Contractors offer specialized skills and long-term project commitment, making them ideal for consistent, flexible workforce needs. Gig workers provide on-demand support with quick turnaround and variable hours, perfect for short-term tasks or fluctuating workloads. Balancing the use of contractors and gig workers enhances operational agility while controlling costs.

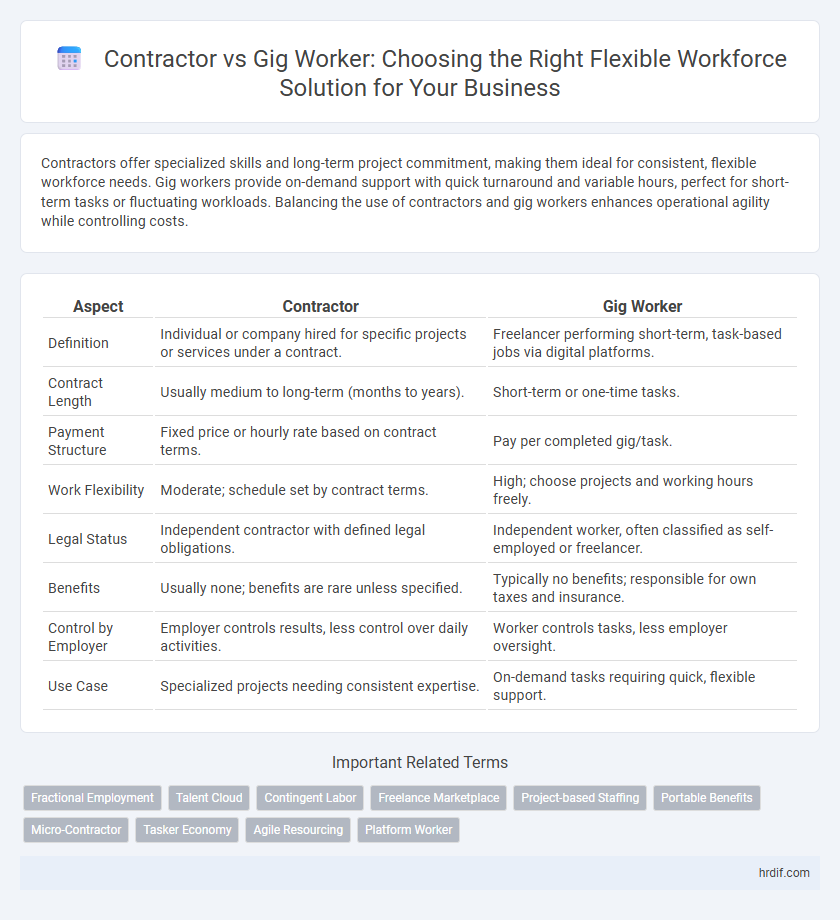

Table of Comparison

| Aspect | Contractor | Gig Worker |

|---|---|---|

| Definition | Individual or company hired for specific projects or services under a contract. | Freelancer performing short-term, task-based jobs via digital platforms. |

| Contract Length | Usually medium to long-term (months to years). | Short-term or one-time tasks. |

| Payment Structure | Fixed price or hourly rate based on contract terms. | Pay per completed gig/task. |

| Work Flexibility | Moderate; schedule set by contract terms. | High; choose projects and working hours freely. |

| Legal Status | Independent contractor with defined legal obligations. | Independent worker, often classified as self-employed or freelancer. |

| Benefits | Usually none; benefits are rare unless specified. | Typically no benefits; responsible for own taxes and insurance. |

| Control by Employer | Employer controls results, less control over daily activities. | Worker controls tasks, less employer oversight. |

| Use Case | Specialized projects needing consistent expertise. | On-demand tasks requiring quick, flexible support. |

Understanding Contractors and Gig Workers

Contractors typically engage in longer-term projects with specific deliverables and maintain a degree of autonomy in how they complete their work, whereas gig workers perform shorter, task-based jobs often mediated through digital platforms. Understanding the legal distinctions, payment structures, and worker rights is essential for organizations managing a flexible workforce. Proper classification ensures compliance with labor laws and maximizes operational efficiency while meeting workforce demand.

Key Differences Between Contractors and Gig Workers

Contractors typically engage in longer-term, project-based agreements with defined deliverables and maintain control over how work is completed, while gig workers perform short-term, task-oriented jobs often facilitated through digital platforms. Contractors usually possess specialized skills and negotiate their contracts directly with employers, whereas gig workers tend to have less formal arrangements and flexible schedules driven by immediate demand. Payment structures also differ, with contractors receiving agreed-upon fees or hourly rates and gig workers often paid per task or ride, reflecting their on-demand work nature.

Legal Definitions and Employment Status

Contractors operate under defined legal agreements with clear terms on deliverables and payment schedules, distinguishing them as independent entities responsible for their own taxes and benefits. Gig workers, often classified as independent contractors, perform short-term tasks via digital platforms but face ambiguous employment status due to evolving labor laws addressing rights like minimum wage and benefits. Understanding these distinctions is critical for companies managing flexible workforce compliance and risk in diverse legal jurisdictions.

Flexibility and Autonomy: Pros and Cons

Contractors enjoy greater flexibility in setting their schedules and choosing projects, offering high autonomy but often facing inconsistent income and lack of employee benefits. Gig workers benefit from extreme flexibility and immediate task-based engagement, yet they may experience unpredictable workloads and limited control over long-term career growth. Both models provide workforce adaptability but differ significantly in stability and personal freedom.

