An accountant specializes in financial record-keeping, ensuring accuracy in bookkeeping, tax compliance, and regulatory reporting. A FinOps expert focuses on optimizing cloud financial management, blending financial acumen with operational strategies to control costs and improve cloud investment efficiency. While accountants maintain financial integrity, FinOps experts drive strategic cost management in dynamic cloud environments.

Table of Comparison

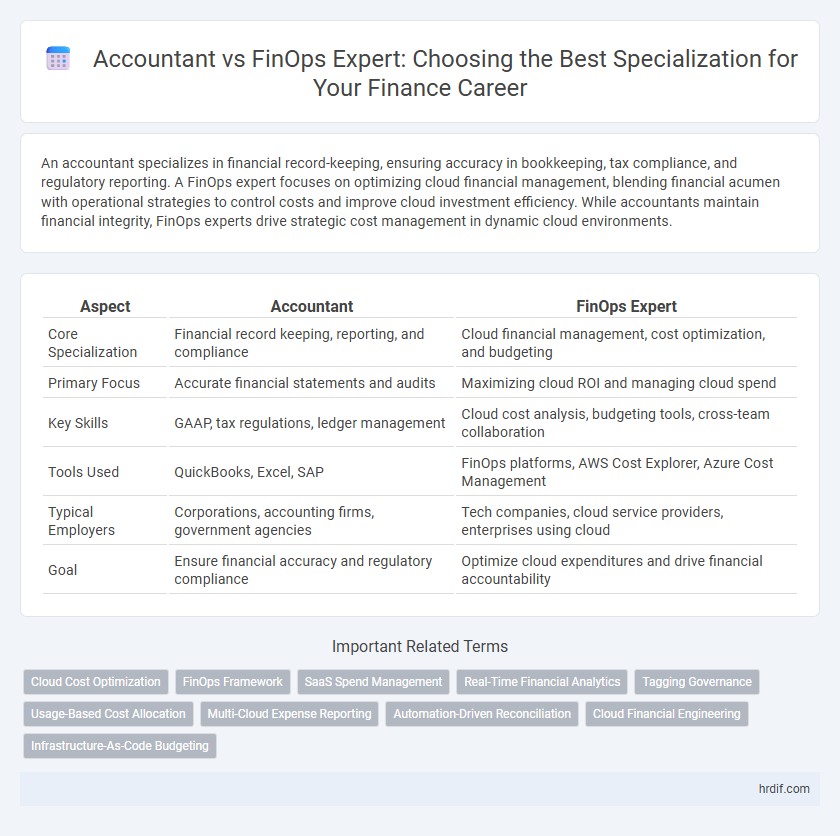

| Aspect | Accountant | FinOps Expert |

|---|---|---|

| Core Specialization | Financial record keeping, reporting, and compliance | Cloud financial management, cost optimization, and budgeting |

| Primary Focus | Accurate financial statements and audits | Maximizing cloud ROI and managing cloud spend |

| Key Skills | GAAP, tax regulations, ledger management | Cloud cost analysis, budgeting tools, cross-team collaboration |

| Tools Used | QuickBooks, Excel, SAP | FinOps platforms, AWS Cost Explorer, Azure Cost Management |

| Typical Employers | Corporations, accounting firms, government agencies | Tech companies, cloud service providers, enterprises using cloud |

| Goal | Ensure financial accuracy and regulatory compliance | Optimize cloud expenditures and drive financial accountability |

Defining the Roles: Accountant vs. FinOps Expert

Accountants specialize in financial reporting, compliance, and auditing, ensuring accuracy in financial statements and adherence to regulatory standards. FinOps experts focus on optimizing cloud financial management by monitoring cloud spend, implementing cost-saving strategies, and bridging finance with engineering teams. The specialization highlights accountants' role in traditional finance functions contrasted with FinOps experts' emphasis on cloud cost optimization and operational efficiency.

