Venture capitalists typically manage large funds and invest in startups with high growth potential, seeking scalable business models and significant returns within a few years. Angel operators, on the other hand, often invest their own money in early-stage ventures, providing not only capital but also hands-on mentorship and industry expertise. Both investment approaches play crucial roles in entrepreneurship, with venture capitalists focusing on structured funding rounds and angel operators offering more flexible, personalized support.

Table of Comparison

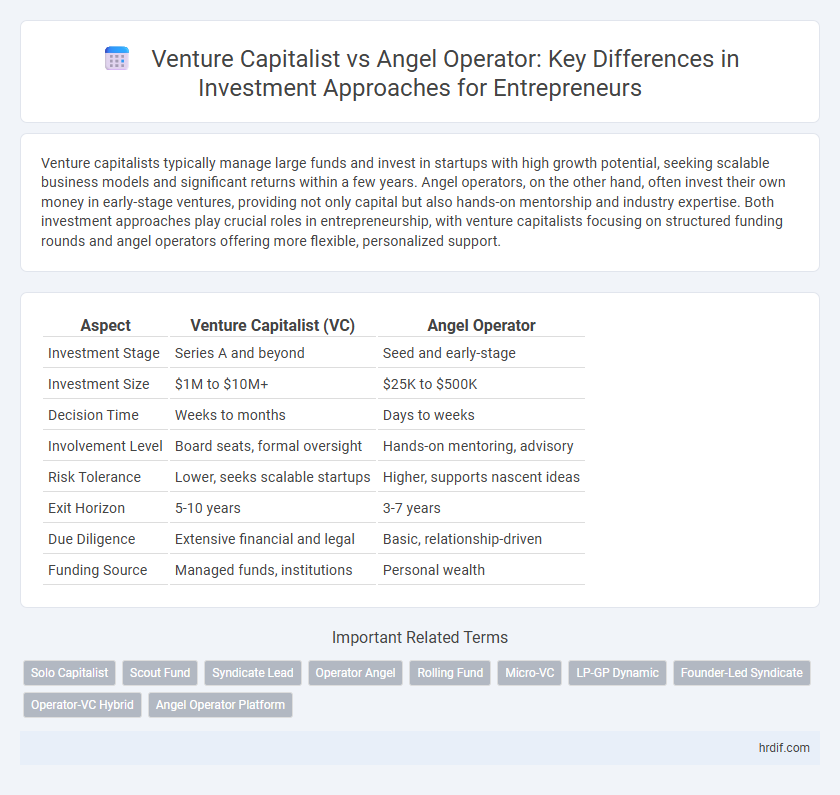

| Aspect | Venture Capitalist (VC) | Angel Operator |

|---|---|---|

| Investment Stage | Series A and beyond | Seed and early-stage |

| Investment Size | $1M to $10M+ | $25K to $500K |

| Decision Time | Weeks to months | Days to weeks |

| Involvement Level | Board seats, formal oversight | Hands-on mentoring, advisory |

| Risk Tolerance | Lower, seeks scalable startups | Higher, supports nascent ideas |

| Exit Horizon | 5-10 years | 3-7 years |

| Due Diligence | Extensive financial and legal | Basic, relationship-driven |

| Funding Source | Managed funds, institutions | Personal wealth |

Defining Venture Capitalists and Angel Operators

Venture capitalists are professional investors managing pooled funds from institutions and individuals, focusing on high-growth startups with potential for substantial returns. Angel operators are individual investors who use personal capital to support early-stage companies, often providing mentorship alongside financial backing. Both play crucial roles in the startup ecosystem by offering different levels of funding, risk tolerance, and strategic involvement.

Key Differences in Investment Strategies

Venture capitalists typically invest larger sums into later-stage startups with proven business models, prioritizing scalability and structured growth potential. Angel investors, often successful entrepreneurs themselves, provide earlier-stage funding with a focus on innovation and personal mentorship, accepting higher risk for potentially higher returns. The key difference lies in the investment horizon and involvement level, where venture capitalists expect formal governance and measurable milestones, while angel operators seek to nurture nascent ideas through direct engagement.

Typical Investment Stages and Funding Sizes

Venture capitalists typically invest during Series A to later funding rounds, providing capital ranging from $1 million to $20 million or more to support scaling and growth phases. Angel operators usually participate in seed or pre-seed stages, investing smaller amounts between $25,000 and $500,000 to help startups develop initial products and gain market traction. The differing investment sizes and stages reflect the varying risk tolerance and involvement levels of venture capitalists versus angel investors in the entrepreneurial ecosystem.

Decision-Making Processes Compared

Venture capitalists rely on structured due diligence, financial metrics, and market potential analysis to guide their investment decisions, often involving multiple stakeholders and formalized processes. Angel operators prioritize personal intuition, founder rapport, and niche industry expertise, enabling faster, more flexible decision-making with less reliance on formal data. The difference in decision-making processes impacts investment speed, risk tolerance, and deal complexity in the entrepreneurial funding landscape.

Relationship with Founders and Startups

Venture capitalists typically maintain structured, formal relationships with founders, emphasizing scalable growth and clear exit strategies, while angel operators often foster more personal, hands-on connections, providing mentorship and strategic guidance. Angels usually invest at earlier stages, offering flexible terms and nurturing innovation, whereas venture capitalists bring larger capital pools and rigorous performance expectations. The depth and style of engagement significantly impact startup development, influencing decision-making, resource access, and long-term success.

