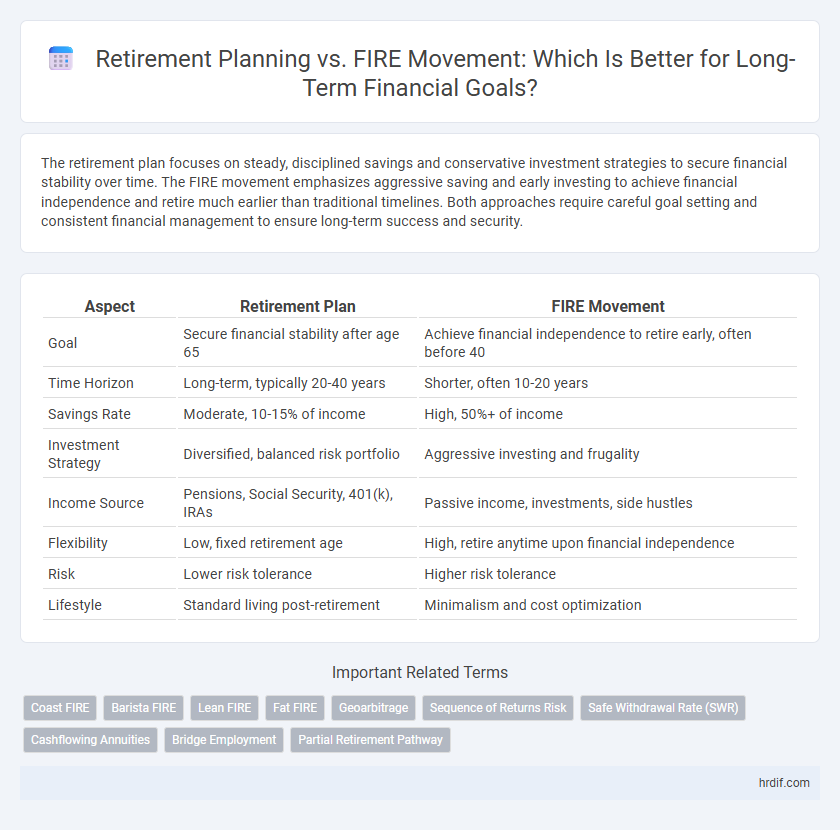

The retirement plan focuses on steady, disciplined savings and conservative investment strategies to secure financial stability over time. The FIRE movement emphasizes aggressive saving and early investing to achieve financial independence and retire much earlier than traditional timelines. Both approaches require careful goal setting and consistent financial management to ensure long-term success and security.

Table of Comparison

| Aspect | Retirement Plan | FIRE Movement |

|---|---|---|

| Goal | Secure financial stability after age 65 | Achieve financial independence to retire early, often before 40 |

| Time Horizon | Long-term, typically 20-40 years | Shorter, often 10-20 years |

| Savings Rate | Moderate, 10-15% of income | High, 50%+ of income |

| Investment Strategy | Diversified, balanced risk portfolio | Aggressive investing and frugality |

| Income Source | Pensions, Social Security, 401(k), IRAs | Passive income, investments, side hustles |

| Flexibility | Low, fixed retirement age | High, retire anytime upon financial independence |

| Risk | Lower risk tolerance | Higher risk tolerance |

| Lifestyle | Standard living post-retirement | Minimalism and cost optimization |

Understanding Traditional Retirement Planning

Traditional retirement planning emphasizes consistent contributions to employer-sponsored 401(k) plans and individual retirement accounts (IRAs) to build a secure financial foundation over decades. It relies on a gradual accumulation of assets with tax-advantaged growth, aiming for financial stability and predictable income streams during retirement. This approach prioritizes risk management, inflation protection, and long-term investment diversification to ensure a steady lifestyle after leaving the workforce.

What Is the FIRE Movement?

The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve early retirement, typically decades ahead of traditional timelines. Unlike conventional retirement plans that rely on steady contributions and employer benefits, FIRE advocates living frugally and maximizing income to build a substantial investment portfolio quickly. This approach prioritizes financial independence, enabling individuals to retire well before typical retirement age by generating passive income streams.

Key Differences: Retirement Plan vs FIRE

Retirement plans typically involve structured savings with gradual contributions and a focus on financial security during later years, often relying on employer-sponsored accounts like 401(k)s or IRAs. The FIRE movement emphasizes aggressive saving and investing early in life to achieve financial independence and retire significantly earlier than traditional retirement ages. Key differences include the FIRE movement's higher savings rate and shorter timeline compared to the conventional, methodical approach of traditional retirement planning.

Financial Independence: Core Concepts

Financial independence in retirement planning emphasizes steady, reliable income sources through diversified investments, employer-sponsored plans, and social security benefits. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving and investing strategies to achieve early withdrawal from traditional employment. Both approaches center on building sufficient assets to cover living expenses long-term, balancing risk tolerance and lifestyle goals for sustainable financial freedom.

Risk Factors: Assessing Stability and Flexibility

Retirement plans typically offer structured benefits and governmental protections, providing stability through consistent contributions and regulated funds, whereas the FIRE movement emphasizes aggressive saving and investing, which may involve higher exposure to market volatility and economic shifts. Evaluating risk factors includes analyzing portfolio diversification, withdrawal strategies, and emergency funds to maintain flexibility against unforeseen financial downturns. Individuals prioritizing long-term security must balance the steady predictability of traditional retirement plans with the adaptable yet riskier nature of FIRE strategies.

