Contractors typically engage in longer-term agreements with defined project scopes, offering more stability and clearer legal protections compared to gig workers, who perform short-term tasks with greater flexibility and fewer commitments. While contractors often receive negotiated pay rates and may work exclusively for one client, gig workers handle multiple assignments simultaneously through digital platforms, benefiting from rapid onboarding and diverse job opportunities. Understanding these differences helps businesses and employees select the optimal flexible work arrangement that balances control, autonomy, and income security.

Table of Comparison

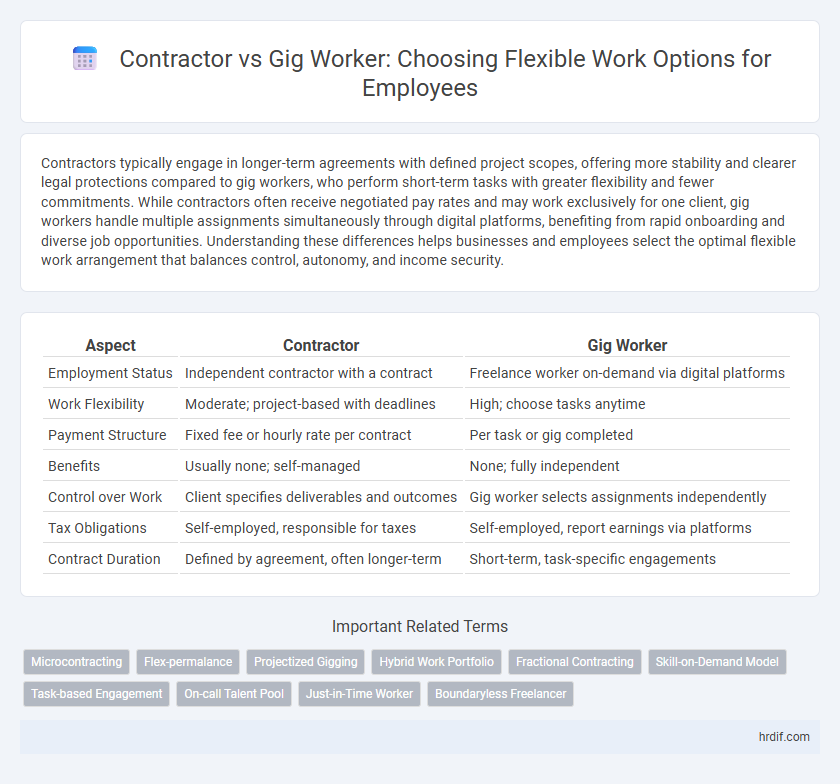

| Aspect | Contractor | Gig Worker |

|---|---|---|

| Employment Status | Independent contractor with a contract | Freelance worker on-demand via digital platforms |

| Work Flexibility | Moderate; project-based with deadlines | High; choose tasks anytime |

| Payment Structure | Fixed fee or hourly rate per contract | Per task or gig completed |

| Benefits | Usually none; self-managed | None; fully independent |

| Control over Work | Client specifies deliverables and outcomes | Gig worker selects assignments independently |

| Tax Obligations | Self-employed, responsible for taxes | Self-employed, report earnings via platforms |

| Contract Duration | Defined by agreement, often longer-term | Short-term, task-specific engagements |

Understanding Contractor and Gig Worker Roles

Contractors typically engage in longer-term, project-based work with more control over how tasks are completed, often requiring specific skills and agreed-upon deliverables. Gig workers perform short-term, task-oriented jobs facilitated through digital platforms, usually with less oversight but limited job security and benefits. Understanding these distinctions helps companies tailor flexible work strategies while ensuring compliance with labor regulations.

Key Differences Between Contractors and Gig Workers

Contractors typically engage in longer-term projects with defined scopes and maintain independent business operations, whereas gig workers perform short-term, task-specific jobs often coordinated through digital platforms. Contractors have greater control over how and when they complete work, while gig workers rely on app-based assignments with less autonomy. Legal classifications impact benefits and tax obligations, as contractors are usually responsible for their own taxes and benefits, while gig workers' status may vary depending on local labor laws.

Flexibility: Contractor vs Gig Worker

Contractors often have greater control over their work schedules and project choices, allowing for tailored flexibility aligned with specialized skills. Gig workers experience flexibility through on-demand opportunities and the ability to accept or decline tasks instantly, suiting variable availability. Both roles offer adaptable work arrangements but differ in commitment level and autonomy within flexible employment models.

Income Stability: Comparing Earning Models

Contractors typically receive fixed project payments or hourly rates, providing more predictable income streams compared to gig workers who rely on task-based earnings that can fluctuate daily. Gig workers often face income volatility due to variable demand and platform algorithms, making financial planning more challenging. Understanding these earning models helps employees choose flexible work options aligning with their income stability preferences.

Legal Status and Worker Rights

Contractors operate under specific contractual agreements that define their responsibilities, often classified as independent businesses with limited employee rights, while gig workers typically engage in short-term, task-based work without formal contracts, resulting in varied legal protections. Legal status for contractors usually grants them more control over work methods but excludes benefits like minimum wage or unemployment insurance. In contrast, gig workers often face ambiguity in classification, limiting access to traditional worker rights such as health benefits, collective bargaining, or job security.

