Employers seeking global expansion often face complex legal and compliance challenges that an Employer of Record (EOR) can efficiently manage by taking on payroll, taxes, and local labor regulations. While a traditional employer handles all hiring and administrative responsibilities internally, leveraging an EOR allows companies to onboard international talent quickly without establishing a local entity. This streamlined approach reduces risk, saves time, and ensures adherence to local employment laws across multiple jurisdictions.

Table of Comparison

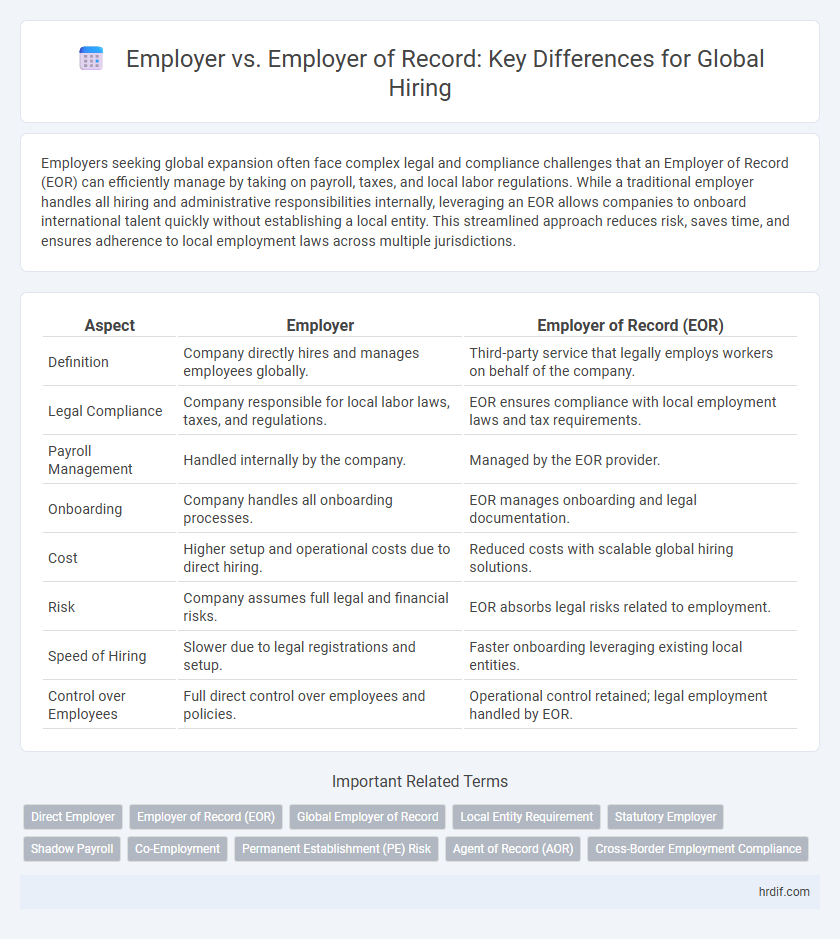

| Aspect | Employer | Employer of Record (EOR) |

|---|---|---|

| Definition | Company directly hires and manages employees globally. | Third-party service that legally employs workers on behalf of the company. |

| Legal Compliance | Company responsible for local labor laws, taxes, and regulations. | EOR ensures compliance with local employment laws and tax requirements. |

| Payroll Management | Handled internally by the company. | Managed by the EOR provider. |

| Onboarding | Company handles all onboarding processes. | EOR manages onboarding and legal documentation. |

| Cost | Higher setup and operational costs due to direct hiring. | Reduced costs with scalable global hiring solutions. |

| Risk | Company assumes full legal and financial risks. | EOR absorbs legal risks related to employment. |

| Speed of Hiring | Slower due to legal registrations and setup. | Faster onboarding leveraging existing local entities. |

| Control over Employees | Full direct control over employees and policies. | Operational control retained; legal employment handled by EOR. |

Understanding the Difference: Employer vs Employer of Record

An Employer directly hires, manages payroll, and controls employee benefits, while an Employer of Record (EOR) legally employs workers on behalf of a company, handling compliance, tax filings, and local labor laws in global hiring scenarios. The EOR enables employers to expand internationally without establishing a local entity, mitigating risks related to immigration, employment contracts, and regulatory compliance. Understanding this distinction is crucial for companies seeking efficient and compliant global workforce management.

