorded workers, create gaps in workforce visibility that hinder effective resource allocation and compliance monitoring. Implementing integrated workforce management systems and promoting transparent reporting practices are key strategies to identify shadow employees and enhance overall organizational visibility and efficiency.

Technology Solutions for Employee Tracking and Transparency

Technology solutions for workforce visibility differentiate between regular employees, who are officially registered and managed within HR systems, and shadow employees, who operate without formal documentation or oversight. Advanced employee tracking software integrates biometric verification, time and attendance monitoring, and real-time location data to ensure transparency and accurate labor cost accounting. Implementing AI-powered analytics enhances detection of shadow workforce activities, enabling organizations to improve compliance and optimize resource allocation.

Building a Future-Ready Workforce: Embracing Visibility and Accountability

Regular employees provide consistent workforce visibility through formal roles, defined responsibilities, and transparent performance metrics, which enables organizations to build accountability and strategic workforce planning. Shadow employees operate without official recognition, creating gaps in data accuracy, hindering comprehensive visibility, and increasing risks in workforce management. Embracing visibility and accountability by integrating shadow employee identification into workforce analytics supports building a future-ready workforce aligned with organizational goals and agility.

Related Important Terms

Workforce Obfuscation

Regular employees appear in official organizational records, providing transparent workforce visibility, while shadow employees operate outside formal structures, contributing to workforce obfuscation that can obscure true labor costs and resource allocation. Identifying and managing shadow employees is crucial to maintaining accurate workforce data, ensuring compliance, and enabling effective human capital management.

Shadow Employment

Shadow employees, often unrecognized in official payroll systems, pose a significant challenge to workforce visibility by creating hidden labor costs and compliance risks that can distort organizational metrics. Unlike regular employees with clear contracts and documented roles, shadow employees operate unofficially, making it crucial for businesses to implement advanced workforce analytics and alongside payroll reconciliation processes to accurately identify and manage this shadow labor.

Hidden Labor Force

Regular employees are officially recorded and tracked within organizational systems, ensuring accurate workforce visibility and resource allocation, while shadow employees represent hidden labor force segments often overlooked due to informal or unrecorded roles. Addressing shadow employees improves operational transparency and prevents inefficiencies caused by untracked labor contributions.

Off-the-Grid Workers

Regular employees are officially registered and tracked within workforce management systems, ensuring clear visibility and compliance, while shadow employees, often off-the-grid workers, remain undocumented, posing risks in labor cost control and regulatory adherence. Effective workforce visibility requires integrating shadow employees into digital HR platforms to accurately capture labor contributions and maintain operational transparency.

Invisible Workforce

Regular employees are officially documented with access to payroll and HR systems, providing clear workforce visibility, while shadow employees operate without formal records, creating an invisible workforce that complicates accurate labor cost analysis and compliance monitoring. Identifying and integrating shadow employees into workforce planning ensures comprehensive data accuracy, improved resource allocation, and enhanced organizational transparency.

Untracked Employee Roles

Regular employees have clearly defined roles with tracked responsibilities and performance metrics, enhancing workforce visibility, while shadow employees operate in untracked roles, creating gaps in organizational oversight and resource allocation. Identifying and integrating shadow employees into workforce management systems improves operational efficiency and reduces hidden labor costs.

Stealth Staffing

Stealth staffing involves shadow employees who operate without formal recognition, creating gaps in workforce visibility compared to regular employees with documented roles and clear accountability. Enhancing transparency around shadow employee engagement is critical for accurate labor cost analysis, compliance, and strategic workforce planning.

Shadow Payroll

Shadow payroll enhances workforce visibility by accurately tracking shadow employees--individuals working in a host country but paid through their home country--to ensure tax compliance and streamline international payroll management. Integrating shadow payroll with regular employee records provides comprehensive insight into global workforce costs and legal obligations without altering standard payroll processes.

Ghost Shifts

Regular employees have clearly defined schedules and roles, enhancing workforce visibility through accurate time tracking and resource allocation. Shadow employees often generate ghost shifts--unrecorded or fictitious work hours--that obscure true labor costs and complicate workforce management analytics.

Workforce Shadowing

Regular employees have defined roles and official records within workforce management systems, providing clear visibility into labor costs and productivity metrics. Shadow employees, often unrecorded or informal workers performing similar tasks, create gaps in workforce visibility, making it challenging to optimize staffing, track performance, and ensure compliance.

Regular employee vs Shadow employee for workforce visibility. Infographic

hrdif.com

hrdif.com