Bonuses provide immediate financial rewards that can boost short-term motivation by directly recognizing individual performance. Equity incentives align employees' interests with company growth, fostering long-term commitment and driving sustained motivation through potential ownership gains. Balancing both can create a comprehensive motivation strategy that addresses immediate needs while encouraging long-term engagement.

Table of Comparison

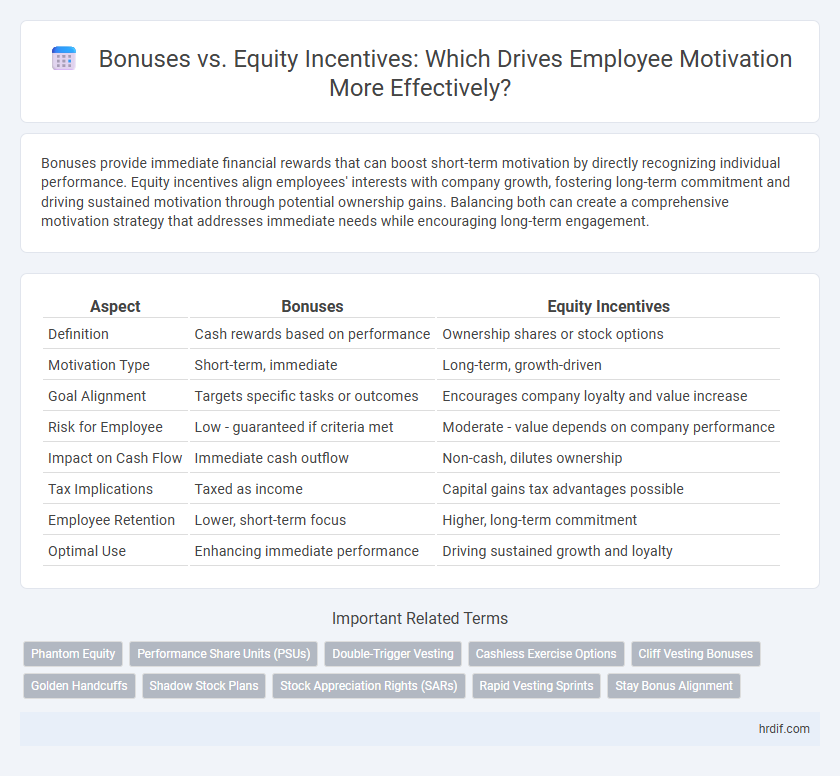

| Aspect | Bonuses | Equity Incentives |

|---|---|---|

| Definition | Cash rewards based on performance | Ownership shares or stock options |

| Motivation Type | Short-term, immediate | Long-term, growth-driven |

| Goal Alignment | Targets specific tasks or outcomes | Encourages company loyalty and value increase |

| Risk for Employee | Low - guaranteed if criteria met | Moderate - value depends on company performance |

| Impact on Cash Flow | Immediate cash outflow | Non-cash, dilutes ownership |

| Tax Implications | Taxed as income | Capital gains tax advantages possible |

| Employee Retention | Lower, short-term focus | Higher, long-term commitment |

| Optimal Use | Enhancing immediate performance | Driving sustained growth and loyalty |

Understanding Bonuses and Equity Incentives

Bonuses provide immediate financial rewards tied to short-term performance metrics, driving quick motivation and goal attainment. Equity incentives, such as stock options or shares, align employees' interests with long-term company growth by offering ownership stakes that increase in value over time. Understanding the distinct impact of bonuses and equity incentives helps organizations tailor compensation strategies to both immediate productivity and sustained commitment.

Key Differences Between Bonuses and Equity

Bonuses provide immediate financial rewards tied to short-term performance metrics, offering quick motivation but limited long-term engagement. Equity incentives grant employees ownership stakes, aligning their interests with the company's growth and fostering sustained commitment over time. The key difference lies in the timing and impact on motivation: bonuses drive short-term results, while equity incentives encourage long-term value creation.

Impact on Employee Motivation

Bonuses provide immediate financial rewards that boost short-term motivation by directly linking performance to tangible outcomes. Equity incentives foster long-term commitment and alignment with company goals by offering employees a stake in the company's success. Combining both strategies can create a balanced motivational environment that drives sustained employee engagement and productivity.

Short-Term vs Long-Term Incentives

Bonuses provide immediate financial rewards that boost short-term motivation by directly linking performance to tangible outcomes. Equity incentives, such as stock options or restricted shares, align employee interests with company growth and foster long-term commitment by offering potential future gains. Balancing bonuses and equity incentives optimizes motivation by addressing both immediate performance and sustained organizational success.

Aligning Rewards with Company Goals

Bonuses provide immediate financial gratification tied to short-term performance metrics, while equity incentives align employee interests with long-term company growth by offering ownership stakes. Equity fosters deeper engagement and retention by incentivizing employees to contribute to the company's sustained success and value creation. Structuring rewards through equity promotes strategic alignment, ensuring motivation supports overarching business objectives and shareholder value.

