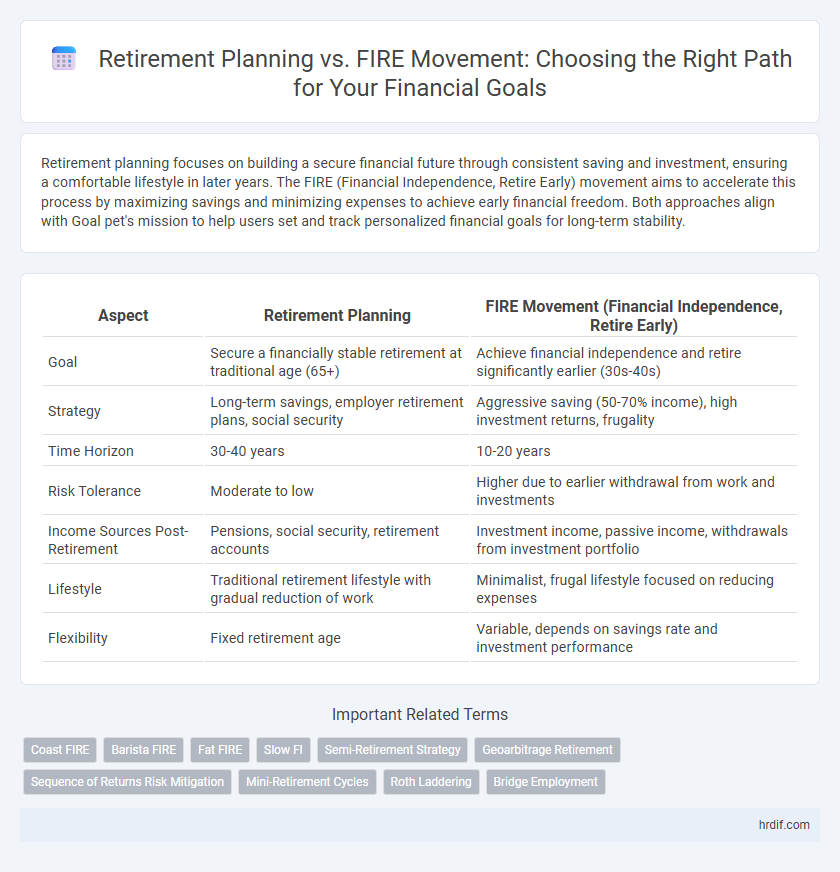

Retirement planning focuses on building a secure financial future through consistent saving and investment, ensuring a comfortable lifestyle in later years. The FIRE (Financial Independence, Retire Early) movement aims to accelerate this process by maximizing savings and minimizing expenses to achieve early financial freedom. Both approaches align with Goal pet's mission to help users set and track personalized financial goals for long-term stability.

Table of Comparison

| Aspect | Retirement Planning | FIRE Movement (Financial Independence, Retire Early) |

|---|---|---|

| Goal | Secure a financially stable retirement at traditional age (65+) | Achieve financial independence and retire significantly earlier (30s-40s) |

| Strategy | Long-term savings, employer retirement plans, social security | Aggressive saving (50-70% income), high investment returns, frugality |

| Time Horizon | 30-40 years | 10-20 years |

| Risk Tolerance | Moderate to low | Higher due to earlier withdrawal from work and investments |

| Income Sources Post-Retirement | Pensions, social security, retirement accounts | Investment income, passive income, withdrawals from investment portfolio |

| Lifestyle | Traditional retirement lifestyle with gradual reduction of work | Minimalist, frugal lifestyle focused on reducing expenses |

| Flexibility | Fixed retirement age | Variable, depends on savings rate and investment performance |

Introduction: Clarifying Retirement Goals

Retirement planning centers on defining clear financial objectives and timelines to ensure long-term security and comfort. The FIRE movement emphasizes aggressive saving and investing strategies to achieve early financial independence, often years ahead of traditional retirement age. Clarifying specific retirement goals helps individuals choose the right approach that aligns with their desired lifestyle and risk tolerance.

