Employer-owned companies typically maintain centralized control and decision-making power, allowing for consistent strategic direction and streamlined management. In contrast, employee-owned companies foster a culture of shared responsibility and engagement, which can boost motivation and productivity by aligning employees' interests with the company's success. Choosing between these ownership structures depends on factors such as desired control, company culture, and long-term business goals.

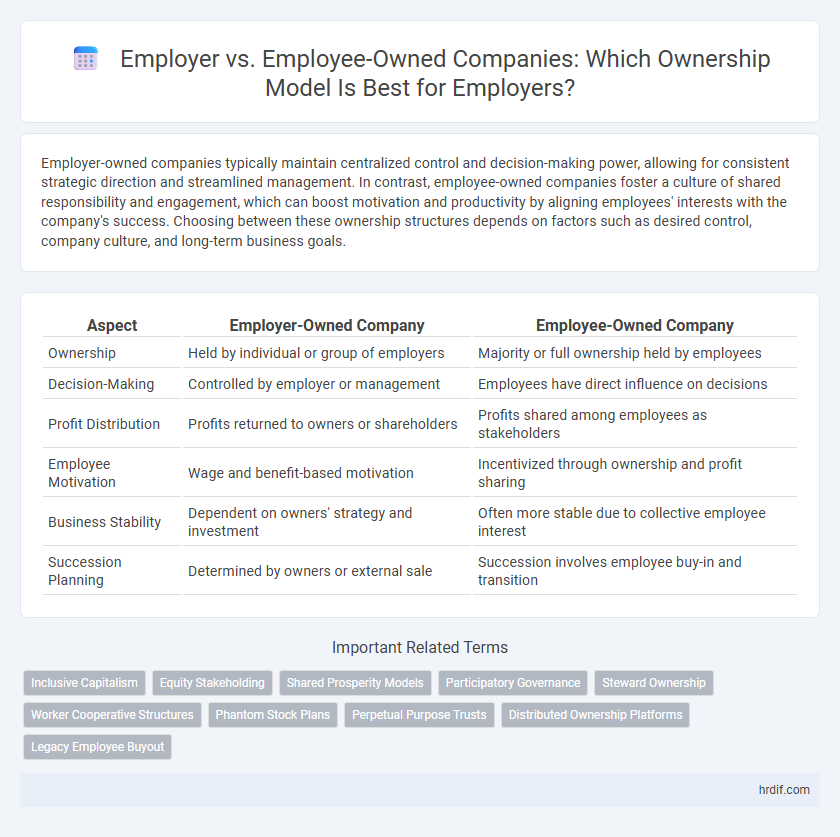

Table of Comparison

| Aspect | Employer-Owned Company | Employee-Owned Company |

|---|---|---|

| Ownership | Held by individual or group of employers | Majority or full ownership held by employees |

| Decision-Making | Controlled by employer or management | Employees have direct influence on decisions |

| Profit Distribution | Profits returned to owners or shareholders | Profits shared among employees as stakeholders |

| Employee Motivation | Wage and benefit-based motivation | Incentivized through ownership and profit sharing |

| Business Stability | Dependent on owners' strategy and investment | Often more stable due to collective employee interest |

| Succession Planning | Determined by owners or external sale | Succession involves employee buy-in and transition |

Understanding Employer-Owned vs Employee-Owned Companies

Employer-owned companies are typically controlled by a single owner or group of investors who make decisions regarding management, profits, and business direction, emphasizing centralized authority and shareholder returns. Employee-owned companies distribute ownership among employees through mechanisms such as Employee Stock Ownership Plans (ESOPs), fostering shared responsibility, increased employee engagement, and potentially higher productivity. Understanding these ownership structures is key to evaluating organizational culture, decision-making processes, and financial incentives within businesses.

Key Differences in Ownership Structures

Employer-owned companies centralize decision-making and financial control within a select group of executives or shareholders, often prioritizing profit maximization and strategic growth. Employee-owned companies distribute ownership stakes among workers, fostering greater employee engagement, collaborative decision-making, and shared financial benefits. The key differences lie in control dynamics, profit-sharing models, and long-term organizational commitments aligned with ownership structure.

How Decision-Making Differs

In employer-owned companies, decision-making authority primarily rests with top executives or a board of directors who prioritize profitability and strategic goals. Employee-owned companies distribute decision-making power more broadly, often empowering workers through democratic voting or representation on governing boards. This structure fosters increased collaboration, accountability, and alignment between ownership interests and daily operational decisions.

Impact on Company Culture and Engagement

Employer-owned companies often exhibit structured hierarchies with clear decision-making authority, which can streamline operations but may limit employee input and innovation. Employee-owned companies foster a sense of ownership and accountability among staff, enhancing motivation, collaboration, and engagement through shared financial and strategic stakes. This participatory culture frequently leads to higher job satisfaction, lower turnover rates, and a stronger alignment between employee goals and company success.

Profit Distribution and Rewards

In employer-owned companies, profits are typically distributed as fixed salaries and occasional bonuses, with owners receiving dividends according to shares. Employee-owned companies emphasize profit-sharing models, where employees gain a direct stake through stock options or equity, promoting shared financial rewards and increased motivation. This structure fosters a collaborative work environment by aligning employees' financial interests with company success.

