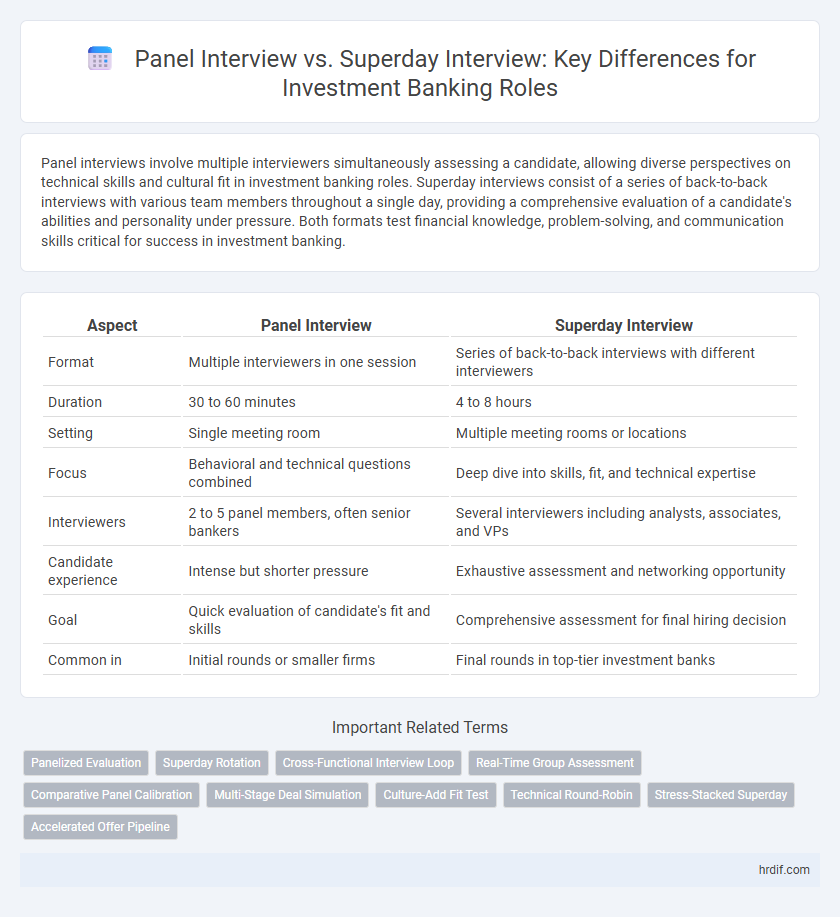

Panel interviews involve multiple interviewers simultaneously assessing a candidate, allowing diverse perspectives on technical skills and cultural fit in investment banking roles. Superday interviews consist of a series of back-to-back interviews with various team members throughout a single day, providing a comprehensive evaluation of a candidate's abilities and personality under pressure. Both formats test financial knowledge, problem-solving, and communication skills critical for success in investment banking.

Table of Comparison

| Aspect | Panel Interview | Superday Interview |

|---|---|---|

| Format | Multiple interviewers in one session | Series of back-to-back interviews with different interviewers |

| Duration | 30 to 60 minutes | 4 to 8 hours |

| Setting | Single meeting room | Multiple meeting rooms or locations |

| Focus | Behavioral and technical questions combined | Deep dive into skills, fit, and technical expertise |

| Interviewers | 2 to 5 panel members, often senior bankers | Several interviewers including analysts, associates, and VPs |

| Candidate experience | Intense but shorter pressure | Exhaustive assessment and networking opportunity |

| Goal | Quick evaluation of candidate's fit and skills | Comprehensive assessment for final hiring decision |

| Common in | Initial rounds or smaller firms | Final rounds in top-tier investment banks |

Overview of Panel Interviews in Investment Banking

Panel interviews in investment banking typically involve a group of interviewers assessing candidates simultaneously, focusing on technical skills, industry knowledge, and cultural fit. This format allows interviewers to evaluate how candidates respond under pressure and engage with multiple perspectives, providing a comprehensive skill assessment in a time-efficient manner. Candidates should prepare for diverse questions from different seniorities and showcase clear communication, analytical thinking, and teamwork aptitude during the panel interview.

