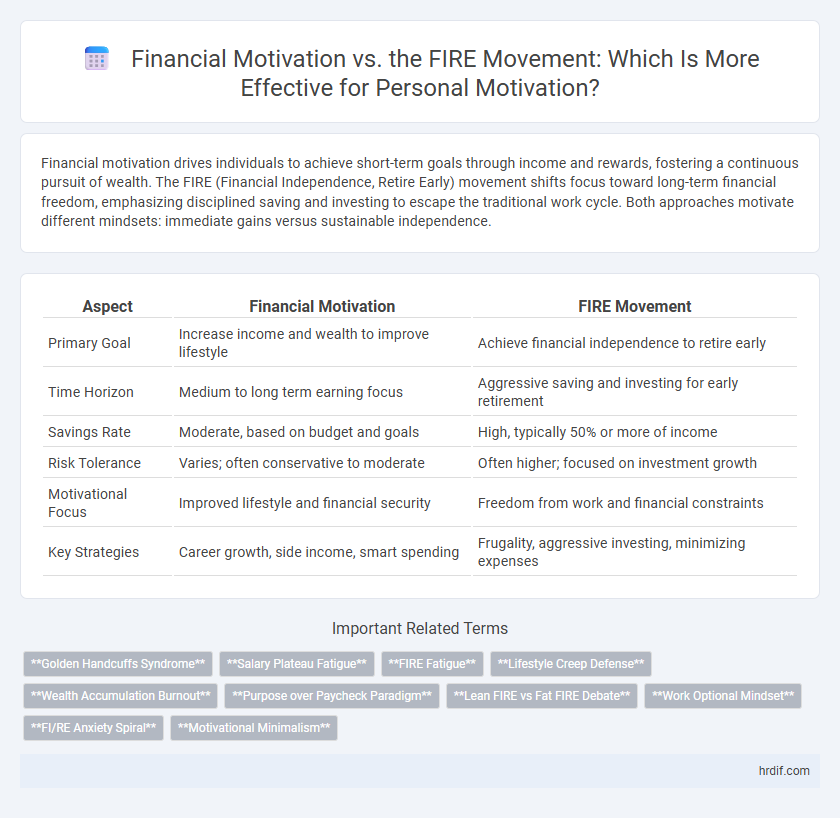

Financial motivation drives individuals to achieve short-term goals through income and rewards, fostering a continuous pursuit of wealth. The FIRE (Financial Independence, Retire Early) movement shifts focus toward long-term financial freedom, emphasizing disciplined saving and investing to escape the traditional work cycle. Both approaches motivate different mindsets: immediate gains versus sustainable independence.

Table of Comparison

| Aspect | Financial Motivation | FIRE Movement |

|---|---|---|

| Primary Goal | Increase income and wealth to improve lifestyle | Achieve financial independence to retire early |

| Time Horizon | Medium to long term earning focus | Aggressive saving and investing for early retirement |

| Savings Rate | Moderate, based on budget and goals | High, typically 50% or more of income |

| Risk Tolerance | Varies; often conservative to moderate | Often higher; focused on investment growth |

| Motivational Focus | Improved lifestyle and financial security | Freedom from work and financial constraints |

| Key Strategies | Career growth, side income, smart spending | Frugality, aggressive investing, minimizing expenses |

Understanding Financial Motivation in Career Choices

Financial motivation plays a crucial role in career choices by directly influencing job satisfaction and long-term stability, with individuals often prioritizing income growth and security. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing strategies, shaping motivation toward financial freedom rather than traditional employment. Understanding these differing approaches helps clarify how financial goals drive career decisions and work-life balance preferences.

The Fundamentals of the FIRE Movement

Financial motivation often centers on earning, saving, and growing wealth to enhance lifestyle and security, whereas the FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investment strategies to achieve early retirement. The fundamentals of the FIRE movement include maintaining a high savings rate, typically 50% or more of income, reducing expenses through frugality, and investing primarily in low-cost index funds to build a sizable investment portfolio. This disciplined approach enables adherents to achieve financial independence years or decades ahead of traditional retirement timelines.

