Achieving a stable income provides consistent financial security, allowing for long-term planning and reduced stress over unpredictable earnings. Digital nomadism offers flexibility and the opportunity to explore diverse cultures while working remotely, but income may fluctuate due to varying client demands and time zone challenges. Balancing stable income with the freedom of digital nomadism requires strategic goal-setting to ensure both financial stability and lifestyle fulfillment.

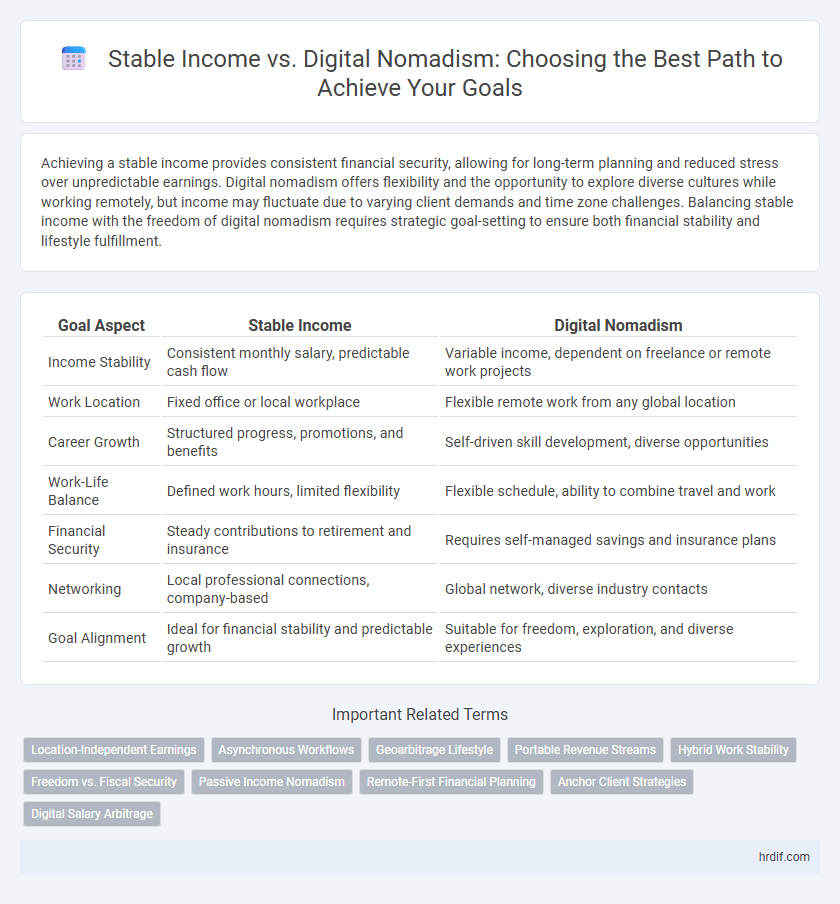

Table of Comparison

| Goal Aspect | Stable Income | Digital Nomadism |

|---|---|---|

| Income Stability | Consistent monthly salary, predictable cash flow | Variable income, dependent on freelance or remote work projects |

| Work Location | Fixed office or local workplace | Flexible remote work from any global location |

| Career Growth | Structured progress, promotions, and benefits | Self-driven skill development, diverse opportunities |

| Work-Life Balance | Defined work hours, limited flexibility | Flexible schedule, ability to combine travel and work |

| Financial Security | Steady contributions to retirement and insurance | Requires self-managed savings and insurance plans |

| Networking | Local professional connections, company-based | Global network, diverse industry contacts |

| Goal Alignment | Ideal for financial stability and predictable growth | Suitable for freedom, exploration, and diverse experiences |

Understanding Stable Income: Definition and Benefits

Stable income refers to a consistent and reliable flow of earnings from regular employment or investments, providing financial security and predictability. Benefits of stable income include reduced stress, easier budgeting, and the ability to plan long-term goals like homeownership or retirement. This financial stability contrasts with the fluctuating earnings often experienced in digital nomadism, making stable income ideal for those prioritizing steady economic growth.

Defining Digital Nomadism: Opportunities and Challenges

Digital nomadism offers the opportunity to work remotely while exploring diverse cultures and locations, fostering flexibility and personal growth. However, it presents challenges such as income instability, lack of traditional employee benefits, and the need for self-discipline and reliable internet connectivity. Balancing these factors is essential for setting realistic goals and achieving sustainable success as a digital nomad.

Financial Security: Stable Careers vs Digital Nomad Lifestyles

Stable careers offer consistent salaries, reliable benefits, and long-term financial security essential for building savings and planning for retirement. Digital nomadism provides income flexibility and lower living costs but often lacks predictable earnings and employer-sponsored financial protections. Choosing between the two depends on prioritizing steady financial stability versus the freedom to earn income from diverse global sources.

Goal Setting: Aligning Your Aspirations with Income Models

Setting clear goals requires aligning your financial aspirations with your income model, whether pursuing stable income or digital nomadism. Stable income offers predictable cash flow and security, ideal for goals centered on long-term savings and consistent budgeting. Digital nomadism provides flexibility and diverse earning opportunities, supporting goals that prioritize lifestyle freedom and global experiences.