Attracting and Retaining Top Talent

Bonuses provide immediate financial rewards that can boost short-term motivation and attract high performers seeking quick returns, while equity incentives align employees with long-term company success by offering ownership stakes, fostering loyalty and retention. Equity-based compensation such as stock options or restricted stock units motivates employees to contribute to sustainable growth and creates a vested interest in the company's future. Companies leveraging a balanced mix of bonuses and equity incentives effectively attract top talent and reduce turnover, enhancing overall organizational performance.

Financial Implications for Employers

Bonuses provide immediate financial rewards that can improve short-term employee motivation but often result in recurring costs and higher payroll expenses for employers. Equity incentives align employee interests with company performance, potentially reducing cash outflows while fostering long-term commitment through stock appreciation. Employers must balance these financial implications by evaluating cash flow impact, tax considerations, and employee retention goals when designing compensation packages.

Perceived Value Among Employees

Employees often perceive equity incentives as more valuable than bonuses due to their potential for long-term financial gain and alignment with company success. Bonuses provide immediate rewards but may lack the motivational impact of ownership stakes that encourage commitment and performance. The perception of value heavily depends on factors such as company growth prospects, transparency, and individual financial goals.

Motivation Across Career Stages

Bonuses provide immediate financial motivation, often driving short-term performance and goal attainment, which is particularly effective for early-career professionals seeking quick rewards. Equity incentives foster long-term commitment and alignment with company success, appealing to mid-to-late career employees focused on wealth accumulation and retirement planning. Tailoring incentive structures by career stage maximizes motivation by balancing the need for instant gratification with long-term investment in company growth.

Choosing the Right Incentive Mix

Selecting the right incentive mix requires balancing immediate rewards like bonuses with long-term motivators such as equity incentives to maximize employee motivation. Bonuses provide quick gratification and reinforce short-term performance, while equity incentives align employees' interests with the company's growth and encourage sustained commitment. An optimal combination tailors incentives to organizational goals and individual preferences, driving both productivity and retention.

Related Important Terms

Phantom Equity

Phantom equity provides employees with the economic benefits of stock ownership without actual share issuance, creating long-term motivation through potential payout linked to company valuation. Unlike cash bonuses that offer immediate but short-term rewards, phantom equity aligns employee interests with company growth, fostering sustained commitment and enhanced performance.

Performance Share Units (PSUs)

Performance Share Units (PSUs) align employee motivation with long-term company performance by granting shares based on achieving specific financial targets, fostering sustained commitment and value creation. Unlike one-time bonuses, PSUs promote retention and encourage executives to focus on strategic goals that drive shareholder wealth over multiple years.

Double-Trigger Vesting

Double-trigger vesting in equity incentives aligns employee motivation with company performance by requiring both a liquidity event and continued employment for vesting, reducing turnover risk. Unlike one-time bonuses, this structure fosters long-term commitment and drives sustained productivity by linking rewards directly to shareholder value creation.

Cashless Exercise Options

Cashless exercise options enhance equity incentives by allowing employees to convert stock options into shares without upfront cash payments, increasing motivation through immediate financial benefits. Compared to bonuses, these options align employee interests with company growth, fostering long-term commitment and wealth accumulation without the strain of personal capital investment.

Cliff Vesting Bonuses

Cliff vesting bonuses create a motivating commitment by requiring employees to stay with the company for a set period before earning rewards, aligning their interests with long-term company goals. Unlike immediate bonuses, these incentives foster retention and sustained performance by tying financial rewards to tenure and future success.

Golden Handcuffs

Golden handcuffs leverage equity incentives to retain key employees by tying financial rewards to long-term company performance, fostering sustained motivation and loyalty. Unlike immediate cash bonuses, equity-based incentives align personal wealth growth with corporate success, reducing turnover and encouraging commitment.

Shadow Stock Plans

Shadow Stock Plans align employee motivation with company performance by providing phantom shares that emulate actual equity value without diluting ownership. These plans enhance long-term commitment by linking rewards to stock price appreciation, offering a balance between immediate bonuses and traditional equity incentives.

Stock Appreciation Rights (SARs)

Stock Appreciation Rights (SARs) provide employees with the financial benefits tied to company stock price increases without requiring actual stock ownership, enhancing motivation through potential future gains. Unlike traditional bonuses, SARs align employee interests with long-term company performance by offering equity-like incentives that foster commitment and retention.

Rapid Vesting Sprints

Rapid vesting sprints significantly enhance motivation by allowing employees to quickly realize the value of equity incentives, aligning their efforts with company growth and long-term success. Unlike traditional bonuses, which provide immediate but short-term rewards, equity vested rapidly creates sustained engagement and drives performance through tangible ownership stakes.

Stay Bonus Alignment

Stay bonuses provide immediate financial rewards that enhance short-term employee retention, while equity incentives align long-term motivation with company performance by granting ownership stakes, fostering sustained commitment and shared success. Combining both mechanisms effectively balances instant gratification with future gains, ensuring continuous engagement and alignment with organizational goals.

Bonuses vs Equity Incentives for motivation. Infographic

hrdif.com

hrdif.com