A retirement plan typically involves setting a steady saving and investing strategy for financial security over the long term, while the FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve early retirement and financial freedom. Both approaches require clear goal-setting, disciplined budgeting, and regular progress tracking to ensure success in reaching desired lifestyle milestones. Understanding individual priorities and risk tolerance helps determine whether a traditional retirement plan or the FIRE approach aligns better with personal financial goals.

Table of Comparison

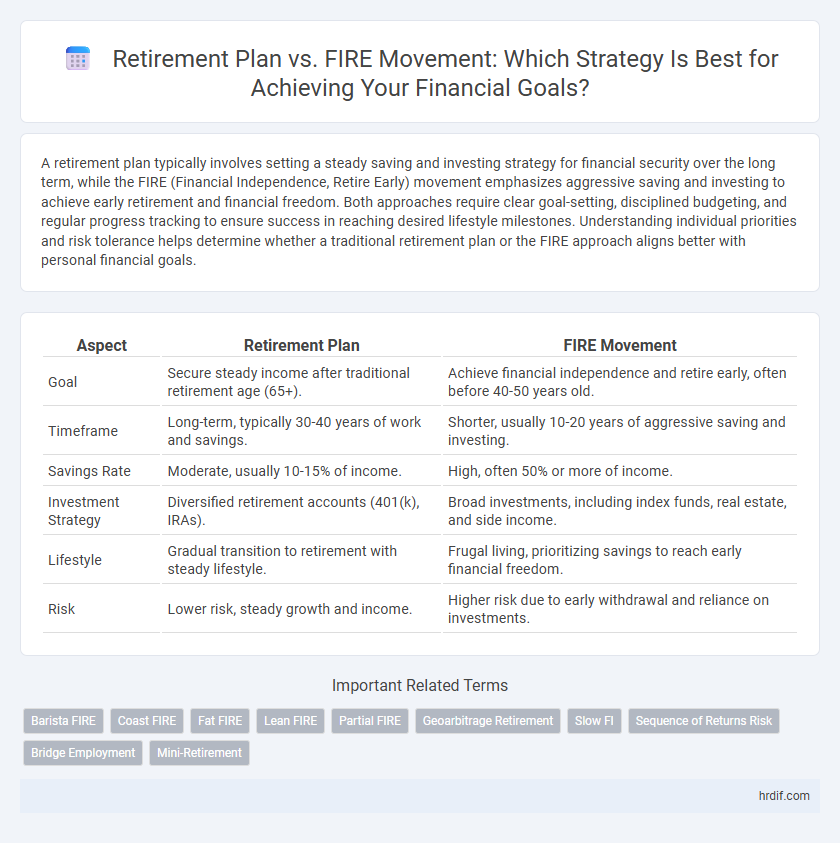

| Aspect | Retirement Plan | FIRE Movement |

|---|---|---|

| Goal | Secure steady income after traditional retirement age (65+). | Achieve financial independence and retire early, often before 40-50 years old. |

| Timeframe | Long-term, typically 30-40 years of work and savings. | Shorter, usually 10-20 years of aggressive saving and investing. |

| Savings Rate | Moderate, usually 10-15% of income. | High, often 50% or more of income. |

| Investment Strategy | Diversified retirement accounts (401(k), IRAs). | Broad investments, including index funds, real estate, and side income. |

| Lifestyle | Gradual transition to retirement with steady lifestyle. | Frugal living, prioritizing savings to reach early financial freedom. |

| Risk | Lower risk, steady growth and income. | Higher risk due to early withdrawal and reliance on investments. |

Traditional Retirement Planning: An Overview

Traditional retirement planning centers on systematic saving, investing in diversified portfolios, and relying on employer-sponsored pension plans or Social Security benefits to ensure financial stability after decades of steady work. This approach emphasizes gradual accumulation of wealth, risk management through asset allocation, and long-term growth to support a comfortable lifestyle post-retirement. Retirement planning also involves setting milestones, adjusting contributions based on income changes, and planning for healthcare and inflation to safeguard future financial goals.