Key Responsibilities: Direct Employer vs Employer of Record

Key responsibilities of a Direct Employer include managing recruitment, payroll, benefits administration, compliance with local labor laws, and overseeing employee performance and workplace policies. An Employer of Record (EOR) handles hiring, payroll, tax withholding, benefits, legal compliance, and risk management on behalf of a client company, enabling global workforce expansion without establishing a local entity. EORs assume legal liability for employment, while Direct Employers retain full control and responsibility for their employees.

Compliance and Legal Risks in Global Hiring

Employers face complex compliance challenges and legal risks in global hiring due to varying labor laws, tax regulations, and employment standards across countries. An Employer of Record (EOR) mitigates these risks by assuming legal responsibility for payroll, taxes, and compliance, ensuring adherence to local employment laws. Utilizing an EOR reduces exposure to penalties, audits, and litigation, providing a secure framework for international workforce management.

Cost Comparison: Employer vs Employer of Record

Comparing cost structures, hiring through an Employer of Record (EOR) typically reduces expenses related to payroll management, tax compliance, and benefits administration in global hiring. Employers face higher direct costs when managing local labor laws, onboarding, and regulatory requirements independently, especially across multiple countries. Utilizing an EOR consolidates these expenses into a manageable service fee, often resulting in significant cost savings in international workforce expansion.

Speed and Efficiency in International Onboarding

Employers leveraging an Employer of Record (EOR) gain significant speed and efficiency in international onboarding by bypassing lengthy local entity setup and compliance requirements. Traditional employer models require extensive legal registration and tax compliance per country, causing delays and operational burdens. Utilizing an EOR enables rapid hiring and payroll processing across multiple jurisdictions, accelerating workforce scaling and reducing administrative complexity.

Payroll Management and Tax Implications

Employers managing global payroll face complex tax compliance and reporting obligations varying by country, making direct management challenging. Using an Employer of Record (EOR) streamlines payroll management by handling local tax withholdings, social security contributions, and regulatory filings, reducing legal risks. This approach ensures timely, accurate payroll processing and minimizes exposure to costly tax penalties or audits for multinational companies.

Employee Experience: Who Offers Better Support?

Employers of Record (EOR) provide enhanced employee experience through streamlined onboarding, local compliance management, and dedicated HR support, reducing administrative burdens for both employees and employers. Traditional employers may struggle with varying international labor laws and lack localized support, potentially causing slower response times and increased employee uncertainty. EORs offer consistent communication, timely payroll processing, and benefits administration tailored to each country, fostering better employee satisfaction in global hiring scenarios.

Scalability and Flexibility for Global Expansion

Employers benefit from direct control but face limitations in scalability and regulatory compliance when expanding globally, whereas an Employer of Record (EOR) offers streamlined hiring processes and legal compliance across multiple countries. The EOR model enhances flexibility by allowing rapid workforce scaling without establishing local entities, reducing administrative burdens and mitigating risks. Companies leveraging EORs accelerate global expansion with adaptable workforce management and simplified payroll, taxation, and employment law adherence.

Choosing the Right Model for Your Business Needs

Selecting between an Employer and an Employer of Record (EOR) hinges on your company's global hiring strategy and operational priorities. An Employer directly manages employment, payroll, and compliance but requires establishing local entities, increasing administrative burden and legal risks in foreign markets. Conversely, an Employer of Record simplifies international expansion by handling compliance, payroll, and benefits, enabling quicker market entry and reducing overhead while ensuring adherence to local labor laws.

