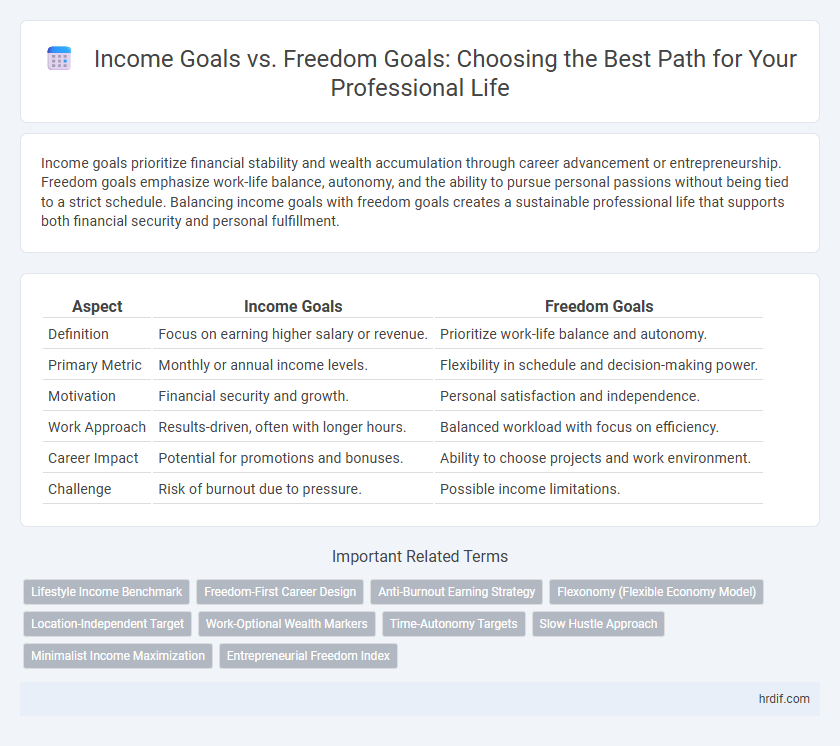

Income goals prioritize financial stability and wealth accumulation through career advancement or entrepreneurship. Freedom goals emphasize work-life balance, autonomy, and the ability to pursue personal passions without being tied to a strict schedule. Balancing income goals with freedom goals creates a sustainable professional life that supports both financial security and personal fulfillment.

Table of Comparison

| Aspect | Income Goals | Freedom Goals |

|---|---|---|

| Definition | Focus on earning higher salary or revenue. | Prioritize work-life balance and autonomy. |

| Primary Metric | Monthly or annual income levels. | Flexibility in schedule and decision-making power. |

| Motivation | Financial security and growth. | Personal satisfaction and independence. |

| Work Approach | Results-driven, often with longer hours. | Balanced workload with focus on efficiency. |

| Career Impact | Potential for promotions and bonuses. | Ability to choose projects and work environment. |

| Challenge | Risk of burnout due to pressure. | Possible income limitations. |

Understanding Income Goals in Professional Life

Income goals in professional life represent the specific financial targets individuals set to achieve stability, growth, and security through their work. These goals often include desired salary levels, bonuses, commissions, or passive income streams essential for meeting personal and family needs. Understanding income goals enables professionals to plan career moves, negotiate compensation effectively, and align their work efforts with measurable monetary outcomes.

Defining Freedom Goals for Career Success

Freedom goals in a professional context prioritize autonomy, flexibility, and work-life balance over income alone. Defining freedom goals involves identifying personal values such as the ability to choose projects, control over work schedules, and opportunities for creative expression. Aligning career decisions with these priorities enhances long-term satisfaction and sustainable success beyond monetary achievements.

Balancing Financial Gain and Lifestyle Flexibility

Income goals prioritize maximizing earnings and financial security through career advancement or entrepreneurship, providing resources for long-term wealth building. Freedom goals emphasize lifestyle flexibility, valuing time autonomy and work-life balance over high income, often through remote work or flexible schedules. Balancing these goals requires strategic planning to achieve sufficient income while preserving personal freedom, ensuring sustainable professional success and well-being.

Aligning Career Choices with Personal Values

Aligning career choices with personal values requires balancing income goals and freedom goals to achieve long-term satisfaction. Income goals focus on financial stability and growth, while freedom goals emphasize flexibility and work-life balance, both essential for holistic professional fulfillment. Prioritizing personal values ensures career decisions support not only monetary success but also autonomy and meaningful engagement.

Long-Term Impact of Income vs Freedom Prioritization

Income goals drive financial stability and enable investments that compound wealth over time, securing resources necessary for future opportunities. Freedom goals prioritize autonomy and work-life balance, fostering creativity and mental well-being that sustain long-term career satisfaction. Balancing income and freedom objectives maximizes both economic security and personal fulfillment, leading to a sustainable professional life with enduring impact.

Measuring Success: Money or Autonomy?

Income goals emphasize quantifiable financial achievements, such as salary increases, bonuses, and net worth growth, aligning success with monetary metrics. Freedom goals prioritize autonomy, flexibility, and work-life balance, measuring success by the ability to control one's schedule and pursue meaningful work. Professionals balancing income and freedom goals often assess success through a hybrid lens incorporating both financial stability and personal independence.