Understanding Superday Interviews: Structure and Purpose

Superday interviews for investment banking roles consist of multiple back-to-back interviews with various team members, designed to assess technical skills, cultural fit, and problem-solving abilities in a condensed timeframe. These sessions often include behavioral questions, case studies, and technical assessments to simulate real job challenges. The structure allows firms to evaluate candidates comprehensively, ensuring alignment with the high-pressure environment and collaborative team dynamics of investment banking.

Key Differences Between Panel and Superday Interviews

Panel interviews for investment banking roles typically involve meeting multiple interviewers simultaneously, allowing candidates to address diverse questions in a single session, whereas superday interviews consist of several back-to-back one-on-one or small group interviews over an entire day. Panel interviews emphasize evaluating communication skills and group interactions at once, while superday interviews assess technical expertise, cultural fit, and problem-solving abilities through varied, intense interactions. The structured format of superday interviews offers deeper insight into a candidate's consistency and adaptability across different interviewers and scenarios.

Common Interview Formats Used by Investment Banks

Panel interviews in investment banking typically involve multiple interviewers assessing a candidate simultaneously, allowing for a holistic evaluation of technical skills and cultural fit. Superday interviews extend this format into a full day of back-to-back sessions with various team members, often including case studies, technical questions, and behavioral assessments. Both formats are designed to rigorously test analytical abilities, industry knowledge, and interpersonal skills critical for success in investment banking roles.

Skills Assessed in Panel vs Superday Interviews

Panel interviews for investment banking roles primarily assess communication skills, industry knowledge, and the ability to handle pressure through targeted questions and situational scenarios. Superday interviews expand this evaluation by testing technical proficiency, problem-solving skills, cultural fit, and teamwork across multiple rounds with various interviewers. Both formats emphasize analytical thinking and behavioral competencies, but Superdays provide a more comprehensive assessment due to their extended duration and diversity of interviewers.

Typical Questions in Panel and Superday Interviews

Panel interviews for investment banking roles typically involve a set of technical questions on financial modeling, valuation methods, and market analysis, along with behavioral questions assessing teamwork and leadership skills. Superday interviews extend this format by including multiple rounds with different interviewers, focusing not only on technical expertise but also on cultural fit, ethical scenarios, and problem-solving under pressure. Candidates can expect to answer case studies, brainteasers, and questions about recent market events during superdays, highlighting their ability to perform in high-stakes environments.

Strategies for Succeeding in Panel Interviews

Panel interviews for investment banking roles require candidates to demonstrate concise communication and strong technical skills under pressure, often facing multiple interviewers simultaneously. Focusing on precise answers, maintaining eye contact with each panelist, and preparing for a broad range of technical and behavioral questions significantly boosts performance. Researching the firm's recent deals and rehearsing tailored responses to common investment banking questions are essential strategies for succeeding in panel interviews.

How to Prepare for a Superday Interview

Preparing for a superday interview in investment banking requires in-depth knowledge of technical finance concepts, including valuation methods, financial modeling, and accounting principles. Candidates should practice behavioral questions and case studies to demonstrate problem-solving skills and cultural fit across multiple rounds with different interviewers. Time management and mental stamina are crucial to maintain focus through several back-to-back interviews during the superday format.

Pros and Cons: Panel Interview vs Superday Interview

Panel interviews for investment banking roles enable candidates to showcase their skills to multiple interviewers simultaneously, offering a broader range of feedback but potentially increasing pressure due to the diverse questioning styles. Superday interviews provide a comprehensive evaluation through a series of consecutive interviews, allowing deeper assessment of fit and technical knowledge, though they can be exhausting and heighten stress levels. Both formats test interview stamina and preparedness, with panel interviews emphasizing initial impact and superdays focusing on sustained performance throughout the day.

Which Interview Format Is Right for You in Investment Banking?