Future Trends: Evolving Roles in Global Employment

The future of global employment is shifting towards hybrid models where traditional Employers and Employers of Record (EOR) collaborate to streamline international hiring processes while ensuring compliance with diverse labor laws. Emerging technologies such as AI-driven compliance monitoring and automated payroll systems enhance the EOR's role in managing remote teams across multiple jurisdictions. Employers increasingly rely on EORs to mitigate risks and accelerate market entry, reflecting a trend of integrated, technology-enabled global workforce strategies.

Related Important Terms

Direct Employer

A Direct Employer assumes full legal responsibility for the employee, including payroll, benefits, and compliance with local labor laws, making it essential for maintaining control over workforce management in global hiring. Unlike an Employer of Record, a Direct Employer directly establishes the employment contract, ensuring alignment with company policies and culture while mitigating risks associated with third-party arrangements.

Employer of Record (EOR)

Employer of Record (EOR) facilitates compliant global hiring by legally employing workers on behalf of companies, managing payroll, tax withholding, and benefits while mitigating local compliance risks. Utilizing an EOR enables businesses to quickly expand into new international markets without establishing a local legal entity, streamlining cross-border workforce management.

Global Employer of Record

Global Employer of Record (EOR) services simplify international hiring by managing compliance, payroll, and benefits, enabling companies to onboard talent worldwide without establishing local entities. This approach reduces legal risks, accelerates market entry, and ensures adherence to diverse labor laws compared to direct employer setup.

Local Entity Requirement

An Employer of Record (EOR) enables global hiring without establishing a local entity by legally employing staff on behalf of a company, ensuring compliance with local labor laws and payroll regulations. In contrast, traditional employers must set up a local entity to hire employees directly, which involves navigating complex registration processes and ongoing administrative responsibilities.

Statutory Employer

A statutory employer assumes legal responsibility for employment obligations such as payroll taxes, benefits, and compliance with local labor laws, distinguishing it from a traditional employer who retains direct control over day-to-day work activities. Utilizing an Employer of Record (EOR) enables companies to hire globally while outsourcing statutory employer duties, ensuring adherence to regional regulations without establishing a legal entity.

Shadow Payroll

Shadow payroll enables employers of record (EOR) to manage global hiring compliance by tracking employee compensation and tax withholdings without directly appearing on official payroll records. Employers benefit from shadow payroll by ensuring accurate tax reporting and avoiding penalties while maintaining workforce control across multiple jurisdictions.

Co-Employment

Employers engaging in global hiring face complexities in compliance and payroll management that an Employer of Record (EOR) solution simplifies by assuming legal responsibility for employees, thus mitigating risks associated with co-employment. Co-employment occurs when both the client company and the EOR share employer obligations, enabling businesses to expand internationally without establishing local entities while ensuring adherence to labor laws and tax regulations.

Permanent Establishment (PE) Risk

Choosing an Employer of Record (EOR) for global hiring mitigates Permanent Establishment (PE) risk by preventing companies from creating unintended taxable entities in foreign jurisdictions. Traditional employer setups may expose businesses to significant PE liabilities due to direct employee management, whereas EORs assume legal responsibility, ensuring compliance with local tax and labor laws.

Agent of Record (AOR)

An Employer of Record (EOR) handles payroll, taxes, and compliance, acting as the legal employer while the company directs day-to-day work, whereas an Agent of Record (AOR) primarily manages contracts and legal representation in global hiring without assuming employer responsibilities. Utilizing an AOR allows businesses to streamline international hiring through local expertise and compliance oversight without transferring employee liabilities inherent in EOR arrangements.

Cross-Border Employment Compliance

An Employer of Record (EOR) ensures cross-border employment compliance by managing local labor laws, tax regulations, and payroll requirements, eliminating risks associated with misclassification and legal penalties. In contrast, a direct Employer must navigate complex international employment legislation themselves, increasing exposure to compliance challenges and potential fines.

Employer vs Employer of Record for global hiring. Infographic

hrdif.com

hrdif.com