Understanding the FIRE Movement

The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve financial independence far earlier than traditional retirement plans typically allow. Unlike conventional retirement plans that target a set retirement age with corresponding pension or social security benefits, FIRE followers aim to reduce expenses drastically and grow passive income streams to exit the workforce much sooner. Understanding the commitment to frugality, high savings rate often above 50%, and strategic investing is crucial for grasping how FIRE contrasts with standard retirement goals.

Key Differences in Retirement Goals

Retirement plans typically emphasize long-term financial security through steady savings and employer-sponsored benefits, aiming for a comfortable lifestyle post-career. The FIRE (Financial Independence, Retire Early) movement focuses on aggressive saving and investing to achieve early financial independence and retire decades sooner than traditional plans. Key differences lie in the timeline for retirement, with traditional plans targeting age 65+ and FIRE aiming for financial freedom often in the 30s or 40s, demanding higher savings rates and lifestyle adjustments.

Financial Requirements: Retirement vs. FIRE

Retirement plans typically require a nest egg of 25 to 30 times annual expenses to ensure steady income through traditional savings and investments, relying on Social Security and pensions for supplemental income. The FIRE (Financial Independence, Retire Early) movement demands a more aggressive savings rate, often 50% to 70% of income, aiming to accumulate a larger financial cushion--usually 25 times annual expenses--much earlier through low-cost index funds and minimal living costs. Both approaches focus on meeting long-term financial requirements but differ significantly in timeline acceleration and lifestyle adjustments.

Lifestyle Expectations: Conventional vs. Early Retirement

Conventional retirement plans typically emphasize steady income replacement and gradual lifestyle adjustments aligned with a standard retirement age around 65, supporting financial security through pensions or 401(k) plans. The FIRE (Financial Independence, Retire Early) movement prioritizes aggressive saving and investing to achieve financial independence decades earlier, enabling an unconventional lifestyle focused on flexibility and minimalism. While traditional retirement expects gradual downsizing, FIRE enthusiasts often adopt frugal habits and prioritize experiences over material wealth to sustain early retirement years.

Risk Factors in Each Retirement Approach

Retirement plans often involve traditional risk factors such as market volatility, inflation, and longevity risk, requiring steady contributions and diversified investments to mitigate potential shortfalls. The FIRE (Financial Independence, Retire Early) movement faces unique risks including aggressive saving rates that may reduce lifestyle quality, reliance on high investment returns, and potential underestimation of unexpected expenses or economic downturns. Both approaches demand careful risk assessment, but FIRE's early timeline intensifies exposure to sequence of returns risk and healthcare cost uncertainties.

Savings Strategies for Retirement and FIRE

Retirement plans emphasize consistent, long-term savings through employer-sponsored 401(k) accounts and IRAs, maximizing tax advantages and compound growth over decades. The FIRE movement accelerates savings rates, often exceeding 50% of income, by minimizing expenses and investing aggressively in low-cost index funds to achieve financial independence early. Both strategies rely on disciplined saving and investment but differ in timeline and lifestyle adjustments to reach their financial goals.

Impact on Life Goals and Personal Fulfillment

Retirement plans offer structured financial security and long-term stability, allowing individuals to align their savings with specific life goals such as home ownership, travel, or family education. The FIRE (Financial Independence, Retire Early) movement emphasizes rapid wealth accumulation and early lifestyle freedom, often prioritizing personal fulfillment through time freedom and unconventional career choices. Both approaches impact life goals differently, with traditional retirement focusing on predictable milestones and FIRE promoting greater flexibility and early pursuit of passions.

Flexibility and Adaptability in Goal Setting

Retirement plans offer structured, long-term financial stability with predictable contributions and timelines, while the FIRE (Financial Independence, Retire Early) movement emphasizes flexibility by encouraging aggressive saving and adaptable goals tailored to individual lifestyles. Adaptability in goal setting within the FIRE framework allows for adjustments based on changing priorities, market conditions, and personal circumstances, supporting a dynamic approach to financial independence. Flexibility in both strategies ensures that financial goals remain attainable despite life's uncertainties, balancing disciplined planning with the freedom to pivot as needed.

