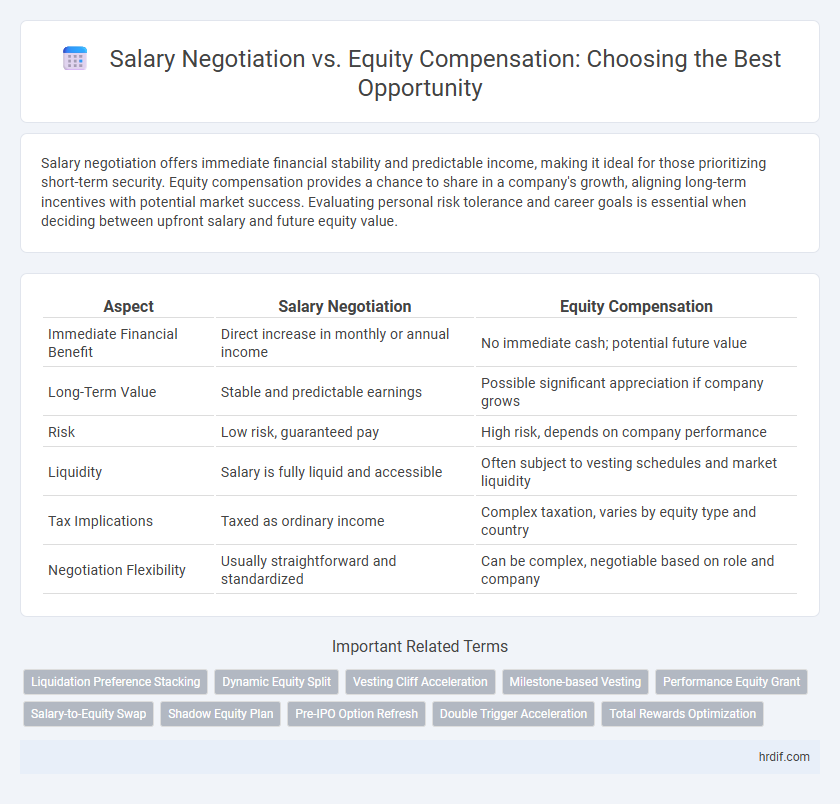

Salary negotiation offers immediate financial stability and predictable income, making it ideal for those prioritizing short-term security. Equity compensation provides a chance to share in a company's growth, aligning long-term incentives with potential market success. Evaluating personal risk tolerance and career goals is essential when deciding between upfront salary and future equity value.

Table of Comparison

| Aspect | Salary Negotiation | Equity Compensation |

|---|---|---|

| Immediate Financial Benefit | Direct increase in monthly or annual income | No immediate cash; potential future value |

| Long-Term Value | Stable and predictable earnings | Possible significant appreciation if company grows |

| Risk | Low risk, guaranteed pay | High risk, depends on company performance |

| Liquidity | Salary is fully liquid and accessible | Often subject to vesting schedules and market liquidity |

| Tax Implications | Taxed as ordinary income | Complex taxation, varies by equity type and country |

| Negotiation Flexibility | Usually straightforward and standardized | Can be complex, negotiable based on role and company |

Understanding Salary Negotiation in Today’s Job Market

Salary negotiation remains a critical step in maximizing immediate financial benefits and reflects a candidate's value in today's competitive job market. Understanding industry salary benchmarks, cost of living variations, and the employer's compensation structure empowers candidates to request fair and strategic pay. Emphasizing transparency around salary expectations and total compensation packages ensures a balanced evaluation of cash salary versus equity opportunities.

The Basics of Equity Compensation Offers

Equity compensation offers provide employees with ownership stakes in a company, typically through stock options or restricted stock units (RSUs), aligning their financial interests with the company's growth potential. Unlike salary, equity compensation's value fluctuates based on company performance and market conditions, making it a high-risk, high-reward component of total compensation. Understanding the vesting schedule, strike price, and potential dilution is crucial for evaluating an equity offer compared to a guaranteed salary increase.

Comparing Immediate Salary vs. Long-Term Equity Gains

Salary negotiation provides immediate financial security, ensuring a predictable income stream that supports daily living expenses and short-term goals. Equity compensation, though potentially less liquid initially, offers substantial long-term financial upside through stock appreciation and company growth, aligning employee interests with the organization's success. Balancing immediate salary needs against future equity gains requires assessing risk tolerance, financial stability, and confidence in the company's trajectory.

Evaluating Risk and Reward: Equity vs. Guaranteed Pay

Evaluating risk and reward in salary negotiation involves comparing guaranteed pay with equity compensation, where salary offers financial stability while equity offers potential for substantial future gains tied to company performance. Salary guarantees steady income and reduced financial uncertainty, whereas equity introduces risk with no immediate payout but the possibility of significant appreciation if the company succeeds. Assessing individual risk tolerance and long-term financial goals is crucial when balancing immediate earnings against the speculative nature of equity stakes.

Key Factors Influencing Salary Negotiation Success

Key factors influencing salary negotiation success include thorough market research on comparable roles and compensation benchmarks, demonstrating quantifiable contributions and unique skill sets, and understanding the company's financial position and culture regarding equity offers. Clarity on long-term career goals and risk tolerance helps balance immediate salary demands against potential future equity gains. Effective communication and preparation foster confidence and leverage in discussions, maximizing the opportunity for favorable compensation outcomes.

