Balancing stable income with passion-driven work is essential for achieving long-term goals without financial stress. While stable income provides security and peace of mind, passion-driven work fuels motivation and personal fulfillment, often leading to greater creativity and success. Finding a middle ground where financial stability supports pursuing passions can create a sustainable and rewarding path toward your goals.

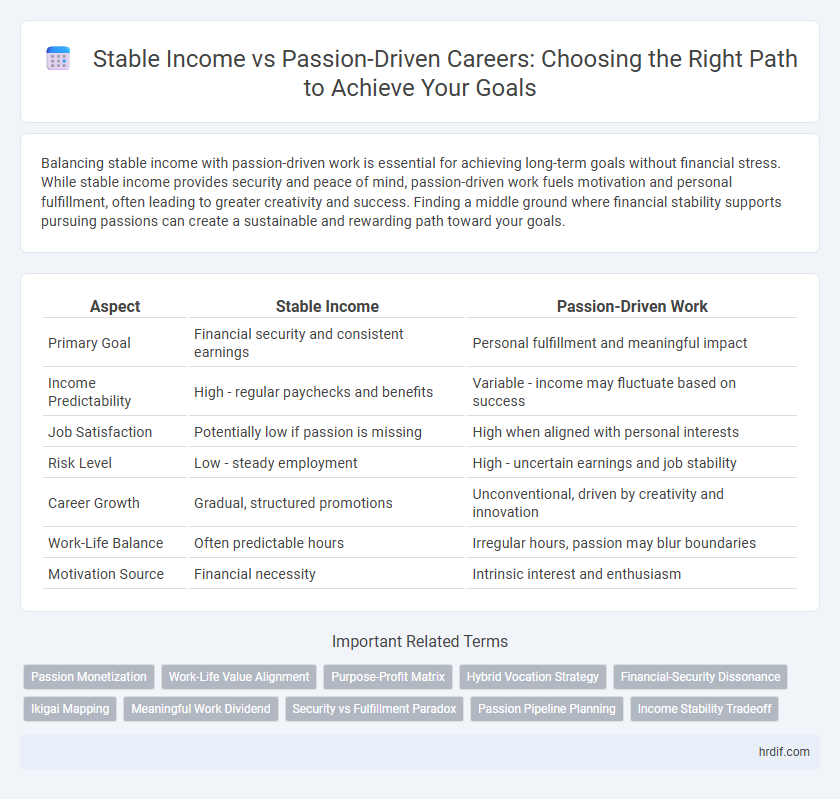

Table of Comparison

| Aspect | Stable Income | Passion-Driven Work |

|---|---|---|

| Primary Goal | Financial security and consistent earnings | Personal fulfillment and meaningful impact |

| Income Predictability | High - regular paychecks and benefits | Variable - income may fluctuate based on success |

| Job Satisfaction | Potentially low if passion is missing | High when aligned with personal interests |

| Risk Level | Low - steady employment | High - uncertain earnings and job stability |

| Career Growth | Gradual, structured promotions | Unconventional, driven by creativity and innovation |

| Work-Life Balance | Often predictable hours | Irregular hours, passion may blur boundaries |

| Motivation Source | Financial necessity | Intrinsic interest and enthusiasm |

Defining Stable Income and Passion-Driven Work

Stable income refers to a consistent and reliable source of earnings that supports financial security and meets essential living expenses regularly. Passion-driven work involves pursuing careers or projects fueled by intrinsic motivation, personal interest, and fulfillment rather than solely financial rewards. Understanding the balance between stable income and passion-driven work is crucial for setting realistic career goals aligned with long-term satisfaction and economic stability.

The Role of Personal Goals in Career Choices

Personal goals play a crucial role in determining whether an individual prioritizes stable income or passion-driven work in their career choices. Aligning career decisions with personal goals enhances long-term job satisfaction and motivation, fostering professional growth and financial security. Understanding the interplay between financial stability and personal fulfillment helps individuals create balanced career paths that reflect their values and ambitions.

Financial Security: A Primary Career Objective

Financial security remains a primary career goal, often motivating individuals to prioritize stable income sources such as salaried positions or reliable freelance work. While passion-driven work offers personal fulfillment, stable income ensures consistent resources to cover expenses and plan for future investments, directly affecting long-term financial stability. Balancing financial security with passion projects can create sustainable career growth without compromising essential monetary goals.

Aligning Passion with Long-Term Career Aspirations

Balancing stable income with passion-driven work is essential for aligning career goals that foster long-term satisfaction and growth. Pursuing roles that offer financial security while integrating personal interests enhances motivation and resilience in professional endeavors. Strategic alignment of passion with market demand ensures sustainable career development and enduring fulfillment.

Weighing the Benefits: Stability vs Fulfillment

Achieving a stable income provides financial security essential for meeting immediate needs and long-term goals, ensuring consistent progress without economic stress. Passion-driven work fosters personal fulfillment and motivation, often leading to innovation and sustained engagement despite potential income fluctuations. Balancing these factors requires evaluating personal priorities, risk tolerance, and the impact on overall well-being and goal attainment.