Tax Implications for Contractors and Gig Workers

Contractors are typically responsible for managing their own tax withholdings and paying estimated quarterly taxes, which can include self-employment tax covering Social Security and Medicare. Gig workers face similar tax responsibilities but often deal with a more variable income stream, making accurate record-keeping essential to avoid underpayment penalties. Both contractors and gig workers must issue and receive Form 1099-NEC or Form 1099-K, depending on payment methods, impacting their overall tax reporting and liability.

Project Scope and Job Responsibilities

Contractors typically engage in projects with well-defined scopes, delivering specific outcomes based on detailed agreements, while gig workers often perform smaller, discrete tasks with more flexible and variable responsibilities. Project scope for contractors involves comprehensive planning, milestones, and accountability, whereas gig workers operate within broader, less-structured job parameters that prioritize speed and adaptability. Clear delineation of job responsibilities aligns contractor efforts with client objectives, contrasting with gig workers' task-oriented engagements that accommodate rapid changes in demand.

Access to Benefits and Protections

Contractors often lack access to traditional employee benefits such as health insurance, retirement plans, and paid leave, while gig workers typically receive minimal or no benefits due to their independent status. Employment laws provide contractors with fewer protections against wage theft, discrimination, and wrongful termination compared to full-time employees. Companies offering flexible work arrangements increasingly explore hybrid models to balance autonomy with essential benefits and labor rights.

Skill Requirements and Career Advancement

Contractors typically possess specialized skills tailored to specific projects, offering expertise that aligns with organizational needs and often leading to clearer paths for career advancement through skill deepening. Gig workers tend to have a broader but less specialized skill set, which provides flexibility but may limit opportunities for progressive career growth within a particular industry. Employers seeking long-term capability development often favor contractors for their potential to contribute to sustained organizational knowledge and professional development.

Choosing the Right Flexible Work Path

Choosing the right flexible work path depends on understanding key differences between contractors and gig workers, such as contract duration, control over schedules, and payment structures. Contractors typically engage in longer-term, project-based agreements with predictable income, while gig workers benefit from on-demand assignments with greater autonomy but less income stability. Evaluating business needs and worker preferences ensures alignment with compliance requirements and operational goals for an optimized flexible workforce.

Related Important Terms

Microcontracting

Microcontracting offers companies a scalable approach to flexible work by engaging gig workers for specific, short-term tasks without long-term employment commitments. Unlike traditional contractors, microcontracted gig workers provide specialized skills on demand, enhancing operational agility and cost-efficiency in dynamic business environments.

Flex-permalance

Flex-permalance offers companies the ability to combine the stability of contractors with the agility of gig workers, creating a hybrid workforce that maximizes productivity and flexibility. This model enables tailored engagement terms, balancing consistent performance expectations with adaptable scheduling to meet dynamic business needs.

Projectized Gigging

Projectized gigging enables companies to engage gig workers on specific projects without long-term commitments, leveraging flexibility and specialized skills. Contractors typically involve more structured agreements and ongoing responsibilities, whereas gig workers operate on a task-by-task basis optimal for dynamic, short-term project needs.

Hybrid Work Portfolio

Contractors in a hybrid work portfolio often provide specialized skills on a long-term basis with structured agreements, while gig workers offer highly flexible, short-term task completion suited for fluctuating workload demands. Organizations optimize workforce agility by balancing contractors' stability and gig workers' scalability to enhance productivity and cost efficiency.

Fractional Contracting

Fractional contracting offers businesses the strategic advantage of engaging highly skilled contractors for specific projects or defined periods without the long-term commitments typical of traditional employment, providing more flexibility than gig work. Unlike gig workers who handle short-term, task-based assignments, fractional contractors contribute deep expertise in targeted roles, enabling scalable workforce solutions aligned with evolving business needs.

Skill-on-Demand Model

Contractors and gig workers both enable flexible work arrangements, but the Skill-on-Demand Model emphasizes the targeted deployment of specialized expertise for specific projects or tasks, maximizing efficiency and cost-effectiveness. This model leverages the unique capabilities of contractors who bring in-depth professional skills, while gig workers offer rapid, task-oriented solutions for scalable workforce needs.

Task-based Engagement

Contractors engage in task-based work with defined project scopes and timelines, offering specialized skills for specific deliverables. Gig workers perform short-term, often on-demand tasks, providing flexibility for both the worker and employer but with less predictable work continuity.

On-call Talent Pool

Contractors provide specialized skills for defined projects within an on-call talent pool, enabling companies to scale quickly with vetted expertise. Gig workers offer rapid availability for short-term, task-based assignments, increasing workforce flexibility without long-term commitment.

Just-in-Time Worker

Just-in-time workers operate as contractors or gig workers, providing businesses with flexible labor that can be scaled up or down based on immediate demand. This model reduces overhead costs while ensuring rapid response to fluctuating workloads through on-demand staffing platforms.

Boundaryless Freelancer

Boundaryless freelancers operate as independent contractors, leveraging flexible work arrangements without traditional employer-employee boundaries, enabling greater autonomy and diverse project opportunities. Unlike gig workers limited by platform restrictions, these contractors manage their own client relationships and schedules, optimizing income potential and professional growth.

Contractor vs Gig worker for flexible work. Infographic

hrdif.com

hrdif.com