Core Skills and Knowledge Required

Accountants specialize in financial reporting, tax compliance, and auditing with core skills in bookkeeping, financial statement preparation, and regulatory knowledge; proficiency in GAAP and tax codes is essential. FinOps experts focus on cloud financial management, combining knowledge of cloud infrastructure, cost optimization techniques, and data analytics to drive efficient cloud expenditure. Strong collaboration between finance and technology teams defines FinOps, while accountants maintain compliance and accuracy in traditional financial processes.

Educational Pathways and Certifications

Accountants typically pursue education in accounting or finance, obtaining degrees such as a Bachelor's or Master's in Accounting, often supplemented by certifications like CPA (Certified Public Accountant) or CMA (Certified Management Accountant) to validate expertise in financial reporting and compliance. FinOps experts generally follow a pathway that blends finance, operations, and cloud computing knowledge, with certifications including FinOps Certified Practitioner (FOCP) and cloud financial management credentials from providers like AWS or Azure, emphasizing cost optimization and cloud spend analysis. The specialization choice depends on career goals: accountants specialize in traditional financial management and auditing, whereas FinOps experts specialize in the operational and strategic management of cloud expenditures.

Daily Responsibilities and Scope of Work

Accountants primarily manage financial records, ensuring accurate bookkeeping, compliance with tax regulations, and preparing financial statements for audits. FinOps experts specialize in optimizing cloud financial management by analyzing real-time cloud usage, forecasting costs, and implementing cost-saving strategies to improve operational efficiency. While accountants focus on historical financial data and regulatory adherence, FinOps professionals drive strategic financial decision-making related to cloud resource allocation and expenditure control.

Tools and Technologies Used

Accountants primarily use tools like QuickBooks, Microsoft Excel, and SAP for financial reporting and compliance, emphasizing accuracy in bookkeeping and tax preparation. FinOps experts specialize in cloud cost management platforms such as Cloudability, Apptio, and AWS Cost Explorer to optimize cloud expenditure and operational efficiency. The distinction lies in accountants focusing on traditional financial systems, whereas FinOps experts leverage advanced cloud-native technologies for financial operations.

Industry Demand and Job Outlook

Accountants maintain core financial records and regulatory compliance, with steady demand driven by all industries' need for accurate financial reporting and auditing. FinOps experts specialize in cloud financial management, experiencing rapid job growth due to widespread cloud adoption and organizations seeking to optimize cloud spending and operational efficiency. Industry demand favors accountants in traditional sectors, while FinOps roles expand primarily in technology, cloud services, and enterprises undergoing digital transformation.

Salary Expectations and Career Progression

Accountants generally command a steady salary with gradual increases tied to certification milestones such as CPA status, while FinOps experts often experience faster salary growth due to the high demand for cloud financial management skills. Career progression for accountants typically follows traditional paths within finance departments, advancing to roles like senior accountant or controller. In contrast, FinOps specialists can move rapidly into strategic positions like FinOps manager or cloud finance lead, driven by the critical role they play in optimizing cloud expenditures.

Specialization Opportunities within Each Field

Accountants specialize in financial reporting, tax compliance, and auditing, providing critical insights into regulatory adherence and historical financial data analysis. FinOps experts focus on cloud cost management, optimizing cloud spend, and aligning financial accountability with operational efficiency in dynamic cloud environments. Each specialization offers opportunities for career advancement through deep expertise in financial governance for accountants and cloud financial strategy for FinOps professionals.

Impact on Business Strategy and Decision-Making

Accountants provide critical financial reporting and compliance expertise that ensures accuracy and regulatory adherence, forming the foundation for informed business strategy and risk management. FinOps experts specialize in optimizing cloud financial operations, enabling real-time cost management and resource allocation that directly influence agility and strategic investment decisions. The integration of traditional accounting principles with FinOps strategies empowers businesses to align financial discipline with dynamic operational demands for enhanced decision-making impact.