Defining Traditional Retirement Planning

Traditional retirement planning involves systematically saving and investing over decades to build a stable nest egg, typically aiming to retire around age 65. This approach emphasizes steady contributions to employer-sponsored 401(k)s, IRAs, and Social Security benefits to ensure financial security during retirement. Key components include asset allocation, risk management, and estimated retirement expenses to maintain a consistent lifestyle post-career.

What is the FIRE Movement?

The FIRE Movement, which stands for Financial Independence, Retire Early, emphasizes aggressive saving and investing to achieve early retirement, often decades ahead of traditional retirement ages. This approach targets a high savings rate, typically 50% or more of income, enabling individuals to accumulate substantial investment portfolios that generate passive income. FIRE advocates prioritize financial freedom over conventional career timelines, aligning their retirement goals with minimalist lifestyles and strategic money management.

Core Principles: Retirement Planning vs FIRE

Retirement planning centers on systematic saving, risk management, and steady growth to secure financial stability for traditional retirement age. The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing, targeting financial independence far earlier through extreme frugality and high savings rates. Core principles differ as retirement planning balances lifestyle and long-term security, while FIRE prioritizes financial autonomy and accelerated early retirement.

Financial Goals: Comparing Objectives

Retirement planning traditionally focuses on accumulating sufficient savings and investments to ensure financial security and a comfortable lifestyle after ceasing full-time work, emphasizing stability and long-term growth. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving and investing strategies to achieve early financial independence, often targeting retirement decades ahead of conventional plans. Both approaches share the objective of financial freedom but differ in timelines, risk tolerance, and lifestyle choices, influencing specific financial goals related to income replacement, asset allocation, and withdrawal strategies.

Income Streams and Saving Strategies

Retirement planning typically emphasizes steady income streams such as pensions, Social Security, and conservative investment returns to ensure financial stability throughout retirement. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving strategies, often exceeding 50% of income, paired with diversified income streams including dividends, rental properties, and side businesses to achieve early financial independence. Both approaches require disciplined budgeting and long-term investment plans, but FIRE demands a higher savings rate and alternative income generation to replace traditional retirement benefits.

Time Horizons: Early vs Conventional Retirement

The FIRE movement emphasizes aggressive saving and investing to achieve financial independence within a short time horizon, often targeting early retirement in 10 to 20 years. Conventional retirement planning typically spans a longer time horizon of 30 to 40 years, balancing steady growth and risk management to ensure a secure retirement at age 65 or later. Early retirement demands precise budgeting and higher savings rates, while traditional planning allows for gradual wealth accumulation and more conservative strategies.

Risk Tolerance and Lifestyle Impacts

Retirement planning generally emphasizes a balanced risk tolerance, aiming for steady growth through diversified investments to ensure financial security and preserve lifestyle stability over decades. The FIRE (Financial Independence, Retire Early) movement often requires higher risk tolerance, as aggressive saving and investing prioritize rapid asset accumulation, which can lead to more volatile financial situations but earlier freedom. Lifestyle impacts differ significantly; traditional retirement planning supports gradual lifestyle enhancements, while FIRE demands lifestyle sacrifices upfront, followed by potential freedom to pursue passions without financial constraints.

Flexibility and Adaptability in Goal Setting

Retirement planning emphasizes long-term security with structured, steady savings and clear timelines, while the FIRE movement prioritizes early financial independence through aggressive savings and lifestyle adjustments. Flexibility in goal setting allows individuals to adapt their strategies based on changing circumstances or market conditions, enhancing resilience in both approaches. Integrating adaptability ensures that retirement plans or FIRE goals remain achievable despite economic fluctuations or life changes.