Choosing the Right Retirement Path for Your Goals

Selecting the right retirement path depends on your financial goals, risk tolerance, and desired lifestyle. A traditional retirement plan emphasizes steady contributions and long-term growth, suitable for those prioritizing stability and gradual wealth accumulation. The FIRE (Financial Independence, Retire Early) movement targets aggressive saving and investing to achieve early retirement, appealing to individuals seeking financial freedom and unconventional life choices.

Related Important Terms

Barista FIRE

Barista FIRE offers a balanced approach to early financial independence by combining part-time work with reduced expenses, allowing individuals to maintain health benefits and steady income while pursuing retirement goals. This strategy differs from traditional retirement plans by emphasizing flexibility and sustainability, enabling a smoother transition into full FIRE (Financial Independence, Retire Early) with lower financial risk.

Coast FIRE

Coast FIRE allows individuals to achieve financial independence by saving aggressively early on and letting investments grow passively until retirement, reducing the need for continuous high savings later. Unlike traditional retirement plans focused on steady contributions and fixed retirement ages, Coast FIRE emphasizes early investment growth, enabling flexibility and lifestyle freedom years before conventional retirement.

Fat FIRE

Fat FIRE emphasizes achieving financial independence with a retirement lifestyle that is significantly more comfortable and affluent than traditional retirement plans, prioritizing higher savings and investment rates to reach this goal faster. Unlike conventional retirement plans that often target modest post-retirement income, Fat FIRE aims for substantial passive income streams enabling luxury living and greater discretionary spending in early retirement.

Lean FIRE

Lean FIRE emphasizes achieving financial independence with a minimalist lifestyle, requiring significantly lower savings compared to traditional retirement plans. This approach accelerates the timeline to financial freedom by focusing on essential expenses and maximizing savings rates.

Partial FIRE

Partial FIRE (Financial Independence, Retire Early) offers a flexible retirement plan by allowing individuals to reduce working hours and expenses while maintaining income streams, contrasting with traditional retirement plans that emphasize full financial independence before retiring. Achieving Partial FIRE involves strategic saving and investing to cover essential expenses, providing a balanced approach to financial freedom and lifestyle goals.

Geoarbitrage Retirement

Geoarbitrage enhances both traditional retirement plans and the FIRE movement by enabling significant cost-of-living reductions through strategic relocation, accelerating wealth accumulation and prolonging retirement sustainability. Leveraging lower expenses in targeted regions maximizes investment growth and withdrawal potential, making geoarbitrage a critical factor in achieving early financial independence and a comfortable retirement lifestyle.

Slow FI

Slow FI emphasizes gradual wealth accumulation through consistent saving and investing, prioritizing financial security and lifestyle balance over rapid early retirement. This approach contrasts with traditional retirement plans by integrating long-term financial independence with realistic, sustainable spending habits.

Sequence of Returns Risk

Retirement plans typically mitigate Sequence of Returns Risk by relying on steady, diversified withdrawals aligned with market cycles, whereas the FIRE movement's early withdrawal strategy heightens exposure to negative early market returns, potentially depleting assets faster. Strategic asset allocation and systematic withdrawal methods are crucial in both approaches to preserve capital and sustain long-term financial goals.

Bridge Employment

Bridge employment serves as a strategic option for those navigating the transition from traditional retirement to financial independence under the FIRE movement, allowing gradual income reduction while maintaining engagement. This approach supports sustained financial stability and personal fulfillment by blending continued work with phased retirement goals.

Mini-Retirement

A Mini-Retirement offers a flexible alternative within the FIRE movement, allowing individuals to take extended breaks from work at various stages rather than waiting for full retirement. This approach emphasizes periodic lifestyle freedom, enabling goal-oriented financial planning that balances saving aggressively with enjoying life experiences throughout one's career.

Retirement plan vs FIRE movement for goal. Infographic

hrdif.com

hrdif.com