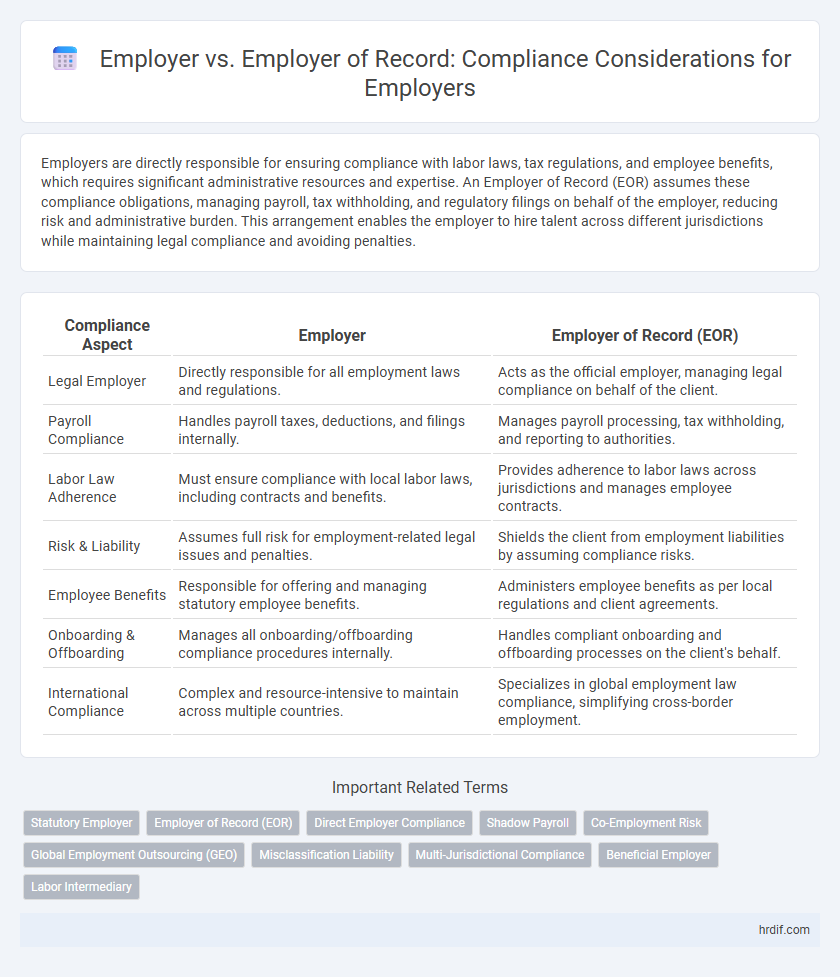

Employers are directly responsible for ensuring compliance with labor laws, tax regulations, and employee benefits, which requires significant administrative resources and expertise. An Employer of Record (EOR) assumes these compliance obligations, managing payroll, tax withholding, and regulatory filings on behalf of the employer, reducing risk and administrative burden. This arrangement enables the employer to hire talent across different jurisdictions while maintaining legal compliance and avoiding penalties.

Table of Comparison

| Compliance Aspect | Employer | Employer of Record (EOR) |

|---|---|---|

| Legal Employer | Directly responsible for all employment laws and regulations. | Acts as the official employer, managing legal compliance on behalf of the client. |

| Payroll Compliance | Handles payroll taxes, deductions, and filings internally. | Manages payroll processing, tax withholding, and reporting to authorities. |

| Labor Law Adherence | Must ensure compliance with local labor laws, including contracts and benefits. | Provides adherence to labor laws across jurisdictions and manages employee contracts. |

| Risk & Liability | Assumes full risk for employment-related legal issues and penalties. | Shields the client from employment liabilities by assuming compliance risks. |

| Employee Benefits | Responsible for offering and managing statutory employee benefits. | Administers employee benefits as per local regulations and client agreements. |

| Onboarding & Offboarding | Manages all onboarding/offboarding compliance procedures internally. | Handles compliant onboarding and offboarding processes on the client's behalf. |

| International Compliance | Complex and resource-intensive to maintain across multiple countries. | Specializes in global employment law compliance, simplifying cross-border employment. |