Work-Life Balance: Which Path Supports Your Desired Lifestyle?

Stable income ensures consistent financial security, allowing for predictable budgeting and long-term planning, which is crucial for maintaining work-life balance. Digital nomadism offers flexibility and freedom to work from anywhere, fostering a lifestyle centered on exploration and adaptability but may introduce income variability. Choosing between these paths depends on prioritizing financial stability versus lifestyle flexibility to support your desired work-life balance effectively.

Career Growth: Comparing Opportunities and Limitations

Stable income provides consistent financial security essential for long-term career growth, enabling investments in skill development and professional advancement. Digital nomadism offers diverse experiences and global networking opportunities but may limit access to traditional career pathways and structured promotions. Balancing both approaches depends on individual priorities between stability and exposure to international markets for career progression.

Flexibility and Freedom: Pros and Cons for Each Path

Stable income offers consistent financial security, ensuring predictability but often limits flexibility due to fixed work hours and location. Digital nomadism provides unparalleled freedom to work from anywhere, promoting lifestyle flexibility but introduces income variability and challenges in long-term financial planning. Balancing the stability of a steady paycheck with the adaptable nature of remote work depends on individual priorities for security versus autonomy.

Risk Assessment: Stability Versus Uncertainty in Career Choices

Stable income provides predictable financial security, reducing stress and enabling long-term planning critical for achieving career goals. Digital nomadism offers flexibility and adventure but introduces income variability and potential gaps in healthcare, retirement, and social benefits. Weighing these risks is essential for aligning career choices with personal values and financial objectives.

Long-term Planning: Retirement, Savings, and Financial Goals

Stable income provides a reliable foundation for long-term financial goals such as retirement savings, allowing consistent contributions to pensions and investment accounts. Digital nomadism offers flexibility but may complicate steady savings due to variable income and different tax jurisdictions. Prioritizing stable income supports structured financial planning critical for achieving retirement security and other long-term objectives.

Choosing the Right Path: Deciding What Aligns with Your Goals

Stable income offers financial security and consistent cash flow, which supports long-term planning and risk-averse goals. Digital nomadism provides flexibility, cultural exposure, and the opportunity to earn remotely, aligning with goals centered on freedom and lifestyle diversity. Choosing between these paths depends on prioritizing either stability for predictable growth or adaptability for experiential enrichment.

Related Important Terms

Location-Independent Earnings

Location-independent earnings offer digital nomads unparalleled flexibility to generate stable income from anywhere, leveraging remote opportunities in freelance, consulting, and online business models. Building diversified revenue streams through passive income, such as affiliate marketing or digital products, enhances financial stability without geographic constraints.

Asynchronous Workflows

Asynchronous workflows enable digital nomads to maintain a stable income by allowing flexible, time-independent task completion aligned with global clients' schedules. Embracing such workflows enhances productivity and financial consistency without tethering individuals to traditional office hours or locations.

Geoarbitrage Lifestyle

Stable income provides financial security and predictable cash flow, essential for sustaining a Geoarbitrage lifestyle where living costs vary significantly across locations. Digital nomadism leverages remote work flexibility to optimize earnings against lower-cost regions, maximizing disposable income and enhancing lifestyle quality through strategic geographic choices.

Portable Revenue Streams

Portable revenue streams enable digital nomads to maintain stable income while traveling, leveraging remote work, freelance projects, and online businesses. This flexibility contrasts with traditional stable income sources tied to physical locations, offering financial independence and adaptability aligned with personal and professional goals.

Hybrid Work Stability

Hybrid work stability combines the reliable cash flow of stable income with the flexibility of digital nomadism, providing a balanced approach to achieving financial security and lifestyle freedom. Embracing hybrid work models enhances goal attainment by mitigating income volatility while supporting remote work opportunities across diverse locations.

Freedom vs. Fiscal Security

Stable income offers fiscal security through consistent earnings, providing a dependable financial foundation essential for long-term goal achievement. Digital nomadism maximizes personal freedom by enabling location-independent work, appealing to those prioritizing lifestyle flexibility over financial predictability.

Passive Income Nomadism

Achieving financial independence through passive income streams enables digital nomads to maintain a stable income while embracing location freedom. Prioritizing diversified investments such as rental properties, dividend stocks, or online businesses secures consistent cash flow essential for sustaining long-term nomadic lifestyles.

Remote-First Financial Planning

Remote-first financial planning prioritizes stable income streams to ensure consistent cash flow while accommodating the flexibility of digital nomadism. Balancing reliable earnings with remote work opportunities optimizes long-term financial security and lifestyle freedom.

Anchor Client Strategies

Stable income from anchor clients ensures predictable cash flow and long-term financial security, crucial for achieving consistent business growth. Digital nomadism offers flexibility but relies on diversified, often volatile income streams, making anchor client strategies essential to balance stability with mobility.

Digital Salary Arbitrage

Digital salary arbitrage leverages geographic income disparities by earning remote salaries from high-paying countries while living in low-cost locations, maximizing financial efficiency. This strategy enables digital nomads to achieve stable income streams without sacrificing lifestyle flexibility or global mobility.

Stable income vs Digital nomadism for goal. Infographic

hrdif.com

hrdif.com