Choosing the Right Path: Factors to Consider

Accountants specialize in financial reporting, compliance, and auditing, ensuring accuracy in company records and tax obligations. FinOps experts concentrate on cloud financial management, optimizing cloud costs, and aligning IT spending with business goals for enhanced operational efficiency. When choosing the right path, consider your interest in traditional finance principles versus technology-driven cost optimization and organizational impact in cloud environments.

Related Important Terms

Cloud Cost Optimization

Accountants focus on financial record-keeping and compliance, while FinOps experts specialize in cloud cost optimization through real-time data analysis, budgeting, and cost allocation strategies. FinOps bridges finance, technology, and business teams to maximize cloud investment efficiency and reduce unnecessary expenditures.

FinOps Framework

FinOps experts specialize in optimizing cloud financial management by implementing the FinOps Framework, which enables real-time cost visibility, budget accountability, and cross-team collaboration, unlike accountants who primarily focus on traditional financial reporting and compliance. Mastery of cloud cost allocation, usage optimization, and financial governance within the FinOps Framework distinguishes FinOps specialists as critical drivers of operational efficiency in cloud environments.

SaaS Spend Management

An Accountant brings expertise in financial reporting and compliance, ensuring accurate bookkeeping and audit readiness, while a FinOps expert specializes in optimizing SaaS spend management through real-time cost allocation, usage analytics, and cloud financial operations. SaaS spend management benefits from a FinOps expert's ability to implement automated budgeting tools and drive cost efficiency, surpassing traditional accounting methods in managing dynamic subscription models.

Real-Time Financial Analytics

Accountants typically specialize in historical financial data management and compliance reporting, while FinOps experts focus on real-time financial analytics to optimize cloud spend and operational efficiency. Real-time financial analytics empowers FinOps professionals to provide actionable insights for dynamic resource allocation, enhancing cost control and financial forecasting accuracy.

Tagging Governance

Accountants specialize in financial record accuracy and compliance, ensuring precise tagging governance for audit readiness and regulatory adherence. FinOps experts optimize cloud cost management with tagging governance strategies that enhance resource allocation, budgeting, and operational efficiency.

Usage-Based Cost Allocation

Accountants specialize in traditional financial reporting and compliance, while FinOps experts focus on usage-based cost allocation to optimize cloud spending and resource efficiency. FinOps leverages real-time data and automation tools to align cloud expenses with actual consumption, enabling more accurate budgeting and cost transparency.

Multi-Cloud Expense Reporting

Accountants specialize in traditional financial reporting and compliance, ensuring accurate bookkeeping and regulatory adherence across general business operations. FinOps experts focus on multi-cloud expense reporting, optimizing cloud cost management by integrating financial accountability with cloud usage data to drive cost efficiency and strategic decision-making.

Automation-Driven Reconciliation

An Accountant specializes in traditional financial record-keeping and compliance, while a FinOps expert leverages automation-driven reconciliation tools to optimize cloud cost management and real-time financial analysis. The FinOps role demands proficiency in automated systems that enhance accuracy and speed in processing transactional data, enabling dynamic budget adjustments and cost transparency.

Cloud Financial Engineering

A Cloud Financial Engineering specialization requires expertise in optimizing cloud expenditures and implementing FinOps best practices, making a FinOps expert more aligned with these goals than a traditional accountant. While accountants are skilled in general financial reporting and compliance, FinOps experts focus on real-time cloud cost management, billing analysis, and strategic cloud investment decisions.

Infrastructure-As-Code Budgeting

Accountants specialize in traditional financial management and reporting, often lacking the technical expertise required for Infrastructure-as-Code (IaC) budgeting, whereas FinOps experts combine financial acumen with cloud infrastructure knowledge to optimize and manage IaC costs efficiently. FinOps specialists leverage real-time cloud usage data and automation tools to enforce budget controls and drive cost-saving strategies tailored to dynamic cloud environments.

Accountant vs FinOps expert for specialization. Infographic

hrdif.com

hrdif.com