Financial Stability and Growth Potential

Employer-owned companies typically benefit from centralized decision-making, which can streamline financial management and support consistent growth strategies. Employee-owned companies often foster higher employee engagement and retention, enhancing productivity and long-term financial stability through shared investment in the company's success. Both models present distinct advantages: employer ownership may prioritize rapid capital accumulation, while employee ownership can drive sustainable growth via collective commitment.

Accountability and Leadership Dynamics

Employer-owned companies often exhibit centralized accountability with decision-making power concentrated at the leadership level, fostering clear hierarchical structures and streamlined strategic direction. In contrast, employee-owned companies promote distributed accountability, encouraging shared leadership dynamics where employees actively participate in governance and influence organizational outcomes. This collaborative model enhances transparency and collective responsibility, driving a culture of empowerment and alignment with company goals.

Talent Attraction and Retention

Employer-owned companies often provide clear hierarchical structures and defined career paths that appeal to professionals seeking stability and traditional benefits, enhancing talent attraction. Employee-owned companies foster a culture of shared responsibility and profit participation, which can significantly boost employee engagement and retention by aligning individual success with company performance. Offering ownership stakes as part of compensation packages in employee-owned firms can differentiate the employer in competitive job markets, attracting candidates motivated by long-term investment and inclusive growth.

Long-Term Vision and Sustainability

An employer-owned company typically prioritizes strategic long-term vision through centralized decision-making and resource allocation, ensuring consistent sustainability goals aligned with shareholder interests. Employee-owned companies foster collective ownership, which enhances commitment to sustainable practices and drives long-term value by integrating employee perspectives into company growth. Both models influence sustainability, but employee ownership often leads to higher engagement in maintaining durable business success.

Which Ownership Model Fits Your Career Goals?

Choosing between an employer-owned company and an employee-owned company depends on your long-term career goals and desired involvement in ownership decisions. Employer-owned companies typically offer clear hierarchical structures and defined roles, providing stability and traditional career advancement. In contrast, employee-owned companies allow for shared ownership and profit-sharing, fostering a collaborative culture and potential for greater financial rewards aligned with company performance.

Related Important Terms

Inclusive Capitalism

Employer-owned companies traditionally concentrate ownership and decision-making power within a limited group, often prioritizing shareholder returns over broader stakeholder interests. Employee-owned companies promote inclusive capitalism by distributing ownership among employees, fostering shared responsibility, improved engagement, and more equitable wealth distribution.

Equity Stakeholding

In employer-owned companies, equity stakeholding is typically concentrated among founders, executives, and external investors, aligning control and decision-making with capital providers. Conversely, employee-owned companies distribute equity more broadly among employees, fostering a sense of ownership, enhancing motivation, and aligning individual performance with company success.

Shared Prosperity Models

Employer-owned companies typically concentrate wealth and decision-making power among a limited group of shareholders, whereas employee-owned companies foster shared prosperity by distributing ownership stakes and profit-sharing among workers, enhancing motivation and long-term organizational stability. Shared prosperity models in employee-owned firms promote inclusive growth, increase job satisfaction, and support community wealth-building by aligning employees' financial interests with the company's success.

Participatory Governance

Employer-owned companies typically centralize decision-making authority with shareholders and senior management, limiting worker influence on governance, whereas employee-owned companies embed participatory governance structures that empower employees with voting rights and direct input into corporate strategies. This inclusive model often enhances employee engagement, accountability, and operational transparency by aligning interests across the workforce.

Steward Ownership

Steward ownership structures prioritize long-term mission alignment by entrusting control to stewards rather than traditional employer or employee shareholders, ensuring the company's purpose and independence prevail over profit maximization. Unlike employee-owned companies where employees hold equity, steward ownership restricts individual gains, reinvesting profits to sustain organizational values and stakeholder interests.

Worker Cooperative Structures

Worker cooperative structures prioritize employee ownership, granting workers democratic control and profit-sharing rights, contrasting with traditional employer-owned companies where ownership and decision-making power rest primarily with shareholders or external investors. This model fosters increased employee engagement, equitable wealth distribution, and collective responsibility, often resulting in higher job satisfaction and sustainable business practices.

Phantom Stock Plans

Phantom Stock Plans offer employers a flexible alternative to traditional equity by providing employees with benefits tied to company ownership without diluting actual shares, aligning employee incentives with corporate performance. These plans enable companies to retain control while motivating employees through virtual shares that mimic real stock value, ensuring employer dominance in ownership structure.

Perpetual Purpose Trusts

Perpetual Purpose Trusts enable Employer-owned companies to maintain long-term vision and stability by legally transferring ownership to a trust that safeguards the company's mission, contrasting with Employee-owned models where ownership is distributed among employees and may fluctuate with workforce changes. This structure ensures the Employer's intent and values persist perpetually, aligning governance with sustainable growth rather than short-term employee equity shifts.

Distributed Ownership Platforms

Distributed ownership platforms enable employers to implement employee ownership structures that enhance workforce engagement and align interests by distributing equity across a broad base. These platforms utilize blockchain or digital ledger technology to facilitate transparent, real-time management of ownership shares, creating a more democratic and decentralized approach compared to traditional employer-owned companies.

Legacy Employee Buyout

Legacy Employee Buyouts ensure business continuity by transferring ownership from the employer to employees, preserving company culture and operational stability. This ownership structure fosters increased employee commitment and long-term growth, contrasting with traditional employer-owned companies where control remains centralized.

Employer vs Employee-owned Company for ownership. Infographic

hrdif.com

hrdif.com