Payment Structures and Compensation Models

Contractors typically receive fixed payment based on project milestones or hourly rates defined in a contract, ensuring predictable compensation aligned with specific deliverables. Gig workers often engage in task-based payments through digital platforms, with earnings varying according to task frequency, complexity, and user ratings. Payment structures for contractors emphasize stability and scope, while gig worker compensation models prioritize flexibility and real-time performance metrics.

Skills and Specialization in Each Role

Contractors typically possess specialized skills and deep expertise tailored to project-specific requirements, enabling them to deliver high-quality, professional services in fields like IT, engineering, and design. Gig workers often bring a diverse skill set suited for flexible, short-term tasks across various industries, excelling in adaptability and rapid execution. Understanding the distinct skills and specialization of contractors versus gig workers helps organizations optimize their flexible workforce for efficiency and project success.

Tax Implications and Financial Considerations

Contractors typically receive 1099 forms and are responsible for self-employment taxes, including Social Security and Medicare, impacting their net income differently than gig workers classified as employees who have payroll taxes withheld. Gig workers often lack benefits such as unemployment insurance and retirement plans, making financial planning crucial for managing income variability and tax liabilities. Understanding classification affects deductions, tax filing requirements, and eligibility for business expense write-offs, directly influencing financial outcomes for flexible workforce participants.

Impact on Career Growth and Stability

Contractors often experience greater career stability due to longer-term projects and clearer organizational ties, enhancing skill development and professional reputation. Gig workers benefit from diverse assignments fostering adaptability but face unpredictable income and limited access to traditional career advancement resources. Employers leveraging a flexible workforce must balance these differences to optimize talent retention and employee growth trajectories.

Rights, Benefits, and Protections

Contractors often receive limited legal protections and benefits compared to full-time employees, whereas gig workers typically operate under independent agreements with minimal entitlement to traditional employee rights. Gig workers face challenges in accessing health insurance, retirement plans, and unemployment benefits due to their classification as independent contractors. Ensuring fair labor standards requires revisiting policies to extend essential rights and protections to both contractors and gig workers in the evolving flexible workforce.

Choosing the Best Option for Your Career Goals

Contractors offer stability with longer-term projects and defined deliverables, making them ideal for professionals seeking consistent income and skill development. Gig workers provide unmatched flexibility and diverse opportunities, allowing individuals to quickly adapt to market demands and balance personal commitments. Evaluating your career goals for stability versus adaptability will help determine the best option between contractors and gig workers in the evolving workforce.

Related Important Terms

Fractional Employment

Fractional employment blends the flexibility of gig workers with the commitment of contractors, enabling companies to leverage specialized skills on a part-time or project basis without the obligations of full-time hiring. This model optimizes workforce agility by providing access to expert talent while controlling costs and maintaining compliance with labor regulations.

Talent Cloud

Contractors offer specialized skills for defined projects while gig workers provide on-demand flexibility, both essential components of a Talent Cloud that enables scalable, agile workforce management. Utilizing a Talent Cloud integrates contractors and gig workers into a seamless talent pool, optimizing cost efficiency and project delivery speed.

Contingent Labor

Contractors offer specialized skills and longer project commitments compared to gig workers, making them ideal for organizations seeking continuity in contingent labor. Gig workers provide rapid scalability and cost-efficient flexibility, enabling businesses to quickly adjust workforce size to fluctuating demands.

Freelance Marketplace

Freelance marketplaces empower businesses to access a flexible workforce by connecting them with contractors and gig workers who offer specialized skills on-demand, enabling scalable project-based hiring without long-term commitments. Contractors typically engage in longer-term contracts with defined deliverables, while gig workers perform shorter, task-specific jobs, optimizing workforce agility through digital platforms.

Project-based Staffing

Project-based staffing leverages contractors who bring specialized skills for defined project durations, ensuring expertise and accountability aligned with business goals. Gig workers offer flexible, short-term support with scalable engagement but may lack continuity and deep project integration compared to contractors.

Portable Benefits

Contractors typically receive limited portable benefits tied to individual contracts, while gig workers increasingly rely on emerging portable benefits platforms designed to offer health insurance, retirement plans, and paid leave across multiple gigs. Portable benefits enhance worker flexibility by providing consistent access to essential social protections regardless of job changes within the gig economy.

Micro-Contractor

Micro-contractors offer companies a flexible workforce solution by providing specialized skills on short-term, project-based engagements without the long-term obligations of traditional employees. This model enables businesses to scale efficiently while micro-contractors enjoy autonomy and diverse income streams in the gig economy.

Tasker Economy

Contractors typically engage in longer-term agreements with clear deliverables and legal protections, while gig workers participate in the tasker economy through short, on-demand assignments with greater flexibility but fewer benefits. The tasker economy drives diverse workforce strategies, leveraging technology platforms to connect businesses with skilled individuals for specific tasks, optimizing operational efficiency and cost-effectiveness.

Agile Resourcing

Contractors offer specialized skills for defined project durations, enabling agile resourcing with predictable costs and compliance benefits. Gig workers provide on-demand flexibility for fluctuating workloads, supporting rapid scaling but requiring robust management to ensure quality and align with organizational goals.

Platform Worker

Platform workers, often classified as gig workers, engage in flexible, task-based assignments mediated through digital platforms, contrasting with traditional contractors who typically work under longer-term agreements with defined scopes. Leveraging platform workers enables businesses to scale their workforce dynamically, accessing specialized skills on demand while managing costs and compliance associated with flexible employment models.

Contractor vs Gig worker for flexible workforce. Infographic

hrdif.com

hrdif.com