Assessing Company Stage: When Equity Makes Sense

Assessing the company stage is critical when deciding between salary negotiation and equity compensation, as early-stage startups often offer substantial equity to offset lower immediate pay. Equity makes sense when a company is in its growth phase with high potential for valuation increase, providing long-term financial gains beyond a fixed salary. Established firms with stable revenues tend to prioritize competitive salaries over equity due to lower risk and predictable cash flow.

Tax Implications: Salary Income vs. Equity Compensation

Salary income is subject to regular income tax rates and payroll taxes at the time of payment, resulting in immediate tax liabilities. Equity compensation, such as stock options or restricted stock units, often benefits from deferred taxation until the shares are vested or sold, potentially capitalizing on lower capital gains tax rates. Understanding the timing and nature of tax events is crucial for optimizing the financial advantage between salary negotiation and equity compensation opportunities.

Negotiation Strategies: Maximizing Value in Offers

Effective negotiation strategies for salary versus equity compensation focus on understanding the total value and growth potential of the equity offered alongside immediate cash benefits. Leveraging market data on company valuation, exit timelines, and stock option terms enables candidates to advocate for a balanced package that aligns with long-term financial goals. Prioritizing transparent communication about risk tolerance and personal financial needs ensures maximized value from complex compensation offers.

Industry Trends: Salary vs. Equity Preferences

Industry trends reveal a growing preference for equity compensation among startups and tech companies, driven by the potential for long-term financial gains. Salary remains the dominant choice in established corporations where stability and predictable income are prioritized. Data from recent surveys indicate that 65% of tech employees favor equity-based packages, while 70% of traditional sector workers prioritize higher fixed salaries.

Making the Right Choice: Aligning Compensation with Career Goals

Choosing between salary negotiation and equity compensation hinges on aligning with long-term career goals and financial priorities. Salary offers immediate financial stability and predictable income, ideal for those valuing cash flow and short-term security. Equity compensation presents growth potential tied to company performance, appealing to individuals seeking wealth accumulation and vested interest in the organization's success.

Related Important Terms

Liquidation Preference Stacking

Negotiating salary versus equity compensation requires careful analysis of liquidation preference stacking, which can significantly dilute the value of stock options in a startup exit scenario, especially when multiple liquidation preferences accrue to earlier investors. Understanding how liquidation preference stacking affects potential returns helps candidates evaluate the true opportunity cost and long-term value of equity compared to guaranteed salary increments.

Dynamic Equity Split

Dynamic equity split offers a flexible alternative to fixed salary negotiations by aligning ownership ownership with individual contributions in real-time, fostering motivation and fairness. This approach enables startup founders and employees to balance cash compensation with equity stakes, optimizing long-term opportunity value while managing immediate financial needs.

Vesting Cliff Acceleration

Salary negotiation offers immediate financial benefits, whereas equity compensation with vesting cliff acceleration provides long-term ownership incentives that can accelerate the timeline for stock option maturity upon triggering events like termination or acquisition. Understanding the implications of vesting cliffs and acceleration clauses is essential for maximizing opportunity value in compensation packages.

Milestone-based Vesting

Salary negotiation provides immediate financial stability, while equity compensation offers long-term growth potential linked to company performance. Milestone-based vesting aligns employee incentives with company success, ensuring equity is earned upon reaching key performance targets or development stages.

Performance Equity Grant

Performance equity grants offer significant long-term upside potential by aligning employee rewards with company growth and market performance, often surpassing immediate salary increases in total value. Negotiating equity compensation alongside salary creates a balanced opportunity to benefit from both steady income and future capital gains tied to the company's success.

Salary-to-Equity Swap

A Salary-to-Equity Swap involves trading a portion of fixed salary for equity shares, aligning employee incentives with company growth and potential valuation increases. This strategy offers opportunity for substantial long-term financial gains but requires assessing risk tolerance and company valuation stability before negotiation.

Shadow Equity Plan

Salary negotiation offers immediate financial benefits, while equity compensation, particularly through a Shadow Equity Plan, provides long-term value tied to company growth without diluting ownership. Shadow Equity Plans replicate the benefits of stock options by granting cash bonuses based on the company's valuation increase, aligning employee incentives with corporate success without requiring actual equity issuance.

Pre-IPO Option Refresh

Pre-IPO option refresh programs can significantly enhance long-term wealth potential by providing employees with renewed equity stakes before a company goes public, often outweighing immediate salary increases. Evaluating salary negotiation against equity compensation requires assessing the company's growth trajectory and liquidity events, as refreshed options may offer substantial upside beyond fixed cash compensation.

Double Trigger Acceleration

Double Trigger Acceleration significantly enhances equity compensation value during acquisition events, making it a crucial factor in salary negotiation for startup employees. Balancing base salary with equity that includes Double Trigger provisions can maximize long-term financial opportunity and risk mitigation.

Total Rewards Optimization

Maximizing total rewards requires balancing salary negotiation with equity compensation, as competitive base pay ensures immediate financial security while equity offers potential long-term wealth through company growth. Strategic evaluation of salary and stock options improves overall compensation packages, aligning personal financial goals with company performance and opportunity for wealth accumulation.

Salary negotiation vs Equity compensation for opportunity. Infographic

hrdif.com

hrdif.com