Key Differences: Financial Motivation vs. FIRE Motivation

Financial motivation centers on increasing income, accumulating wealth, and achieving material success, driven by external rewards and immediate financial goals. The FIRE (Financial Independence, Retire Early) movement emphasizes long-term financial freedom, frugality, and early retirement through disciplined saving and investing to gain autonomy over one's time. Key differences lie in timeframe orientation, with financial motivation targeting short-term gains, while FIRE prioritizes sustainable lifestyle changes for lasting independence.

Short-Term Gains vs. Long-Term Financial Independence

Financial motivation often drives individuals to seek short-term gains through salary increases, bonuses, or immediate returns on investments, emphasizing quick rewards that boost current lifestyle satisfaction. The FIRE (Financial Independence, Retire Early) movement prioritizes long-term financial independence by promoting aggressive savings, frugality, and strategic investments to achieve early retirement and sustained wealth. Balancing immediate financial incentives with the disciplined approach of FIRE can optimize overall motivation by aligning present actions with future financial freedom goals.

How Financial Motivation Shapes Career Progression

Financial motivation significantly influences career progression by driving individuals to seek higher-paying roles, pursue advanced skills, and prioritize job stability. The FIRE (Financial Independence, Retire Early) movement offers an alternative motivation, focusing on aggressive saving and investing to achieve early retirement, which can lead to more strategic career decisions centered around income maximization and lifestyle flexibility. Understanding these contrasting financial motivations helps explain diverse career trajectories and work-life balance preferences in the modern workforce.

Is the FIRE Movement Changing Workplace Ambitions?

The FIRE movement is reshaping workplace ambitions by prioritizing early financial independence over traditional career progression and long-term employment stability. Financial motivation now increasingly aligns with achieving personal freedom and reduced work hours rather than solely maximizing income or promotions. This shift is influencing employees to seek jobs with greater flexibility and purpose rather than conventional salary-driven roles.

Psychological Impacts of Financial and FIRE Goals

Financial motivation often triggers short-term behavioral responses driven by immediate rewards and external validation, impacting stress levels and decision-making processes. In contrast, the FIRE (Financial Independence, Retire Early) movement fosters long-term psychological benefits by promoting autonomy, reduced anxiety about future financial constraints, and increased life satisfaction. Both approaches influence mental well-being differently, with financial motivation sometimes linked to pressure and burnout, while FIRE goals encourage deliberate planning and sustained motivation.

Balancing Immediate Rewards and Future Security

Balancing immediate financial rewards with long-term security is crucial for sustainable motivation, as the Financial Independence, Retire Early (FIRE) movement emphasizes rigorous saving and investing to achieve early retirement. While traditional financial motivation drives individuals through short-term goals like bonuses or pay raises, the FIRE approach prioritizes future financial freedom, encouraging disciplined budgeting and strategic asset accumulation. Integrating both strategies can optimize motivation by combining the gratification of present incentives with the assurance of future stability.

Common Pitfalls: Money-Driven Careers vs. FIRE Pursuits

Pursuing a money-driven career often leads to burnout due to unrealistic salary expectations and neglect of personal well-being, whereas the FIRE (Financial Independence, Retire Early) movement risks delaying enjoyment of life by focusing excessively on frugality and early retirement targets. Both approaches can foster stress and dissatisfaction if motivation centers solely on financial gains without aligning with intrinsic values or lifestyle goals. Balancing financial ambition with purposeful living remains critical to avoiding common pitfalls in motivation strategies.

Which Motivation Fits Your Professional Journey?

Financial motivation drives many professionals by emphasizing salary growth, bonuses, and tangible rewards to fuel career advancement and stability. The FIRE (Financial Independence, Retire Early) movement promotes a disciplined savings and investment strategy focused on achieving early retirement and long-term financial freedom. Assessing personal values, career goals, and risk tolerance helps determine whether traditional financial incentives or the FIRE philosophy better aligns with your professional journey.