Setting Realistic Goals in Today’s Job Market

Setting realistic goals in today's job market requires balancing stable income and passion-driven work by assessing financial needs alongside personal fulfillment. Prioritizing achievable milestones, such as securing a dependable salary while gradually integrating passion projects, enhances long-term career satisfaction. Understanding market demand, skill development, and flexibility ensures goals align with both economic stability and individual aspirations.

Short-Term versus Long-Term Career Goals

Balancing stable income with passion-driven work depends on whether short-term financial security or long-term career fulfillment is prioritized. Short-term goals often emphasize steady earnings and job stability, crucial for immediate financial responsibilities. Long-term goals focus on aligning work with personal interests and growth, fostering sustained motivation and professional satisfaction over time.

Measuring Success: Salary, Satisfaction, or Growth?

Measuring success in stable income versus passion-driven work hinges on evaluating salary consistency, personal satisfaction, and professional growth opportunities. Stable income provides financial security and measurable benchmarks, while passion-driven work enhances intrinsic motivation and fulfillment. Balancing these factors requires individual prioritization of tangible earnings against long-term career development and emotional well-being.

Adapting Career Goals to Life Changes

Adapting career goals to life changes requires balancing stable income and passion-driven work to maintain financial security while pursuing personal fulfillment. Prioritizing job flexibility, skill development, and long-term growth helps individuals navigate shifting circumstances and evolving priorities. Setting realistic milestones aligned with changing life stages ensures sustainable progress toward both economic stability and meaningful work.

Strategies for Balancing Income and Passion

Balancing stable income with passion-driven work requires strategic financial planning and time management to ensure sustainability while pursuing personal fulfillment. Diversifying income sources, such as maintaining a reliable job alongside passion projects, can provide financial security and creative freedom. Setting clear goals, prioritizing tasks, and continuously reassessing both financial needs and passion goals help maintain equilibrium between earning stability and personal satisfaction.

Related Important Terms

Passion Monetization

Passion monetization transforms personal interests into sustainable income streams by leveraging niche expertise and targeted audience engagement, balancing financial stability with meaningful work. Focusing on building brand authenticity and scalable digital platforms enhances consistent revenue generation while maintaining alignment with core passions.

Work-Life Value Alignment

Stable income provides financial security that can support consistent work-life balance, while passion-driven work enhances personal fulfillment and motivation, creating deeper alignment between professional goals and individual values. Prioritizing work-life value alignment ensures that career choices contribute to overall well-being and long-term happiness, regardless of income stability.

Purpose-Profit Matrix

The Purpose-Profit Matrix highlights the importance of balancing stable income sources with passion-driven work to achieve sustainable financial goals. Focusing on projects that align personal values with revenue potential maximizes long-term satisfaction and economic stability.

Hybrid Vocation Strategy

Combining stable income with passion-driven work through a hybrid vocation strategy allows individuals to secure financial stability while pursuing meaningful goals. This approach balances risk management and personal fulfillment by integrating reliable revenue streams with projects aligned to intrinsic motivation.

Financial-Security Dissonance

Balancing stable income with passion-driven work often leads to financial-security dissonance, where individuals struggle between consistent earnings and pursuing meaningful careers. Prioritizing financial stability can limit personal fulfillment, while following passion without sufficient income risks economic hardship and stress.

Ikigai Mapping

Balancing stable income and passion-driven work through Ikigai mapping helps identify the intersection of what you love, what you are good at, what the world needs, and what you can be paid for, guiding sustainable goal setting. This alignment enhances motivation and financial security, ensuring long-term fulfillment and practical achievement of personal and professional goals.

Meaningful Work Dividend

Balancing stable income with passion-driven work creates a meaningful work dividend that enhances long-term fulfillment and financial security. Pursuing goals aligned with personal values fosters sustained motivation, improving productivity and overall well-being.

Security vs Fulfillment Paradox

Balancing stable income and passion-driven work highlights the Security vs Fulfillment paradox, where consistent earnings provide financial safety but may lack personal satisfaction, while pursuing passion offers deep fulfillment often at the expense of economic stability. This dynamic requires careful goal-setting to align financial security with meaningful professional engagement.

Passion Pipeline Planning

Passion Pipeline Planning prioritizes aligning career goals with intrinsic motivation, fostering sustainable success beyond stable income. This approach leverages continuous skill development and personal growth to transform passion-driven work into reliable revenue streams.

Income Stability Tradeoff

Balancing stable income with passion-driven work often requires evaluating the income stability tradeoff, where consistent earnings provide financial security but may limit personal fulfillment. Prioritizing long-term financial planning can mitigate risks associated with pursuing passion projects that typically offer variable or unpredictable income streams.

Stable Income vs Passion-Driven Work for goal. Infographic

hrdif.com

hrdif.com