Choosing the Right Path for Your Retirement Goals

Retirement planning traditionally emphasizes steady savings and gradual wealth accumulation aligned with long-term financial security and lifestyle goals. The FIRE (Financial Independence, Retire Early) movement advocates for aggressive saving and investing strategies to achieve early retirement, requiring careful expense management and high income allocation. Evaluating personal risk tolerance, income stability, and desired retirement timeline is crucial in choosing the optimal path to meet your retirement objectives effectively.

Related Important Terms

Coast FIRE

Coast FIRE offers a strategic balance between traditional retirement planning and the aggressive savings approach of the FIRE movement by allowing individuals to save aggressively early on and then let investments grow passively until retirement age. This method emphasizes reaching a financial milestone where no additional contributions are needed, enabling more flexibility and reduced stress while still securing long-term financial independence.

Barista FIRE

Barista FIRE, a subset of the FIRE movement, emphasizes achieving partial financial independence by covering essential expenses through part-time work while using retirement planning strategies to build sustainable income streams. This approach balances early retirement goals with practical income generation, providing flexibility and reducing reliance on full savings depletion.

Fat FIRE

Fat FIRE emphasizes achieving financial independence with a lifestyle beyond basic needs, allowing for luxury expenses and greater discretionary spending during retirement. Retirement planning for Fat FIRE requires aggressive savings rates, high investment returns, and a detailed budget that supports sustained high living costs without employment income.

Slow FI

Slow FI emphasizes steady, intentional savings and smart investments over decades to achieve financial independence and comfortable retirement without drastic lifestyle changes. Retirement planning traditionally targets a specific age with pension and Social Security, while Slow FI prioritizes flexibility, gradual asset growth, and early partial withdrawal options enabling financial freedom at a personalized pace.

Semi-Retirement Strategy

Semi-retirement strategy blends elements of traditional retirement planning and the FIRE movement by allowing gradual workload reduction while maintaining financial stability through diversified income streams. This approach emphasizes sustainable withdrawal rates, flexible budgeting, and phased investment adjustments to support long-term financial independence without full early retirement.

Geoarbitrage Retirement

Geoarbitrage retirement within the FIRE movement emphasizes relocating to lower-cost regions to maximize savings and accelerate financial independence, contrasting traditional retirement planning that relies on prolonged saving in high-cost areas. Adopting geoarbitrage strategies can significantly reduce living expenses, enabling earlier retirement and greater lifestyle flexibility aligned with FIRE goals.

Sequence of Returns Risk Mitigation

Mitigating Sequence of Returns Risk is critical in both retirement planning and the FIRE movement, as early negative returns can drastically reduce portfolio longevity. Strategic approaches such as increasing cash reserves pre-retirement, adopting dynamic withdrawal rates, and diversifying assets help safeguard against sequence risk and ensure sustainable income streams.

Mini-Retirement Cycles

Mini-retirement cycles offer a flexible alternative within retirement planning by allowing individuals to take extended breaks throughout their careers instead of waiting for traditional retirement. This approach aligns with the FIRE (Financial Independence, Retire Early) movement's emphasis on early financial freedom while promoting work-life balance through periodic lifestyle design.

Roth Laddering

Retirement planning traditionally emphasizes steady contributions to tax-advantaged accounts, while the FIRE movement leverages Roth laddering to access tax-free funds early by strategically converting traditional IRA assets to Roth IRAs over multiple years. This Roth laddering technique enables goal-oriented savers to minimize tax burdens and maintain financial flexibility during early retirement or financial independence phases.

Bridge Employment

Bridge employment serves as a strategic option within retirement planning and the FIRE (Financial Independence, Retire Early) movement, enabling individuals to transition gradually from full-time work to retirement while maintaining financial stability. By engaging in part-time or flexible jobs, retirees can extend income streams, reduce dependency on savings, and align career goals with lifestyle preferences.

Retirement Planning vs FIRE Movement for Goal. Infographic

hrdif.com

hrdif.com