Related Important Terms

Golden Handcuffs Syndrome

Financial motivation often traps individuals in the Golden Handcuffs Syndrome, where substantial salaries and benefits create reluctance to leave unfulfilling jobs, contrasting sharply with the FIRE (Financial Independence, Retire Early) movement that prioritizes freedom and purposeful living over monetary incentives. The FIRE movement challenges this entrapment by encouraging aggressive saving and investing strategies aimed at achieving independence, thereby breaking free from the psychological and financial constraints imposed by Golden Handcuffs.

Salary Plateau Fatigue

Salary plateau fatigue often drives individuals to seek financial motivation beyond traditional income growth, prompting many to embrace the FIRE (Financial Independence, Retire Early) movement as a strategic alternative. The FIRE approach prioritizes aggressive saving and investing to achieve early financial independence, offering a clear antidote to the stagnation experienced during salary plateaus.

FIRE Fatigue

Financial motivation drives individuals through tangible goals like salary increases and bonuses, yet the FIRE movement's promise of early retirement often leads to FIRE fatigue, where relentless saving and extreme frugality cause burnout and diminishing enthusiasm. This fatigue highlights the psychological toll of pursuing financial independence aggressively, emphasizing the need for balanced approaches that maintain motivation without sacrificing well-being.

Lifestyle Creep Defense

Financial motivation often drives individuals to increase earnings and spending simultaneously, leading to lifestyle creep that undermines long-term savings; the FIRE (Financial Independence, Retire Early) movement emphasizes strict budgeting and frugality to defend against lifestyle inflation and accelerate wealth accumulation. By prioritizing controlled spending and mindful lifestyle choices, FIRE adherents effectively mitigate lifestyle creep, ensuring their financial independence goals remain attainable.

Wealth Accumulation Burnout

Financial motivation fueled by traditional wealth accumulation often leads to burnout due to relentless work hours and stress, contrasting sharply with the FIRE (Financial Independence, Retire Early) movement which prioritizes smart saving and investing strategies to achieve early financial freedom without sacrificing mental health. Embracing the FIRE philosophy reduces the risk of Wealth Accumulation Burnout by promoting balanced lifestyle choices and long-term sustainability in personal finance.

Purpose over Paycheck Paradigm

Financial motivation emphasizes immediate monetary rewards as the primary driver for work, whereas the FIRE movement prioritizes early financial independence to enable purposeful living beyond traditional employment. This purpose over paycheck paradigm shifts the focus from earning to aligning actions with long-term values and personal fulfillment.

Lean FIRE vs Fat FIRE Debate

Lean FIRE emphasizes achieving financial independence with minimal expenses, fostering motivation through frugality and simplicity, while Fat FIRE prioritizes maintaining a higher lifestyle post-retirement, driving motivation by aspiring to greater comfort and luxury. The debate centers on balancing disciplined saving versus enjoying present-day abundance, influencing how individuals tailor their financial goals and retirement strategies.

Work Optional Mindset

Financial motivation traditionally drives individuals to earn and save for security, while the FIRE (Financial Independence, Retire Early) movement emphasizes a work optional mindset centered on achieving early financial freedom through aggressive saving and investment. The work optional mindset fosters autonomy by prioritizing financial independence, enabling individuals to choose whether to work based on personal passion rather than necessity.

FI/RE Anxiety Spiral

The FI/RE anxiety spiral often emerges when the relentless pursuit of financial independence and early retirement triggers stress over market volatility and savings adequacy. Financial motivation rooted in fear contrasts with the FI/RE movement's goal of freedom, highlighting the psychological tension between wealth accumulation and emotional well-being.

Motivational Minimalism

Financial motivation drives individuals to increase income and accumulate wealth, while the FIRE (Financial Independence, Retire Early) movement emphasizes reducing expenses and simplifying life to achieve early retirement. Motivational Minimalism combines these approaches by focusing on purposeful spending, prioritizing essential goals, and finding fulfillment through financial freedom and intentional living.

Financial motivation vs FIRE movement for motivation. Infographic

hrdif.com

hrdif.com