Overcoming Common Challenges in Setting Career Goals

Income goals often provide clear benchmarks like salary targets and bonuses, while freedom goals emphasize work-life balance and autonomy, requiring a different strategy to define success. Overcoming common challenges in setting career goals involves aligning personal values with measurable outcomes, addressing fears of instability, and breaking down abstract aspirations into actionable steps. Effective goal setting integrates both financial objectives and desires for freedom, ensuring motivation and satisfaction in professional growth.

Case Studies: Professionals Who Chose Income vs Freedom

Professionals like Sarah, a corporate lawyer, prioritize income goals by targeting high-paying clients to maximize their earnings, showcasing how financial stability drives career decisions. In contrast, Michael, a freelance graphic designer, emphasizes freedom goals by structuring his workload for flexible hours and creative autonomy, highlighting the value of work-life balance over maximum income. These case studies reveal how individual priorities shape career paths, with income-focused professionals often accepting rigid schedules and freedom-focused ones valuing personal time and control.

Tools and Strategies for Setting Balanced Career Goals

Income goals emphasize measurable financial targets such as salary milestones, bonuses, and investment returns, while freedom goals prioritize work-life balance, flexible schedules, and autonomy in professional decision-making. Effective tools for setting balanced career goals include SMART criteria combined with journaling apps to track progress, and self-assessment platforms like StrengthsFinder to align financial ambitions with personal values. Strategies involve integrating regular reflection periods and feedback loops from mentors to ensure income objectives do not undermine freedom priorities, fostering holistic career satisfaction.

Building a Sustainable and Fulfilling Career Path

Income goals prioritize financial stability and wealth accumulation, driving professionals to seek higher salaries, bonuses, and investment opportunities. Freedom goals emphasize autonomy, work-life balance, and the ability to pursue passions without restrictive schedules or micromanagement. Balancing income goals with freedom goals fosters a sustainable and fulfilling career path by aligning monetary rewards with personal fulfillment and long-term well-being.

Related Important Terms

Lifestyle Income Benchmark

Income goals prioritize reaching a specific Lifestyle Income Benchmark that supports desired expenses and financial stability, ensuring consistent cash flow aligned with professional achievements. Freedom goals emphasize achieving financial independence that surpasses the Lifestyle Income Benchmark, enabling flexible work choices and prioritizing time over earnings.

Freedom-First Career Design

Freedom-first career design prioritizes flexible work schedules and location independence over traditional income benchmarks, enabling sustained personal autonomy and work-life balance. Structuring professional objectives around freedom goals fosters creativity and intrinsic motivation, often leading to diversified income streams that support long-term financial stability without compromising personal freedom.

Anti-Burnout Earning Strategy

Income goals prioritize maximizing financial earnings through targeted career advancements and high-paying roles, while freedom goals emphasize work-life balance and flexible schedules to prevent burnout. An anti-burnout earning strategy integrates sustainable income streams with autonomy, fostering long-term career satisfaction and mental well-being.

Flexonomy (Flexible Economy Model)

Income goals prioritize quantifiable earnings targets, while Freedom goals emphasize autonomy and work-life balance within the Flexonomy model, which advocates for flexibility in time, location, and tasks to optimize professional satisfaction and productivity. Balancing these goals requires aligning financial objectives with personal freedom, leveraging Flexonomy's adaptable frameworks to create sustainable career paths.

Location-Independent Target

Income goals emphasize maximizing revenue streams and financial stability for professionals, while freedom goals prioritize autonomy and flexibility, enabling location-independent work that supports a balanced lifestyle. Achieving a location-independent target requires integrating scalable income strategies with systems that maintain productivity regardless of physical location.

Work-Optional Wealth Markers

Income goals emphasize increasing active earnings through career advancement and business growth, while freedom goals prioritize accumulating passive income streams and investments that support work-optional lifestyles. Work-optional wealth markers include achieving diversified portfolio returns, substantial passive cash flow, and financial independence ratios that allow choosing projects based on passion rather than necessity.

Time-Autonomy Targets

Income goals prioritize maximizing earnings to achieve financial stability or growth, while freedom goals emphasize time-autonomy to balance work with personal life and pursue meaningful activities. Time-autonomy targets measure success by the ability to control work hours and reduce dependency on constant income generation.

Slow Hustle Approach

Income goals prioritize measurable financial milestones, emphasizing steady revenue growth and tangible earnings, while freedom goals focus on achieving autonomy, flexible schedules, and lifestyle balance. The Slow Hustle Approach harmonizes these by encouraging deliberate, sustainable progress toward income targets that support long-term professional freedom without burnout.

Minimalist Income Maximization

Minimalist income maximization emphasizes achieving essential financial targets with streamlined effort, prioritizing income goals that support a simplified lifestyle over expansive earnings aimed at excessive freedom. This approach aligns professional endeavors with critical revenue benchmarks while minimizing complexity, fostering sustainable work-life balance and targeted financial security.

Entrepreneurial Freedom Index

Income goals prioritize maximizing revenue streams and profit margins to achieve financial benchmarks, while Freedom goals emphasize work-life balance and autonomy, as measured by the Entrepreneurial Freedom Index, which quantifies the ability to control time and creative processes in professional life. Entrepreneurs scoring high on the Entrepreneurial Freedom Index often trade higher immediate income for long-term flexibility and personal fulfillment.

Income goals vs Freedom goals for professional life Infographic

hrdif.com

hrdif.com