Understanding the Role of an Employer

An employer holds direct legal responsibility for employee compliance with labor laws, tax regulations, and workplace safety standards. An Employer of Record (EOR) assumes these compliance duties on behalf of a company, managing payroll, benefits, and legal obligations to mitigate risk. Understanding the distinction helps businesses maintain regulatory adherence while focusing on core operations.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party organization that legally employs workers on behalf of another company, handling payroll, tax compliance, benefits, and regulatory requirements. Unlike a traditional employer, the EOR assumes responsibility for adhering to local labor laws and employment standards, reducing compliance risks for businesses operating in multiple jurisdictions. Utilizing an EOR allows companies to expand globally without establishing a legal entity, ensuring labor law compliance and streamlined workforce management.

Key Legal Differences: Employer vs. Employer of Record

Key legal differences between an Employer and an Employer of Record (EOR) center on liability and control over employment compliance. An Employer directly holds responsibilities for payroll, benefits, tax withholdings, workers' compensation, and adhering to labor laws, while an EOR assumes these obligations on behalf of another company, legally employing the worker and ensuring regulatory compliance. This distinction reduces legal risks for the client company but transfers employment liabilities and compliance duties to the EOR, especially in multi-jurisdictional hiring scenarios.

Compliance Responsibilities and Liabilities

An Employer bears full compliance responsibilities including payroll taxes, benefits administration, and adherence to labor laws, directly managing liabilities associated with employee management. In contrast, an Employer of Record assumes these compliance obligations on behalf of the company, mitigating risks related to employment law violations and tax filings. This distinction ensures businesses maintain regulatory adherence while shifting legal liabilities and administrative burdens to the Employer of Record.

Hiring and Onboarding: Traditional Employer vs. EOR

Traditional employers handle hiring and onboarding internally, managing recruitment, employee verification, and compliance with labor laws directly. Employers of Record (EOR) streamline this process by legally employing workers on behalf of the client company, ensuring compliance with local regulations, payroll, and benefits administration. EORs reduce risks related to misclassification and regulatory penalties by taking on responsibility for employment contracts and statutory reporting.

Payroll and Tax Compliance: Who Handles What?

Employers are traditionally responsible for payroll processing and tax compliance, including withholding income taxes, Social Security, Medicare, and unemployment contributions. In contrast, an Employer of Record (EOR) assumes these payroll and tax responsibilities, ensuring full compliance with local labor laws and regulations on behalf of the client company. This arrangement mitigates risks related to misclassification and tax penalties by shifting these obligations to the EOR, who specializes in maintaining accurate payroll records and submitting timely tax filings.

Managing Employee Benefits and Contracts

Employers handle employee benefits and contracts directly, ensuring compliance with labor laws and company policies within their jurisdiction. Employer of Record (EOR) services manage these responsibilities on behalf of companies, facilitating compliance with local regulations, benefits administration, and contract management across multiple regions. Utilizing an EOR reduces legal risks and streamlines benefits delivery by leveraging expertise in local employment laws and standardized contract templates.

Cross-Border Employment Compliance Challenges

Navigating cross-border employment compliance requires understanding the distinct roles of an Employer versus an Employer of Record (EOR), as the latter assumes legal responsibility for adhering to local labor laws, tax regulations, and social security obligations. Employers often face challenges such as managing varying employment contracts, ensuring payroll accuracy across jurisdictions, and complying with diverse data protection laws. Utilizing an Employer of Record mitigates risks by centralizing compliance management and reducing the complexity of international workforce administration.

Risk Management and Mitigation with EORs

Engaging an Employer of Record (EOR) significantly reduces compliance risks by assuming responsibility for payroll, taxes, benefits, and labor law adherence, which mitigates potential legal exposure for the primary Employer. EORs ensure up-to-date regulatory compliance across multiple jurisdictions, addressing complex risk management challenges while avoiding costly penalties and lawsuits. Utilizing an EOR bolsters business continuity by transferring employment liabilities, enhancing operational security in global workforce management.