Saving Strategies for Each Approach

Retirement plans typically emphasize consistent contributions to 401(k)s or IRAs with employer matching and tax advantages, fostering steady growth over decades. The FIRE movement prioritizes aggressive saving rates, often 50% or more of income, to achieve financial independence rapidly through diversified investments and frugal living. Both approaches rely on disciplined saving strategies, but retirement planning favors gradual accumulation while FIRE demands high savings intensity and early investment.

Lifestyle Considerations: Freedom vs Structure

Retirement plans often emphasize structured saving and gradual withdrawal strategies, prioritizing financial security and predictable income streams that support a stable lifestyle. The FIRE (Financial Independence, Retire Early) movement focuses on maximizing savings rate and investment growth to achieve early freedom from traditional work constraints, enabling more flexible living choices and spontaneous life changes. Evaluating long-term goals requires balancing the structured predictability of retirement plans with the lifestyle freedom championed by FIRE, aligning financial strategies to personal values and desired daily routines.

Tax Implications and Withdrawal Plans

Retirement plans typically provide tax-deferred growth with mandatory Required Minimum Distributions (RMDs) starting at age 73, impacting withdrawal timing and tax liability. The FIRE movement emphasizes tax-efficient strategies using Roth IRAs and taxable accounts to enable flexible, penalty-free withdrawals before traditional retirement age. Understanding tax implications and withdrawal rules is crucial for optimizing long-term financial security in both approaches.

How to Choose the Right Path for You

Choosing between a traditional retirement plan and the FIRE movement depends on your financial goals, risk tolerance, and desired lifestyle timeline. A retirement plan typically offers structured savings with employer contributions and tax advantages, while FIRE emphasizes aggressive saving and investing to achieve early financial independence. Evaluate your income stability, spending habits, and flexibility preferences to determine which approach aligns with your long-term planning objectives.

Long-Term Outcomes: Security, Happiness, and Fulfillment

A well-structured retirement plan emphasizes financial security through disciplined savings and predictable income streams, ensuring stability in later years. The FIRE (Financial Independence, Retire Early) movement prioritizes early financial freedom, offering flexibility and potential for greater personal fulfillment but requires aggressive saving and investment strategies. Long-term outcomes for both approaches depend on aligning financial goals with lifestyle preferences, balancing security, happiness, and fulfillment.

Related Important Terms

Coast FIRE

Coast FIRE allows individuals to stop contributing to their retirement savings early while still achieving financial independence by relying on investment growth to cover future needs, contrasting with traditional retirement plans that require continuous contributions until retirement age. This strategy emphasizes early aggressive saving and compounding returns, enabling more flexibility and reduced financial stress over the long term.

Barista FIRE

Barista FIRE represents a hybrid approach to retirement planning, combining partial early retirement with part-time work to sustain financial independence while maintaining healthcare benefits and social engagement. This strategy offers a flexible path for long-term planning by reducing dependence on full retirement savings compared to traditional retirement plans or full FIRE movements.

Lean FIRE

Lean FIRE emphasizes achieving financial independence through minimalistic living and aggressive savings, allowing early retirement with reduced expenses compared to traditional retirement plans. This approach contrasts standard retirement plans by accelerating the timeframe to financial freedom through disciplined budgeting and strategic investment, focusing on sustaining a simpler lifestyle.

Fat FIRE

The Fat FIRE movement emphasizes achieving financial independence with a higher annual spending level, typically $100,000 or more, allowing for a more comfortable and flexible retirement compared to traditional retirement plans. Fat FIRE requires larger savings and investment portfolios, often exceeding $2 million, to sustain long-term lifestyle goals without compromising quality of life.

Geoarbitrage

Retirement plans traditionally emphasize steady savings and conservative investments, whereas the FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving and geoarbitrage to accelerate financial freedom by relocating to lower-cost regions. Leveraging geoarbitrage enables FIRE adherents to stretch their savings further, optimizing long-term planning by balancing lifestyle flexibility with reduced living expenses.

Sequence of Returns Risk

Retirement plans typically manage Sequence of Returns Risk through diversified portfolios and systematic withdrawal strategies, ensuring sustainable income over time. The FIRE movement, emphasizing early aggressive savings and investment, requires careful timing to mitigate the heightened vulnerability to market volatility during early retirement years.

Safe Withdrawal Rate (SWR)

The Safe Withdrawal Rate (SWR) is a critical metric in both traditional retirement plans and the FIRE (Financial Independence, Retire Early) movement, guiding how much retirees can sustainably withdraw annually from their savings without depleting their funds. Long-term planning models typically recommend a 3-4% SWR to balance growth and longevity of the portfolio, ensuring financial stability whether retiring at a conventional age or pursuing early retirement through aggressive savings and investment strategies.

Cashflowing Annuities

Cashflowing annuities provide a reliable stream of income that complements both traditional retirement plans and the FIRE movement by ensuring consistent cash flow without market volatility. These annuities enhance long-term financial security by converting lump sums into predictable payments, supporting sustainable spending throughout retirement.

Bridge Employment

Bridge employment serves as a strategic option within retirement planning and the FIRE (Financial Independence, Retire Early) movement by allowing individuals to gradually transition from full-time work to full retirement, enhancing financial stability and personal fulfillment. Integrating bridge employment into long-term planning supports smoother income continuity, reduces the risk of premature withdrawal of retirement funds, and aligns with sustainability goals of both traditional retirement plans and the FIRE approach.

Partial Retirement Pathway

Partial retirement offers a flexible alternative to the all-or-nothing approach of the FIRE (Financial Independence, Retire Early) movement, allowing individuals to gradually reduce work hours while maintaining income and benefits. This pathway supports long-term financial stability by balancing ongoing earnings with lifestyle adjustments, optimizing both retirement savings and quality of life.

Retirement plan vs FIRE movement for long-term planning. Infographic

hrdif.com

hrdif.com