Value-Added Support Beyond Capital

Venture capitalists provide structured value-added support through established networks, strategic guidance, and access to follow-on funding rounds, enhancing scalability for startups. Angel operators offer hands-on mentoring, personalized industry expertise, and agile decision-making, fostering early-stage innovation and operational growth. Both investment approaches deliver critical non-financial resources, yet their support manifests differently according to startup maturity and sector needs.

Risk Tolerance and Portfolio Diversification

Venture capitalists typically exhibit a lower risk tolerance by investing larger sums in fewer startups, emphasizing rigorous portfolio diversification to mitigate potential losses. Angel operators, conversely, assume higher individual investment risks due to smaller capital allocations in early-stage companies, often resulting in less diversified but higher-risk portfolios. Understanding these distinct approaches is critical for entrepreneurs seeking targeted funding aligned with their growth and risk profiles.

Exit Strategies and Return Expectations

Venture capitalists typically aim for high-return exits through IPOs or acquisitions within 5 to 7 years, targeting scalable startups with proven traction. Angel operators often invest earlier, accepting longer timelines and higher risk for potentially exponential returns, focusing on strategic exits via buyouts or secondary sales. Both seek liquidity events but differ in risk tolerance, investment size, and expected return multiples.

Impact on Startup Growth Trajectories

Venture capitalists typically provide substantial funding and strategic resources, accelerating startup growth through rigorous due diligence and scalability-driven mentorship. Angel operators often offer early-stage investments coupled with hands-on guidance and industry connections, fostering innovation and risk-taking in nascent startups. The distinct investment approaches of venture capitalists and angel operators significantly influence startup growth trajectories by shaping capital availability, operational support, and market access.

Choosing the Right Investor for Your Startup

Venture capitalists typically invest larger sums of money and seek equity stakes with structured terms, favoring startups with high growth potential and scalable business models. Angel operators often provide smaller, more flexible investments and bring hands-on mentorship, making them suitable for early-stage ventures requiring guidance and strategic support. Selecting the right investor hinges on aligning your startup's stage, funding needs, and desired involvement with the investor's investment style and value proposition.

Related Important Terms

Solo Capitalist

Solo capitalists operate as individual investors bringing personal expertise and flexible decision-making to startups, contrasting with venture capitalists who typically invest pooled funds through structured firms. Their hands-on approach and direct involvement often enable faster deal execution and tailored support for early-stage ventures.

Scout Fund

Scout funds leverage a network of industry insiders and angel operators to identify early-stage startups with high growth potential, providing strategic mentorship alongside capital. Venture capitalists typically deploy larger capital pools through structured funds, focusing on scalable businesses, whereas scout funds prioritize agility and niche expertise in sourcing disruptive innovations.

Syndicate Lead

Venture capitalists typically lead syndicates by pooling substantial funds from multiple investors to support startups with scalable growth, while angel operators often act as syndicate leads by personally coordinating smaller, high-risk investments and leveraging their industry expertise. The syndicate lead role involves setting deal terms, conducting due diligence, and managing investor relations to maximize returns and mitigate risks throughout the funding cycle.

Operator Angel

Operator Angels leverage hands-on industry experience and strategic involvement to drive startup growth, often providing more than just capital by mentoring founders and optimizing operations. Their investment approach focuses on active collaboration and value creation, differentiating them from traditional Venture Capitalists who typically prioritize financial capital and structured funding rounds.

Rolling Fund

Venture capitalists typically invest larger sums through structured funds with predefined timelines, while angel operators using rolling funds benefit from continuous capital influx and flexible investment pacing. Rolling funds enable angel operators to raise capital quarterly, allowing them to adapt quickly to emerging startups and market trends compared to traditional one-time fund closures by venture capitalists.

Micro-VC

Micro-VCs invest smaller capital pools than traditional venture capitalists, targeting early-stage startups with scalable potential, while angel operators typically contribute personal funds and hands-on mentorship. Micro-VCs leverage structured fund strategies and diverse portfolios, optimizing risk and offering startups strategic growth resources beyond initial capital.

LP-GP Dynamic

Venture capitalists operate through a structured LP-GP dynamic where limited partners (LPs) provide capital managed by general partners (GPs) who make investment decisions, contrasting with angel operators who typically invest personal funds without formal LP-GP relationships. This LP-GP framework enables venture capitalists to pool resources, diversify risk, and leverage professional management, enhancing scalability compared to the more personalized and flexible investment approach of angel operators.

Founder-Led Syndicate

Founder-led syndicates empower entrepreneurs by enabling founders to lead investment rounds, fostering stronger alignment and more hands-on support compared to traditional venture capitalists who often rely on structured fund management and formal due diligence. Angel operators, blending investment with operational expertise, provide personalized guidance and quicker decision-making but typically have smaller capital pools and less rigorous scalability mechanisms than venture capitalists.

Operator-VC Hybrid

An Operator-VC hybrid combines the strategic insight and hands-on experience of angel operators with the financial acumen and network capacity of venture capitalists, enabling more active portfolio management and scalable startup growth. This investment approach leverages deep industry expertise and operational skillsets to enhance value creation beyond traditional capital infusion, often accelerating product-market fit and customer acquisition.

Angel Operator Platform

Angel Operator platforms uniquely combine the personalized mentorship and risk tolerance of traditional angel investors with structured investment processes, enabling early-stage startups to access both capital and operational expertise. These platforms leverage a network of experienced operators who actively engage in scaling ventures, offering hands-on support that often surpasses the purely financial focus of conventional venture capitalists.

Venture Capitalist vs Angel Operator for investment approach. Infographic

hrdif.com

hrdif.com