Choosing Between an Employer and an Employer of Record for Compliance

Choosing between an employer and an employer of record hinges on compliance complexity and risk management. An employer of record assumes full responsibility for payroll, taxes, benefits, and regulatory adherence, reducing legal risks for the hiring company, especially in multiple jurisdictions. Opting for a traditional employer model requires robust internal HR and legal teams to navigate evolving labor laws and ensure full compliance.

Related Important Terms

Statutory Employer

A statutory employer assumes legal responsibility for employment taxes, workers' compensation, and compliance with labor laws, simplifying risk management for the primary employer. Utilizing a statutory employer arrangement ensures adherence to regulatory requirements while reducing liability exposure in complex workforce structures.

Employer of Record (EOR)

Employer of Record (EOR) assumes full legal responsibility for payroll, tax withholding, and labor law compliance, reducing risks for the client company. Utilizing an EOR streamlines international expansion by ensuring adherence to local employment regulations and mitigating potential penalties.

Direct Employer Compliance

Direct Employer Compliance requires the employer to manage payroll, taxes, benefits, and labor law adherence internally, ensuring full accountability for workforce management. In contrast, an Employer of Record assumes these compliance responsibilities, reducing risk for the hiring company but limiting control over employee management.

Shadow Payroll

An Employer of Record (EOR) manages payroll, taxes, and compliance on behalf of the client company, ensuring accurate reporting and adherence to local employment laws, which significantly reduces risks related to shadow payroll discrepancies. Utilizing an EOR helps employers maintain regulatory compliance by properly documenting expatriate income and benefits, thereby avoiding costly penalties and audits associated with unmanaged shadow payroll obligations.

Co-Employment Risk

Employers face significant co-employment risk when working with an Employer of Record (EOR), as both parties may share legal liabilities related to worker classification, payroll, and tax compliance. Properly managing these responsibilities through clear contractual agreements and adherence to labor laws reduces the potential for fines, penalties, and legal disputes in co-employment arrangements.

Global Employment Outsourcing (GEO)

Global Employment Outsourcing (GEO) simplifies compliance by acting as the Employer of Record (EOR), managing legal, tax, and labor regulations across multiple jurisdictions. Traditional employers face increased risk and administrative burden when directly employing internationally, whereas GEO providers ensure adherence to local employment laws and streamline global workforce management.

Misclassification Liability

Misclassification liability arises when businesses treat workers as independent contractors instead of employees, exposing Employers to fines, penalties, and back taxes under labor laws. Using an Employer of Record (EOR) mitigates such risks by ensuring proper worker classification, payroll compliance, and adherence to local employment regulations.

Multi-Jurisdictional Compliance

Navigating multi-jurisdictional compliance requires understanding the distinctions between an Employer and an Employer of Record (EOR), with the latter assuming legal responsibility for employment taxes, payroll, and regulatory adherence across regions. Utilizing an EOR streamlines compliance by managing local labor laws, benefits administration, and risk mitigation, reducing the operational burden for companies expanding globally.

Beneficial Employer

A Beneficial Employer retains control over employee work conditions and benefits while outsourcing payroll and compliance obligations to an Employer of Record, ensuring legal adherence without sacrificing internal management. This arrangement mitigates risks related to tax liabilities, labor laws, and worker classification by clearly defining operational and legal responsibilities.

Labor Intermediary

An Employer of Record (EOR) acts as a labor intermediary that assumes responsibility for payroll, tax compliance, and employment regulations on behalf of a client company, ensuring adherence to local labor laws and reducing legal risks. Unlike a traditional employer, the EOR manages employment contracts and regulatory reporting, enabling businesses to maintain operational control while outsourcing compliance obligations.

Employer vs Employer of Record for compliance. Infographic

hrdif.com

hrdif.com