Panel interviews in investment banking typically involve multiple interviewers assessing candidates simultaneously, allowing for diverse evaluation of technical skills and cultural fit, while superday interviews consolidate multiple rounds into a single intensive day, offering a comprehensive yet fast-paced assessment. Candidates who perform well under continuous pressure and can sustain energy across varied interviewers might prefer superday formats, whereas those who excel in focused, staged interactions could find panel interviews more manageable. Understanding your personal stamina, preparation style, and ability to engage with different interviewers helps determine which format best aligns with your strengths in investment banking recruitment.

Related Important Terms

Panelized Evaluation

Panel interviews for investment banking roles involve multiple interviewers assessing candidates simultaneously, enabling diverse perspectives on technical skills, cultural fit, and problem-solving abilities. Superday interviews extend this approach over several hours with multiple rounds and panel interviews, offering a comprehensive panelized evaluation that captures a candidate's consistency and adaptability under prolonged pressure.

Superday Rotation

Superday rotation interviews in investment banking consist of multiple back-to-back interviews with various team members, providing a comprehensive assessment of a candidate's technical skills, cultural fit, and adaptability under pressure. Unlike panel interviews where a group interviews simultaneously, superday rotations simulate real workday scenarios, allowing firms to evaluate candidates across different functional areas and teams.

Cross-Functional Interview Loop

Panel interviews in investment banking often feature multiple interviewers assessing technical skills and cultural fit simultaneously, enabling a comprehensive evaluation within a single session. Superday interviews extend this approach through a cross-functional interview loop, involving several back-to-back meetings with professionals from different departments to rigorously test candidate adaptability, domain knowledge, and collaborative potential.

Real-Time Group Assessment

Panel interviews for investment banking roles involve multiple interviewers assessing a candidate simultaneously, emphasizing real-time group assessment of technical skills, teamwork, and communication under pressure. Superday interviews extend this process over several hours or a full day, incorporating multiple rounds of individual and group evaluations to measure adaptability, problem-solving, and client interaction abilities in a simulated real-world environment.

Comparative Panel Calibration

Panel interviews in investment banking typically feature a consistent calibration process where multiple interviewers assess candidates simultaneously, ensuring aligned evaluation criteria and immediate feedback. Superday interviews expand this calibration by incorporating numerous back-to-back sessions with various teams, allowing for broader performance benchmarking and a more comprehensive assessment of skills and cultural fit.

Multi-Stage Deal Simulation

Panel interviews in investment banking often focus on assessing technical skills and industry knowledge through targeted questions, while superday interviews incorporate Multi-Stage Deal Simulations that evaluate candidates' ability to perform comprehensive, real-time deal analysis and collaboration across multiple rounds. These simulations provide a practical insight into candidates' problem-solving, teamwork, and communication skills under pressure in a realistic banking environment.

Culture-Add Fit Test

Panel interviews for investment banking roles typically assess candidates' culture-add fit by focusing on collaborative problem-solving and interpersonal skills within a smaller group setting, revealing adaptability and communication style. In contrast, superday interviews involve multiple back-to-back evaluations with various team members, providing a comprehensive gauge of a candidate's cultural alignment and consistency under pressure, reflecting real-world teamwork dynamics in high-stakes environments.

Technical Round-Robin

Panel interviews for investment banking roles typically involve multiple interviewers assessing candidates simultaneously, allowing for diverse technical questioning and immediate cross-referencing of responses. Superday interviews consist of sequential technical round-robin sessions where candidates face different interviewers in dedicated time slots, enabling a deeper evaluation of specialized skills and problem-solving abilities across distinct technical domains.

Stress-Stacked Superday

Stress-stacked Superday interviews in investment banking combine multiple high-pressure sessions, including technical, behavioral, and case study components, to rigorously assess candidates' resilience and expertise. Panel interviews, while still challenging, typically involve fewer evaluators and focus on direct interaction, making Superdays a more intense and comprehensive evaluation format.

Accelerated Offer Pipeline

Panel interviews provide a streamlined evaluation process by allowing multiple interviewers to assess candidates simultaneously, accelerating feedback and decision-making in investment banking recruitment. Superday interviews, involving several back-to-back meetings with senior bankers, intensify candidate evaluation and often fast-track top performers through the accelerated offer pipeline.

Panel interview vs superday interview for investment banking roles. Infographic

hrdif.com

hrdif.com